About That "Bull Market Til 2016" Call: Before You Buy the Dip, Check Out This Chart

If credit expansion leads the stock market, the market is in trouble.

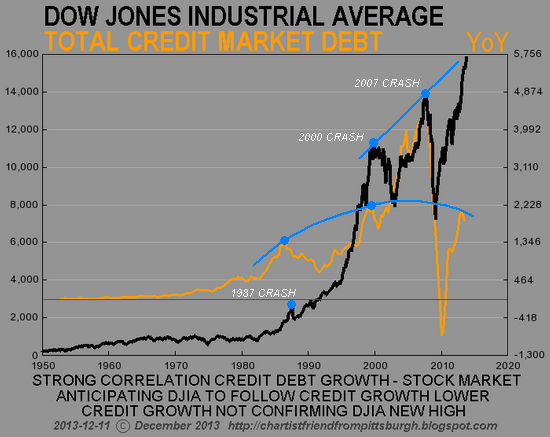

Before you buy the dip "because this Bull market will run until 2016," please ponder this chart from our Chartist Friend From Pittsburgh of total credit and the Dow Jones Industrial Average (DJIA). Unsurprisingly, the stock market advances when credit is expanding and declines when credit growth slows.

Why is this unsurprising? Because ours is a debt-dependent consumer economy: everything from local government building projects to the purchase of vehicles to going to college requires borrowing money (i.e. credit expansion).

Source: The Dome Top Bears Have Been Given Their Stock Market Sell Signal

Here is Chartist Friend From Pittsburgh's commentary:

Total Credit Market Debt (TCMD) growth is not confirming the new DJIA high at all.The trend of TCMD growth clearly reversed lower in 2007 by making a new all time low. The uptrend of the DJIA appears to be up since it's recently made new all-time highs.I would add these points:

The point is - there's a serious disconnect/divergence/non-confirmation going on here and in the end credit growth is the more important of the two and determines the trend because people can't make a move nowadays without taking out a loan (house, car, student, government spending, etc.).

1. Notice that credit growth is rolling over, and that its recent peak was significantly lower than the 2007 peak. In other words, despite rescuing the Too Big To Fail Banks (TBTF) to the tune of $16 trillion and the creation of $3.2 trillion that it pumped into the financial system to goose housing and stocks, the Federal Reserve's unprecedented campaign to reflate leverage and credit only managed a weak bounce from 2007 highs in credit growth.

This is known as diminishing returns: Our Era’s Definitive Dynamic: Diminishing Returns(November 11, 2013)

The Fatal Disease of the Status Quo: Diminishing Returns (May 1, 2013)

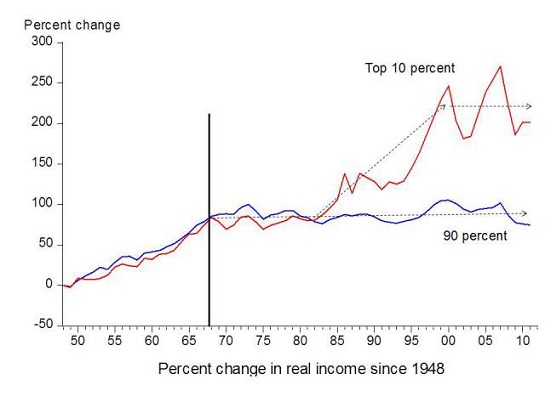

2. In a debt-dependent consumer economy beset with declining real income for the bottom 90%, the only way to expand credit is to blow asset bubbles that boost phantom assets long enough to leverage new debt:

Why Our Consumer-Debt Dependent Economy Is Doomed (December 10, 2013)

Why We're Stuck with a Bubble Economy (December 9, 2013)

See those two little blips up in the real wages of the bottom 90%, circa 1999 and 2007? Those modest boosts in income were the result of monumental credit/asset bubbles. Once those bubbles popped, real income for 100% of households plummeted, and the bottom 90% saw its real income (i.e. the purchasing power of earnings) decline by 7%.

You can't leverage more debt off declining income unless you loan money at near-zero rates of interest. That explains the Fed's Zero Interest Rate Policy (ZIRP), which has the sole purpose of enabling more leverage and debt even as real income stagnates.

And just to remind us how those bubbles ended:

Buy the dip "because this Bull market will run until 2016?" Based on what? Does liquidity from the Fed ultimately drive the market, or does credit expansion drive the market? We will find out in 2014.

If You Seek Practical Gifts, Consider These Everyday Kitchen Tools

The Nearly Free University and The Emerging Economy:

The Revolution in Higher Education

Reconnecting higher education, livelihoods and the economyWith the soaring cost of higher education, has the value a college degree been turned upside down? College tuition and fees are up 1000% since 1980. Half of all recent college graduates are jobless or underemployed, revealing a deep disconnect between higher education and the job market.

It is no surprise everyone is asking: Where is the return on investment? Is the assumption that higher education returns greater prosperity no longer true? And if this is the case, how does this impact you, your children and grandchildren?

We must thoroughly understand the twin revolutions now fundamentally changing our world: The true cost of higher education and an economy that seems to re-shape itself minute to minute.

The Nearly Free University and the Emerging Economy clearly describes the underlying dynamics at work - and, more importantly, lays out a new low-cost model for higher education: how digital technology is enabling a revolution in higher education that dramatically lowers costs while expanding the opportunities for students of all ages.

The Nearly Free University and the Emerging Economy provides clarity and optimism in a period of the greatest change our educational systems and society have seen, and offers everyone the tools needed to prosper in the Emerging Economy.

Read the Foreword, first section and the Table of Contents.

print ($20) Kindle ($9.95)

Things are falling apart--that is obvious. But why are they falling apart? The reasons are complex and global. Our economy and society have structural problems that cannot be solved by adding debt to debt. We are becoming poorer, not just from financial over-reach, but from fundamental forces that are not easy to identify. We will cover the five core reasons why things are falling apart:

1. Debt and financialization

1. Debt and financialization2. Crony capitalism

3. Diminishing returns

4. Centralization

5. Technological, financial and demographic changes in our economy

Complex systems weakened by diminishing returns collapse under their own weight and are replaced by systems that are simpler, faster and affordable. If we cling to the old ways, our system will disintegrate. If we want sustainable prosperity rather than collapse, we must embrace a new model that is Decentralized, Adaptive, Transparent and Accountable (DATA).

We are not powerless. Once we accept responsibility, we become powerful.

Kindle: $9.95 print: $24

| Thank you, Colin C. ($5/month), for your lavishly generous subscription to this site-- I am greatly honored by your support and readership. |