If it isn't a Depression, it's a very close relative of a Depression.

Just for the sake of argument, let's ask: what if we're in a Depression but don't know it? How could we possibly be in a Depression and not know it, you ask? Well, there are several ways we could be in a Depression and not know it:

1. The official statistics for "growth" (GDP), inflation, unemployment, and household income/ wealth have been engineered to mask the reality

2. The top 5% of households that dominate government, Corporate America, finance, the Deep State and the media have been doing extraordinarily well during the past eight years of stock market bubble (oops, I mean boom) and "recovery," and so they report that the economy is doing splendidly because they've done splendidly.

I have explained exactly how official metrics are engineered to reflect a rosy picture that is far from reality.:

I also also asked a series of questions that sought experiential evidence rather than easily gamed statistics for the notion that this "recovery" is more like a recession or Depression than an actual expansion:

Rather than accept official assurances that we're in the eighth year of a "recovery," let's look at a few charts and reach our own conclusion. Let's start with the civilian labor force participation rate--the percentage of the civilian work force that is employed (realizing that many of the jobs are low-paying gigs or part-time work).

Does the participation rate today look anything like the dot-com boom that actually raised almost everyone's boat at least a bit? Short answer: No., it doesn't. Today's labor force participation rate is a complete catastrophe that can only be described by one word: Depression.

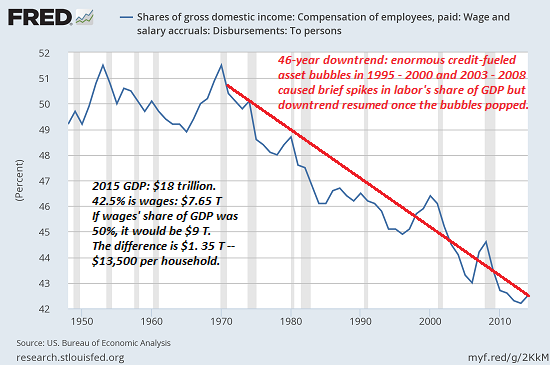

Wages as a percentage of GDP has been in a 45-year freefall that can only be described as Depression for wage earners:

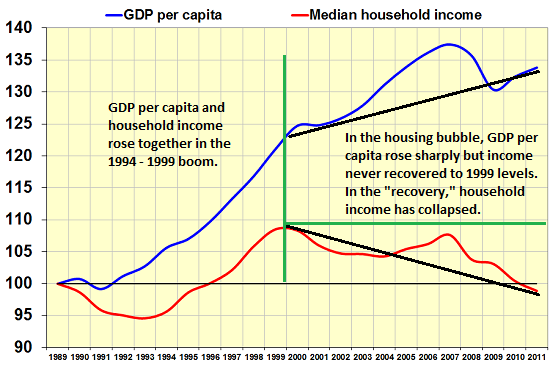

Notice what happened when the Federal Reserve started blowing serial asset bubbles in 2000: GDP went up but wages went down. Is this a recession or depression? It's your call, but if you're the recipient of the stagnating wages, it's depressing.

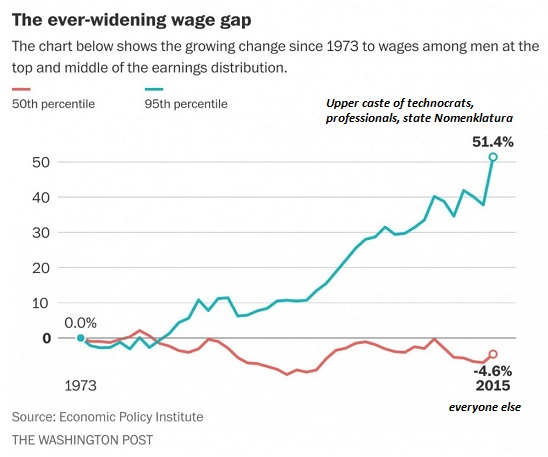

Meanwhile, the top 5% who own most of the assets that have been bubbling higher have been doing great. The Depression is only a phenomenon of the bottom 95%:

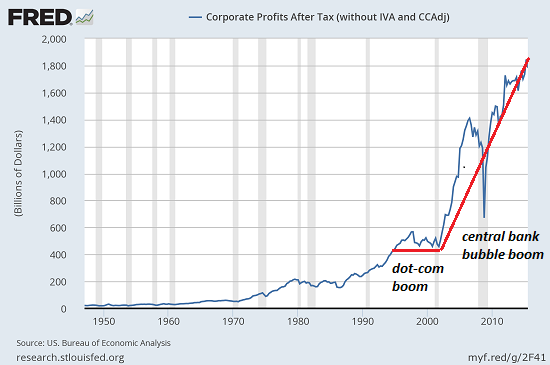

Look at the rocket ship of corporate profits. What happened around 2001 to send corporate profits on a rocket ride higher? The Fed happened, that's what:

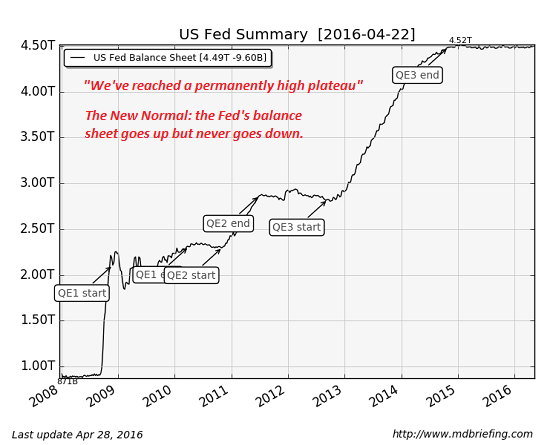

Here's the Fed balance sheet: to the moon!

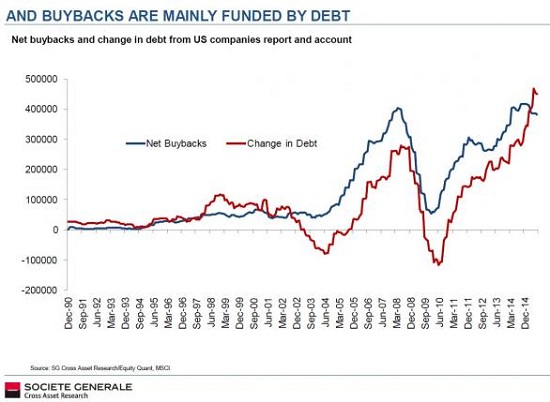

Free money for financiers and corporations fueled the stock market buyback boom:

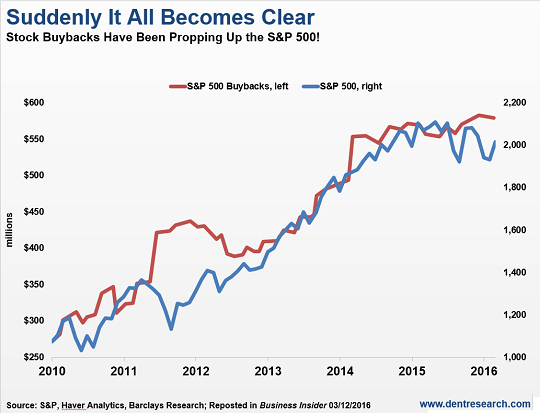

Which fueled the stock market bubble:

Is the economy in a Depression? Not if you're a corporate bigwig skimming vast gains from corporate buybacks funded by the Fed's free money for financiers.

But if you're a wage earner who's seen your pay, hours and benefits cut while your healthcare costs have skyrocketed--well, if it isn't a Depression, it's a very close relative of a Depression.

Recent interviews:

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Christine W. ($5/month), for your splendidly generous Patreon pledge to this site-- I am greatly honored by your support and readership.

| |