Why We're Stuck with a Bubble Economy

Inflating serial asset bubbles is no substitute for rising real incomes.

Why are we stuck with an economy that only generates serial credit/asset bubbles that crash with catastrophic consequences? Ths answer is actually fairly straightforward. Let's start with the ideal conditions for an economy that depends on consumer spending.

1. Rising real income, i.e. after adjusting for inflation/currency depreciation, wages/salaries have more purchasing power every year.

2. An expanding pool of new households, i.e. young people who move away from home or graduate from college, get a job and start their own household. New households buy homes, vehicles, furniture, appliances, kitchenware, tools, etc., driving consumption far more than established households.

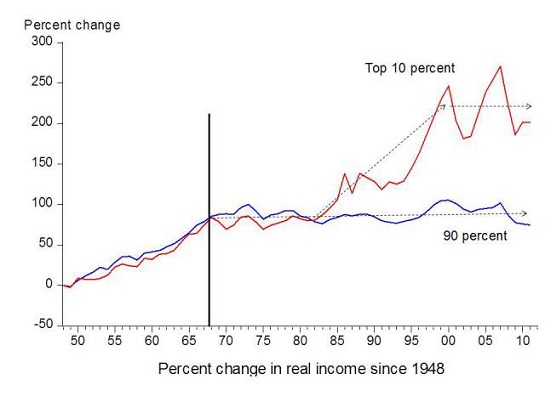

Neither of these conditions apply to today's economy. Income for the bottom 90% has been stagnant for forty years, and has declined 7% in real terms since 2000.

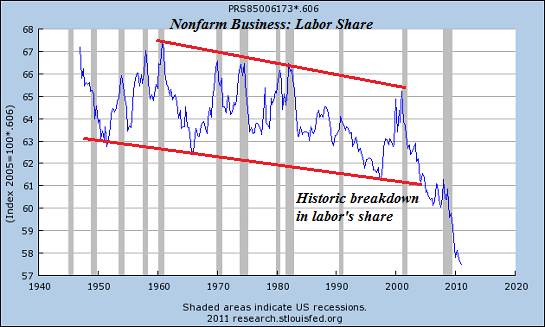

This stagnation is not the "new normal": the new normal is much worse, as labor's share of the national income has fallen off a cliff:

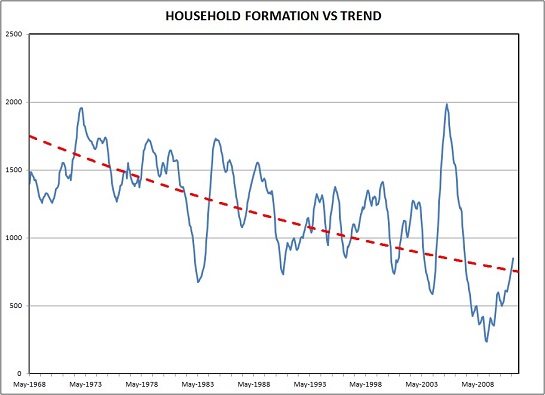

Household formation has also stagnated. That spike circa 2004-07 was caused by the housing bubble, which created new jobs and collateral that could be leveraged into new home purchases.

Since 2008, the Federal Reserve has bought $3.2 trillion in mortgages and Treasury bonds, and the Federal government has borrowed and blown $7 trillion in deficit spending. That $10 trillion in stimulus (not counting $16 trillion in Fed loans to banks and trillions more in other loans/subsidies), household formation has only recovered to the sub-1 million a year level.

In an economy of 316 million people, that isn't enough to generate "growth" in a $16 trillion economy.

With these organic sources of growth moribund or declining, the Fed and Federal government have resorted to other ways of stimulating more borrowing and spending, the sources of leveraged, high-risk "growth":

1. Lower interest rates so stagnant income can leverage more debt (and thus more spending)

2. Generate asset bubbles in stocks and housing that boost "the wealth effect," i.e. the emotional sense of being wealthier as a result of one's assets rising sharply in value, and the collateral available to support more debt.

If a house rises by $100,000 in value in a few short years, the owner has $100,000 more collateral to support new debt. The gargantuan expansion of home equity lines of credit (HELOCs) as the housing bubble expanded was the goal of the status quo, as asset bubbles create collateral that supports new borrowing and spending.

Now that interest rates are near-zero and mortgage rates are rising from historic lows, there is no more juice to be squeezed from low rates.

As for asset bubbles, they always burst, destroying collateral and rendering borrowers and lenders alike insolvent.

Without organic demand from rising real income and new households with good-paying jobs and low levels of debt, the consumer-debt based economy stagnates.This has left the economy dependent on serial asset bubbles that create phantom collateral that can support new debt, albeit temporarily.

Inflating serial asset bubbles is no substitute for rising real incomes and new households that aren't burdened with high levels of debt from student loans.

If You Seek Practical Gifts, Consider These Everyday Kitchen Tools

The Nearly Free University and The Emerging Economy:

The Revolution in Higher Education

Reconnecting higher education, livelihoods and the economy

We must thoroughly understand the twin revolutions now fundamentally changing our world: The true cost of higher education and an economy that seems to re-shape itself minute to minute.

Things are falling apart--that is obvious. But why are they falling apart? The reasons are complex and global. Our economy and society have structural problems that cannot be solved by adding debt to debt. We are becoming poorer, not just from financial over-reach, but from fundamental forces that are not easy to identify. We will cover the five core reasons why things are falling apart:

1. Debt and financialization

1. Debt and financialization2. Crony capitalism

3. Diminishing returns

4. Centralization

5. Technological, financial and demographic changes in our economy

Complex systems weakened by diminishing returns collapse under their own weight and are replaced by systems that are simpler, faster and affordable. If we cling to the old ways, our system will disintegrate. If we want sustainable prosperity rather than collapse, we must embrace a new model that is Decentralized, Adaptive, Transparent and Accountable (DATA).

We are not powerless. Once we accept responsibility, we become powerful.

Kindle: $9.95 print: $24

| Thank you, Gwyneth M. ($50), for your superbly generous contribution to this site-- I am greatly honored by your support and readership. |