Unemployment: The Gathering Storm

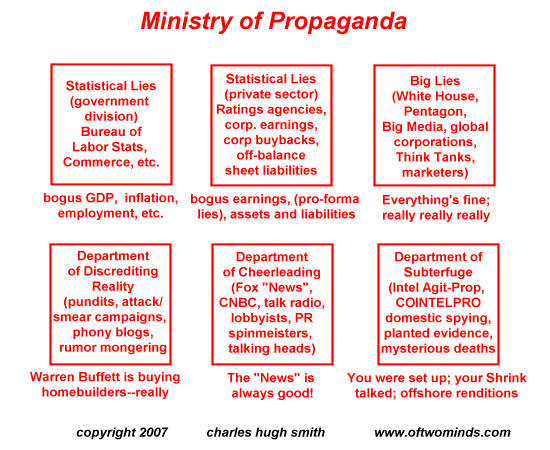

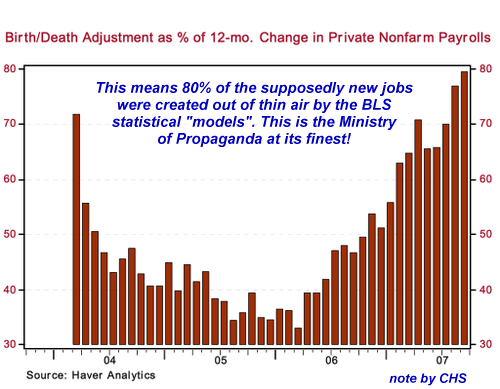

Officially, 14.9 million Americans are unemployed. That number will double. The number of people who are unemployed is almost unimaginable: 15 million.According to the Bureau of Labor Statistic's August 2009 Employment Situation Report, 14.9 million persons are unemployed, 9.1 million are "working part time for economic reasons," and 2.3 million are "marginally attached to the labor force," i.e. they wanted a job but have not actively looked for a job in the past four weeks. That totals 26.3 million people unemployed or under-employed. In January of this year, the Standard Issue Financial Punditry (SIFP) was parroting "official estimates" that the economy would lose 2 million jobs during this recession. I dismantled that absurd fantasy with an analysis of the employment situation which concluded that 21 million jobs lost is actually an optimistic guesstimate compared to what could transpire in the years ahead--a gradual evaporation of 30-35 million jobs. Sadly, the current numbers fall into the range that I suggested was realistic. (The End of (Paying) Work, January 21, 2009) We need to understand the dynamics behind the unemployment numbers. 1. Some unemployment is normal; people lose a job or quit and then find another one, usually within six months--at least in times of prosperity. So even in prosperity, 5 to 6 million people are "between jobs" and thus officially unemployed while they draw unemployment benefits. Thus at least 5 million of the 15 million currently unemployed are "baseline" unemployed, the normal shifting and adjusting of thousands of enterprises and 137 million workers (the size of the civilian workforce as of December 2008). So while the "official" estimate was 2 million people would lose their jobs due to recession, the actual number is already 10 million. At least 2.3 million have given up looking and 9 million more have had their hours slashed. Note to Ministry of Propaganda: you really need to align slightly with reality or you lose all credibility. 2. The BLS estimates the number of jobs created by the "birth" of new small businesses which it assumes are flying beneath its statistical radar and the number lost as these same small business close their doors. Uncannily, millions of these phantom jobs are statistically "created" every year by the BLS model, which of course was constructed on the basis of decades of endless prosperity. My esteemed blogger colleague Mish Shedlock has explained the Birth-Death Model extremely cogently. Even if you grant the BLS statisticians some slack, it is patently absurd to expect small business to create jobs in a deep recession at the same rate it (supposedly) creates them in prosperity. 3. Official unemployment does not differentiate between the long-term unemployed--those who have been looking for over a year with no luck--and the typical unemployed who find another job within six months. In "normal prosperity" then an uptick in unemployment is not too worrisome because people find another job within a year. But when the economy sheds jobs relentlessly, then people become long-term unemployed: they can't fnd a job this year, or next year, or the year after that. This is also called structural unemployment. What few are willing to accept is that the U.S. economy is entering a decades-long period of structural unemployment in which there will not be enough jobs for tens of millions of citizens. My January analysis remains conservative; given the end of the credit/debt bubble and other structural issues, it seems very likely that the U.S. economy might have about 100 million jobs in a few years--leaving some 35 to 40 million people without formal fulltime work or employer-paid benefits. Since we're already at 26.3 million unemployed/under-employed, losing 10 million more jobs is really not much of a stretch. That would leave 36 million people without fulltime work or any work at all and about 100 million still employed. 4. Since many professionals such as realtors, contractors, freelance designers, consultants, etc. are usually self-employed, then these millions of people may be reporting (in the "household employment survey") that they're employed but their income may be near-zero as work in these fields has dried up. In an economy based on exponential expansion of debt and ever-increasing velocity of borrowed money, the loss of this credit expansion and velocity is nothing short of catastrophic. I find the many fantasies about "new high-tech industries creating millions of jobs" to be especially tiresome because they are always generated by Standard-Issue Financial Pundits who don't even know what a Molecular Foundry even is, much less what goes on inside it--or by a venture capitalist touting why the company he just invested in is worth a gazillion dollars. The more you actually know about very high level technology, the less likely you are to spout nonsense about millions of jobs being created. For instance: nanotechnology. Well guess what, SIFP cheerleaders: we already have nanotechnology and it's called silicon wafer/chip production. With computer chip circuitry down to the sub .25 micron range, that's nanotechnology. How many jobs are being created in this industry? very few, as the machines which actually produce the nanotechnology are mostly automated. How about all that R&D (research and development) in biofuels? I was speaking to a biofuels researcher at Caltech (California Institute of Technology) ealier this year about his team's biofuels/bioengineering project, and he was extremely wary about the prospects of this technology being scaled up to a meaningful level, i.e. a technology which reliably produces, day after day after day, tens of millions of gallons of high-energy-density liquid fuels which can replace fossil-fuel based jet fuel, diesel and gasoline. The more you actually know about very high level technology, the less likely you are to spout nonsense about scaling up extremely finicky and unproven technologies. It doesn't take more than high school chemistry, biology and physics to understand 99% of the technical/biological limitations of "miracle" technologies. For instance, algae, like every other organism, requires some feedstock (food). It doesn't just reproduce with no inputs. And like every other organism, it can die if conditions sour. So gigantic ponds of algae producing biofuels sounds good until you actually try it and your algae mysteriously dies off. Sorting out the actual fuel from the gunk and sludge is a non-trivial task as well. James Howard Kunstler's recent post Original Sin neatly lays out the other structural erosion in the U.S. economy: the end-state of the Suburban Lifestyle. Much of the FIRE economy (finance, insurance and real estate) was based on the endless expansion of suburbs and exurbs. Now that we have built and outfitted suburbia, we have 18.6 million vacant homes in the U.S.--a staggeringly large number. Here is the Census report: CENSUS BUREAU REPORTS ON RESIDENTIAL VACANCIES AND HOMEOWNERSHIP Of the 2.1 million increase in total housing units, 1.1 million were occupied and 1.0 million were vacant units. Of the 1.0 million additional vacant units from last year, only 20.5 percent were for rent or for sale. The number of total vacant housing units, 18.6 million, was higher than the estimated number in first quarter 2007. Of these vacant housing units, 13.9 million were for year-round use and 4.7 million were for seasonal use. Approximately 4.1 million of the year-round vacant units were for rent, 2.3 million were for sale only, and the remaining 7.5 million units were vacant for a variety of other reasons. (From Why Housing Is Far from Bottoming: Depression, Demographics, Defaults and Dumps, October 8, 2008) The idea that we as a nation need to build 10 million more homes is a non-starter when 19 million dwellings are empty, of which no more than 4.7 million are "second homes." (Dirty secret #2: thousands of these homes are on the market as downsizing bourgeois attempt to unload unneeded vacation homes.) My original January analysis by job category remains pertinent. Given events since then and the coming meltdown/implosion of state and local governments as tax revenues plummet, these estimates seem optimistic. Here are the pre-recession (early 2008) employment statistics from the Bureau of Labor Statistics: Nonfarm employment.......| 137,331 Let's look at each category and make a rough back-of-the-envelope estimate for how much paying work each category might support in, say, 18 to 24 months. Construction. While bridges being repaired will certainly support heavy-construction employment, the far larger categories of residential building and remodeling and commercial construction (office towers, malls, warehouses, etc.) are completely overbuilt for years to come. So let's guesstimate that there will be 50% less demand for construction and a job loss of 3.5 million in this category. Manufacturing. Unfortunately, a tremendous amount of manufacturing is dependent on construction (glass, appliances, steel, etc.) and transportation (rubber, steel, components, semiconductors, etc.) both of which are in freefalls. Exports are falling as fast as imports. Let's be charitable and only carve off 3.5 million jobs here, leaving 10 million intact. Retail. Does anyone doubt that fully 1/3 of all retail outlets are now surplus? We're talking about fulltime positions here; so cutting hours from everyone on the floor may actually save jobs (i.e. hours cut will not show up in the above statistics) but the equivalent fulltime positions (that is, 40 hours of paid work a week) may well have vanished. Let's guesstimate that 5 million retail positions will no longer be supported by sales/profits. Professional and Business Services. Legal and accounting services will suffer as businesses fold. Businesses will decide they need fewer contract workers, fewer consultants, fewer financial services and fewer software upgrades. Let's guesstimate that 2.5 million jobs will eventually be lost in this category. Education and Health Services. These have been the growth industries, along with financial services, during the bogus "prosperity" of the past eight years. Once millions of jobs are shed, then millions of dollars of health insurance are no longer paid by employers, which means healthcare providers will get squeezed along with every other category. Here is California, college enrollments are being capped as deficits soar; the inevitable next step is to leave jobs unfilled as people retire--one way or another, a reduction in total education employment. Let's guesstimate 1 million of these jobs get cut--perhaps not by layoffs but by retiring workers not being replaced. Leisure and hospitality. The sad fact is nobody needs to take a cruise or a vacation; both are the acme of discretionary expenditures. I would be shocked if the U.S. economy didn't shed 3.5 million jobs in this category. Government. Local government (cities, counties, states and agencies) has added 12% more employees in the past eight years of bogus debt-based "prosperity," and the freefall in tax revenues means those 12% of "new" government jobs will vanish--and that's the best-case scenario. Let's guess that a total of 2.5 million jobs will disappear as tax revenues plummet and then keep plummeting. The total: 21.5 million jobs--3 times the BLS estimate of 6.7 million jobs lost to date. Very few have the stomach to consider the reality that perhaps 20+ million jobs are no longer supportable by private industry revenues and profits and the tax revenues which depend on those profits and jobs. 21.5 million jobs lost works out to about 15.6% unemployment--a full 10% lower than the 25% unemployment rate reached in the Great Depression. In other words, 21 million jobs lost is actually an optimistic guesstimate compared to what could transpire in the years ahead--a gradual evaporation of 30-35 million jobs. If Federal fiscal stimulus funds a couple million jobs--more likely retaining jobs in heavy construction and manufacturing that would otherwise be lost rather than adding jobs--then the total job loss might not be as severe until the "extra" Federal spending ends in 2010. Just off the top of my head, here are industries which are sure to be hard-hit: media, advertising, cruise ships, professional sports (how many people will be able to afford $45 tickets for seats plus $20 for parking and $35 for a few beers and hotdogs?), spas, auto detailing, non-profits, pricey venues like museums which depend on wealthy donors (far fewer of those suddenly)--the list is long indeed. Even worse, the deeper issue--the End of Work in a resource-profligate and consumer-based economy--isn't even being addressed yet. Knowledgeable reader Matt S. recently recommended The End of Work Rifkin's primary point is that the "full employment" of the bubble eras (dot-com asset bubble followed by credit-housing bubble) was a temporary aberration from the underlying trend caused solely by unsustainable credit-based (borrow and spend) consumerism. The long-term trend is: productivity is raised by the replacement of human labor (jobs) with automation/machines/software. As productivity rises, the number of jobs decreases. Rifkin points to the U.S. steel industry as an example. Since 1981, the industry has boosted production by about a third while reducing the number of jobs from 384,000 to 74,000. So three long-term structural trends are firmly in place: 1. The end of the 60-year long "build and outfit suburbia" economy. 2. The end of the 80-year long Keynesian experiment in boosting "growth" and employment with ever-higher deficits and exponential expansion of credit and debt. 3. The ongoing trend to replace high-cost human labor with automation, software and fundamental efficiencies and the global arbitrage of wages (offshoring, moving production to low-wage nations, etc.). So what happens when 40 million people don't have jobs and benefits? Well, we can act as the Ministry of Propaganda suggests and believe it will all work out somehow if only people borrow and spend more money, or we can adapt. We can keep extending unemployment benefits, essentially forever. This is the compassionate response to structural unemployment. As Bob Marley sang, "a hungry mob is an angry mob" and food riots might well be the result of leaving 30 million people without any income. As I have noted many times, unemployment and food stamps are "cheap" programs. The entire food stamp program which serves tens of millions of households costs about $30 billion-- less than 5% of the bloated Medicare system. For context, recall that "defense" and the GWOT (global war on terrorism), Social Security and the Medicare/Medicaid system all cost about $650 billion each. Compared to those numbers, $30-40 billion to feed people is modest indeed. It is especially cheap when compared to the obscene $11.6 trillion in Federal bailouts we have collectively ponied up. Some sort of cultural shift to job-sharing might be in order. Yes, I understand it's inefficient but there are social "efficiencies" to consider as well as financial ones. As I noted in End of Work, End of Affluence III: The Rise of Informal Businesses (December 10, 2008), the Third World model of tens of millions of people finding informal employment in non-formal businesses holds much promise for the U.S. unemployed. As someone who has been "marginally attached to the labor force" for decades (with occasional brief interruptions of formal employment), I can assure you that what I term hybrid work is entirely possible: some paid work, lots of unpaid work, and lots of "experiential capital" created and traded. All it requires is an entrepreneural mindset, an understanding that Capitalism requires Risking Capital and/or Labor to generate a Return (i.e. failure is part of the process, so don't let it get to you) and a very low-cost lifestyle. The stress level of a low-cost lifestyle is lower than that of a high-cost lifestyle.If happiness is more about "the pursuit of happiness" than consuming, then hybrid work holds the potential of being far more satisfying than formal fulltime work in Corporate America--especially if you can't find work in Corporate America. "Your book is truly a revolutionary act." Kenneth R. Thank you, Andrew M. ($25), for your exceedingly generous donation via U.S. mail to this site. I am greatly honored by your support and readership.

The dirty secret all along was that by 2005 there was no economy left in the USA beyond the suburban sprawl economy with its so-called "consumer" nexus -- largely devoted to the outfitting of suburbia.

There were an estimated 129.4 million housing units in the United States in the first quarter 2008. Approximately 110.8 million housing units were occupied: 75.1 million by owners and 35.7 million by renters.

Goods-producing (1)........| 21,351

Construction ......... 7,141

Manufacturing ....... 13,423

Service-providing (1)......| 115,980

Retail trade (2)....... 15,259

Professional and

business services ..... 17,849

Education and health

services .......... 18,975

Leisure and

hospitality ....... 13,627

Government .......... 22,504 by Jeremy Rifkin.

Permanent link: Unemployment: The Gathering Storm

I've been invited to join the writers contributing to Seeking Alpha. You can also find my work on AOL's Daily Finance.

If you want more troubling/revolutionary/annoying analysis, please read Free eBook now available: HTML version: Survival+: Structuring Prosperity for Yourself and the Nation (PDF version (111 pages): Survival+)

Of Two Minds is now available via Kindle: Of Two Minds blog-Kindle