My One Prediction for 2023

The question that should be on our minds is: how are my household's buffers holding up?

Lists of predictions for the new year are reliably popular. Here's 10 predictions, there's 17 predictions,

over here we have 23 and a half... let's strip it all down to one prediction: everyone's predictions will be wrong

because 2023 isn't going to follow anyone's script.

There are several reasons for this. One is that the vast majority of predictions are based on historical

comparisons to previous eras. If the current era is unique in its combination of dynamics and instability, previous

pathways are not going to accurately predict what happens next.

Recency bias leads us astray. The past 50 years of relatively mild weather, the past 40 years of Bull

Markets, the past 30 years of financialization and the supremacy of monetary policy--all of these offer a warm and

fuzzy confidence that the future will be comfortingly similar to the recent past. This assumption works pretty well

in stable eras but fails dismally in destabilizing, transitional eras.

Stability and instability are not evenly distributed, so every cherry-picked bias can be supported. You

predict slow sales? Here's an empty shopping mall. See, I'm right! You predict a return to the good old days? Here's

a crowded street fair. See, I'm right!

Those who happen to be living inside an island of coherence are inside a bubble that they mistakenly

think encompasses the entire world. This is especially prevalent in the top 5% who shape the narratives

that influence the rest of us. If real estate is sinking in their little corner of the world, they predict real

estate will crash everywhere.

If everything's rosy in their protected enclave, they predict a mild recession and steady growth, blah blah blah.

Those living in a place that has lost its coherence and stability see the world differently. Systems are

breaking down and when they are restored, they're not the same: they're less reliable, more expensive and prone

to decay / decoherence.

This tracks the core-periphery model I often reference. Those in the still-coherent core cherry-pick

evidence that all is well in the decohering periphery while those in the periphery expect the rot to spread quickly

to the core.

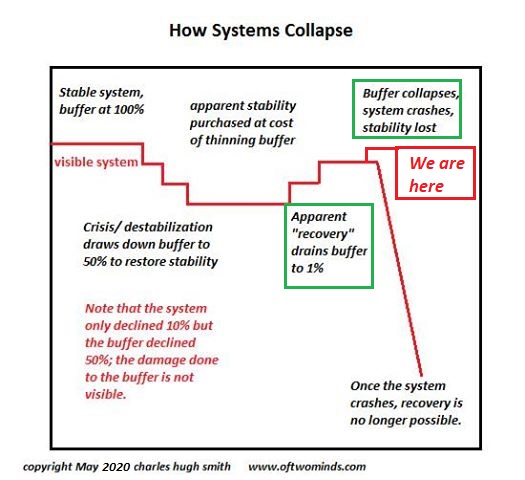

It depends on how much is left in the buffers protecting core systems. As the diagram below illustrates,

a system's ability to bounce back (restore stability and function) depends on the robustness of its buffers:

how much labor, capital, expertise, spare parts, etc. can be rushed into service to repair damage and restore functionality.

The quality and quantity of these buffers are invisible to outsiders. When staffing has eroded and there's no

one available to call up, when spare parts have been depleted, when budget constraints, corruption and managerial

incompetence have stripped the system of expertise and the willingness to sacrifice, the system breaks down and cannot

be restored because the means to do so are no longer available.

Outsiders clinging to recency bias are thus shocked when systems they assumed were rock-solid

no longer function reliably. Insiders are amazed the duct-tape has held this long while outsiders are

stunned to learn that student nurses are being passed off as certified nurses and the maintenance of critical

systems has completely collapsed.

As I explained in

How Things Fall Apart,

The Blowback from Stripmining Labor for 45 Years Is Just Beginning and

The "Let It Rot" Death Spiral, the competent are leaving in droves, leaving the ambitiously incompetent

at the wheel while those keeping the whole mess glued together are burning out and retiring, quitting or

downsizing to gigs with less pressure and more control of their work.

Systems that are still competently managed with ample buffers will maintain their coherence. The systems

that are incompetently managed, riddled with corruption and favoritism and coasting on buffers that have been

worn down and are now wafer-thin will break down and lose coherence and functionality.

This process is uneven and unpredictable. In some cases, the core will shield itself from the decay and

breakdown in the periphery, in other cases the falling dominoes will destabilize the core that everyone in the

bubble thought was permanently safe and secure.

The question that should be on our minds is: how are my household's buffers holding up? What resources do

we have in reserve when systems lose their reliability and predictability?

Counting on the demi-gods in central banks to save us is not a substitute for strengthening your own buffers.

There's no substitute for owning and controlling everything that counts in your life, and developing trusted

personal networks of reliable, trustworthy, productive people. Those are the foundations of

self-reliance.

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

Read the first chapter for free (PDF)

Read excerpts of all three chapters

Podcast with Richard Bonugli: Self Reliance in the 21st Century (43 min)

My recent books:

The Asian Heroine Who Seduced Me

(Novel) print $10.95,

Kindle $6.95

Read an excerpt for free (PDF)

When You Can't Go On: Burnout, Reckoning and Renewal

$18 print, $8.95 Kindle ebook;

audiobook

Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States

(Kindle $9.95, print $24, audiobook)

Read Chapter One for free (PDF).

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel)

$4.95 Kindle, $10.95 print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print)

Read the first section for free

Become

a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, David S. ($200), for your super-outrageously generous contribution to this site -- I am greatly honored by your steadfast support and readership. |

Thank you, Marty W. ($120), for your outrageously generous contribution to this site -- I am greatly honored by your steadfast support and readership. |