The Fed's Hobson's Choice: End QE and Zero-Interest Rates or Destabilize the Dollar and the Treasury Market

Though the Fed is doing its best to mask its abject failure and lack of choices with public relations, the reality is it has no choice but to taper and eventually end its endless spew of credit and its unprecedented and destabilizing purchases of assets.

Many smart observers assume the Federal Reserve (and other central banks) can print money and buy assets like bonds, mortgages and stocks unconstrained by any limit. Indeed, at first glance, it seems like a closed circle: print the money and use it to buy bonds, mortgages and equities, which are booked as assets.

The more the Fed buys (or enables proxies and financiers to buy), the greater the assets value, as buying pushes prices higher.

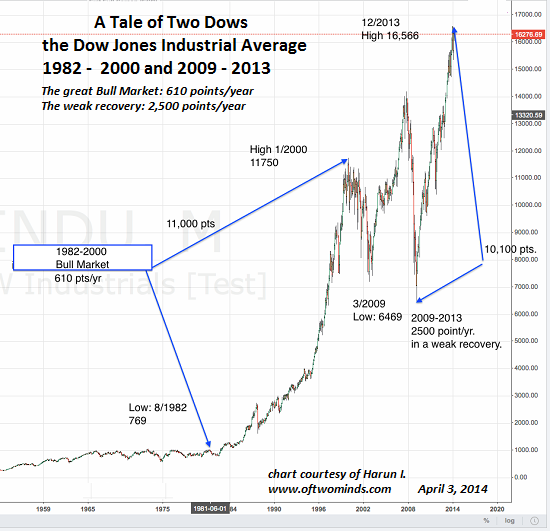

After all, look what quantitative easing (i.e. buying assets like Treasury bonds and home mortgages) and zero-interest rates have done for the stock market: to the moon, baby!

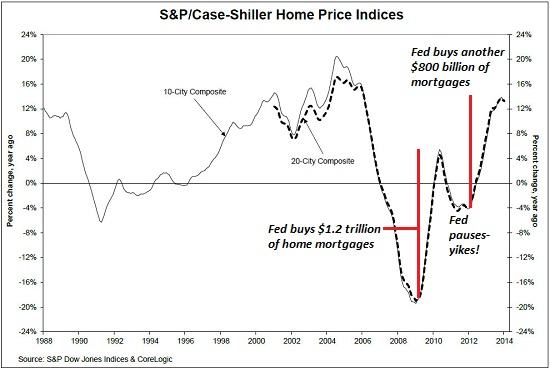

And to housing: thanks to the printing press and buying mortgages, the Fed inflated an echo-bubble to soften the inevitable crash of the previous bubble:

On the surface, there are no intrinsic limits to QE and central bank money-printing:in other words, there appears to be nothing stopping the Fed from printing essentially limitless money and buying up the majority of Treasury bonds, mortgages and stocks.

But we must be mindful that the economy is not linear. Pushing asset prices higher via unlimited credit at zero-interest rates has not trickled down to wages or consumer spending. That is, the wealth effect is missing in action despite a $20 trillion increase in household net worth. (Most of this increase flowed to the top 10%, and within that, most flowed to the top 1/10 of 1%.)

Meanwhile, risky credit bets are soaring: subprime auto loans are now common, margin debt has skyrocketed and purchases of junk bonds have gone through the roof.

The Fed's printing and asset purchases do not occur in a vacuum. Fed printing and asset purchases affect the reserve currency, the U.S. dollar, and the Treasury market, which the Fed now dominates via its purchases.

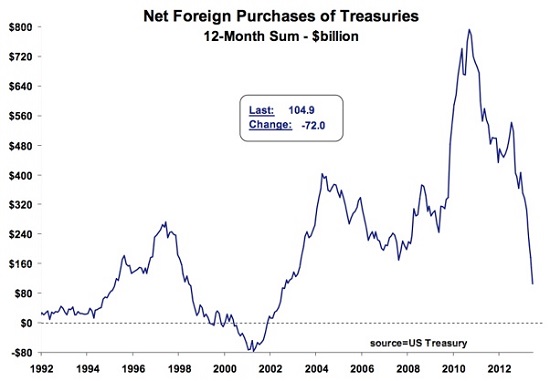

Keeping interest rates near zero has removed any financial incentive to buying Treasury bonds other than flight to safety. As Stephanie Pomboy observed in her excellent Wine Country Conference 2014 presentation, (and I paraphrase here): "every day they continued QE, they chased away more and more of our foreign creditors."

The Treasury must sell bonds to fund the Federal deficit, which is running about $500 billion a year. The Treasury must also sell new bonds to replace the immense amounts of T-Bills that are maturing.

The more T-bills the Fed buys to keep interest rates at zero, the more it drives foreign and domestic buyers out of the Treasury market.

This is also true of the U.S. dollar. This sets up the Fed's Hobson's Choice, which is the term for an illusory choice, i.e. a choice in which only one option is offered.

If the Fed continues QE, it destabilizes the Treasury market that funds U.S. government deficits, and the hegemony of the U.S. dollar. If it ceases QE, interest rates will rise as non-central bank buyers will demand an actual return on their capital.

Rising rates will crush the echo bubbles in housing and the stock market, which has been propped up by dividend-paying stocks and speculative issues purchased with Fed-supplied "free money."

For the Deep State, there is no choice: dollar hegemony is paramount. Rising interest rates and the fate of financiers who have over-leveraged the Fed's free money are not even secondary.

Who Gets Thrown Under the Bus in the Next Financial Crisis? (March 3, 2014)

The Dollar and the Deep State (February 24, 2014)

Is the Deep State Fracturing into Disunity? (March 14, 2014)

The Fed believed that five years of free money and incentivizing risk would heal the economy. They were wrong. The real economy is more fragile and dysfunctional than ever due to the distortions created by Fed policies, while the top 1/10th of 1% have feasted on the asset bubbles inflated by these same policies.

Meanwhile, beneath the crony-capitalist celebration of new asset bubbles, the foundations of the nation's fiscal security--the Treasury market and the U.S. dollar--have been undermined and destabilized by these same Fed policies.

Those who focus solely on the Fed assume the ruling Elite is monolithic: unified in worldview, strategy and goals. I believe this is overly linear and overly simplistic: there are competing elites, and nations fall when their elites experience profound disunity.

Though the Fed is doing its best to mask its abject failure and lack of choices with public relations ("Pay no attention to what's behind the curtain!"), the reality is it has no choice to tapering and eventually ending its gargantuan spew of credit and its unprecedented and destabilizing purchases of assets.

Get a Job, Build a Real Career and Defy a Bewildering Economy(Kindle, $9.95)(print, $20)

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible.

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible.And like most of you, the way I've moved toward my goal has always hinged not just on having a job but a career.

You don't have to be a financial blogger to know that "having a job" and "having a career" do not mean the same thing today as they did when I first started swinging a hammer for a paycheck.

Even the basic concept "getting a job" has changed so radically that jobs--getting and keeping them, and the perceived lack of them--is the number one financial topic among friends, family and for that matter, complete strangers.

So I sat down and wrote this book: Get a Job, Build a Real Career and Defy a Bewildering Economy.

It details everything I've verified about employment and the economy, and lays out an action plan to get you employed.

I am proud of this book. It is the culmination of both my practical work experiences and my financial analysis, and it is a useful, practical, and clarifying read.

Test drive the first section and see for yourself. Kindle, $9.95 print, $20

"I want to thank you for creating your book Get a Job, Build a Real Career and Defy a Bewildering Economy. It is rare to find a person with a mind like yours, who can take a holistic systems view of things without being captured by specific perspectives or agendas. Your contribution to humanity is much appreciated."

Laura Y.

Gordon Long and I discuss The New Nature of Work: Jobs, Occupations & Careers (25 minutes, YouTube)

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

| Thank you, John H. ($5/month), for renewing your extremely generous subscription to this site -- I am greatly honored by your steadfast support and readership. | Thank you, William C. ($5), for your most generous contribution to this site -- I am greatly honored by your support and readership. |