The Status Quo's Fundamental Paradigms Are Broken

The paradigms which undergird the global status quo are broken; doing more of the same (the current strategy) will not fix them.

Reading the Mainstream Media, you almost forget that the Status Quo's fundamental paradigms are completely broken. The Status Quo's essential paradigms are as follows:

1. "Growth" is the essential lifeblood of the global economy.

2. "Growth" means higher GDP and economic activity. Thus new luxury condos and Starbucks cafes on the coast of Peru boost Peru's GDP, and thus Peru is experiencing "growth" which is not just intrinsically "good" but essential.

3. "Growth" requires consuming more resources.

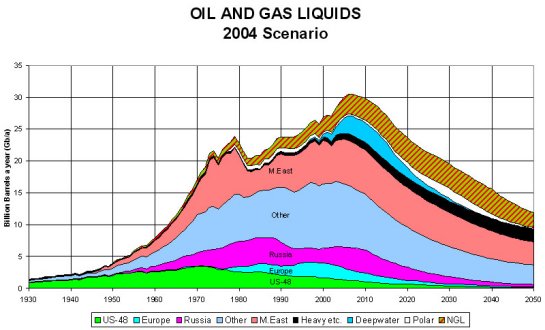

4. There will always be more resources into the foreseeable future. For instance, here is the Status Quo's depiction of fossil fuels supplies:

5. The transition from fossil fuels to alternatives will be slow and seamless because there is still plenty of cheap oil and gas.

6. The dominant paradigms of the global economy are the State Corporation (China) and the Corporate State (U.S.A.). Both are permanent because they are highly efficient.

7. Restrictions on trade and capital flows are "bad." They cause depressions.

8. The nation-state is a durable social structure which will never be seriously threatened with dissolution.

9. As long as the global "pie" of wealth keeps expanding, everyone can grow wealthier together.

10. Low interest rates and expansion of money supply and credit are the three essential financial fuels for "growth."

I think a strong case can be made that each of these paradigms is either already broken or in danger of breaking. Studies have shown that when presented with factual evidence that their core beliefs are wrong, humans respond by clinging even more tightly to their fallacious beliefs.

I think that is precisely the reaction of the global Status Quo.

Here is a typical presentation of the Status Quo's faith in the "China Story" that China's growth can and will continue unimpeded for decades to come:

Elizabeth C. Economy is a well-informed, insightful analyst. Yet she presumes that China can grow like a tree to the sky and that its consumption of oil and other resources can likewise double every few years forever.

There is not one word in this long essay which even hints at the possibility that constraints in the real world might hinder China's vast ambitions and appetites for "the good life" of middle-class consumption for its 1.2 billion citizens.

Though China runs a good PR game about building a "green economy," we should note that its energy consumption equaled the U.S. this year and its production of vehicles far surpassed the U.S. this year.

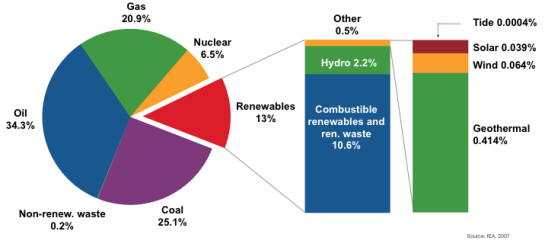

Like every other industrialized nation, China's alternative energy sector supplies at best a sliver of the nation's energy. This is a global chart from the IEA which includes nations like Brazil which have vast biofuel industries using sugar cane.

While subsidizing state-owned plants to manufacture solar panels is certainly a forward-thinking strategy, in the meantime building tens of millions of vehicles every year which require gasoline is pursuing an entirely different set of "growth" and dependency priorities.

Even in the U.S., electricity consumption has risen 25% since 1990, outstripping population growth.

Let's look at some facts before we buy into the paradigm that China (or any other nation) can grow to the sky.

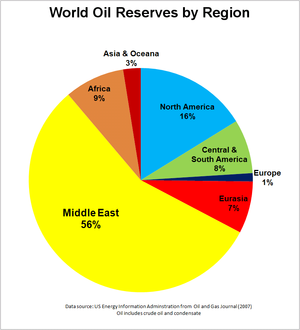

I was accused of saber-rattling after I pointed out in The Great Game: Geopolitics and Oil(October 19, 2010) that the U.S. has a "hard power" presence in the heart of the Mideast while China has a presence in Sudan and other African nations. Let's look at which presence controls more oil:

Now let's look at the reality rather than the fantasy of future oil production:

That sets up an inevitable grab for the resources needed for "growth." The timeframes on this chart are of course approximations; no one knows exactly when oil demand will rise above maximum oil production, but the status quo paradigm that China can double its consumption of oil every few years is clearly wrong.

China is culturally predisposed to feeling that the last few hundred years of weakness was an anomaly and that China is once again the center of the world. (The Chinese character for "center" has been read as "middle," i.e. the Middle Kingdom, but this misses the crucial self-awareness of China as the center of the world).

The future course of China's rising confidence in its heft can be seen everywhere: in its hardening claims for islands in the South China Sea, in its plans to divert rivers originating on the Tibetan plain away from other nations to benefit its own consumption, and in its recent export restrictions of rare industrial metals.

Anyone believing China will remain content with making solar panels while its supplies of essential resources dwindle is misreading China's larger plans.

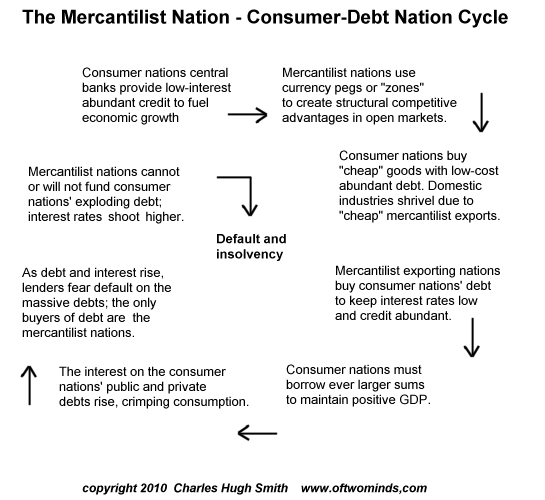

Another paradigm which is already broken is the trade-capital flow fantasy of mercantilist nations funding consumer nation's consumption. China's dissatisfaction with the end-game of this dynamic is already apparent, and a similar breakdown is occurring in Europe as the mercantilist machine that is Germany must bail out one consumer nation after another.

That dynamic is already doomed, and incantations to the contrary are simply beliefs which are unsupported by fact.

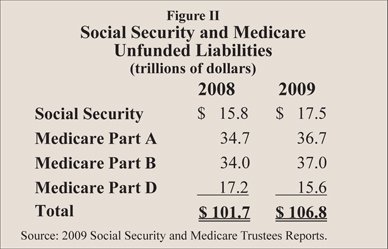

The other core paradigm of the Status Quo is a massive Central State--what I call The Savior State in the Survival+ critique.

In the U.S., personal income is around $9 trillion, and the Federal budget is around $3.6 trillion and state/local governments and agencies consume about $1.5 trillion. So government is about 36% of the nation's GDP.

Recently, the Federal government has been borrowing $1.5 trillion a year to maintain the status quo (representing about 11% of GDP). While the Status Quo presents a happy PR picture of an economy rebuilding its decaying infrastructure, the reality is the Federal borrowing is merely propping up personal income. "Transfers" are funds delivered by the government to individuals:

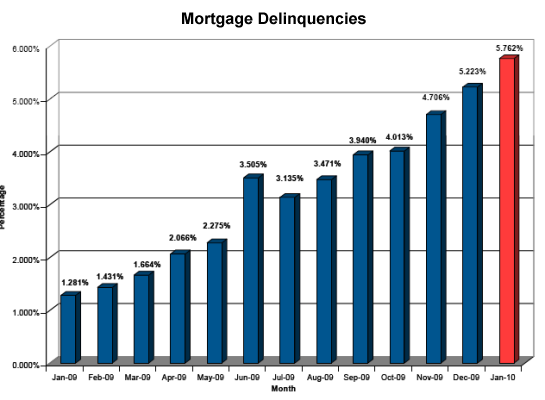

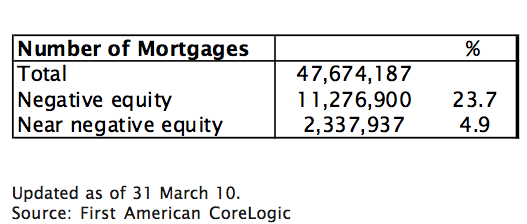

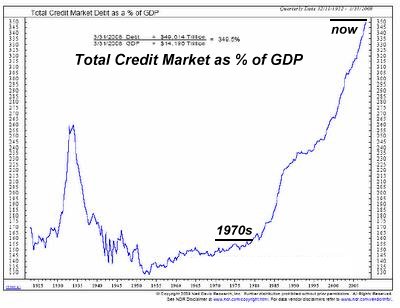

Lastly, the entire fantasy that exponentially rising debt/credit can fuel an asset bubble that then fuels a "virtuous cycle" of rising net worth and more borrowing and spending is also irrevocably broken. Let's start with the trajectory of mortgage delinquencies:

Any questions about the trend here?

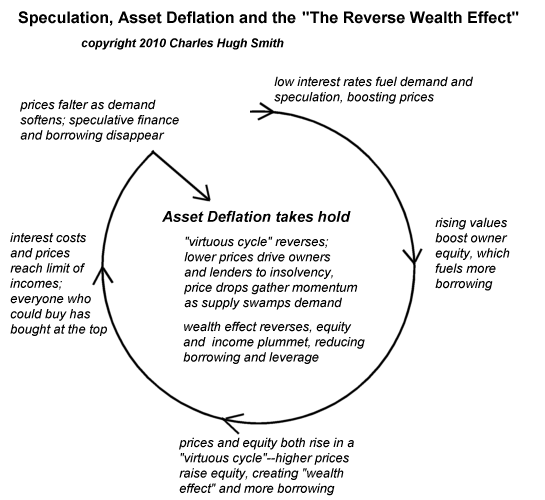

As asset bubbles pop, the "wealth effect" reverses:

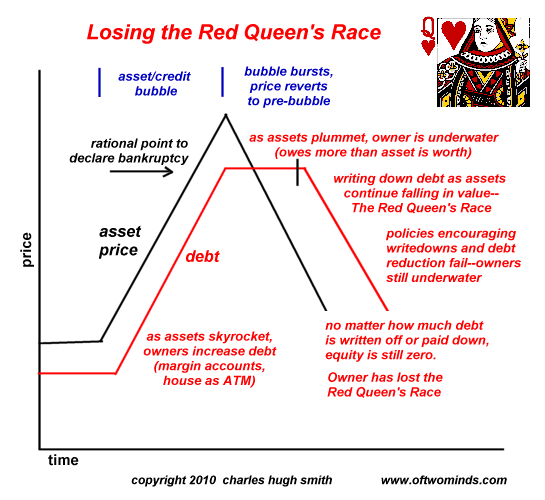

No matter how much uncollectible debt is written down, assets are falling faster: the debtor, the bank and the debtor nation all lose "The Red Queen's Race":

Ultimately, the implosion of the Savior State's finances mean the paradigm of a vast Central State is also threatened. We can understand this another way by considering the Central State as an energy consumer. As long as the Central State provides more benefits that it consumes, then the organism it lives off of (the economy) will support it.

But when the benefits dwindle and the carrying costs of the Central State continue rising, than at some point the economy can long longer support the consumption costs of the Central State.

At that point the Central State collapses or shrinks down to a sustainable size.

Anyone who believes the Savior State will endure without any adjustment in the coming decade is simply ignoring the facts and hardening their faulty beliefs. That refusal to learn from facts is not a successful survival strategy.

I don't have "all the answers" or a crystal ball, but it seems clear that "more of the same" is not a sustainable option. New applications of technology and new social/economic models (both localized and international) will have to be developed, tested and adapted which require less energy and resources.

If you would like to post a comment where others can read it, please go toDailyJava.net, (registering only takes a moment), select Of Two Minds-Charles Smith, and then go to The daily topic. To see other readers recent comments, go to New Posts.

Order Survival+: Structuring Prosperity for Yourself and the Nation and/or Survival+ The Primer from your local bookseller or from amazon.com or in ebook and Kindle formats.A 20% discount is available from the publisher.

Of Two Minds is now available via Kindle: Of Two Minds blog-Kindle

| Thank you, Auntiegrav ($20), for your much-appreciated generous contribution to this site-- I am greatly honored by your support and readership. | Thank you, Mike M. ($50), for your exceptionally generous contribution to this site-- I am greatly honored by your support and readership. |