The Cure for What Ails Us: Market Crash and Mass Defaults

The system has reached extremes that can no longer be rebalanced by policy tweaks, borrowing another couple trillion dollars or inflating asset bubbles.

There are many possible answers to the question "what ails us?" but they all boil down to one reality: the socio-political-economic system has slowly transmogrified into one that benefits the few at the expense of the many by its very structure. There are many moving parts in this transmogrification, hence the multiplicity of answers to "what ails us?"

The net result is extreme asymmetry in wealth and income, a reality I've often explored, most recently in

The Seeds of Social Revolution: Extreme Wealth Inequality. As documented in the data-rich history

The Great Leveler: Violence and the History of Inequality from the Stone Age to the Twenty-First Century, extreme asymmetries of wealth / income get rebalanced one way or the other, either by policy changes or social upheaval.

Correspondent John recently proposed a third rebalancing mechanism: a crash of The Everything Bubble markets and a mass default by the bottom 90% that erases a major chunk of debt, which as often noted here, is somebody else's asset: default on the debt and the asset is wiped out.

Here are John's comments on this third rebalancing mechanism:

The wealth divide has been my (very) hot button issue for years, overriding all others. I agree with your two options, but you left out door #3.

As for policy change, I think that is fanciful thinking. The top 10% (who think everything is wonderful) will never vote for substantial change, as they'll never vote for anything other than feel-good minor change ...with loopholes, of course.

I think Door #3 will be taken ... which the Deep State will have to allow as they see civil unrest coming ever clearer on the horizon if not. What is Door #3? A Crash of assets, which will flatten the divide. In a credit-based economy, it will be easy to let it all fall. Assets fall everywhere ... including debt (an asset for top 10%) as the bottom 90% just walk away (as there are no debtor prisons). A crash of assets requires no vote ... just The Powers That Be standing back. (Of course, half measures will be taken to show the top 10% we're DOING SOMETHING ... but in reality this only stretches out the collapse).

Thank you, John, for an insightful description of a third option that rebalances extreme wealth inequality by reducing the assets of the top 10% and the liabilities of the bottom 90%. As John noted, this process is easy in a debt-based economy: just reduce the expansion of debt and the asset bubble pops, the economy craters and debtors default en masse, reducing the liabilities side of the ledger.

As John so presciently described, The Powers That Be will oversee this reduction while wringing their hands and promoting their ineffective efforts to stem the collapse as "we're giving it all we got, Captain!"

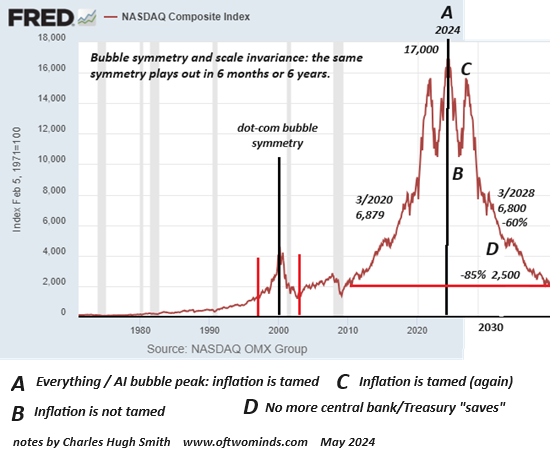

The asset bubble and debt load are so enormous, tens of trillions of dollars will need to be shaved off both ledgers to rebalance the system. All bubbles pop under their own weight at some point, and bubbles often deflate in a symmetrical fashion, dropping at the same rate as the bubble inflated. This chart of NASDAQ illustrates how bubble symmetry might play out going forward.

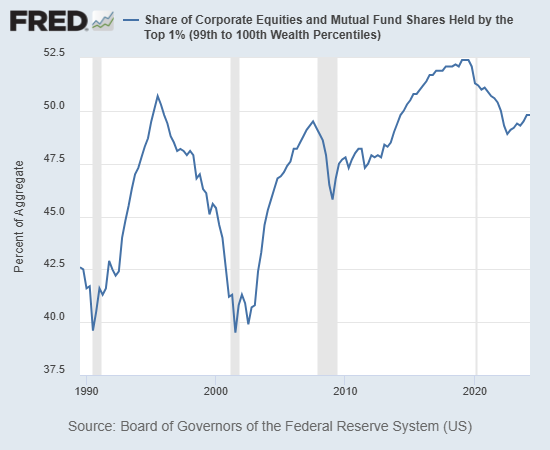

Since the top 1% own 50% of all stocks, guess who this drop will hurt the most? The top 90% to 99% own close to 40% of the remaining equities, so the top 10% will absorb roughly 90% of the losses as the stock market bubble pops.

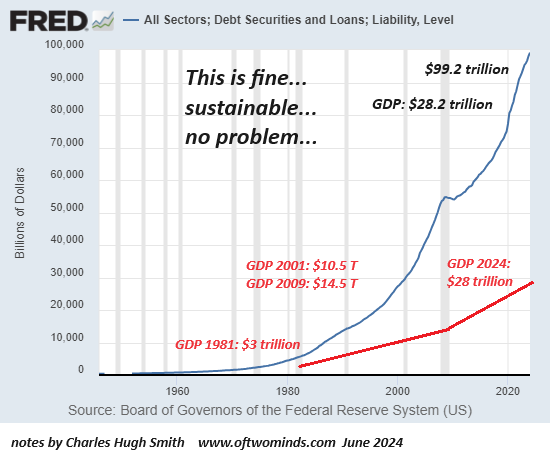

Here is total systemic debt. The federal government debt isn't going away, short of a complete systemic collapse, and the legal pathway of local governments defaulting on their debts is murky, but there are no obstructions to private-sector defaults of all lender-generated debt: commercial real estate mortgages, housing mortgages, credit cards, auto loans, etc. As for student loans, the old phrase you can't get blood from a turnip may describe the futility of trying to collect blood (student loan payments) from turnips (debtors without assets or income.)

We can play the game Japan has played for 35 years, keeping non-performing loans on the books at full (i.e. phantom) value, but look where that artifice got Japan: 35 years of stagnation as everyone knows the "assets" are phantom and so the value can't be discovered by the market. Since accurate valuation is impossible, trust dissipates and the system rots away from within.

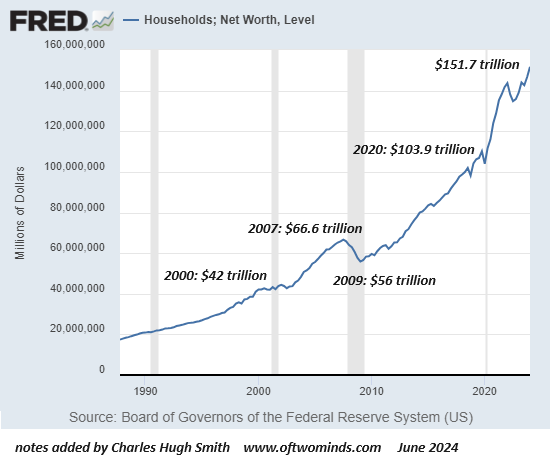

As a thought experiment, let's project writing off $50 trillion of debt based on phantom collateral that's evaporated. That is of course a writedown of assets by $50 trillion, too, which would reduce household assets to around $100 trillion--still substantial, just no longer a bubble.

The system has reached extremes that can no longer be rebalanced by policy tweaks, borrowing another couple trillion dollars or inflating asset bubbles. What ails us can be rectified by adjusting (ahem) assets (collateral) and debt to rebalance the extremes that are destabilizing the system from within.

The Slow Death of the Single Family Home (30:57 min).

My recent books:

Disclosure: As an Amazon Associate I earn from qualifying purchases originated via links to Amazon products on this site.

The Mythology of Progress, Anti-Progress and a Mythology for the 21st Century print $18, (Kindle $8.95, Hardcover $24 (215 pages, 2024) Read the Introduction and first chapter for free (PDF)

Self-Reliance in the 21st Century print $18, (Kindle $8.95, audiobook $13.08 (96 pages, 2022) Read the first chapter for free (PDF)

The Asian Heroine Who Seduced Me (Novel) print $10.95, Kindle $6.95 Read an excerpt for free (PDF)

When You Can't Go On: Burnout, Reckoning and Renewal $18 print, $8.95 Kindle ebook; audiobook Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States (Kindle $9.95, print $24, audiobook) Read Chapter One for free (PDF).

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook) Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel) $4.95 Kindle, $10.95 print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print) Read the first section for free

Become a $3/month patron of my work via patreon.com.

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Mike P. ($70), for your magnificently generous subscription to this site -- I am greatly honored by your support and readership. |

Thank you, Craig W. ($70), for your superbly generous subscription to this site -- I am greatly honored by your support and readership. |

|

|

Thank you, Taz ($7/month), for your marvelously generous subscription to this site -- I am greatly honored by your support and readership. |

Thank you, Nick S. ($70), for your splendidly generous subscription to this site -- I am greatly honored by your support and readership. |