Having Too Much Money Leads to Catastrophe

The best thing that could happen to America would be the destruction of its credit card and a deep, prolonged recession that emptied the punch bowl of phantom bubble wealth and the illusion of endless credit.

Money being scarce saves us from many pernicious forms of mischief, and having too much money/credit leads to catastrophe. This is of course the exact opposite of the conventional belief that having lots of money makes life not just easier but expansive and, well, as perfect as human life can be.

On the scale of nation-states, having too much money/credit leads to the catastrophe of wars of choice, as having a couple million silver ducats to play with opens the door to Imperial temptations, for example, assembling a great fleet of warships and sending this Armada to conquer troublesome England.

I just finished reading what is likely the definitive account of the Spanish Armada:

Armada: The Spanish Enterprise and England's Deliverance in 1588.

Digging deep into the extensive archives of the era, the authors' translations of Philip II's voluminous correspondence makes it abundantly clear that the galleons of silver arriving annually from Spain's colonies in the Americas gave the Empire and its leadership the means to conduct ongoing wars in the Netherlands and Italy, conquer Portugal and its island possessions, defend the Empire's far-flung holdings in the Caribbean and the Philippines, as well as entertain a variety of other costly Imperial schemes, from a proposed invasion of a chunk of China (Philip II wisely passed on this request) to establishing a fort to defend the freezing, windswept Straits of Magellan from interlopers seeking to plunder Spanish holdings in the Pacific. (This project rather predictably ended in disaster and was abandoned after squandering treasure and lives.)

Sending an invasion fleet to conquer England was a two-fer for Philip: a Holy War to return Protestant England to the Catholic faith, and a means to root out the piracy of Sir Francis Drake and other English privateers at the source.

Without the millions of silver ducats jingling in his pockets, Philip would not have been able to pursue yet another costly military adventure. Updating the dynamic of too much money/credit leads to catastrophe, had the U.S. lacked the ability to borrow a couple of trillion dollars to fund wars of choice in Iraq and Afghanistan, those wars would have remained pipe-dreams of the neoconservatives bent on a secular version of a "holy war" to impose "our way of life" on other nations (never mind nobody else could afford such extravagance).

In the private sector, we might glance at Facebook/Meta's disastrous squandering of billions of dollars on a quixotic race to scoop up the mythical treasures of virtual reality, a quest that would have bankrupted a company with a smaller pile of ducats awaiting the misadventures of the leadership.

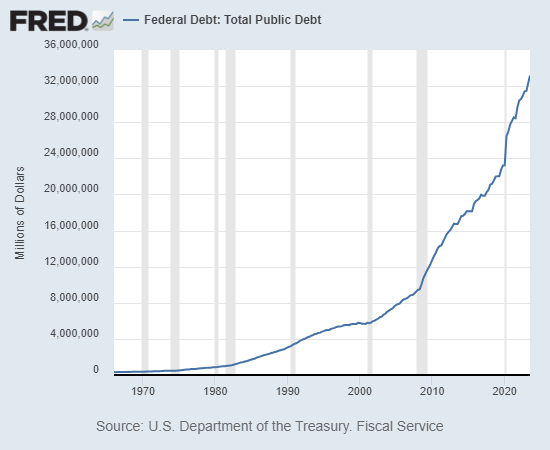

All of which leads us to the present, and America's catastrophic splurging with the nation's credit card, a card with no upper limit, or so it seems, until it's too late and the interest payments ruin the party.

Scarcity of resources, time and cash force innovation, experimentation, discipline, accountability, deferred gratification and resourcefulness because these are the only affordable problem-solving tools available.

In contrast, an abundance of ducats and credit encourages the sins of procrastination / avoidance of hard choices, narrative control as a substitute for actual problem-solving, loss of accountability, delusions of grandeur, the destruction of discipline and the normalization of corruption.

Having too much money / credit also gives free rein to all the classic sins: excessive pride, unbridled greed, wrath (take out the frustrations of failure on weaker parties), envy / class warfare, lust for power, gluttony in all things and sloth / incompetence / waste.

The best thing that could happen to America would be the destruction of its credit card and a deep, prolonged recession that emptied the punch bowl of phantom bubble wealth and the illusion of endless credit. Once the ducats and credit disappeared, then we'd finally be forced to start actually solving problems rather than papering them over by borrowing and squandering additional trillions.

Once seated at the banquet of consequences, we'd be forced to surrender the delusion that narrative control accomplishes anything other than putting off the inevitable reckoning.

new podcast: CHS on Gold and What Currency Systems Make Sense (31:37 min).

My recent books:

Disclosure: As an Amazon Associate I earn from qualifying purchases originated via links to Amazon products on this site.

Self-Reliance in the 21st Century print $18, (Kindle $8.95, audiobook $13.08 (96 pages, 2022) Read the first chapter for free (PDF)

The Asian Heroine Who Seduced Me (Novel) print $10.95, Kindle $6.95 Read an excerpt for free (PDF)

When You Can't Go On: Burnout, Reckoning and Renewal $18 print, $8.95 Kindle ebook; audiobook Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States (Kindle $9.95, print $24, audiobook) Read Chapter One for free (PDF).

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook) Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel) $4.95 Kindle, $10.95 print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print) Read the first section for free

Become a $3/month patron of my work via patreon.com.

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Ken B. ($70), for your monumentally generous subscription to this site -- I am greatly honored by your steadfast support and readership. |

Thank you, Duane S. ($25), for your exceedingly generous subscription to this site -- I am greatly honored by your steadfast support and readership. |

|

|

Thank you, Richard S. ($70), for your magnificently generous subscription to this site -- I am greatly honored by your steadfast support and readership. |

Thank you, Stephen S. ($25), for your superbly generous contribution to this site -- I am greatly honored by your support and readership. |