Is Oil Cheap?

Gasoline is expensive at the pump, but by one measure oil is cheap, and poised to go higher.

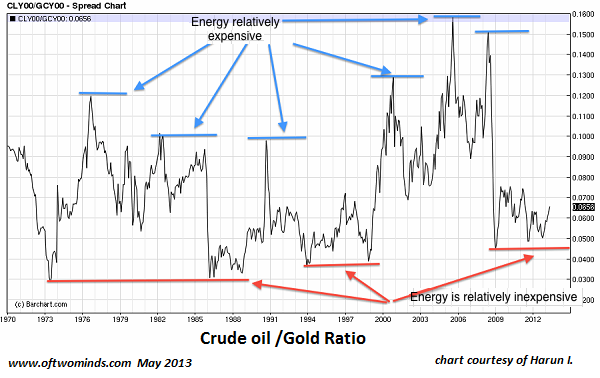

Very good question. I suggest we not make the error of just considering nominal price. For example, below is a chart I marked up about a week ago, the Crude Oil/Gold ratio. I like relative-strength charts because they are a better indication of high and low prices and they tend to oscillate within a range. Here we see a history going back to the 1970s.

At the highs and lows consider what this meant to the economy at that time. What I find rather interesting is that, currently the chart is indicating crude oil is relatively inexpensive. However, one trip to the pump says something entirely different. In fact, prices at the pump are not far off their peak from when this ratio was at its height.

Now imagine what would happen to prices if this ratio returns to its high. Remember this is relative, there could be a demand collapse and this ratio could still go to its historic high. What would that look like in the economy? Well much like the Great Depression, plenty of stuff but no money to buy it. Commodities are real and the effects of hot money are felt almost immediately causing demand to collapse quickly because the real people that make up the economy don't eat paper. If hot money flows into crude oil driving pump prices to $8.00/gallon it would devastate the economy even further.

The Fed is trapped. There were no good answers in 2000, 2008, or now. But the room has gotten a lot smaller.

The reflationary bubble in equities has acted as a hedge but it has not increased purchasing power. No wealth has been created for the middle class. This is why the Fed cannot lift off the accelerator. Therein lies the problem. How does the Fed square the divergence of the equity markets and its monetary stance? How can it continue to claim that they are not the cause of inflation or bubbles?

Where will money flow? It may foment mini-bubbles in all things tangible, classic cars, precious metals, art, etc., as the wealthy scramble to get out of cash. But there will be no place to hide. This will get messy, but the revealing of really big lies always is.

The chart above is cause for grave concern. The fact that it is indicating that energy prices are cheap and have no place to go but up is sounding an alarm. It is my opinion that the average person is in no place (in terms of purchasing power) to absorb a return to the relative highs on this chart.

Things are falling apart--that is obvious. But why are they falling apart? The reasons are complex and global. Our economy and society have structural problems that cannot be solved by adding debt to debt. We are becoming poorer, not just from financial over-reach, but from fundamental forces that are not easy to identify or understand. We will cover the five core reasons why things are falling apart:

1. Debt and financialization

1. Debt and financialization2. Crony capitalism and the elimination of accountability

3. Diminishing returns

4. Centralization

5. Technological, financial and demographic changes in our economy

Complex systems weakened by diminishing returns collapse under their own weight and are replaced by systems that are simpler, faster and affordable. If we cling to the old ways, our system will disintegrate. If we want sustainable prosperity rather than collapse, we must embrace a new model that is Decentralized, Adaptive, Transparent and Accountable (DATA).

We are not powerless. Not accepting responsibility and being powerless are two sides of the same coin: once we accept responsibility, we become powerful.

Kindle edition: $9.95 print edition: $24 on Amazon.com

To receive a 20% discount on the print edition: $19.20 (retail $24), follow the link, open a Createspace account and enter discount code SJRGPLAB. (This is the only way I can offer a discount.)

| Thank you, Jane T. ($10/month), for your stupendously generous subscription to this site -- I am greatly honored by your support and readership. | Thank you, George K. ($50), for your gigantically generous contribution to this site -- I am greatly honored by your support and readership. |