Seven Points on Investing in Treacherous Waters

What's truly valuable has no price and cannot be bought.

If all investments are being cast into Treacherous Waters, our investment strategy must adapt accordingly.

Once we set aside denial and magical thinking as strategies and accept that we're in treacherous waters, a prudent

starting point is to discern the most consequential contexts of all decisions about where and how we invest our time,

energy and capital.

The most consequential global context is to first and foremost "invest in yourself": invest in forms of capital that cannot lose value

(for example, integrity, skills and experience) and assets that are not dependent on fluctuations in valuations for

their utility. This is the essence of Self-Reliance.

For example, tools retain their utility regardless of their current market value, and so does a house as shelter and

yard to grow food. Whether the value drops to $1,000 or soars to $1 million, the property provides the same utility of

shelter and sustenance.

In other words, the mindset of speculation--buy low and sell high to accumulate as much money as possible--is not the only

context to consider.

A second global context is that speculative winners--assets that rise sharply in value--will increasingly be targets

for "windfall" and/or wealth taxes, as well as capital controls, such as limits on selling.

If you log a 500% gain, then paying a wealth tax is a small price to pay for such a handsome gain. But such enormous

gains will very likely be far more scarce going forward as speculative bets become net drains on capital and speculators

exit because their gambling chips are gone or they realize they better conserve what capital is still left.

Meanwhile, back on the Government Ranch, the crying need for more tax revenues will become increasingly dire. As speculative

bubbles pop, capital gains will dry up and blow away, and this rich source of tax revenues will have to be replaced with

higher taxes and junk fees on whatever income and assets are available for "revenue enhancement," ahem.

A "special assessment" tax on those worth $100 million or more will be approved first. The bar will then be lowered to

$10 million, and then $1 million, which will of course include all assets, the family home, 401Ks, pension plans,

small businesses, etc., and any assets held overseas. Civil penalties for stashing assets in dodgy offshore tax havens

will of course increase concurrently. Purchases of cryptos and precious metals will be closely monitored / scrutinized.

Yes, the billionaires and corporations will remain untouchable due to their heavy buying of influence on the Political

Action Auction (tm), but the plump medium-sized fish who can't swing millions in political contributions and legal fees

will be inviting targets.

This generalized increase in taxes and junk fees on the wealthy and high consumption households will favor those who

figure out how to live well on less income and fewer high-value assets.

A third global context is that simple bets on sectors may not provide the easy, stable returns that characterized the

past 40 years.

Those who rotated into "hot sectors" and cashed out when everyone else jumped in did very well.

This mindset is still ubiquitous. Many are calling for a commodity super-cycle that will deliver reliable gains to anyone

investing in energy/commodities for years or decades to come. Others are flooding back into Big Tech or emerging markets.

Such simple trend-following sector bets will not work as reliably going forward, for several reasons.

One is that artificial scarcities tend to be followed by gluts that crush valuations.

Another is the emergence of asymmetries within sectors. In other words, a rising tide will no longer not raise all boats.

Per a quote from Nassim Taleb: "Finance has three simple rules: maintain a clear mind, figure out

asymmetries, never talk to idiots."

What are asymmetries? In shorthand, "winners take most."

Put another way, the winners in each sector may garner the majority of the gains within the sector, as the winners have

figured out a strategy to navigate treacherous waters.

Those pursuing old strategies will either lose or reap meagre gains.

The most successful investors / speculators will dig into companies, looking for asymmetries in financial assets,

expertise, management, etc.--the traditional tools of stock pickers.

Buying index funds and ETFs to ride the tide higher will mean losing as the speculative tide ebbs.

A fourth context is that speculations in assets with no real-world utility such as NFTs have run their course

and the gains will flow to companies producing real-world goods/services with essential utility.

This may be seen as part of the global trend of re-industrialization / reshoring / friendshoring.

A fifth global context is that one tool to discern productive asymmetries is to ponder what the wealthy value.

The wealthy have the means to buy the most experienced advice and the incentive to protect capital, so what they

pursue is worthy of consideration. This doesn't mean they will always be right, it simply means that just as keeping an eye on

the herd is useful, so too is keeping an eye on the "some are more equal than others" group.

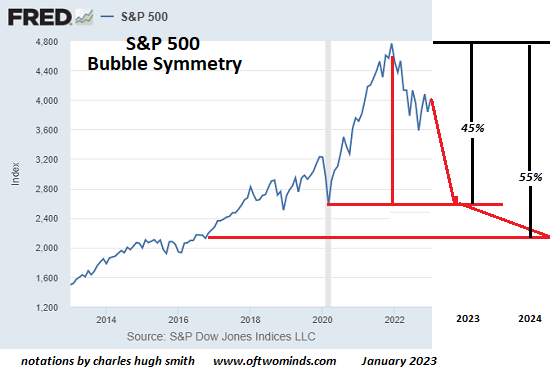

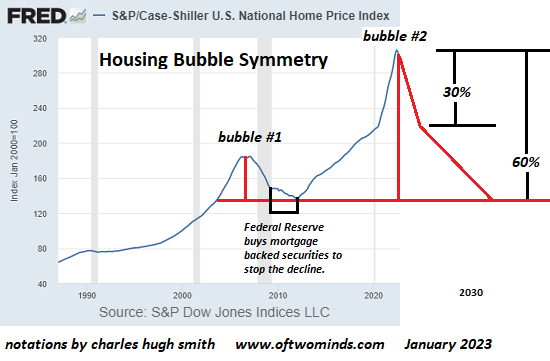

Real estate and housing is one example. The global housing bubble is finally popping, and house valuations have a long

way to drop to reach historic trendlines.

That said, enclaves with all the attributes valued by the wealthy--safety, good schools and healthcare, local sources

of energy and food, attractive natural settings and distance from decaying urban cores--will drop less, or could even retain

their value due to the relative scarcity of places that meet these high standards.

A sixth global context is the value of maintaining a low profile that doesn't telegraph your wealth, what's known as

the "gray person" strategy: blend in with neighbors, drive average-looking vehicles, avoid any ostentation. Blend into the

background so no one will look at you twice.

A seventh global context is to invest in trusted personal networks, producing essentials others will value and your

community of family, friends, neighbors, small enterprises and other local connections.

These have value that cannot be assessed with a market price. As I've said many times, what's truly valuable

has no price and cannot be bought.

Or as I've put it previously: "In a world besotted with the artifice of consumerism, what matters is not what

can be commodified and bought but what can't be commodified and bought."

My Mobile Creative credo also speaks to this: trust your network, not the corporation or the state.

Trust and integrity are high on the list of what cannot be bought, and these are assets we should all leverage as

the waters become increasingly treacherous.

This essay was first published as a weekly Musings Report sent exclusively to subscribers and

patrons at the $5/month ($50/year) and higher level. Thank you, patrons and subscribers, for

supporting my work and free website.

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

Read the first chapter for free (PDF)

Read excerpts of all three chapters

Podcast with Richard Bonugli: Self Reliance in the 21st Century (43 min)

My recent books:

The Asian Heroine Who Seduced Me

(Novel) print $10.95,

Kindle $6.95

Read an excerpt for free (PDF)

When You Can't Go On: Burnout, Reckoning and Renewal

$18 print, $8.95 Kindle ebook;

audiobook

Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States

(Kindle $9.95, print $24, audiobook)

Read Chapter One for free (PDF).

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel)

$4.95 Kindle, $10.95 print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print)

Read the first section for free

Become

a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Egon V.G. ($108), for your outrageously generous contribution to this site -- I am greatly honored by your steadfast support and readership. |

Thank you, Holton R.P. ($10.80), for your most generous contribution to this site -- I am greatly honored by your support and readership. |