The Core of the Economy--The Middle Class--Is Crumbling

The net result of hyper-globalization and hyper-financialization is the crumbling

of the middle class.

Neofeudal societies and economies lack a vibrant middle class. This is the defining feature of

feudalism and its updated V2.0, neofeudalism: a nobility (based on birth or finance, it doesn't matter)

controls the vast majority of wealth, political power and productive capital, all served by a powerless peasantry.

The modern versions of capitalism emerged when a European middle class arose and became powerful enough economically

and politically to dismantle feudalism. The fundamentals of the middle class are:

1. A mindset / set of values embracing (as highlighted by writer Peter Frost) "thrift, prudence, negotiation, and hard work."

2. Access to markets and credit so enterprises could be established and expanded.

3. Sufficient education to navigate regulations and the requirements of enterprise.

4. The free flow of labor, capital, goods and services.

Feudal economies lacked these fundamentals by design. All these forces were restricted to enforce the power and

perquisites of the Nobility.

Neofeudalism is a trickier beast. Neofeudal economies and societies make a big PR show of being open to new

enterprise, but the real-world reality is not so warm and fuzzy: new cartels and monopolies arise in a fierce struggle

to stamp out competition and influence regulators to not just enable predatory cartels/monopolies but defend them.

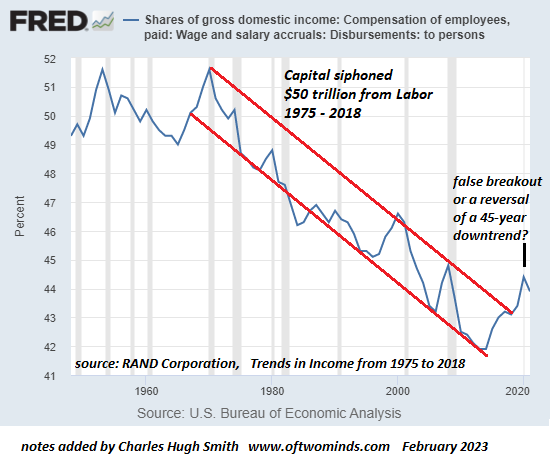

The past 30 years can be characterized by the ascent of capital and the decline of labor. As the chart below

shows, wages' share of the economy has been in a 45-year decline. The recent uptick may be a false breakout or it might

be a change in trend. It's too early to tell. But in any event, wages--the bedrock not just of the working class but of

the middle class--have been chipped away to the tune of $50 trillion siphoned away by capital.

(Source:

Trends in Income From 1975 to 2018 RAND Corporation)

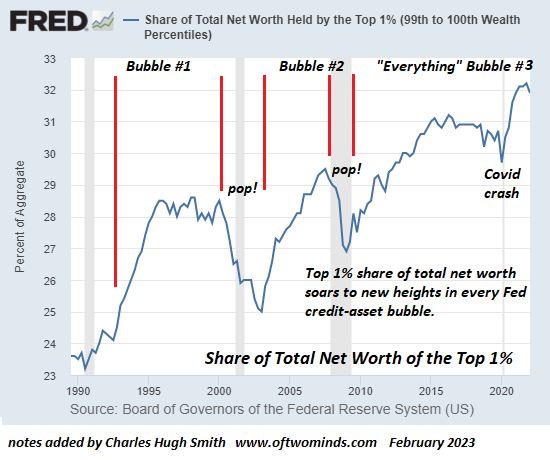

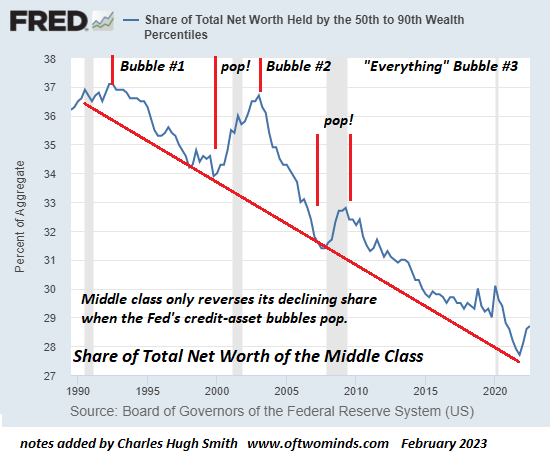

Another mechanism is visible in the charts below showing the Share of Total Net Worth of the top 1% and

the middle class, i.e. the households between 50% and 90% (this broad definition includes the spectrum fron

lower middle class, households with incomes around the median, and upper-middle class households earning considerably more).

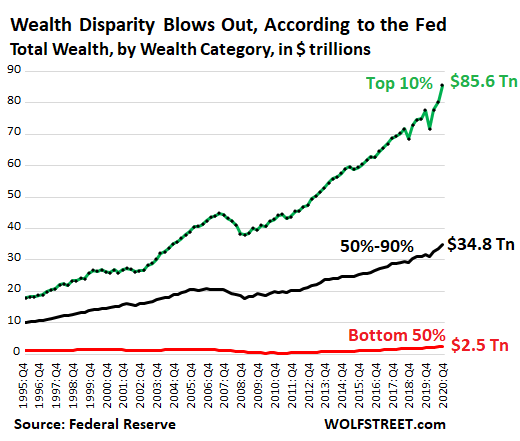

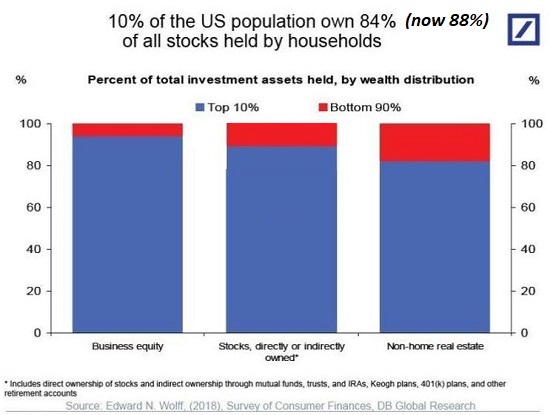

As the chart below shows, the top 10% own the vast majority of income-producing assets:, stocks bonds, income

real estate and enterprises. The relative share owned by the middle class is at best modest, at worst negligible.

The key economic dynamic of the past 30 years is central bank-driven credit-asset bubbles which propel

the assets owned by the top 10% to the moon. Those who own few such assets do not benefit from these asset bubbles,

so their share of net worth (wealth) declines accordingly.

The two primary forces in the past 30 years are financialization and globalization,

forces which accelerated under central bank / Neoliberal trade policies into hyper-financialization and

hyper-globalization: hyper-financialization constantly inflates ever-larger asset bubbles,

enriching the already-rich, while hyper-globalization forces labor to compete with lower-cost workforces

globally, effectively transferring wages to capital, which can optimize labor / regulatory /credit / currency arbitrage

to maximize corporate profits at the expense of the bottom 90% who depend on wages for their income rather than capital.

The most striking feature of the fortunes of the top 1% and the middle class is clearly visible: the share of

total wealth of the top 1% soars to new heights in every bubble, while the share of the middle class dives.

The share of the middle class only rises when asset bubbles pop. This is the result of the

top tier of US households owning the vast majority of assets: as bubbles pop, those who own few assets suffer far less

than those who own most of the assets that bubble higher on the back of central bank stimulus and easy credit.

When the bubbles inevitably pop, the share of the top 1% crashes as the share of the middle class makes a temporary gain.

Please take a look. It's rather remarkable, isn't it?

The net result of hyper-globalization and hyper-financialization is the crumbling

of the middle class, which has seen its share of the nation's wealth and income eroded for the past 45 years,

a trend that accelerated in the past 20 years.

Neofeudal economies and societies are static, brittle, dysfunctional and incapable of generating broad-based prosperity.

Does that sound like an economy we know?

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

Read the first chapter for free (PDF)

Read excerpts of all three chapters

Podcast with Richard Bonugli: Self Reliance in the 21st Century (43 min)

My recent books:

The Asian Heroine Who Seduced Me

(Novel) print $10.95,

Kindle $6.95

Read an excerpt for free (PDF)

When You Can't Go On: Burnout, Reckoning and Renewal

$18 print, $8.95 Kindle ebook;

audiobook

Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States

(Kindle $9.95, print $24, audiobook)

Read Chapter One for free (PDF).

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel)

$4.95 Kindle, $10.95 print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print)

Read the first section for free

Become

a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Laura D. ($50), for your magnificently generous contribution to this site -- I am greatly honored by your steadfast support and readership. |

Thank you, Linda M. ($5/month), for your marvelously generous pledge to this site -- I am greatly honored by your support and readership. |