We're Eating Our Seed Corn

What will break is not as predictable as the reality that the current trajectory is untenable and unsustainable.

If we're limited to our income, there's only so much we can spend on consumption and servicing existing debts, and invest / save to build capital / future income.

If we have access to the miraculous elixir of credit, we can expand our spending / investing by borrowing more money. This boosts our consumption and perhaps our investing, but it also increases our debt service--the interest that must be paid on debts old and new.

When interest rates are near-zero / less than inflation, this burden is light. Once interest rates return to historic norms, however, large debt loads generate large interest payments, and the elixir of credit becomes a toxin sapping th borrower of income and an unencumbered future: rather than having the option of saving income to invest in the future, the borrower must devote an increasing share of income to debt service.

Unless income is rising faster than debt service, the tapeworm of debt service starves the borrower.

This dual nature of debt--elixir and toxin--is scale-invariant, meaning that it functions in the same manner on the small scale of households all the way up to nation-states.

The vast horde of cheerleaders of debt always claim "we'll grow our way out of debt": by investing the borrowed money in wonderfully productive things, the economy (and household income, corporate profits, etc.) will grow so smartly that the debt service will remain a paltry and inconsequential percentage of spending.

The rosy forecast is the U.S. is investing in reshoring / re-industrialization / energy transition, and all these will jump-start growth for decades to come. Yes, we're borrowing trillions of dollars, but these dollars are being wisely invested in future productivity and improved national security.

The cheerleaders point to the history of the past 60 years as proof that this dynamic of "growing our way out of debt" can be counted on into the future.

Nice, but the cheerleaders forgot what happened in the 1970s, a decade of high inflation, rising costs and uneven expansion. The conventional explanation for this stagflation focuses on the "oil shock" of sharply higher oil prices in 1973-74, the rise of global competition and rising bond yields / interest rates.

But as I explained in

The Forgotten History of the 1970s (1/13/23),

a major contributor to the stagflation was the enormous investments that were poured into cleaning up America's polluted air and water, and re-engineering the nation's industrial base to be cleaner and more efficient.

The eventual payoff was huge, but it took decades to reap the rewards, which in this case included restored waterways

(The 1970s: From Rotting Carcasses Floating in the River to Kayak Races 1/22/23) and a more efficient industrial base.

Note that this enormous investment did not generate more corporate profits or consumption. From the point of view of "growth," it was a monumental money-pit, for the pay-off--a cleaner environment--did not generate profits or growth until far down the road.

The same dynamic will play out in the vast sums that must be sunk into reshoring / re-industrialization / energy transition, a process that raises costs for years or even decades before the eventual benefits outweigh the enormous costs.

Given higher rates of interest, borrowing trillions to fund both consumption and investment is in effect eating our seed corn as consumption isn't an investment that generates a return, and the return on vast investments with payoffs far down the road will jack up interest payments and other costs without generating the "growth" cheerleaders count on.

Gordon Long and I discuss what happens when "growing" consumption and investments are dependent on increasing debt faster than income in

Is a 70% Consumption Economy Sustainable? (43:53 min).

The federal government has many obligations and many constituencies. Seven decades of economic expansion has raised expections of every constituency for more federal funding. This has generated what I call the Savior State, a central government tasked with meeting every constituencies' needs with few limits.

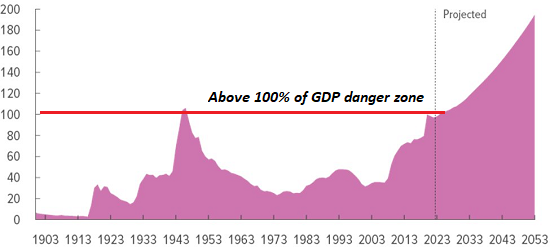

If borrowing and debt service rise faster than the returns on investment, the borrower goes broke before the return on investment catches up with the soaring cost of servicing the skyrocketing debt. Historical studies suggest problems of solvency and crimped spending arise once the national debt exceeds the national output, i.e. GDP. When debt rises above GDP, the nation starts consuming its seed corn to maintain consumption.

Savior States have an unsolvable problem: their social pension and healthcare programs were designed for economies with five full-time workers for every retiree. Now the ratio is closer to two-to-one: two workers (134 million full-time wage earners) for every retiree / recipient (67+ million recipients of Social Security and Medicare).

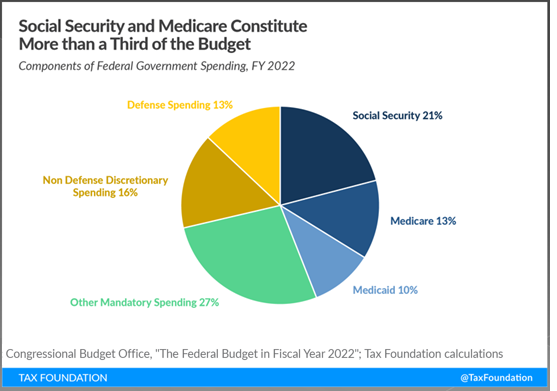

As this chart shows, social pension / healthcare programs are 44% of the federal budget (Social Security, Medicare and Medicaid).

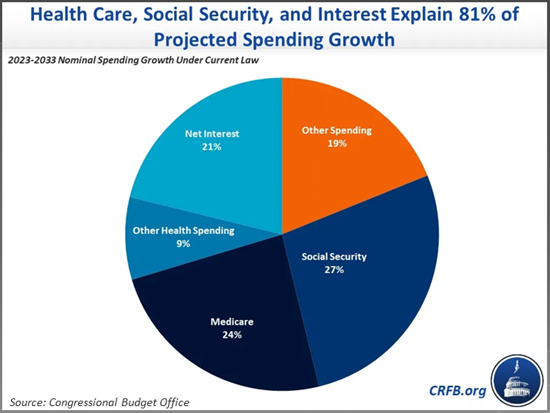

As the cohort of beneficiaries increases and costs of healthcare increase, federal spending will rise regardless of any other factors. Since federal revenues don't cover expenditures, the Treasury is borrowing trillions of dollars, guaranteeing the interest payments of the government will rise significantly. This chart shows the projected growth of each segment, not the current expenditures.

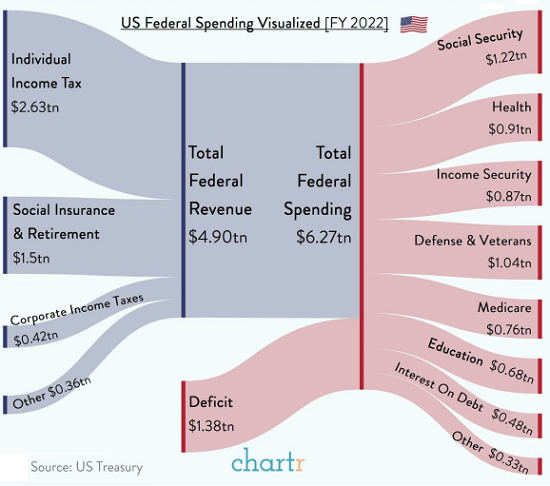

Here's a breakdown of federal revenues and expenditures.

Can we maintain a 70% consumption economy without bankrupting the nation? Combine the vast requirements for investments with minimal immediate financial payoffs with social pension / healthcare obligations designed for an economy that no longer exists, the expectations that consumption "should" keep expanding regardless of debt / interest payments and the impossibility of funding all this out of revenues, and the answer is: something's gotta give. What will break is not as predictable as the reality that the current trajectory is untenable and unsustainable.

Is a 70% Consumption Economy Sustainable? (43:53 min).

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

Read the first chapter for free (PDF)

Read excerpts of all three chapters

Podcast with Richard Bonugli: Self Reliance in the 21st Century (43 min)

My recent books:

Disclosure: As an Amazon Associate I earn from qualifying purchases originated via links to Amazon products on this site.

The Asian Heroine Who Seduced Me

(Novel) print $10.95,

Kindle $6.95

Read an excerpt for free (PDF)

When You Can't Go On: Burnout, Reckoning and Renewal

$18 print, $8.95 Kindle ebook;

audiobook

Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States

(Kindle $9.95, print $24, audiobook)

Read Chapter One for free (PDF).

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel)

$4.95 Kindle, $10.95 print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print)

Read the first section for free

Become

a $1/month patron of my work via patreon.com.

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Kolya. ($50), for your magnificently generous Substack subscription to this site -- I am greatly honored by your support and readership. |

Thank you, Rich P. ($50), for your superbly generous Substack subscription to this site -- I am greatly honored by your support and readership. |

|

|

Thank you, Tunc K. ($50), for your splendidly generous Substack subscription to this site -- I am greatly honored by your support and readership. |

Thank you, Edward D. ($50), for your marvelously generous Substack subscription to this site -- I am greatly honored by your support and readership. |