Beware Of Extrapolating Trends

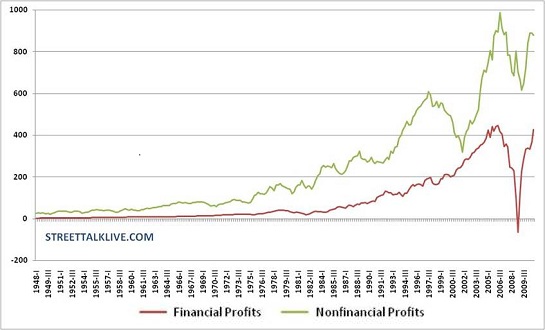

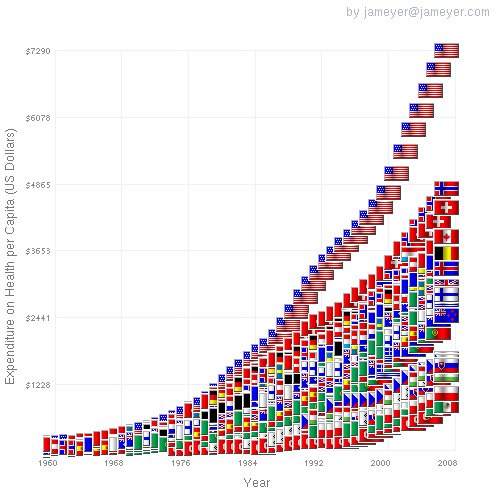

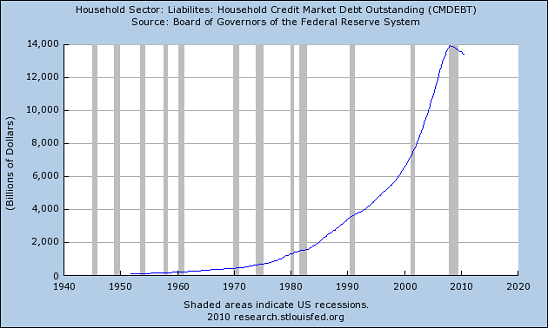

Extrapolating trends is exciting but misleading. Manias, bubbles and "momentum investing" all rely on observing a trend and extrapolating it into the future. This is how we get "housing never goes down" and other trends which eventually run out of oxygen. Consider this example of extrapolation. If you follow basketball at all, either your local high school or college teams or the pros, then you've seen a game start out with one team scoring a quick three baskets for 6 points while holding the other team scoreless, making it a 6 to 0 game. If we extrapolate those first few moments of play, then we'd expect the score at the end of the game to be 200 to 0. Let's say the first basket was scored in 60 seconds, the second one after another 30 seconds of play and the third (perhaps a steal) after only 15 seconds. If we extrapolate that timeline, then we soon reach the point where baskets are being scored in milliseconds, as the fourth basket is scored in only 7.5 seconds, the fifth in 3.75 seconds, and so on. Let's turn from this admittedly absurd example to some real-world charts. The current stock market rally is supposedly based on rising corporate profits, which have rebounded smartly from the March 2009 lows. The Bulls' euphoric expectation of ever-rising stock valuations is based on the extrapolation of these profit trends. But interestingly, non-financial corporate profits have already peaked and are turning down, while financial corporate profits have already hit the nose-bleed level that marked the last top. Legions of China Bulls (i.e. true believers of the "China story") extrapolate China's spectacular GDP growth into the future. If we ponder this chart, we see that Japan also experienced a rapid rise in GDP in its boost phase, but that growth rate cannot continue on to the Moon and beyond. Exactly how much farther China's GDP can run at this rate of expansion is unknown, but anyone betting on this trend continuing at its current trendline for years to come is basically betting on the basketball game's score ending up at 200 to 20. A peculiarly gripping mania has led many to believe that U.S. healthcare costs can continue rising on its current trendline forever-- or at least until 2050 or so, which is politically the same as 2550. Once again, anyone who thinks sickcare costs can skyrocket by 6% to 11% annually while the nation's GDP is flat or negative (once Federal borrowing and spending are subtracted) is expecting the game to end with a score of 200 to 20. Few seem to recognize any upper limits on consumer debt. The idea that this trend cannot be resumed strikes terror into the hearts of economists and politicos alike. What does the U.S. economy do for "growth" if this consumer debt trend rolls over and heads down? All sorts of trends are being extrapolated to justify sky-high stock valuations, insane levels of government borrowing and complacent confidence in a permanent abundance of cheap energy--to name but a few. The Fed has raced out and scored a few points in the Great Recession, and yet few analysts extrapolate its expanding balance sheet out a few years. Can the Fed really create $10 or $20 trillion in free money and use that to buy up the U.S. economy's impaired debt and unwanted Treasury bonds without any negative consequences? Corporate profits have rebounded on the back of a declining U.S. dollar and an unprecedented explosion of Federal deficit spending. Yet SIFPs (standard-issue financial pundits) still expect corporate profits to rise steadily despite the fact that the underlying trends have reversed. Healthcare costs are rising at a rate that leads to all sorts of 200-to-0 games: if the current trendline holds, then the average household's health insurance will cost $300,000 in today's dollars in a few years. Does anyone seriously believe this runaway expansion of healthcare is remotely sustainable? As stock market Bulls are about to discover, the one thing we know about trends is that they do not continue on to the Moon as per extrapolation lines neatly drawn with a ruler. They flatten, reverse or crash. Long-time financial supporters of this site: email me if you'd like to receive the (subscribers-only) Weekly Musings email. Of Two Minds Kindle edition: Of Two Minds blog-Kindle

Readers forum: DailyJava.net.

Order Survival+: Structuring Prosperity for Yourself and the Nation (free bits) (Mobi ebook) (Kindle) or Survival+ The Primer (Kindle) or Weblogs & New Media: Marketing in Crisis (free bits) (Kindle) or from your local bookseller.Thank you, Brendan O'C. ($100), for your outrageously generous contribution to this site--one of many-- I am greatly honored by your continuing support and readership. Thank you, Roger H. ($25), for your outstandingly generous contribution to this site -- I am greatly honored by your ongoing support and readership.