Only the wealthy will benefit from ZIRP, and the benefits of "the wealth effect" and "trickle down" have not just diminished--they're now negative. Welcome to the era of ZAP.

Correspondent Scott suggested I consider the possibility that the powers that be will respond to a weakening of the economy by pushing interest rates toward zero, reinstating ZIRP--Zero Interest Rate Policy. The purpose of ZIRP is to reduce the costs of borrowing money as the means of goosing borrowing-and-spending and inflating another credit-asset bubble, a.k.a. "the wealth effect," the Federal Reserve's tried-and-true means of goosing the spending of the top 10% by making them wealthier--not by becoming more productive, but by jacking up the market valuation of the assets they own.

Here is my paraphrasing of Scott's summary of this dynamic:

Here's the logic of ZIRP: near zero interest rates 2008-2020 were beloved by the already rich, hedge funds and private equity (all of whom have enormous political influence). So they borrowed tens of billions of dollars to buy up every asset that wasn't nailed down: stocks & bonds (both touching all time highs), houses (few now available for a decent price), businesses (half the NYSE was bought up by competitors), mobile home parks (desperate people pay their rent), apartment buildings, retirement homes, etc.

This generates higher prices/inflation for overbought assets. This doesn't affect the Powers That Be--they're not affected as the expansion of their wealth far outstrips goods-and-services inflation.

It also means those relative few with access to this "free money" will own the vast majority of the assets. Everyone else becomes a minimum-wage worker and renter.

The Lords and Ladies of the estate are back! The new feudalism.

Thank you, Scott. As long-time readers know, I've often documented these very dynamics: the top 10% already own roughly 90% of all stocks and the majority of other income-producing assets (bonds, rental housing, business equity). The top 0.1% collect the majority of unearned income (i.e. income from assets).

I've also described how lumping all households into one bucket makes everything look rosy by masking the widening divide in wealth and income between the top 10% and the bottom 90%. I've often posted charts showing the bottom 50% of US households own such a thin slice of the nation's financial wealth that it's mere signal noise.

In other words, ZIRP works great if we define "great" as increasing wealth-income inequality and increasing consumption by making the already-rich even richer. Spending by the top 10% is about half of all consumption, meaning the wealthy are propping up the economy based on the enormous bubble in the assets they own.

Wealthy Americans Are Spending. People With Less Are Struggling.

Data show a resilient economy. But that largely reflects spending by the rich, while others pull back amid high prices and a weakening labor market.

In other words, thanks to the Fed's "stimulus" and ZIRP, globalization and financialization, ours is a fully neofeudal economy and society. I lay this out in my new book Investing In Revolution.

But here's the thing: the Fed may try ZIRP, but end up with ZAP-- Zero Adaptive Policy, a policy that no longer works as it did in the past because conditions have changed. In other words, ZIRP will not longer be a solution, it will be the problem.

What's changed? Many things. We can start with these:

1. China is no longer providing a deflationary impulse in the global economy that offsets the sources of higher prices (inflation). Now systemic inflationary forces have the upper hand.

2. Risk pushes costs higher throughout the economy. Risks are obviously rising systemically, and so the risk premium is increasing. This pushes up the cost of everything.

3. The Fed's "wealth effect" and "trickle-down" policy--the spending of the wealthy will "trickle down" to the bottom 90%--have pushed wealth-income inequality to extremes that trigger social disorder. Doing more of what worked post-2009 will not generate "growth"--it will generate instability.

4. Bubbles are teleological: they get bigger and more systemically corrosive with each iteration. There is no guarantee that Fed stimulus and ZIRP will reinflate the ruins left after the Everything / AI bubble deflates.

Here is the chart of the S&P 500 (SPX) from 1990 to the present: note the three bubbles: the dot-com bubble and the 2007-08 housing/stock bubble look like modest speed bumps compared to the Everything Bubble (#3 bubble).

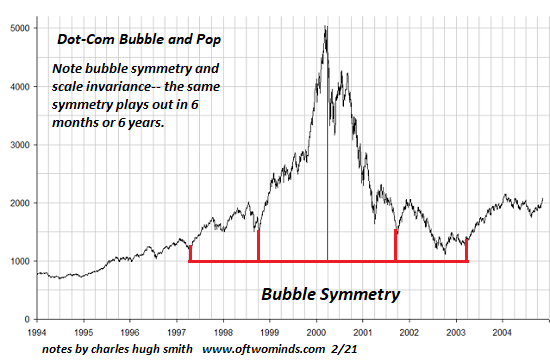

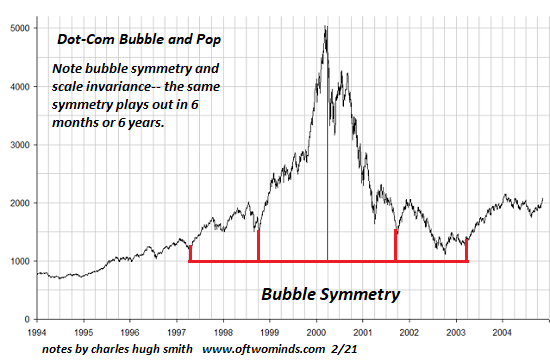

Here is the 2000 dot-com bubble in close-up: non-trivial losses of about 80% from peak to trough.

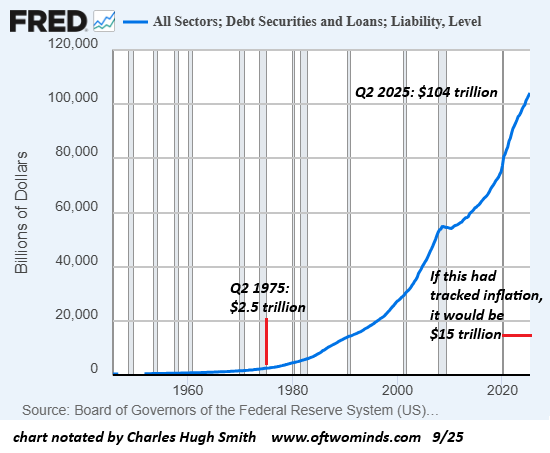

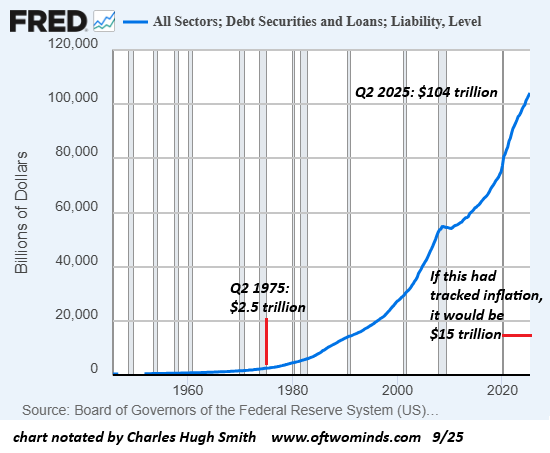

There are limits on using debt to fuel consumption.

Here is the chart of Total Debt, courtesy of the Federal Reserve:

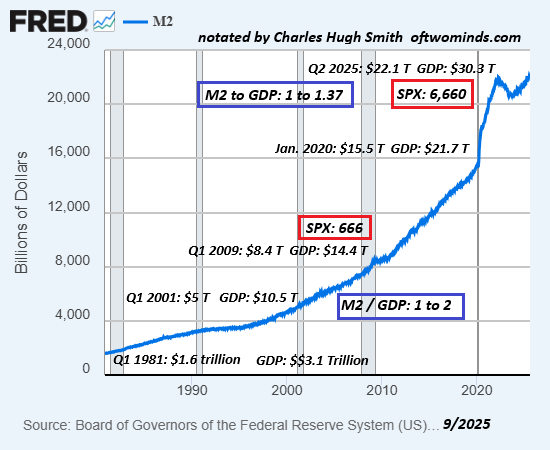

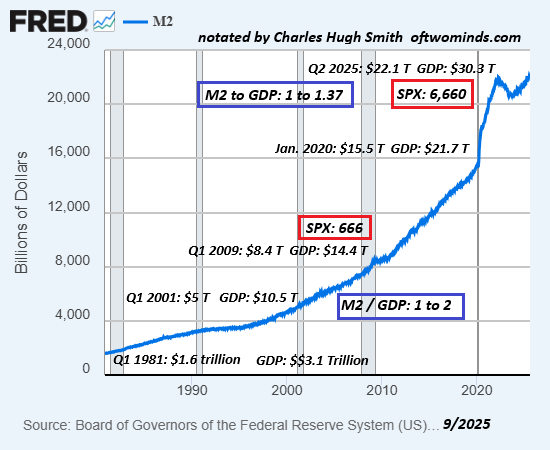

There are limits on goosing the economy by expanding the money supply:

Here is the chart of M2 Money Supply: note the diminishing returns on GDP growth.

The velocity of money has been in a free-fall from the dot-com era peak which was the last spurt of "growth" that actually trickled down to wage earners.

Here is the chart of M2 money velocity--a multi-decade decline:

The Fed inflates asset bubbles. It's not clear what else they do, but they have inflated three credit-asset bubbles. The first bubble was easy--the dot-com bubble in tech stocks. To inflate Bubble #2 in housing and stocks was also easy: just unleash mortgage fraud on a mass scale (subprime mortgages and mortgage-backed securities).

But when the 2008 bubble #2 popped, the Fed had to print / backstop trillions of dollars to inflate this final bubble #3.

This chart shows the SPX stock index divided by the Fed balance sheet:

As I noted in the previous post, it's natural to assume inflating credit-asset bubbles is a linear process and therefore predictable, as that's what it looks like when looking back at the past 35 years. But the process isn't inherently linear; it's non-linear as the dynamics around money, credit and risk are emergent, meaning that the sum of the parts have qualities of their own that are not predictable.

ZIRP is assumed to be linear, but since it's mal-adapted to current realities, pushing interest rates down will result in non-linear ZAP: Zero Adaptive Policy Pushing wealth-income inequality to even more extreme heights is not a solution, it's the problem.

As for lowering interest rates doing any good for the bottom 80%--you're joking: the high interest rates paid by the bottom 60% on credit cards, auto loans and student loans aren't going to drop even with ZIRP.

Only the wealthy will benefit from ZIRP, and the benefits of "the wealth effect" and "trickle down" have not just diminished--they're now negative. Welcome to the era of ZAP.

My new book Investing In Revolution is available at a 10% discount ($18 for the paperback, $24 for the hardcover and $8.95 for the ebook edition) through October 31.

Introduction (free)

New podcast:

Anti-Progress, Reverse Leverage and the Hot-Potato Economy (45 min)

Check out my updated Books and Films.

Become

a $3/month patron of my work via patreon.com

Subscribe to my Substack for free

My recent books:

Disclosure: As an Amazon Associate I earn from qualifying purchases originated via links to Amazon products on this site.

THE REVOLUTION TRILOGY:

Investing In Revolution

Ultra-Processed Life

The Mythology of Progress

Systemic Problems/Solutions

Investing In Revolution (2025) Introduction (free)

The Mythology of Progress (2024) Introduction (free)

Global Crisis, National Renewal (2021) Introduction (free)

Money and Work Unchained (2017) Introduction (free)

A Radically Beneficial World (2015) Introduction (free)

What You Can Do Yourself

Ultra-Processed Life (2025) Introduction (free)

Self-Reliance in the 21st Century (2022) Introduction (free)

When You Can't Go On: Burnout, Reckoning and Renewal (2022) Introduction (free)

Get a Job, Build a Real Career and Defy a Bewildering Economy (2014) Intro (free)

Novels

The Adventures of the Consulting Philosopher Intro (free)

The Secret Life of an Asian Heroine First chapters (free)

Become

a $3/month patron of my work via patreon.com.

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email

remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Phil S. ($70), for your magnificently generous subscription

to this site -- I am greatly honored by your support and readership.

|

|

Thank you, Dina ($7/month), for your marvelously generous subscription

to this site -- I am greatly honored by your support and readership.

|

|

Thank you, J.F.D. ($70), for your superbly generous subscription

to this site -- I am greatly honored by your support and readership.

|

|

Thank you, Steve J. ($7/month), for your splendidly generous subscription

to this site -- I am greatly honored by your support and readership.

|