Systemic fragility doesn't respond to central bank jawboning or Keynesian claptrap; unlike those "policy tools," fragility is real.

The core narrative of central bank/cartel capitalism is centralized agencies have the power to limit downturns and extend credit-based "good times" almost indefinitely. The centralized power bag of tricks includes fiscal policies such as deficit spending to boost "aggregate demand" in downturns and monetary policies such as lowering interest rates to zero and buying assets, a.k.a. quantitative easing.

If we crawl under the barbed wire and escape the ideological Keynesian Concentration Camp, we find thinkers such as

Ugo Bardi,

John Michael Greer and

Dimitry Orlov, whose work explores the dynamics of collapse, resilience and sustainability.

All three have added a great deal to my own (emerging) understanding of the many dynamics of collapse.

We can summarize the dynamics of collapse in many ways; here's one: collapse is latent fragility manifesting. A familiar (and tragic) health analogy offers an example: a middle-aged man doesn't appear ill, a bit thick around the middle perhaps, but neither he nor his intimates can see the fragility of his clogged arteries and blood-starved heart. Seemingly "out of the blue," the man has a massive heart attack and passes from this Earth, to the shock of everyone who knew him.

Financial collapse isn't "out of the blue," any more than a heart attack is "out of the blue." Actions and choices have consequences, and as resilience and redundancy are slowly stripped from complex systems, systemic fragility builds beneath the surface. At some difficult-to-predict point, a threshold is reached and the complex system fails.

In the financial realm, fragility builds as the system relies ever more heavily on marginal lenders, borrowers, buyers and investments for its "growth." The current "recovery" (smirk) is completely dependent on marginal lenders (China's shadow banking), borrowers (auto buyers taking subprime 7-year loans), buyers (corrupt Chinese officials buying $3 million homes in Vancouver B.C. with their ill-gotten gains) and investments (empty malls, empty factories, stock buy-backs, etc.).

The problem for "growth" based on the fragile margins is that the entire system becomes fragile as a direct result of this dependence on fragile margins. The current global real estate bubble is predicated on one condition: that the supply of corrupt Chinese officials fleeing China with ill-gotten millions to invest overseas is endless.

But no supply of corrupt officials, even in China, is truly endless, and markets based on this thin edge of corrupt capital will collapse once the corrupt capital dries up.

The same can be said of marginal oil production, marginal auto/truck buyers, marginal cafes, marginal malls, etc. When fragile (i.e. highly risky) shadow banking becomes a dominant force in credit, the system itself becomes fragile.

Conventional economists are entirely blind to system fragility. There is no ready Keynesian Cargo Cult econometric formula that measures systemic fragility, so it simply doesn't exist within conventional economics.

This is why financial panics and collapses always appear (like fatal heart attacks) to be "out of the blue" to conventional economics.

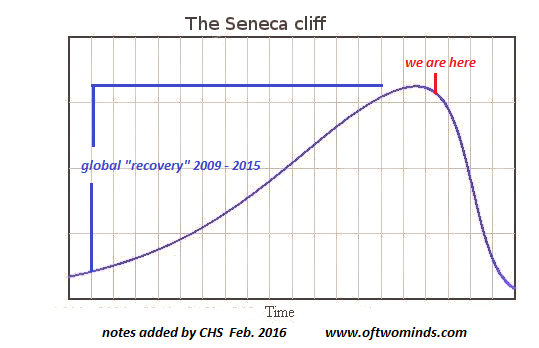

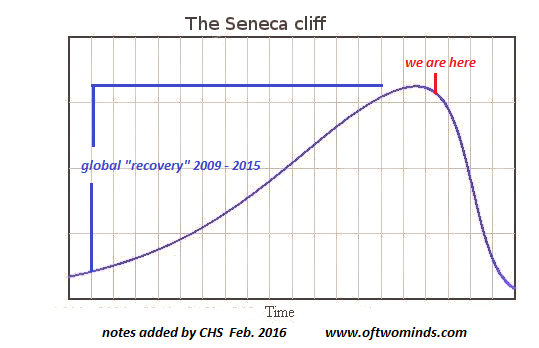

I propose that the Global Recession of 2016 will trace the Seneca Cliff as described by Ugo Bardi. This application may not align with Bardi's own work, and I want to make it clear this application is my own, not Bardi's. But I think a strong case can be made that the global financial/economic system is primed for a ride down the Seneca Cliff:

Recall that the global "recovery" 2009 - 2015 was entirely based on the expansion of debt taken on by marginal borrowers. Systemic fragility doesn't respond to central bank jawboning or Keynesian claptrap; unlike those "policy tools," fragility is real.

Admin note: I will be busy with family commitments until mid-month. As a result, blog posts will be sporadic and email responses will be near-zero. Thank you for your understanding.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

Thank you, James W. ($150), for yet another outrageously generous contribution to this site -- I am greatly honored by your steadfast support and readership.

| |

Thank you, Ted C. ($100), for your outrageously generous contribution to this site -- I am greatly honored by your steadfast support and readership.

|