Are the Fed's Honchos Simpletons, Or Are They Just Taking Orders?

Without exception the Fed's policies are pernicious failures; either they are exceptionally thickheaded, or they are just taking orders.

At the risk of boring you with material you already know well, let's quickly cover the Fed's policies and stated goals since the Global Financial Meltdown of late 2008.

The Fed's supposed goal is "get the economy on its feet again" by stabilizing employment and prices. At the risk of sounding naive, we can paraphrase all the Fed's statements thusly: "We're trying to help everyone in the U.S. by fighting this recession."

Sounds noble enough, so let's look at what the Fed has actually done in the real world.

1. The Fed has injected "liquidity" into the banking sector, enabling banks to borrow essentially unlimited sums at essentially zero interest--the infamous ZIRP (zero-interest rate policy).

2. The Fed has pushed down mortgage rates by buying over 10% of all outstanding mortgages in the U.S.--all the toxic garbage loans which the banks were desperate to get off their crippled balance sheets.

3. The Fed has pushed down yields on U.S. Treasury bonds ("monetizing" this newly issued debt) by buying hundreds of billions of dollars of bonds itself.

Here is what each program was intended to do:

1. ZIRP and unlimited liquidity was intended to enable the banks to "earn their way back to solvency" by giving them free money which they could then loan out at much higher rates. The difference between zero (their cost) and the interest rate they charged borrowers (such as those wonderful 19% credit cards) was pure profit, courtesy of the Federal Reserve.

2. The purchase of $1.2 trillion in mortgage-backed securities was intended to stabilize housing and real estate proces at far above their "natural" level set by "organic" supply and demand; in essence, the goal was to stop market prices from "reverting to the mean," i.e. returning to historical trendlines which are roughly equivialent to pre-bubble valuations circa 1997-98.

This was intended to stop the implosion of banks' balance sheets as their assets--all those mortgage-backed securities and derivatives they own--kept falling in value.

It was also intended to stabilize real estate prices so banks could slowly sell off the millions of foreclosed (REO) and defaulted homes they hold in the "shadow inventory" at prices far above where organic supply and demand would let them settle.

As a side benefit, keeping home prices inflated far above their real value would also allow the Fed to dump its own portfolio of $1.2 trillion mortgage-backed securities without suffering catastrophic losses.

Lastly, the goal was to lower the cost of mortgages to such ridiculously low levels that otherwise prudent citizens might be seduced into buying a house "because rates are so low." (Never mind what happens if the house falls another 40% in value over the next few years.)

The idea was to encourage rampant home buying (for speculation or long-term ownership, it didn't matter) to prop up the market with "demand," even if that "demand" was driven by the low cost of borrowing rather than organic demand based on the need for shelter. (Please recall that there are 19 million vacant dwellings in the U.S. now.)

3. The outright purchase of U.S. Treasury bonds was intended to drop the yield on newly issued bonds to keep the cost of borrowing trillions of dollars for "fiscal stimulus" down so the potential future cost of all the trillions of dollars in new Federal debt would be masked from a credulous citizenry who care more about their entitlements than what happens to their kids and grandkids.

4. All the policies led to super-low yields on low-risk investments so that "cash is trash;" that created a powerful incentive to put capital into risk assets such as stocks, commodities and real estate. By explicitly pushing free money and zero-interest rates, the Fed made it impossible to earn any yield on low-risk assets; thus they have been explicitly pushing capital and borrowed money into the "risk trade": emerging markets, commodities, and stocks.

The goal here is to create a new "wealth effect": if another bubble is inflated in stocks and commodities, then owners of capital will feel wealthier and as a result, they will start spending more.

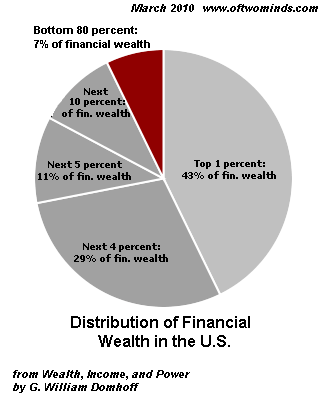

Are the Fed's honchos really such knuckleheads that they don't know most Americans have no financial assets to boost in a new bubble?

Source: Wealth, Income, and Power.

The top-earning 20 percent of Americans — those making more than $100,000 each year — received 49.4 percent of all income generated in the U.S., compared with the 3.4 percent earned by those below the poverty line.

U.S. median household income fell 3 percent in 2009 to $50,221, the second straight annual drop, the Census Bureau said.

One Year Later, No Sign of Improvement in America's Income Inequality Problem:

Income inequality has grown massively since 2000. According to Harvard Magazine, 66% of 2001-2007's income growth went to the top 1% of Americans, while the other 99% of the population got a measly 6% increase.

The Top 5 percent in income earners — those households earning $210,000 or more — account for about one-third of consumer outlays, including spending on goods and services, interest payments on consumer debt and cash gifts, according to an analysis of Federal Reserve data by Moody’s Analytics.

The Fed's central idea was to create a "trickle down" of wealth as a new stock and commodity bubble increased the financial wealth of the top 10%. That idea has demonstrably failed; could the Fed's economic geniuses really be so stupid as to trust in the long-discredited "trickle down" theory that enriching the top tranch will actually benefit the bottom 90%?

5. All the policies were designed to flood the economy with new "free" money, thereby sparking inflation and a new round of consumption that would inject "growth" into the economy.

In other words, the "problem" is perceived as sagging asset prices (real estate and the worthless mortgages written on homes that have lost 50% of their value) which have impoverished homeowners and impaired banks' assets.

The Fed's "solution" is to reinflate the housing bubble (or stabilize its collapse) and push investors and speculators alike into risk assets, in the hopes that a new asset bubble somewhere will boost assets enough to create a "feel good" wealth effect which will trigger massive new consumer spending and repair banks' balance sheets with higher asset valuations.

Put another way, here are the Fed's goals stripped of niceties:

1. Revoke the business cycle--no recessions allowed. In the normal business cycle of classical Capitalism (as opposed to the crony Capitalism we have today), then expansion of credit/debt and rising assets leads to mal-investment and rampant speculation: overbuilding, overcapacity, over-indebtedness and leveraged bets that misprice risk.

Which is precisely what occurred in the 1995-2000 stock market bubble and the 2002-2007 housing/real estate bubble: mal-investment, over-indebtedness, overbuilding and mispricing of risk on a grand, unprecedented scale.

In the normal scheme of things, all this bad debt would be written off and the assets would be sold/liquidated. Holders of those assets and the debt based on those assets would both suffer losses or even be wiped out. All the overbuilt properties and overcapacity would be sold for pennies on the dollar, and the liabilities (debt) wiped off the balance sheet along with all the inflated assets.

There is no other way to clear the market for future growth. Yet the Fed has pursued a "solution" that violates all the principles of Capitalism: to reinflate asset bubbles or keep them artifically high by injecting more credit/debt into the system.

In other words, if you can't service your current debt and you're insolvent because your assets have declined, then the Fed's "solution" is to give you free money to roll over into a bigger debt load and boost the risk-asset trade so the assets on your books will rise again, "solving" your insolvency.

Does anyone at the Fed really believe this will work , or are they just thick? Or even worse, are they just lackeys taking orders from Wall Street and the Financial Power Elites?

You cannot eliminate the consequences of speculative bad bets and over-indebtedness with more debt and more speculation, yet that is precisely the intent of all the Fed's policies.

The Fed's unprecedented purchase of mortgages and Treasury debt have indeed reinflated the stock and housing bubbles to a limited degree, but most of that free money has flowed into emerging markets and commodities, which are now in their own massive bubbles.

In yet another pernicious consequence, the Fed's bumbling attempts to create inflation in the U.S. have failed--the inflation is raging in China. And as inflation rages there, then the cost of Chinese goods in the U.S. will rise.

Is there any possible way to fail more spectacularly that the Fed? Instead of sparking "good inflation" in the U.S. which they presumed (thickheadedly) would boost wages along with prices, thus enabling debt-serfs to pay down their debts with "cheaper" money, they have sparked runaway asset bubbles in commodities and "bad" inflation in China, which means the cost of goods the debt-serfs need to survive is skyrocketing while their wages and income stagnate.

In other words, the policies of the Fed have completely backfired in terms of "helping" 90% of the citizenry. The "wealth effect" of rising stock prices failed to boost the spirits and balance sheets of the bottom 90% who have essentially no financial capital, average incomes have declined in the recession and yet prices for commodities are climbing.

The Fed's policies have created the worst-case scenario for the average American household: stagnant income and rising prices of essentials. The problem is demand is falling along with net incomes, not the supply of new debt. By raising the costs of commodities, the Fed is actually reducing the net disposable income of households: the reverse of the "wealth effect."

Rather than allow the economy to clear out bad debt and re-set asset prices that would enable organic growth, the Fed has tried to inflate new asset bubbles to save the Financial Power Elites from suffering the losses resulting from the last two bubbles popping.

It's as if the fever the patient needs to wipe out a deadly infection has been suppressed by the Fed, creating the illusion of "health" even as the infection destroys the patient from within.

2. "Save" Wall Street, the banks, the nation's Financial Power Elites and the nation's homeowners by blowing new asset bubbles with massive injections of free money and the bogus "demand" created by the Fed's own purchases. The dynamic has already been explained above: cover the losses of the last bubble imploding by blowing an even bigger bubble now that boosts the asset side of balance sheets.

Do the Fed's honchos really think there is another end-game here other than the collapse of their latest ZIRP-QE2-driven asset bubbles? Could they really be so blind, so stupid, so misinformed, so ignorant of reality and history, as to believe their policies will actually work?

Are they so detached from reality that they fail to see their policies are backfiring, further impoverishing most of the citizenry as they set up the inevitable collapse of the banks they have tried so hard to save?

Are they really simpletons, or are they just taking orders from the Financial Elites who have the most to lose when the whole sagging sandcastle finally collapses into the waves?

If you would like to post a comment where others can read it, please go toDailyJava.net, (registering only takes a moment), select Of Two Minds-Charles Smith, and then go to The daily topic. To see other readers recent comments, go to New Posts.

Order Survival+: Structuring Prosperity for Yourself and the Nation and/or Survival+ The Primer from your local bookseller or from amazon.com or in ebook and Kindle formats.A 20% discount is available from the publisher.

Of Two Minds is now available via Kindle: Of Two Minds blog-Kindle

| Thank you, C. A. ($10), for your much-appreciated generous contribution to this site-- I am honored by your support and readership. | Thank you, Karin H. ($25), for your magnificently generous donation to this site-- I am honored by your support and readership. |