What Happens When Millions of Renters Can No Longer Afford High Rents and Move Back Home?

What's no longer affordable is eventually jettisoned, including high-rent homes and apartments.

Recency bias can stretch back 40 years. It's been over 40 years since the U.S. experienced a deep recession (what I call a "real recession") which is characterized by elevated inflation, interest rates, yields, unemployment, defaults and bankruptcies, none of which can be reversed with air-drops of "free money" because higher inflation, rates and yields all limit central bank money-printing and fiscal "free money" via deficit spending.

Without air-drops of trillions of dollars in "free money", the accumulated excesses of the economy have to sort themselves out the hard way via defaults, bankruptcies, insolvencies, layoffs, tightening credit and reduced spending / consumption.

The last time this burn-off of excesses could no longer be pushed forward occurred in 1980-82, the deepest downturn since the Great Depression in the 1930s.

Few remember the 1980-82 recession and even fewer think a recurrence is even possible. The dead-wood of excesses never get burned off, they just pile higher with each central bank-fiscal bailout / "free money" air-drop.

Recessions which burn off excesses act as catalysts for profound social, financial and economic shifts. Up until the recession, everyone assumes the current situation is permanent and forever. This is the equivalent of assuming a forest piled high with deadwood will never catch fire.

By way of example, consider that the relatively mild dot-com implosion recession of 2000-02 led to 100,000 residents of the San Francisco Bay Area moving away to lower-cost climes because once the layoffs swept through the dot-com bloat, people could not longer afford the high rents and cost of living.

The situation now is far more precarious due to the spread of high rents from a few urban areas to virtually the entire nation. As a percentage of net income, the cost of living is far higher than it was in 2000. Given the nonsensical manner that official inflation is calculated (owners equivalent rent, etc.), statistics are untrustworthy measures. An apples-to-apples comparison of purchasing power of wages (i.e. what percentage of wages are required to pay rent, taxes, insurance, transportation, childcare, food, etc.) is the only accurate measure of the true impact of the soaring cost of living.

The consensus holds that soaring rents are the result of housing shortages. In other words, the demand for housing is so strong that landlords can charge a premium.

So what happens to the strong demand for rentals and the resulting high rents if millions of renters vacate their apartments and move in with other single households? This is precisely what happens in a recession in which millions lose their jobs (or have to take lower income work) and can no longer afford stratospheric rents.

The facts suggest that instead of a housing shortage, we have an enormous quantity of housing that is currently occupied by a single person--housing that could easily accommodate more occupants per unit.

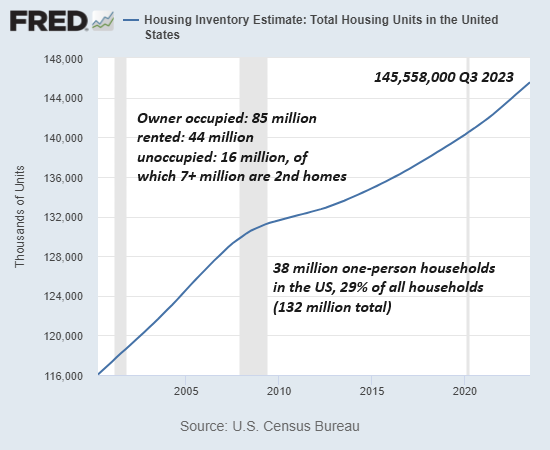

To sketch out how this scenario could play out, let's start with some basic facts about America's housing stock, the age of the occupants and the number of single-person households. As shown on this chart courtesy of the Federal Reserve, there are 145 million housing units in the U.S.--85 million owner-occupied homes and condos, 44 million rented houses and apartments, and 16 million unoccupied dwellings, of which 7+ million are 2nd homes / vacation homes. The remaining 9 million unoccupied homes may be in the process of being sold or held off the market for various reasons, or they're abandoned or no longer livable due to obsolescence / decay.

Some might be in areas with poor employment options and so the demand is so low that vacancies abound.

Next, let's look at home ownership and one-person households. According to the

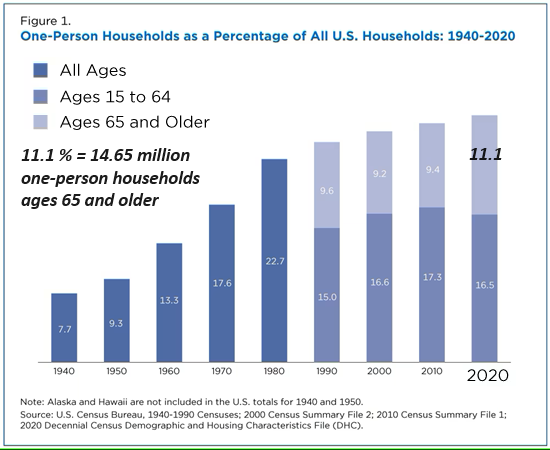

Census Bureau, "There were 37.9 million one-person households, 29% of all U.S. households in 2022. In 1960, single-person households represented only 13% of all households." (There are about 132 million households in the U.S.)

The Census Bureau also reported that

46.4% of U.S. adults are single--that's 117.6 million unmarried Americans, "nearly every other adult aged 18 and over. This includes those who are divorced or widowed as well as those who have never married."

About 11% of these one-person households are 65 years of age or older, or about 14.65 million people.

As you might imagine, homeownership is skewed to the older population, as is ownership of homes without mortgages, i.e. homes owned free and clear.

According to How the Demographics Are Shaping the Housing Market, older Americans own almost 90% of all housing: The Silent Generation (78 and older) own 11.3%, Boomers (ages 59 to 77) own 43.5% and Gen X (ages 43 to 58) owns 32.5%. Some break the Boomers into Boomers I (ages 69-77) and Boomers II (ages 59-68).

We can thus project that a substantial percentage of individuals age 65 and older who are living alone own their own homes. It required a much more modest down payment and percentage of net income two or three generations ago to buy a home, and so it's to be expected that home ownership is heavily skewed to older cohorts who were able to buy homes with median incomes--something that is no longer possible for younger generations.

There are also millions of renters who live alone, some percentage of which might be persuaded to accept a roommate if their income/finances deteriorate. Of the 38 million single-person households, how many would welcome another occupant? Retirees with limited income might welcome paying boarders, and single elderly might offer free housing to younger family members in exchange for help around the house.

How many Boomers and Gen X homeowners would accept an adult child or grandchild moving home if financial conditions preclude any other option? Anecdotally, I see grandparents hosting a grandchild and her daughter, and I hear accounts of an elderly parent deeding their home to the adult child who moves back home and cares for the parent.

It is well within the realm of possibility that 10% of the roughly 40 million single-person households could vacate their rentals and move in with another single or into a large empty-nest home owned by parents are grandparents should conditions change and high rents are no longer affordable. That would leave about 10% of the rental housing unoccupied.

Although few believe it is even in the realm of possibility, in an extended downturn, 8 million renters could vacate now-unaffordable rentals for far more affordable living spaces in other dwellings.

As the saying goes, necessity is the mother of invention, which in the case of unaffordable rents in a recession, we can modify to necessity is the mother of radically downsizing expenses by any means available.

Rents tend to be as stubborn as human nature. Landlords tend to believe the highest rent ever received is the "fair price," and the majority will cling to this fantasy long past the point at which a rational assessment of market conditions would suggest a 25% reduction in asking rent would be the bare minimum to snare a tenant for the vacant flat.

If the 2000-02 recession is any guide, tenants will cling on to their over-priced flats as long as possible, hoping for a job offer that never transpires. The unemployment checks aren't enough, temp gigs dry up, savings run out and the inability to continue paying sky-high rent finally forces a move.

No one remembers what happens in a deep, prolonged recession, and we're long overdue to find out what happens. What's no longer affordable is eventually jettisoned, including high-rent homes and apartments.

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

Read the first chapter for free (PDF)

Read excerpts of all three chapters

Podcast with Richard Bonugli: Self Reliance in the 21st Century (43 min)

My recent books:

Disclosure: As an Amazon Associate I earn from qualifying purchases originated via links to Amazon products on this site.

The Asian Heroine Who Seduced Me

(Novel) print $10.95,

Kindle $6.95

Read an excerpt for free (PDF)

When You Can't Go On: Burnout, Reckoning and Renewal

$18 print, $8.95 Kindle ebook;

audiobook

Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States

(Kindle $9.95, print $24, audiobook)

Read Chapter One for free (PDF).

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel)

$4.95 Kindle, $10.95 print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print)

Read the first section for free

Become

a $1/month patron of my work via patreon.com.

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Jay S. ($50), for your marvelously generous contribution to this site -- I am greatly honored by your steadfast support and readership. |

Thank you, FPJM L. ($100), for your outrageously generous contribution to this site -- I am greatly honored by your steadfast support and readership. |

|

|

Thank you, Judith B. ($100), for your outrageously generous contribution to this site -- I am greatly honored by your steadfast support and readership. |

Thank you, John D. ($5/month), for your superbly generous subscription to this site -- I am greatly honored by your support and readership. |