Housing and the Paradox of Credit Bubbles, Equity and Demand

by Charles Hugh Smith

There is an unresolvable paradox at the heart of the government's desperate attempts to keep housing prices from falling any lower: the government must either reinflate housing values or at least maintain them at current levels, lest owners and lenders lose all their capital/collateral.

But keeping house prices artifically inflated to save owners and lenders who borrowed/lent during the bubble means that prices will remain unaffordable to qualified buyers (i.e. those who actually meet prudent lending standards, not government giveaway programs like the FHA 3% down payment, the $8,000 tax credit, etc.)

Without organic demand (demand from truly qualified buyers), then there is nothing to keep prices artifically high; over-supply and limited demand lead to lower prices.

To fully understand the paradox, we need to start with the fact that the U.S. economy depends on consumers borrowing ever-larger sums of money for its "growth." When borrowing ceases, the economy tanks.

To fully understand the paradox, we need to start with the fact that the U.S. economy depends on consumers borrowing ever-larger sums of money for its "growth." When borrowing ceases, the economy tanks.

As I documented in The Contrarian Trade of the Decade: the U.S. Dollar (March 22, 2010), U.S. consumers added $3 trillion of new debt in 2006 and a mere $46 billion in 2008. "Net increase in household liabilities" grew by $1.8 trillion in 2006 and $1.4 trillion in 2007, and then fell to $146 billion in 2008. Mortgage debt rose by $1.1 trillion in 2005, $1 trillion in 2006, $686 billion in 2007--and then fell by $106 billion in 2008.

In 2006 U.S. households borrowed $3 trillion in 2006 (fully 25% of the entire U.S. GDP), and the savings rate was either negative or near-zero, depending on who made the calculation. The economy was declared "healthy" and "growing."

In 2008, total household liabilities and mortgages grew by a meager $46 billion, household savings shot up to $470 billion and the economy was declared on life-support.

So here is the Federal Reserve and Federal government's terrible dilemma. In an economy totally dependent on exponentially rising credit and debt for its "growth" (in parentheses because the demand is not organic but credit-based), the government had to lower interest rates to zero (or negative rates, when inflation is considered) to goose faltering demand. (Zero interest rate policy: ZIRP.)

ZIRP greatly expanded credit by increasing the leverage of income. All borrowing is based on collateral: either disposable income and a credible promise to pay the debt incurred, or the collateral of cash/liquid (easily marketable) assets.

At high interest rates, $100 a month in disposable income might leverage $1,000 in new credit/debt. At very low rates of interest, that $100 supports $3,000 in new credit card purchases.

That's why American consumers have been trained to think only in terms of "the monthly nut." American households didn't really care if the mortgage was $200,000 or $400,000, as long as they could make "the monthly nut."

In the prosperous mid-1980s, mortgage rates were around 10%-12% (I know because I had one). So let's say a $1,000 monthly nut could support a $100,000 mortgage.

Drop interest rates to 5%-6%, and voila, the same "monthly nut" of $1,000 now supports a mortgage of $200,000. Though the Federal Reserve shills and lackeys deny that ZIRP had any causal relation to the housing bubble, it is clear that cutting interest rates in half will cause housing prices to double.

Credit was further expanded by lowering lending standards via Fannie Mae and Freddie Mac so heretofore marginal buyers could leverage modest down payments and incomes into home ownership.

The final two boosters which expanded credit to previously unknown levels were the subprime mortgage phenomenon of "no-doc" "liar loans" and zero-down mortgages, and Wall Street's packaging of these doomed subprime and Fannie/Freddie loans into mortgage-backed securities. Once the intrinsically corrupt ratings agencies blessed these defective fraudulent tranches as AAA (safe, low-risk investments), then Wall Street could sell virtually unlimited quantities of MBS, creating an unquenchable demand for more mortgages.

The consequence of this explosion of credit was predictable: housing values skyrocketed as millions of previously unqualified buyers leaped into homeownership on the back of unprecedented leverage (liar loans without prudent documentation of income, and low-/no-down payments).

The results of this imprudent expansion of credit were so predictable that the staid FDIC felt impelled to issue a warning in 2006 that 10% of recent home buyers were at risk of default.

Sadly, the FDIC was correct; there are about 50 million mortgages in the U.S., and about 5 million are in default (10%). But the dominoes have fallen further than the FDIC expected, and now fully one-third of mortgage-holders are "underwater," i.e. their mortgage exceeds the value of their home, and so foreclosures will certainly exceed 5 million.

Also predictably, the lenders of all these distressed/defaulted mortgages have been bankrupted by the staggering losses. To hide this fact, the Federal government regulatory agencies have allowed lenders to keep loans on the books at "mark to fantasy" valuations, and lenders are actively engaged in a host of other accounting tricks to mask the true extent of their losses--the main one being to evade the foreclosure process entirely so the loan will be left on the books as if it were "performing."

Now the Fed and the U.S. government are in a real bind: both the pool of borrowers and the pool of lenders has seen their collateral/capital wiped out to the tune of trillions of dollars.

Call it whatever you like: assets, collateral, cash or equity, trillions have been wiped off the balance sheets of households and lenders.

Oops--how can households with no collateral borrow money, and how can lenders with no capital extend credit?they can't, so the Fed has had to step in and essentially take over the mortgage market since no private buyers could be found who were stupid enough to buy FHA loans which which were defaulting shortly after the ink was dry on the mortgage docs.

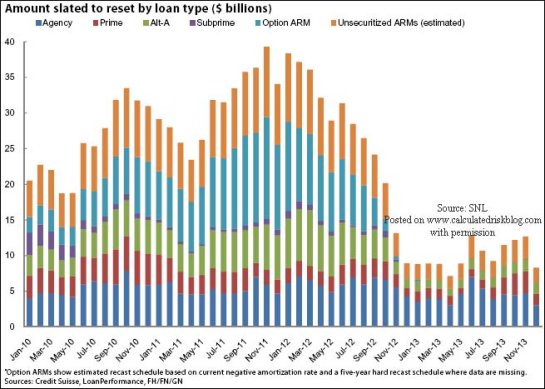

Then there is the mortgage-reset "hammer of doom" which is about to drop on vulnerable homeowners and lenders:

There is one way to reignite demand from legitimate, qualified house buyers: let prices drop back to pre-bubble valuations circa 1997-8. And indeed, in many less-desirable or marginal areas, prices have fallen by 75% from their bubble-era levels. In the San Francisco Bay Area (supposedly immune to declines in value), there are multiple zip codes which have seen declines of 70+%, and many more which have experienced drops of 40% or more: Pinpointing home prices by ZIP code (S.F. Chronicle).

But drops of these magnitudes essentially bankrupt lenders and wipe out whatever equity the home buyers invested in the property. Those stupendous losses have yet to be fully tallied (due to the accounting tricks noted above) for either borrowers or lenders, but it is clear that as a nation the ability to borrow/lend $3 trillion a year by any prudent metrics of qualification is gone.

The collateral basis of that borrowing--home equity--has vanished for the majority of homeowners, and the ability of lenders to lend to marginal/fraudulent borrowers has been curtailed. Now the Fed's $1.4 trillion support of the mortgage market is scheduled to end, just as mortgage resets are set to surge.

The Fed and the U.S. government have fought tooth and nail to resist the declines in prices which are inevitable after a credit bubble has burst and supply far exceeds demand.

The government has done everything possible to keep bubble-era prices inflated: by essentially socializing the entire U.S. mortgage market, by offering an $8,000 tax giveaway to anyone buying a house, by enabling fraudulent accounting by lenders, and by launching one program after another aimed at keeping underwater borrowers in their homes, and maintaining the artifice that the loan is still performing and worth its nominal book value.

Meanwhile, in the real world, Half of U.S. Home Loan Modifications Default Again.

The paradox cannot be resolved. Prices cannot be allowed to settle to levels which will attract legitimate, qualified buyers (demand) because that will bankrupt millions of homeowners and multiple "too big to fail" mortgage lenders, wiping out trillions more in equity and capital, hobbling the borrowing and credit expansion on which the U.S. economy is now totally dependent.

There is another way, but it will never be taken: switch the incentives of the economy from borrowing and consumption to savings and production. But that would require a "reset" not just of finance but of society, government and culture.

In the meantime, look for a "Lost Decade" in which distressed debt is covered up via "extend and pretend" year after year, collateral, credit and borrowing continue to contract and various "fixes" which have failed miserably are expanded in a desperate attempt to "solve" the burst credit bubble by reinflating it.

It won't work, for the simple reason that borrowing is based on collateral; as incomes and equity/assets shrink, so does the ability to leverage/borrow--for both households and lenders.

If you haven't visited the forum, here's a place to start. Click on the link below and then select "new posts." You'll get to see what other oftwominds.com readers and contributors are discussing/sharing.

DailyJava.net is now open for aggregating our collective intelligence.

Order Survival+: Structuring Prosperity for Yourself and the Nation and/or Survival+ The Primer from your local bookseller or from amazon.com or in ebook and Kindle formats.A 20% discount is available from the publisher.

Of Two Minds is now available via Kindle: Of Two Minds blog-Kindle

| Thank you, Bryan S. ($50), for remarkably generous donation to the site (in response to my 2/21 rant). I am greatly honored by your support and readership. | Thank you, Barney S. ($10), for your continuing generous support of the site. I am greatly honored by your contributions and readership. |