The Crises and Sacrifices Yet to Come

The timing of finally embracing risk and sacrifice as the only option left is exquisitely sensitive: finally caving in a moment too late leads to the system collapsing beyond recovery.

The sense that we're approaching a tipping point into a crisis with no easy resolution is pervasive, a sense that beneath the veneer of normalcy (the Federal Reserve will lower interest rates and that will fix everything), we sense the precariousness of this brittle normalcy.

While many are uneasily scanning the horizon for geopolitical crises, others see the crisis emerging here at home, possibly a political crisis or a financial crisis that ensnares us all.

Few look at the decay of our social order as the source of crisis. Few seem to notice that corruption has become so normalized that we don't even recognize the ubiquity and depth of our corruption; we tell ourselves that this isn't corruption, it's just healthy self-interest, the "invisible hand" of the market magically organizing our economy to optimize efficiency and productivity. This provides cover for our worship of self-interest, a polite phrase for limitless greed.

While the media glorifies illusions of salvation and grandeur (AI!), few look at what's been lost in the decay of our social order, a list that starts with sacrifice for the common good and civic virtue.

The American Dream has a peculiarly truncated vision of sacrifice: we make individual sacrifices to advance our personal goals, but sacrifices for the common good are not part of the Dream: sacrifices for the sake of our fellow citizens are at best unnecessary and at worst a waste of money, something only chumps fall for.

The Smart Money spends a fortune evading taxes, as part of the prevailing ethos: Get rich by whatever means are necessary and let the Devil take the hindmost.

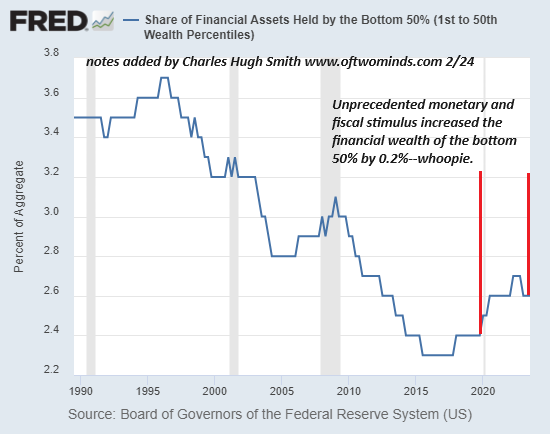

What few seem to have noticed is specific classes of the citizenry have already been sacrificed to clear the path for limitless greed and corruption to reap the spoils. These classes include the majority of the citizenry, the bottom 90%, though the burdens of the systemic cannibalization / predation have fallen most heavily on the bottom 50%, whose share of the nation's financial wealth is effectively signal noise: 2.6%.

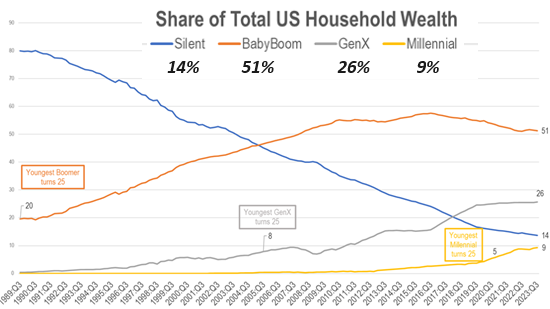

The generational divide is equally stark: Boomers hold 51% of household wealth, while Millennials hold a mere 9%.

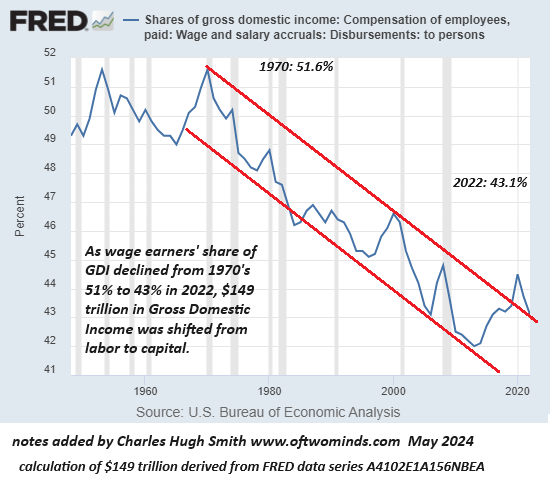

The divide between wage earners and owners of capital is staggering, yet of little interest to the financial media: Labor's share of gross domestic income (GDI) has declined for decades, resulting in the transfer of $149 trillion from wage earners to owners of capital:

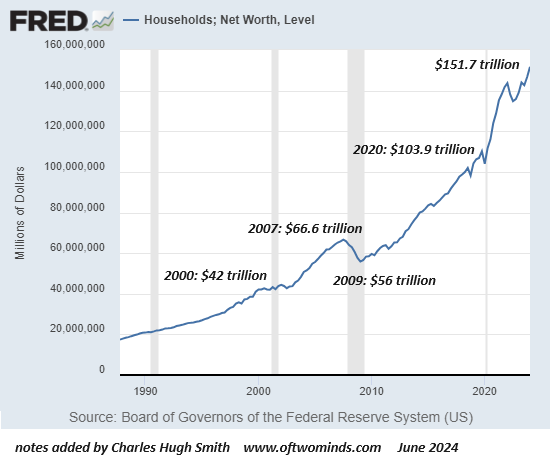

The sacrifices yet to come will fall on everyone, but they will fall most heavily on capital as capital has scooped up the vast majority of the financial gains for the past 45 years. The owners of capital are already whining, as if the addition of $50 trillion to their wealth in the past four years is their birthright, the legitimate rewards of their brilliant creation of stupendous gains in productivity rather than the illegitimate gains of a centrally planned bubble that enriched the few at the expense of the many.

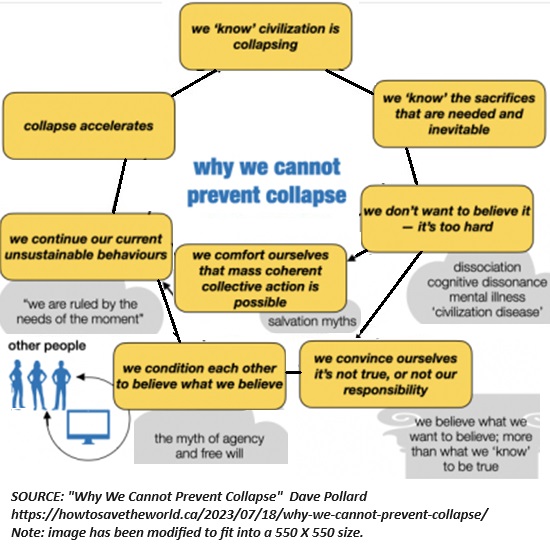

We are reluctant to face the consequences of our corruption and our vastly unequal economy. The dynamics of our ability to rationalize away the coming crisis are crystalized in this graphic composed by

Dave Pollard in his post Why We Cannot Prevent Collapse:

In summary, we are fixated on the short-term, enamored by our own power, intoxicated by normalization and conditioned to being "saved", confident that our salvation will be delivered via a painless central bank "save" should anything threaten to overturn our apple cart.

Financial podcaster Emerson Fersch asks a cogent question: what catalyst will finally tip the system into disorderly incoherence? My answer is the core of our recent podcast, Crisis, Sacrifice and the New Economy.

I don't have a crisp answer that fits in a Tweet or a Tik-Tok video because any prediction is nothing more than a guess due to the nature of the global economic system: an open, (i.e. emergent) tightly bound system that has veered far from equilibrium and is prone to sudden drops into chaotic disorder in which there are no guarantees that the previous stability / equilibrium can be restored.

We know a few things that offer some minimal guidance. We know that in complex, highly interconnected /tightly bound systems, small perturbances can generate large effects.

We also know that should events occur faster than the system's stabilizing feedbacks can respond, the system is highly prone to collapse.

We also know that humans don't change anything that requires exposure to open-ended risk and sacrifice until there is no other choice.

Lastly, we know that the timing of finally embracing risk and sacrifice as the only option left is exquisitely sensitive: finally caving in a moment too late leads to the system collapsing beyond recovery. When this moment arrives, who will be ready and who will resist, rationalize and prevaricate until it's too late?

When we're finally ready to bargain--OK, we'll sacrifice a bit--it's too late to stop the whirlwind.

Podcasts:

Crisis, Sacrifice and the New Economy, with Emerson Fersch (1 hour)

Financial Nihilism, Inflation & The Collapsing American Dream.

My recent books:

Disclosure: As an Amazon Associate I earn from qualifying purchases originated via links to Amazon products on this site.

Self-Reliance in the 21st Century print $18, (Kindle $8.95, audiobook $13.08 (96 pages, 2022) Read the first chapter for free (PDF)

The Asian Heroine Who Seduced Me (Novel) print $10.95, Kindle $6.95 Read an excerpt for free (PDF)

When You Can't Go On: Burnout, Reckoning and Renewal $18 print, $8.95 Kindle ebook; audiobook Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States (Kindle $9.95, print $24, audiobook) Read Chapter One for free (PDF).

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook) Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel) $4.95 Kindle, $10.95 print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print) Read the first section for free

Become a $3/month patron of my work via patreon.com.

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Frank E. ($100), for your outrageously generous subscription to this site -- I am greatly honored by your steadfast support and readership. |

Thank you, Craig H. ($70), for your exceedingly generous subscription to this site -- I am greatly honored by your steadfast support and readership. |

|

|

Thank you, John M.-G. ($75.61), for your magnificently generous subscription to this site -- I am greatly honored by your support and readership. |

Thank you, Francis M. ($70), for your superbly generous subscription to this site -- I am greatly honored by your steadfast support and readership. |