To Make America Great Again, Start Here

Our status quo is so thoroughly corrupt that it's no longer even seen as corruption, it's just BAU--business as usual.

It's a big ask, but let's depoliticize the phrase "make America great again" and consider what this would actually entail, not as a lobbyists' grab-bag of tax breaks for the wealthy and arcane giveaways in 500-page Congressional bills, but as a restoration of the fundamental foundations of greatness.

In the conventional contexts of the current era, this boils down to ideology and finance. If we dial back culture-war over-reach and free up "market forces," for example, this will restore America's greatness.

The problem with all this kind of thinking is it's superficial and banal, for it ignores the real source of America's decline: the moral rot that has eroded every institution and every nook and cranny of our society. Whenever I mention this moral rot, I get immediate push-back of this sort: corruption has always been around, so today is no different from previous eras.

While it's self-evident that self-interest and greed manifest as corruption, it's not true that the systemic corruption of the present is no different from previous eras--it's worse, much worse because it's now normalized, and so we accept the most outrageous forms of corruption as "normal."

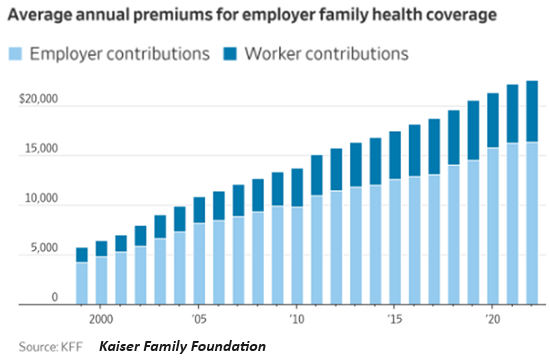

So private equity buys a company, loads it with debt, transfers all the borrowed cash to the private equity "owners," and then leaves the company a sinking hulk that soon declares bankruptcy. Or when private equity snaps up hospitals and healthcare clinics and prices rise not for better service but to "reward the owners," this plundering of "healthcare" is just good solid MBA-school maximization of shareholder value.

What few seem to notice is the barriers that limited the pillage and plundering of the private and public-sectors have all eroded or been hollowed out. The legal framework is now a mirror-image of the financial sector, a series of facades that mask the pillage and plundering: of course it's profitable, but it's also legal.

The social barriers have also been dismantled. There are no taboos left, as "anything goes" is the modern zeitgeist. The notion that corporations have a social responsibility to the community they're embedded in is now a quaint whiff of nostalgia, along with the notion that corporations have an implicit responsibility to serve the larger national interests as well as "shareholder value."

Every institution has been hollowed out by self-service. Is it any wonder than younger generations have near-zero trust in institutions, given that their PR veneer of "public service" is just a cover for milking the system for private gain?

If you read histories of capitalism--for example, Fernand Braudel's three-volume Civilization and Capitalism, 15th-18th Century ( Volume 1,

Volume 2,

Volume 3)

you discover that "capitalism" only functions as advertised if it is embedded in a moral order, something Adam Smith understood.

In early European capitalism, Christianity (Catholic and Protestant) provided this moral order. In China, Confucianism provided the moral foundation of the society and the economic - political structures.

Consider Xi Jinping's campaign to unify Confucianism and Marxism. This is not an anachronism, it reflects Xi's understanding that Marxism does not provide the moral foundation needed to limit the corruption undermining China. Only restoring a Confucian moral order can do that.

I explored this in some depth in this essay

Pieces of the China Puzzle (April 27, 2024).

Here is an excerpt:

As the author noted, "his attempted synthesis of Marx and Confucius has prompted bafflement, even mockery, among observers outside and inside China."

To me, there is nothing baffling in this synthesis; it not only makes perfect sense, it can be understood as essential in the broader context of China's history and culture.

If we truly want to make America great again, as opposed to using the slogan as cover for more grift and graft, then we have to start by recognizing the moral sinkhole we're in. Institutions, the government and corporations have all lost our trust because they're all cesspools of self-serving corruption.

No, this is not "normal" or "the way it's always been." Those are the excuses we deploy to avoid facing the truth: our status quo is so thoroughly corrupt that it's no longer even seen as corruption, it's just BAU--business as usual.

There will be consequences, for a society that lacks a moral foundation is a society shorn of value, a society of fakery, PR and narrative control designed to mask maximizing my gain regardless of consequences pillage and plunder.

When a hard rain finally falls, it will surprise us, for in our grandiosity and hubris, we imagined we were gods, immune to the fatal consequences of our corruption.

Check out my new book Ultra-Processed Life and my new fiction/novels page.

Become

a $3/month patron of my work via patreon.com.

Subscribe to my Substack for free

My recent books:

Disclosure: As an Amazon Associate I earn from qualifying purchases originated via links to Amazon products on this site.

Ultra-Processed Life print $16, (Kindle $7.95, Hardcover $20 (129 pages, 2025) Read the Introduction and first chapter for free (PDF)

The Mythology of Progress, Anti-Progress and a Mythology for the 21st Century print $16, (Kindle $6.95, Hardcover $24 (215 pages, 2024) Read the Introduction and first chapter for free (PDF)

Self-Reliance in the 21st Century print $15, (Kindle $6.95, audiobook $13.08 (96 pages, 2022) Read the first chapter for free (PDF)

When You Can't Go On: Burnout, Reckoning and Renewal $15 print, $6.95 Kindle ebook; audiobook Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States (Kindle $6.95, print $16, audiobook) Read Chapter One for free (PDF).

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $6.95, print $15, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $3.95, print $12, audiobook) Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel) $3.95 Kindle, $12 print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print) Read the first section for free

Become a $3/month patron of my work via patreon.com.

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, James M. ($70), for your exceedingly generous subscription to this site -- I am greatly honored by your support and readership. |

Thank you, Dan T. ($5/month), for your marvelously generous subscription to this site -- I am greatly honored by your support and readership. |

|

|

Thank you, Christopher H. ($50), for your superbly generous subscription to this site -- I am greatly honored by your support and readership. |

Thank you, John C. ($32), for your splendidly generous subscription to this site -- I am greatly honored by your support and readership. |