What If (Almost) All Assets Fall Together?

Since virtually all asset classes rose together, why can't they all fall together, too?

Just as a thought experiment: as the wheels fall off the bogus "global recovery" story, what if all asset classes fall together (with one exception)? This is what I call the "nowhere to hide" scenario, and the case for it can be made with the following charts.

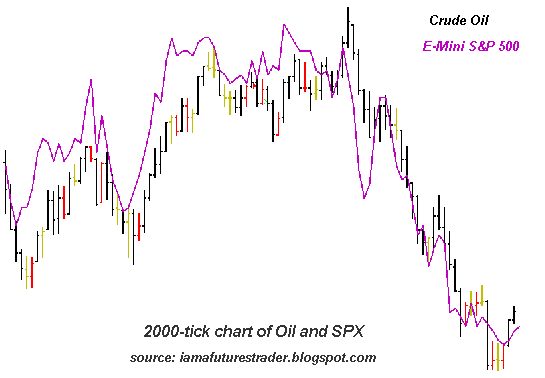

Chart One: Tight correlation of assets.

Source: I Am a Futures Trader

Here is a 2000-tick chart of crude oil and the S&P 500 futures contract (E-Minis).

This sort of extreme correlation in markets which historically have not been tightly correlated smacks of manipulation and/or "hot money" borrowed from the Fed's quantitative easing punchbowl chasing all assets higher.

Or invent your own causal chains. Whatever the reason for this tight correlation, it suggests when one heads down, so will the other.

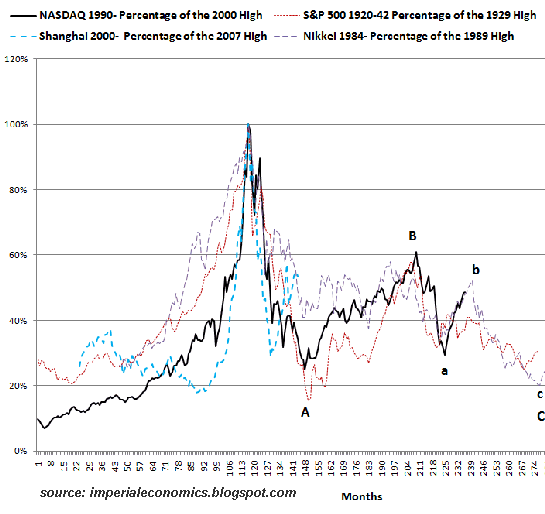

Chart Two: NASDAQ overlaid against other post-bubble equity markets.

Source: THE ECONOMICS OF OIL EMPIRE AND PEAK OIL

This chart, courtesy of frequent contributor/blogger B.C., illustrates how the Shanghai market (blue dotted line) has tracked the NASDAQ 2000 bubble, crash and recovery quite well. It is now poised to collapse from its post-peak high.

The NASDAQ itself (solid black line) is tracking the post-crash Nikkei index (dotted purple line) quite closely, suggesting it is poised to roll over.

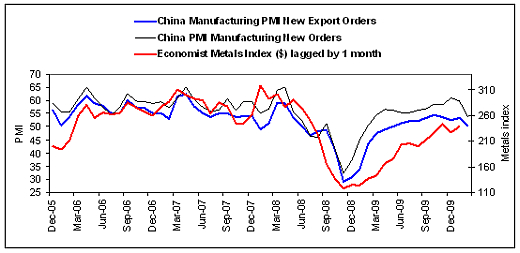

Chart Three: China's manufacturing orders are rolling over.

This chart is self-explanatory: China's new orders and new export orders are both rolling over as the $15 trillion (or is it $30 trillion?) in global goosing by central governments runs out of exponential-debt creation magic.

China's orders rolling over sounds the death-knell for all the industrial commodities like copper, crude oil and iron ore. Once the "global boom is re-inflating" story expires, so too will speculative demand for commodities.

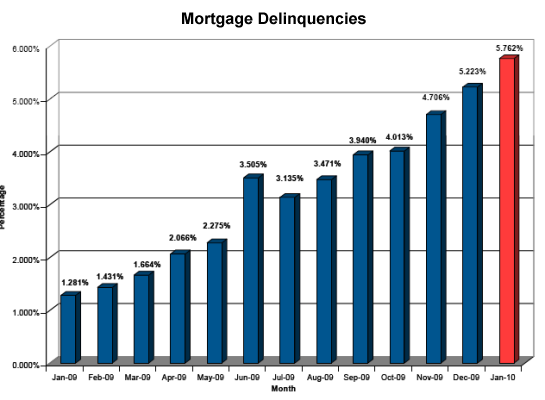

Chart Four: FHA mortgages are souring at an incredible rate.

FHA has backed most of the mortgages originated since the global markets crashed in 2008. That those loans are defaulting reveals that the FHA has no more credible risk management than the subprime originators who inflated the housing/credit bubble before it (mostly Fannie Mae and Freddie Mac, with help from Wall Street MBS packagers).

Chart Five: mortgages delinquencies are skyrocketing.

If 2009 was a year of recovery, there is little evidence of that in this chart. So-called "prime" 30-year fixed mortgages and Jumbo loans are both souring, too, despite all the happy stories about "this is limited to subprime loans."

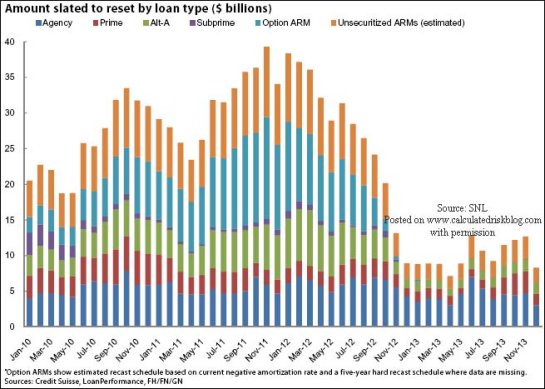

Chart Six: mortgage reset are set to rise.

This is a newly updated chart of all the mortgage resets just ahead. It is difficult to swallow the MSM pablum that the housing market is "recovering" if you glance at this chart.

Chart Seven: maybe even gold is set to roll over.

This chart of the gold ETF GLD illustrates how volatile gold is as an asset, and it sure looks like gold is either taking a breather or set to roll over in one of its typical 6-to-12-month declines.

Why would gold decline if all other assets are falling? Perhaps because some owners will need to raise cash as their debts come due, and they will dump the one asset which is holding its value (gold) before they liquidate their fast-falling assets (i.e. "slope of hope" deleveraging in which you sell your best assets first in the hope your other assets will somehow recover).

The scenario for bonds is straightforward: as interest rates rise in response to a new appreciation for risk and default, the value of all bonds falls. Today's news of rising inflation in China just adds a little fuel to the higher-rates-ahead fire.

Chart Eight: the UUP ETF, a proxy for the U.S. Dollar.

The lowly dollar has been kicked around for several years--with good reason-- and the pundits calling for it to crash are legion. Perhaps, but the chart suggests the trend has reversed and the bruised DXY/USD might actually be in a new uptrend.

Why would the USD rise while everything else plummets? One possibility is a "relative flight to risk" and liquidity. If rates pop up globally (for the reason there isn't enough money, fiat or otherwise, to fund all the debt which is being floated or rolled over globally) then a modest return and a liquid market might look fairly attractive.

It's possible that a lot of this seeking-safety money could flow into gold and silver (and other precious metals), but it's also possible that the PM markets aren't large enough or liquid enough for such a flood of money, and it's also possible that many big-money managers might need some yield, however modest.

In this amateur observer's thought-experiment (which is NOT investment advice---please read the HUGE GIANT BIG FAT DISCLAIMER below), cash (and/or a short position) would be the only assets which retained or gained value.

Please note this is a speculative thought-experiment, not a strategy.

By way of disclosure: I am short various markets via puts on BAC and APC and inverse leveraged ETFs. I have no long positions and I am holding a significant percentage of my tiny portfolio in cash. I sold my gold mining stocks some months ago and will patiently await a re-entry point. Please do not interpret this disclosure as "advice;" I am posting this in response to a reader who suggested that what I own/ don't own is a better indication of my views that what I might write. Fair enough, and those are my positions: cash and short.

If you haven't visited the forum, here's a place to start. Click on the link below and then select "new posts." You'll get to see what other oftwominds.com readers and contributors are discussing/sharing.

DailyJava.net is now open for aggregating our collective intelligence.

Order Survival+: Structuring Prosperity for Yourself and the Nation and/or Survival+ The Primer from your local bookseller or from amazon.com or in ebook and Kindle formats.A 20% discount is available from the publisher.

Of Two Minds is now available via Kindle: Of Two Minds blog-Kindle

HUGE GIANT BIG FAT DISCLAIMER: Nothing on this site should be construed as investment advice or guidance. It is not intended as investment advice or guidance, nor is it offered as such. It is solely the opinion of the writer, who is NOT an investment counselor/professional. All the content of this website is solely an expression of his personal interests and is posted as free-of-charge opinion and commentary. If you seek investment advice, consult a registered, qualified investment counselor (As with any other professional service, confirm their track record and referrals).

| Thank you, Venkatesh P. ($50), for your stupendously generous donation to this site. I am greatly honored by your support and readership. | Thank you, Gene P. ($40), for your exceedingly generous donation to the site. I am greatly honored by your support and readership. |