What's Behind the Rise in U.S. Industrial Production?

The domestic energy boom is behind the expansion of Industrial Production.

In contrast to other measures of economic activity that are stagnant or declining, U.S. industrial production has been rising: Industrial Production and Capacity Utilization (Federal Reserve data)

Is this evidence that manufacturing is on-shoring, i.e. returning from overseas? While there is anecdotal evidence for on-shoring, it appears that energy production (classified as part of mining in government statistics) is the big driver of rising industrial production.

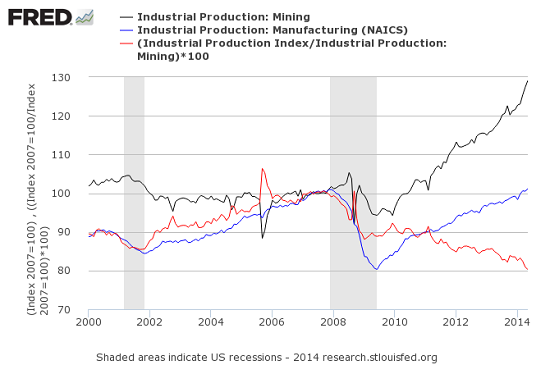

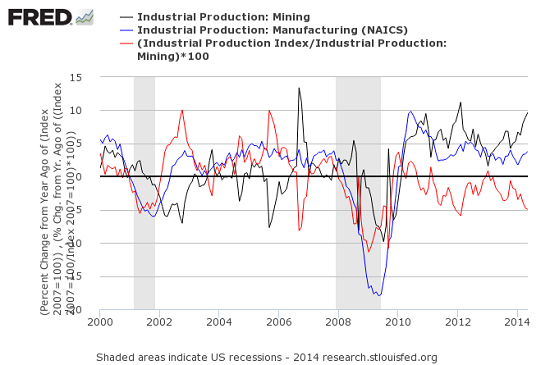

Longtime correspondent B.C. submitted these two charts breaking down industrial production into mining, manufacturing and total production. While manufacturing has recently returned to pre-recession levels of late 2007, energy production (included in mining) has soared as the energy industry has put fracking and new wells into production. B.C. Commented: "The remarkable untold story: Ex mining and oil and gas extraction, US Industrial Production has been in contraction for most of the period since Peak Oil in 2005-08."

The red line is the ratio of total production to mining/energy. Its decline reflects the dominance of mining/energy in the rise of industrial production as a whole.

The second chart is percent change from a year ago. This shows the rate of manufacturing expansion has been declining since 2010 while mining/energy has been on a tear, spiking as high as 10% gains per year.

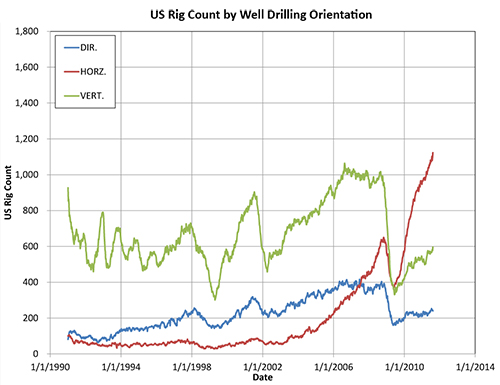

Here is a chart of the U.S. oil/gas rig count:

For context, here is a longer term look at the U.S. rig count. Note that the number of active rigs in the early 1980s was considerably higher than the present count.

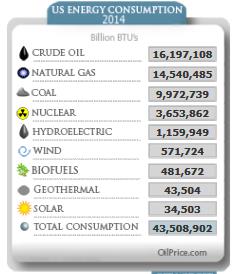

For context, here is total U.S. energy consumption. The takeaway here is the reliance on oil, gas and coal, i.e. the fossil fuels:

One last bit of context: U.S. oil imports. While the increase of 3+ million barrels a day in domestic production is welcome on many fronts (more jobs, more money kept at home, reduced dependence on foreign suppliers, etc.), the U.S. still needs to import crude oil.

U.S. Imports by Country of Origin (U.S. Energy Information Administration)

Get a Job, Build a Real Career and Defy a Bewildering Economy(Kindle, $9.95)(print, $20)

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible.

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible.And like most of you, the way I've moved toward my goal has always hinged not just on having a job but a career.

You don't have to be a financial blogger to know that "having a job" and "having a career" do not mean the same thing today as they did when I first started swinging a hammer for a paycheck.

Even the basic concept "getting a job" has changed so radically that jobs--getting and keeping them, and the perceived lack of them--is the number one financial topic among friends, family and for that matter, complete strangers.

So I sat down and wrote this book: Get a Job, Build a Real Career and Defy a Bewildering Economy.

It details everything I've verified about employment and the economy, and lays out an action plan to get you employed.

I am proud of this book. It is the culmination of both my practical work experiences and my financial analysis, and it is a useful, practical, and clarifying read.

Test drive the first section and see for yourself. Kindle, $9.95 print, $20

"I want to thank you for creating your book Get a Job, Build a Real Career and Defy a Bewildering Economy. It is rare to find a person with a mind like yours, who can take a holistic systems view of things without being captured by specific perspectives or agendas. Your contribution to humanity is much appreciated."

Laura Y.

Gordon Long and I discuss The New Nature of Work: Jobs, Occupations & careers (25 minutes, YouTube)

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

| Thank you, Stephen J. ($20), for yet another splendidly generous contribution to this site -- I am greatly honored by your ongoing support and readership. | Thank you, Tim L. ($50), for your superbly generous contribution to this site -- I am greatly honored by your steadfast support and readership. |