The Tax Benefits of Self-Employment

Lowering one's tax burden is not the reason to pursue self-employment, but it is something worth understanding if you're exploring self-employment.

It's tax preparation time, the secular equivalent of crawling around the temple on cobblestones littered with broken glass. When our numbed minds read instructions like this--"Enter the smaller of line 10 or line 14. Also enter this amount on the applicable line of your return (see instructions)"--we wonder which is more applicable--Kafka's Castle, filled with unseen workers toiling away 24/7 getting nothing remotely useful accomplished, or Huxley's loving our servitude, or perhaps a tortuous mix of both.

The simplified form for wage earners is much easier, of course, but it offers precious little in the way of deductions or tax breaks. The tax system for wage earners without huge mortgage interest or out-of-pocket medical expenses deductions is relatively skimpy in terms of tax breaks. The complexity--and the tax breaks--apply mostly to enterprises, from sole proprietors on up.

I am not a tax professional, I am only sharing my experience as a self-employed worker. This is not tax or financial advice, it's an account of what I've learned preparing my own taxes for decades. Like most people, I rely on the tax preparation software to comply with tax codes and to do the heavy lifting of preparing the tax return.

Of my 54 years of working and paying taxes, 14 were as an employee and 40 were self-employed, so I have experience in both realms. What continues to amaze me is the number of straightforward tax breaks available to the self-employed / sole proprietor.

Let's avoid sugarcoating self-employment: it's difficult, demanding and risky. As a general rule, self-employment demands more of us than being an employee on all fronts: we own it all, victories and mistakes. Regulatory burdens and shadow work eat us alive. Much of what passes for self-employment now is low-paid gig work with little upside.

So there is a trade-off here: self-employment is difficult to build up and keep going (taking a vow of poverty is a good start), which is why so few people manage to earn a middle-class income via self-employment outside the professions (accountant, attorney, etc.)--and even those fields are not easy paths to reliable livelihoods.

But there are tax advantages. Let's start with business expenses. How we run our business is up to us. If we keep track of legitimate expenses (bought lunch for Client A, drove X miles to post office to mail packages, etc.), then nobody can deny that business expense. And if Client A only spent 10 seconds of an hour-long lunch talking "business," that's the nature of business lunches.

Everyone understands there's wiggle-room in expenses. The system is designed to seek out unsubstantiated claims, not question how we run our business. If you happened to stop at the supermarket on the way to the post office, nobody's going to nix your mileage deduction. You went to the post office to mail a business-related package, and here's the receipt.

Then there's the list of deductions for things you had to pay anyway. The self-employed pay both the employee and employer parts of Social Security and Medicare, so that's a hefty 15.3% of taxable income. But half of this self-employment tax is deductible.

The cost of your healthcare insurance is also deductible.

Retirement funding is another benefit. Yes, wage earners with 401K plans can contribute big chunks of cash into their tax-deferred accounts, but not every employee has a 401K plan at work. the basic limits for contributing to an IRA (individual Retirement Account) is $7,000--not much in today's inflationary era.

The self-employed can open a Solo 401K that offers two benefits: the sums that can be stashed in the tax-deferred account are substantial (depending on one's income and age, $30,000 and up), and the Solo 401K funds can be used to buy precious metals or rental real estate as well as traditional financial assets--options not available to corporate 401K plans.

Then there's the Qualified Business Income Deduction, a deduction available to most sole proprietor enterprises that tax-prep software such as TurboTax generates automatically.

If you have a dedicated home office, the costs of that percentage of your house can be deducted as an expense.

These deductions knock down your taxable net income, reducing your tax burden. And you can take the standard deduction, of course, further reducing your taxable income.

All this requires tedious, attention-to-detail bookkeeping. That takes effort. But that's part of being in business.

Yes, some people try to get away with absurd deductions, but it's easier to assume every expense / deduction will be audited, and proceed accordingly. There are plenty of legitimate expenses and deductions, so flim-flam is unnecessary.

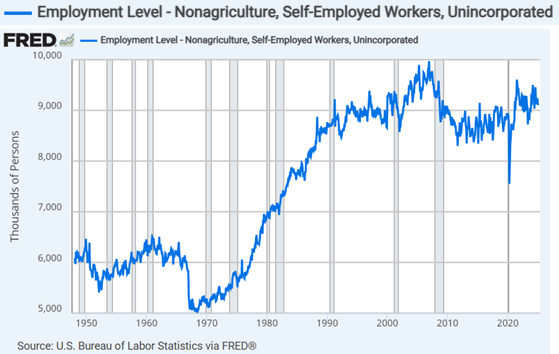

Lowering one's tax burden is not the reason to pursue self-employment, but it is something worth understanding if you're exploring self-employment. There are roughly 9.8 million unincorporated self-employed (700K in agriculture and 9.1 million in non-ag sectors) and about 6.5 million incorporated self-employed, which are typically professionals in healthcare, legal and accounting services, engineers, architects, etc. Compare these to the wage-salary workforce of 152 million.

Labor Force Statistics (BLS)

As we might expect, self-employment rises in booms and declines in busts. It is currently around the same numbers it reached 30 years ago, despite the U.S. population rising by 30%, from 265 million in 1995 to 345 million in 2024. This suggests self-employment is declining as a percentage of the workforce. This also doesn't factor in the reality that the many self-employed workers earn modest sums and have a wage job to supplement their income.

It's more challenging to start self-employment now, and more challenging to make a middle-class livelihood as a self-employed worker. Many regulations seem designed to favor corporations, and many locales claim to favor small business but do little to make it easier / cheaper to start a sole proprietorship.

For many of us self-employed, we have no choice. The independence and accountability are what allow us to to thrive as human beings.

New podcast: Charles Hugh Smith - LeafBox -- wide-ranging discussion of Anti-Progress, technology, mythology, and experimenting to right-size your own electrical utility...

My recent books:

Disclosure: As an Amazon Associate I earn from qualifying purchases originated via links to Amazon products on this site.

The Mythology of Progress, Anti-Progress and a Mythology for the 21st Century print $18, (Kindle $8.95, Hardcover $24 (215 pages, 2024) Read the Introduction and first chapter for free (PDF)

Self-Reliance in the 21st Century print $18, (Kindle $8.95, audiobook $13.08 (96 pages, 2022) Read the first chapter for free (PDF)

The Asian Heroine Who Seduced Me (Novel) print $10.95, Kindle $6.95 Read an excerpt for free (PDF)

When You Can't Go On: Burnout, Reckoning and Renewal $18 print, $8.95 Kindle ebook; audiobook Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States (Kindle $9.95, print $24, audiobook) Read Chapter One for free (PDF).

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $8.95, print $20, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook) Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel) $4.95 Kindle, $10.95 print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print) Read the first section for free

Become a $3/month patron of my work via patreon.com.

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Sue W. ($225), for your beyond-outrageously generous subscription to this site -- I am greatly honored by your steadfast support and readership. |

Thank you, Michael D. ($70), for your superbly generous subscription to this site -- I am greatly honored by your steadfast support and readership. |

|

|

Thank you, David E. ($100), for your outrageously generous subscription to this site -- I am greatly honored by your steadfast support and readership. |

Thank you, Don F. ($50), for your splendidly generous subscription to this site -- I am greatly honored by your steadfast support and readership. |