If we step out of the conventional brainwashing about how bad deflation is, we discover it's actually good and it's inflation that's bad.

We have been brainwashed into believing that inflation is good and deflation is bad. The truth is that inflation is good for banks and bad for households, while deflation is bad for banks and good for households.

Since ours is a bank credit system enforced by the Central State, what’s bad for the banks is presumed to be bad for everyone.

This is simply not true. Inflation is “good” for borrowers, but only if their income rises while their debts remain fixed. For everyone with stagnant income--and that's 90% of the nation's households--inflation is just officially sanctioned theft.

The conventional view can be illustrated with this example. Let’s say a household earns $50,000 a year and they have a fixed-rate mortgage of $100,000. If they set aside 40% of their income to pay the mortgage, that’s $20,000 a year. This means they can pay off their mortgage in five years. (To keep things simple, let’s ignore interest.) Let’s say the household’s annual grocery bill is $5,000—10% of the annual income.

If inflation causes all prices and incomes to double, the household income rises to $100,000 and groceries cost $10,000--still 10% of the annual income. In this sense, inflation hasn’t changed anything: it still takes the same number of hours of work to buy the household’s groceries.

We can say that the purchasing power of an hour of labor hasn't changed; whether the hour is converted into $1 or $1 million, that money buys the same quantity of goods and services as it did before the inflation.

But inflation does something magical when incomes rise and debts remain fixed:now 40% of the household income is $40,000, and so the household can pay off the fixed-rate mortgage in only two-and-a-half years.

Why is inflation good for the banks? After all, the mortgage is paid with depreciated money that no longer buys what it used to. Inflation benefits the banks for the simple reason that it enables the household to make its debt payments and borrow more.

Remember that banks don’t just earn profits on interest, they make money on transaction fees: issuing loans and processing payments. The more loans they originate and manage, the more money they make. The more debt and leverage increase, the more money the banks make.

Banks don’t actually hold many of the loans they originate. They bundle the loans and sell them to investors, a process called securitization. The banks bundle the loans into a security such as a mortgage-backed security (MBS) that can be sold in pieces to investors around the world. (Near-worthless mortgages always have a ready buyer: the Federal Reserve.)

The bank made its money when it originated the loan. Future inflation hurts the investors who bought the loan, not the bank. The bank sold the loan and booked the profit. To make more money, it needs to originate more loans. And to do that, it needs consumers who feel richer because inflation has boosted their nominal (face value) income.

It’s all an illusion, of course; it still takes the same number of hours of labor to buy groceries. But this illusion of having a higher income encourages households to borrow more. This is how inflation greatly benefits banks.

But the mechanism falls apart if incomes don’t rise along with prices for goods and services. When incomes stay the same and prices of goods and services rise, the household is poorer-- their income buys less than it did before inflation.

The mechanism also falls apart if interest rates rise while income stays flat. In adjustable rate loans and credit cards, for example, the interest rate can adjust higher; the rate is not fixed.

This is the situation we find ourselves in: 90% of households are experiencing stagnant or declining income, even as inflation raises the cost of goods and services every year. Adjusted for (probably understated) official inflation, the median household income has fallen 8% in the past five years.

Major expenses like medical insurance and college tuition have been rising at 5% to 6% a year for decades, twice the official rate of inflation.

The Federal Reserve’s policies are explicitly intended to create 3% inflation, as this benefits the banks. But since wages and incomes are declining for 90% of households, the Fed’s policy is stealing purchasing power from households and enriching the banks.

The Fed is a “reverse Robin Hood,” stealing from the poor to give to the rich. The Real Reverse Robin Hood: Ben Bernanke and his Merry Band of Thieves (August 31, 2012)

Since we’ve been brainwashed into uncritically believing deflation is bad, we haven’t thought it out for ourselves. Take computers as an example: we can buy more memory and computer power every year with less money. The cost of computers has deflated for decades. Calculated in 2012 dollars, I paid $5,350 for my first Macintosh computer in 1985. Last year I bought a Hewlett-Packard PC for $450, less than 10% of the cost of a computer in 1985, and the PC has 1,000 times the power and memory of a 1985-era computer.

This is deflation in action: our money buys more goods and services every year. How is this bad? If deflation is good when it comes to computers, how does it suddenly become bad when applied to everything else?

Not only is deflation good for the household with fixed or declining income, it’s also good for the economy. How many people could afford a computer in 1985? Very few. How many can afford a computer now that they cost one-tenth as much? Almost everyone can afford one, even those households that are officially near the poverty line ($23,000 for a family of four in 2012).

If inflation had driven up the cost of computers while income stayed flat, even fewer people could afford computers, and manufacturers would have a much smaller market.

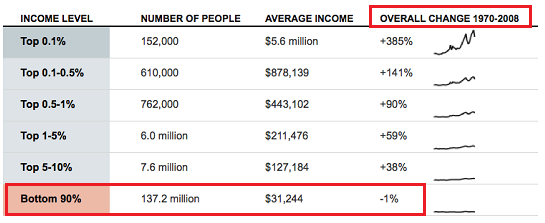

It’s important to remember that adjusted for inflation, the median income for the lower 90% of wage earners (138 million people) has been flat since 1970--forty years. Only the top 10% (14 million people) actually gained income, and only the top 5% gained significantly (+90%). The only way 90% of the populace can buy more goods and services is with deflation.

Let’s consider a household that earns $1,000 a month that enables them to buy 100 good and services.

At 4% inflation, in five years the household will only be able to afford 80 goods and services, because inflation stole 20% of the value (purchasing power) of their income. Those producing and selling goods and services have lost 20% of their market.

At 4% deflation, in five years they can afford 120 goods and services--20% more. If you are producing a good or service, your market has expanded by 20%.

Let’s total the consequences of inflation and deflation. With 4% inflation, households are poorer, as they can buy fewer goods and services, and those producing goods and services see their market shrink by 20%. Inflation is a disaster for everyone but the banks.

With deflation, households’ purchasing power increases by 20% and the market for goods and services also increases by 20%. If productivity rises more than 20% over five years, companies can actually produce and sell 20% more goods and make more profit than they did five years before.

What the banks and their neofeudal enforcer the Federal Reserve want is for households to become poorer but more heavily indebted. They don’t want households to be able to afford more goods and services--they want households to have to borrow more money to buy more goods and services because issuing more loans is how banks make huge profits.

Politicians love bank profits as much as the banks because they collect tens of millions of dollars in contributions (in more honest terms, bribes) from the banks. Politicians don’t care if 90% of American households get poorer every year thanks to inflation created by the Federal Reserve: the 1/10th of 1% live in a completely separate world than the 99.9%.

The banks and their politician partners love inflation because it lines their pockets with tens of billions of dollars in profit. They have worked very hard to convince the 99.9% that inflation is good and deflation is bad, but it’s simply not true. Inflation is a slow, continual theft that robs the hard-working productive members of society and transfers the wealth to the banks and their crony lapdogs, the politicians and lobbyists.

Banks and the Federal Reserve hate deflation because people can buy more goods and services without borrowing money to do so.

If the Federal Reserve’s nightmare comes true and deflation occurs, something else happens that the banks fear and loathe: marginal borrowers default on all their debts. Rather than being easier to pay, the debts become more difficult to pay as money gains value. Marginal borrowers no longer get the “boost” of inflation, so they increasingly default on their loans.

How is it bad for hopelessly over-indebted, overleveraged households to default on all their debt and get a fresh start? Exactly why is that bad? What is the over-indebted household losing other than a lifetime of debt-serfdom, stress and poverty?

The banks have to absorb the losses, and since they are so highly leveraged, the losses drive the banks into insolvency. They are bankrupt and must close their doors.

Note that 99.9% of the people benefit when bad banks absorb losses and close their doors. Only the bank managers, owners and bond holders lose, and everyone else gains as an unproductive, poorly managed bank no longer burdens the economy with its malinvestments and risky bets.

The Federal Reserve’s policy of protecting the wealth and power of the banks while stealing from wage earners via inflation is a catastrophe for the nation and the 99.9% who are not financiers, politicians and lobbyists.

If you want to do something for the poor and middle class, encourage deflation.

Exclusive offer to oftwominds.com readers: 20% discount off MacroStory.com memberships. Tony at MacroStory.com, a full service community for traders and investors, is offering oftwominds.com readers a 20% discount on any membership. Just enter coupon code OfTwoMinds.

Please note that I receive no commission or compensation from this offer, which is presented as a service to readers.

Resistance, Revolution, Liberation: A Model for Positive Change (print $25)

Resistance, Revolution, Liberation: A Model for Positive Change (print $25)

(Kindle eBook $9.95)

We are like passengers on the Titanic ten minutes after its fatal encounter with the iceberg: though our financial system seems unsinkable, its reliance on debt and financialization has already doomed it.We cannot know when the Central State and financial system will destabilize, we only know they will destabilize. We cannot know which of the State’s fast-rising debts and obligations will be renounced; we only know they will be renounced in one fashion or another.

The process of the unsustainable collapsing and a new, more sustainable model emerging is called revolution.Rather than being powerless, we hold the fundamental building blocks of power. We need neither permission nor political change to liberate ourselves. A powerless individual becomes powerful when he renounces the lies and complicity that enable the doomed Status Quo’s dominance.

| Thank you, Robert Z. ($100), for your magnificently generous contribution to this site-- I am greatly honored by your ongoing support and readership. |

-->

Resistance, Revolution, Liberation: A Model for Positive Change (print $25)

Resistance, Revolution, Liberation: A Model for Positive Change (print $25)