Playing monetary games has done nothing to eliminate moral hazard.

If we step back and look at the past six years since the global financial meltdown of 2008, we see that in terms of financial and political power, nothing has changed--and that's the problem. If nothing has changed structurally, then none of the problems that caused the meltdown have truly been addressed.

All that's changed is the vast expansion of monetary games has masked the dysfunctional reality that the same old vested interests that had a death-grip on wealth and power in 2008 have tightened their death-grip in the past six years.

Here's the problem facing every nation and trading bloc:

1. Vested interests institutionalized moral hazard, separating their gains from the consequences of taking risks. This is also known as privatized gains, socialized losses: vested interests reaped the gains from risky speculative bets, but then passed the staggering losses onto the central banks and taxpayers while keeping the gains.

2. The vested interests control the machinery of governance, so there is no way the central state will force the vested interests to absorb the losses that are rightfully theirs. Instead of de-institutionalizing moral hazard, governments have spewed thousands of pages of complicated regulations, in effect, grudgingly nudging the barn door half-closed after the horses of systemic risk galloped away in 2008.

3. With moral risk still institutionalized, nothing has changed: all the gains from subprime auto loans, selling sovereign bonds issued by insolvent governments, etc., are private, and all the risk is being transferred to the central banks and taxpayers.

The money-printing of quantitative easing--central banks printing money to purchase sovereign bonds and mortgages--is actually a form of money-laundering, as all this expansion of central bank balance sheets, debt and liquidity enables the vested interests to expand their control of the financial and political power centers at the expense of everyone else.

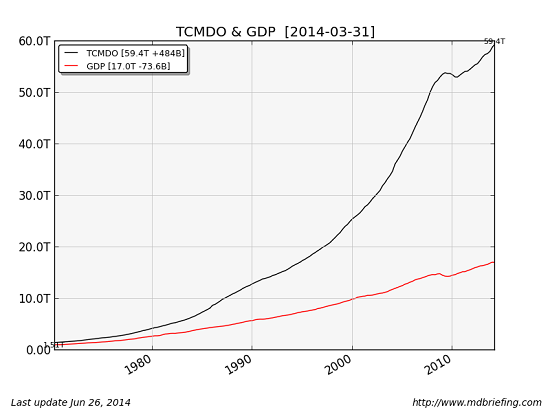

Take a look at the vast expansion of debt and the modest impact of that debt on GDP

Look at the unprecedented expansion of the Fed's balance sheet and ask cui bono-- to whose benefit?

Since moral hazard--the disconnect of risk and consequence--is the fundamental cause of the global meltdown of 2008, the only solution is to eliminate moral hazard. By this I mean de-institutionalizing moral hazard.

But de-institutionalizing moral hazard means smashing the vested interests' primary engine of wealth and political power.

The only way forward is to assign the losses that have been piled up in the shadows to those who created and bought the risk for their own gain. That means the investment banks that originated the subprime mortgages and auto loans, etc., and the mutual funds, pension funds, wealth funds, etc. that bought them as "low-risk" investments.

Right now, we're bailing out the con-artists (the banks) and their credulous marks-- the suckers who foolishly trusted the grifters of Wall Street, London, Shanghai, etc.

This re-linking of risk and consequence is not only the only moral way forward--it's also the only political and financial way to clear the poison of moral hazard from the system.

Saving vested interests from the losses they earned and they deserve poisons the entire financial system. When the poisoned system finally collapses, it will destroy everyone with a stake in the system--including the vested interests who reckoned that their political power would save them from the losses that are rightfully theirs.

Playing monetary games has done nothing to eliminate moral hazard; indeed, playing monetary games cannot possibly eliminate moral hazard, as monetary policy enforces moral hazard.

Those playing monetary games--Kuroda, Draghi, Yellen et al.--will discover this, but only after it's too late to stop the slide into the abyss.

Get a Job, Build a Real Career and Defy a Bewildering Economy(Kindle, $9.95)(print, $20)

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible.

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible.

And like most of you, the way I've moved toward my goal has always hinged not just on having a job but a career.

You don't have to be a financial blogger to know that "having a job" and "having a career" do not mean the same thing today as they did when I first started swinging a hammer for a paycheck.

Even the basic concept "getting a job" has changed so radically that jobs--getting and keeping them, and the perceived lack of them--is the number one financial topic among friends, family and for that matter, complete strangers.

So I sat down and wrote this book: Get a Job, Build a Real Career and Defy a Bewildering Economy.

It details everything I've verified about employment and the economy, and lays out an action plan to get you employed.

I am proud of this book. It is the culmination of both my practical work experiences and my financial analysis, and it is a useful, practical, and clarifying read.

Test drive the first section and see for yourself. Kindle, $9.95 print, $20

"I want to thank you for creating your book Get a Job, Build a Real Career and Defy a Bewildering Economy. It is rare to find a person with a mind like yours, who can take a holistic systems view of things without being captured by specific perspectives or agendas. Your contribution to humanity is much appreciated."

Laura Y.

Gordon Long and I discuss The New Nature of Work: Jobs, Occupations & Careers(25 minutes, YouTube)

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

| Thank you, Sriram E. ($75), for your outrageously generous contribution to this site-- I am greatly honored by your steadfast support and readership. | |

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible.

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible.