Irony Alert: "Outlawing" Recession Has Made a Monster Recession Inevitable

Those who came of age after 1982 have never experienced a real recession, and so they're unprepared for anything other than guarantees of rescue and permanent expansion.

The mainstream view is that recession is caused by economic-financial factors. The mainstream view is wrong, for recession is ultimately caused by Wetware1.0--human nature. Human nature--our innate attraction to windfalls and something-for-nothing, our ability to habituate to extremes and normalize counterproductive dynamics--manifest as economic-financial factors, but these are effects, not causes.

The mainstream view is that recessions are bad, so let's make sure they never happen. In other words, let's outlaw them by flooding the economy and financial system with Federal Reserve monetary stimulus and federal stimulus via increased deficit spending.

The history of the past 40 years "proves" these policies effectively eliminate recession: all recessions since 1981-82 have been shallow and brief, basically a spot of bother that lasts one quarter.

Our Wetware1.0 has responded to this "no recession guarantee" in ways that count as unintended consequences. Massive "emergency" stimulus that became permanent policy has created a bubble economy in which low interest rates and unlimited credit for those who are more equal than others has sparked demand for income-producing assets, which then sparked a speculative mania.

We've habituated to both the bubble economy and the speculative mania so that these are now considered normal. But behind the comfortable normalization, something counterproductive has taken hold: we're now addicted to the bubble economy and its crazed twin, speculative mania. If the bubbles pop and speculators go broke, the economy and financial system will both implode.

Without ZIRP (zero-interest rate policy), capital actually has a cost, and the bubble economy cannot survive if capital has a cost. Once capital has a cost, then speculation becomes risky, and speculation cannot survive if risk actually has a cost.

Having made unprecedented, permanent stimulus the bedrock of the economy, there's no stopping the runaway train: should the bubble threaten to burst, the only possible response is to push stimulus to new extremes. These new extremes become normalized and once normalized, the counterproductive internal dynamics of these extremes are conveniently ignored.

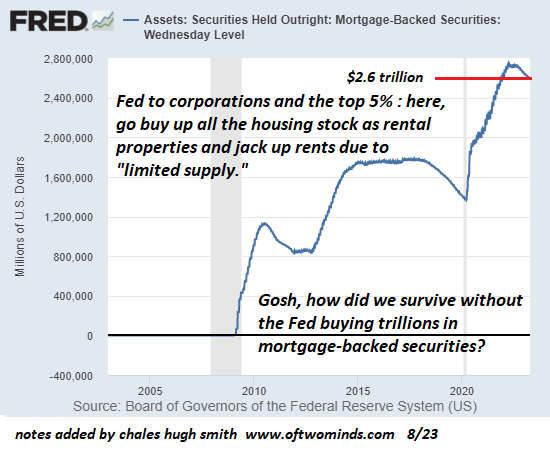

Consider Federal Reserve support of the housing bubble. One wonders how the nation survived without the Fed buying trillions of dollars of mortgage-backed securities--in effect, socializing the mortgage market, along with the federal agency-backed mortgages (FHA and VA mortgages).

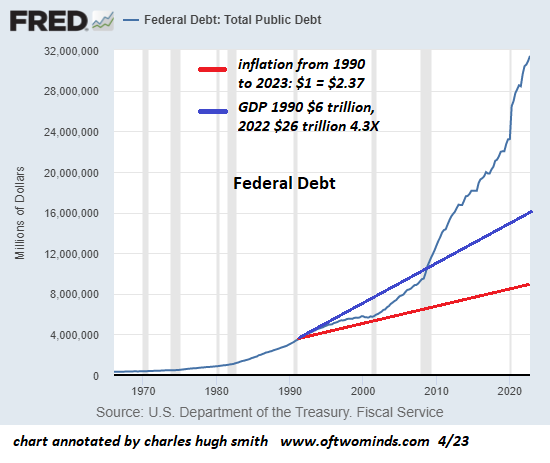

Skyrocketing federal borrowing has also been normalized: since the Fed will soon drop interest rates back to zero, there's nothing to worry about here. Carry on doom spending, all is well.

But all this creation of "money" chasing a limited pool of assets, labor and resources has another consequence: inflation, the steady erosion of purchasing power and the value of labor. This generates a feedback loop: wages have stagnated for 40+ years, and as inflation has devoured 20% of the value of wages just since 2020, labor must be compensated at higher rates or only the upper-middle class and elites will be able to pay their bills. This feeds back into inflation, as does money-printing, credit expansion and the artificial scarcities created by monopolies and cartels.

Another consequence of unprecedented, permanent stimulus is the widening of wealth-income inequality. Those at the top of the system could borrow money for next to nothing and use near-infinite lines of credit to scoop up all the income-producing assets, which boosted their unearned income and generated a feeding-frenzy bidding war for these assets which pushed valuations into the stratosphere.

Financiers borrowed at 2%, debt-serfs paid 20% for credit card debt. The bottom 95% coluld not outbid the financiers and corporations for low-risk assets, so they turned to speculative gambling as the only remaining means to increase their wealth.

Since the Fed has implicitly guaranteed that no bubbles will ever be allowed to pop, this gambling has acquired a dangerously thin veneer of safety. Any dip in housing or stock prices will soon be bought, and so valuations will continue their happy ascent to ever higher highs. The trick is to rotate out of one bubble into the next bubble, and leverage the winnings from the first winning bet into a pyramid of assets.

So the first Airbnb rental house was a smashing success, then leverage that into three more, or five more, or 20 more.

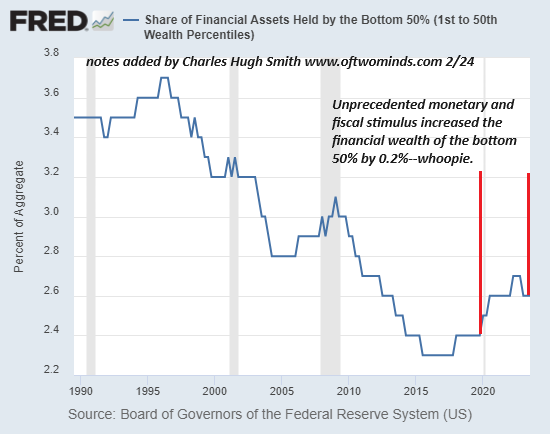

This has worked marvelously for the top 10% who own roughly 90% of all financial assets, but it hasn't moved the needle much for the bottom 50%, whose share of financial assets rose a meager 0.2% despite trillions of dollars of stimulus flooding the economy.

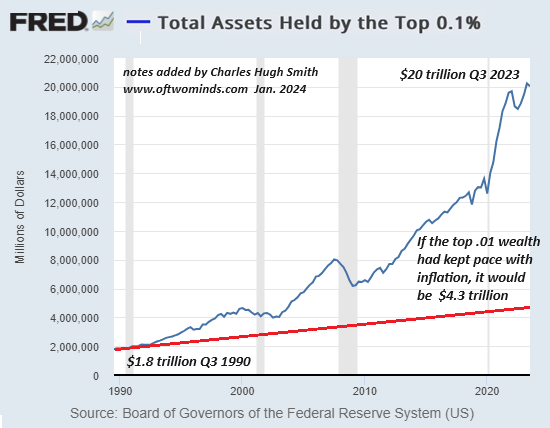

The top 0.1% did a bit better, adding about $10 trillion to the value of their assets.

As a result of the great success of outlawing recessions, everyone is complacent. There will always be plenty of credit, jobs and monetary-fiscal stimulus, and the Fed will always jump in to save the bubbles from popping. Nothing can possibly go wrong because it's all under control, and we have 40 years of "proof" that there's nothing that can possibly break this guarantee.

Beneath this complacency, the counterproductive dynamics are increasing. Inflation limits the Fed from dropping interest rates back to zero, wealth inequality undermines social stability, speculative manias are actually not low-risk, and bubbles find a way to pop despite all the assurances of god-like control.

Rather than guarantee the permanent expansion of all the good things, outlawing recessions guarantees a monster recession as our innate ability to normalize extremes and slip into blissful complacency will shatter in unexpected ways. Those who came of age after 1982 have never experienced a real recession, and so they're unprepared for anything other than guarantees of rescue and permanent expansion.

New podcast: Opportunities and Benefits of International Cities (49 min)

My recent books:

Disclosure: As an Amazon Associate I earn from qualifying purchases originated via links to Amazon products on this site.

The Asian Heroine Who Seduced Me (Novel) print $10.95, Kindle $6.95 Read an excerpt for free (PDF)

When You Can't Go On: Burnout, Reckoning and Renewal $18 print, $8.95 Kindle ebook; audiobook Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States (Kindle $9.95, print $24, audiobook) Read Chapter One for free (PDF).

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook) Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel) $4.95 Kindle, $10.95 print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print) Read the first section for free

Become a $1/month patron of my work via patreon.com.

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Andrew D. ($80), for your monstrously generous contribution to this site -- I am greatly honored by your steadfast support and readership. |

Thank you, Steve B. ($50), for your marvelously generous contribution to this site -- I am greatly honored by your steadfast support and readership. |

|

|

Thank you, Sudheer B. ($25), for your splendidly generous contribution to this site -- I am greatly honored by your steadfast support and readership. |

Thank you, Michael E. ($50), for your magnificently generous contribution to this site -- I am greatly honored by your support and readership. |