Lyrics/Poems for Our Age

Frequent contributor Bill Murath sent in a song recommendation whose lyrics, he suggests, "are so fitting of the time now." Have a read/listen and see if you agree; I certainly do.

The percentage you're paying is too high priced

While you're living beyond all your means

And the man in the suit has just bought a new car

From the profit he's made on your dreams

But today you just read that the man was shot dead

By a gun that didn't make any noise

But it wasn't the bullet that laid him to rest was

The low spark of high-heeled boys

If you had just a minute to breathe and they granted you one final wish

Would you ask for something like another chance?

Or something similar as this? Don't worry too much

It'll happen to you as sure as your sorrows are joys

And the thing that disturbs you is only the sound of

The low spark of high-heeled boys

If I gave you everything that I owned and asked for nothing in return

Would you do the same for me as I would for you?

Or take me for a ride, and strip me of everything including my pride

But spirit is something that no one destroys

And the sound that I'm hearing is only the sound

The low spark of high-heeled boys

The Low Spark of the High-Heeled Boys

by Steve Winwood/Jim Capaldi and recorded by Traffic in 1972.

My own recommendation is justifiably famous but has never seemed more accurate than in our "house of mirrors and lies/The Emperor has no clothes" era:

Turning and turning in the widening gyre

The falcon cannot hear the falconer;

Things fall apart; the centre cannot hold;

Mere anarchy is loosed upon the world,

The blood-dimmed tide is loosed, and everywhere

The ceremony of innocence is drowned;

The best lack all conviction, while the worst

Are full of passionate intensity.

The Second Coming

by William Butler Yeats 1921

Shall we hazard a comment and suggest the falconer is our better sense, and the falcon our nation, running out of control on so many levels, loosing a blood-dimmed tide? As for the worst being full of passionate intensity--look no further than your nearest ideologue pounding the podium for the next war, culturally or geopolitically, insulting and deriding any and all opposition with any means at hand (wishing John Edwards had been killed in a terror attack, such a thoughtful, reasonable political comment, the true voice of unmuzzled right-wing purity).

As for the ceremony of innocence--a belief that no one is above the law, and that the law is above political meddling--it has indeed been drowned by Executive privilege, the last resort of liars and thieves. Yet the nation dances in the street of "endless prosperity," mindless of everything but what can be purchased, consumed or displayed in a show of self-absorbed pride.

As things fall apart--and certainly the center is not holding--perhaps mere anarchy will soon be loosed on our built-on-the-shifting-sands-of-lies world.

Saturday, June 30, 2007

Friday, June 29, 2007

Science Matters: Global Warming--Read These Two Essays

I am not a scientist by trade, but I believe most science is accessible to anyone with a high school education and a willingness to learn. For example, the vast majority of the articles in Scientific American are accessible to the layman/laywoman, as that is the intended audience. I say this as someone with only high school chemistry and physics in my formal-education science folder, and as a 25-year subscriber to Scientific American.

Science is like medicine: if you don't want to learn anything yourself and you just want to trust "the experts," prepare to make some very bad choices. Like agreeing to a needless or risky operation and promptly dying, if not on the operating table, then of an infection you picked up in the hospital. Or taking an ineffectual drug and erroneously thinking you're being "cured."

Frequent contributor U. Doran recommended a fascinating dismantling of Big Pharma's (the big drug makers) statistical legerdemaine (slight of hand) The crucial health stat you've never heard of.

The article describes how drug companies tout a "relative risk reduction" of 31%, which sounds impressive, but in reality the "absolute risk reduction" is only 2%--meaning, only 2 out of 100 people are going to see any results of the "wonder drug." Not as impressive sounding, right? If you look into the Phase 2 and 3 drug trial data which is used to approve drugs, you will find multiple layers of obfuscation and data-finagling.

In other words, flaky data is used to get a drug approved, and flaky statistics are used to sell an ignorant public on the supposed benefits of the (expensive, immensely profitable) drug.

Speaking of finagled data: here are two of the best, most clearly presented essays on Global Warming you'll ever find, and they are exclusively here at Of Two Minds.

We've all read about global warming, and here we have two articles which explain the basis (data) for the global warming thesis, and how it all stacks up. You really owe it to yourself to read these this weekend.

Global Warming: Our Story So Far

by Michael Goodfellow

The Hockey Stick Breaks (Global Warming Data refuted)

by Protagoras

I think we as a society have absorbed the negative view that science is "too hard to understand," which makes for a handy excuse to "trust the experts." Yes, at very high levels, say, senior-college level classes, then chemistry, biology and physics are technically challenging because you need a large foundation of knowledge to understand "state of the art." But as Scientific American and other science magazines show, even the highest-level science can always be explained in a way that virtually anyone can understand should they desire to do so.

As someone who is blessed to count working scientists as longtime friends, I have learned that data collection is the name of the game; if you don't have good data, i.e. data which hasn't been tainted, and which can be repeated in other labs or locales, then you have nothing.

Here is an excerpt from Protagoras's look at the validity of the data being used to support the "humans are causing Global Warming" thesis:

"A truly dramatic event in contemporary intellectual history occurred unnoticed in April. To understand it, you have to understand the history of the famous Hockey Stick climate chart, which has decorated IPCC documents since the late nineties, appeared in lots of Green publications all over the world, and has been used as vivid proof that human caused global warming (AGW) is real and an imminent threat to human life and civilization.

The Hockey Stick chart appeared to show that we live in extraordinary times. The researchers, Michael Mann and his coauthors, had assembled a reconstruction of temperatures going back about 1,000 years. There were two elements to this. First, there were temperature records from weather stations. These however only go back about 100 years, if that. So you need some other way of estimating temperatures from earlier periods."

And here is an excerpt from Michael Goodfellow's summary of the evidence pro and con for the "humans are causing Global Warming" thesis:

"Like it or not, real or not, global warming is a huge problem for the world. Serious debate is going on about what to do, government action on this is already affecting us all, and will continue to do so. The potential effects of legislation on the world economy, the politics of trade and on our lifestyles are all huge. So it makes sense to follow this debate as closely as you follow any other big issue, from the housing bubble to the Iraq war. The problem, as usual, is getting some context and separating the facts from the political bias.

Let's start with the big picture. This graph is a reconstruction of the Earth's temperature for the last 500 million years. As with the rest of these graphs, read them from right to left. The left edge, at zero, is the present. "

Both essays provide numerous links to other sources, so you can explore the topic further with just a few clicks.

I am deeply indebted to these writers for investing so much energy and time to bring a clear-eyed, well-reasoned perspective to the most important topic of our era. Please take advantage of this opportunity and read these two wonderfully written, well-researched essays.

Thursday, June 28, 2007

China's Brand and the Product Liability Lawsuits to Come

Correspondent Cheryl A. recently alerted me to an issue which may well affect China-U.S. trade: defective products and tainted food. here are two links to the Wall Street Journal (subscription required), but the stories are available from many other sources.

Accident Raises Safety Concerns On Chinese Tires

China Shuts 180 Food Plants Amid Food-Safety Concerns

The two big questions are: Is this merely an anomaly, or the tip of an iceberg of defective, dangerous products? and, Can China fix its quality control problems, or are they endemic to its political/economic structure?

The Chinese government's first response was to impound some dried fruit from the U.S. and proclaim it dangerously tainted.

In other words, "See, you make tainted products, too! So lay off already!"

This face-saving gesture went over like a lead balloon, so their next step was to shut a few dozen plants (out of tens of thousands) for a few days. This is the public-relations equivalent of a bulldozer crushing a few thousand pirated DVDs while the cameras roll. Meanwhile a few kilometers away the piraters are making new copies by the millions.

Given the vast quantities of foodstuffs such as farmed seafood now being imported from China, the possibility exists that the next tainted-food deaths will not be pets but humans. As various news agencies have reported, humans in other countries have died from consuming Chinese-made drugs which were adulterated with cheap (and poisonous) fillers.

As for seafood, consider this recent article from the San Francisco Chronicle: Domestic farmed fish go under the microscope :

"Most of (the seafood) we eat that's farmed is coming from China. We have little idea of what's happening in China," said Peet. Food and Water Watch reports that the United States imports 80 percent of the seafood we consume, most of it from Latin America and Asia. The aquaculture practices in many of these countries damage the environment, and many enterprises use additives and antibiotics banned in the United States.

Are you still willing to put a Chinese-made tire on your car or truck? I didn't think so. How about when you read about somebody getting sick from some imported seafood which happened to be grown in China? Will you start asking where that jumbo shrimp came from?

China has no lock on unregulated industries, of course; there's no way to know what might be in the food which is imported into this country because inspections and testing are virtually non-existent. Exactly how are you going to insure the quality of every jumbo shrimp and tomato?

It boils down to trust. In this sense, every nation is a "brand." Back in 1965, Japanese products consisted of cheap toys and transistor radios which were widely mocked as "cheap" and poor in quality. Fifteen years later, the Japanese were challenging American and European auto manufacturers with vehicles a leap ahead in quality and durability. (The Volkswagen Beetle's demise can be correlated to the emergence of the Toyota Corolla and Datsun cars.)

It's been fifteen years since China emerged as a manufacturing power, and what they're producing is defective tires, bikes, etc. Various financial pundits with no knowledge of China are fond of saying it will follow the same path to fanatic quality control trod by the Japanese and Koreans (why? Because they're Asians), but this thesis doesn't take into account the following conditions in China which were not present in Japan or Korea:

1. China is deeply and pervasively corrupt at all levels. If you deny this, you simply don't know any Chinese citizens well enough to hear the truth. Your kid doesn't do well on an entrance exam? Some "help" can be arranged. Your factory is dumping toxic pollutants into the air? You can "arrange" to close for a few days and then start running it at night, when the toxic plume isn't visible.

The stories are as varied as they are endless. Thus the idea that the quality of anything can be regulated by a trustworthy, uncorruptible agency within China is simply impractical.

2. The dynamism of the economy and its entrepreneurs makes quality control difficult. Entrepreneurs in China often change businesses and locales quickly; thus a fish farm which is closed for over-using antibiotics will close and the owner will enter another business. The bike manufacturer will close if the market dries up and start making soemthing else. While this dynamism is great for employment and growth, it makes external quality control basically impossible.

The global corporations can of course control quality in their own factories, but much of the industry in China is localized production of parts and goods made by small businesses. Where did that tainted pet food come from? It took a major investigation of the convoluted, poorly documented supply chain to find out.

3. Quality is not Job One. Those of you who have a religious faith for the "endless growth of China" story will balk, but again, you need to talk to actual real live people, Big Noses (Caucasians) and Chinese, about actual business practices in China. Sure, if you tour a computer parts factory owned and operated by Taiwanese (yes, I have), it all looks great. If you work for a global corporation in a clean little cubicle and frequent watering holes in fancy Shanghai hotels, it probably all looks great to you, too.

But what about the silk suit manufacturer down the road, who sold the French guy based on a high-quality silk product and then delivered 50,000 lower-quality suits? Or the pharmaceutical plant which closed over in the business park because their product packaging was quickly pirated and filled with sugar pills, thus destroying its brand?

These are real stories, and they're not from 15 years ago.

4. The idea that U.S. agencies can monitor, document and test for quality is a non-starter. Which of the thousands of containers coming from overseas are you going to inspect? How many bottles of medications are you going to laboriously test to make sure it actually contains what the label says it should? It's impossible.

It comes down to trust. At some point, let's be original and call it a tipping point, a country's "brand" will fall into distrust. And as any company knows, once the public has lost trust in your brand, it is very difficult to get it back.

Could China's "brand" become irrevocably tarnished? It may depend on how many lawsuits get filed and how much publicity is generated--for instance, Wal-Mart prevails in suit over defective bikes made in China.

It's no surprise that Wal-Mart would win; they'll probably always win. But if enough suits get filed, they may lose anyway--by losing their customers. I asked fellow blogger and attorney Fred Roper for his take on product liability, and his comments are insightful:

My knowledge regarding products liability cases is pretty limited. The rule is: if a merchant sells a product to a user or consumer that is unreasonably dangerous and causes harm then that merchant is liable for the injuries to that user or consumer. Because of the nature of the distribution chain, a plaintiff and sue anyone or everyone in the chain of distribution. The reason for this is that the merchant is presumed to be in a better position to know the potential dangers that the product poses for an unsuspecting consumer. Therefore, the defense of "comparative" or "contributory negligence" is not normally available to defendants in these kinds of cases.

If the merchant knew that such a danger was posed to the ultimate user or consumer and fails to warn or protect the consumer from harm, punitive damages can be assessed.

That is what happened in the famous McDonald's coffee case. A memo was discovered that showed that McDonald's knew that their coffee, at 180 degrees Fahrenheit, would cause 3rd-degree burns.

For more on the McDonald's case see this link:

THE "MCDONALD'S COFFEE CASE" AND OTHER FICTIONS.

5. McDonald's admitted that it has known about the risk of serious burns from its scalding hot coffee for more than 10 years -- the risk was brought to its attention through numerous other claims and suits, to no avail;)

If you will notice, business lobbies are trying to limit damages that consumers can receive when they prove intentional malfeasance on the part of the defendant business. As you are pointing out, there is not enough inspections to protect consumers from dangerous products from China, and with the courts now getting emasculated by damage limits on lawsuits, there is much less incentive for private businesses to inspect their products as well. It was always difficult enough to prove that they knew their product posed a danger; but now even if you prove it then the potential damages may not be enough to make them want to change their practices.

Okay, so actually proving negligence on the part of Chinese manufacturers or U.S. distributors and retailers is going to be near-impossible. But the publicity generated by these cases may slowly cause American consumers to start asking where this tire or bicycle was made, and ask where this jumbo shrimp was grown. If they start making decisions based on where these products came from, trade between the U.S. and China could take a direction few expect.

Wednesday, June 27, 2007

Does Short Interest Really Support the Market?

To those of you who tire of financial and stock analysis--my apologies. The reason why I am concentrating on this topic this week is the market may be poised to move dramatically-- which provides an opportunity for us small-fry to profit, should we guess the direction of the move, or hedge our bets properly.

Disclosure: I took a short position via puts yesterday in CFC and FNM, two stocks I discussed in the Monday entry. I anticipate them skyrocketing, now that I am short.

One reason to suspect the market is posed to move dramatically is all the major indices are hugging their 50-day moving averages; this suggests indecision. The high volume on major down days like last Friday suggests weakness/distribution, i.e. "smart money" selling to those willing to "buy on the dips."

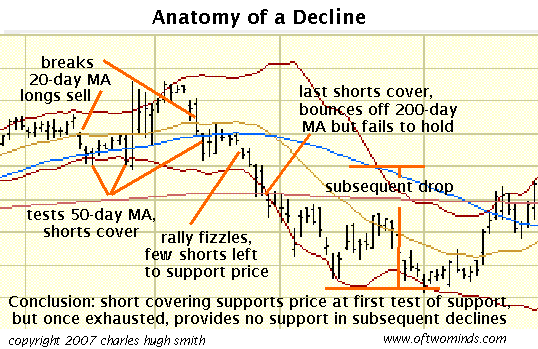

Let's consider one cliche you read again and again: record short interest places a strong bid under the market, providing key support in the event of a sharp decline. As this chart shows, this works at the first test of support; but once the shorts have covered, there's no longer any floor under the stock.

Here's the basic idea: let's say a hedge fund manager owns a million shares of Google; he or she is thus "long" Google. To protect the long position against a sudden drop, the manager sells a million shares short, or buys put option contracts on a million shares. This "short position" fully hedges the million "long" shares against losses.

So if GOOG drops $10 per share, the portfolio drops $10 in value on the long side, but gains $10 on the short side--i.e. the shares held short have a $10 gain, as do the puts. Recall that selling short means you received the current price for shares you don't yet own; when you buy the shares later (hopefully for a price lower than you received), then you've "covered your short." The difference between what you sold them for and what you paid to buy them is your profit.

Headlines blare that "short interest is at new highs." So guess what percentage of NYSE (New York Stock Exchange) shares are short. Drumroll, please: 3.3%. Yes, the "record high" short interest is not even 4% of all outstanding shares--about 12 billion shares, or four days' trading volume. This is an awfully small percentage of shares to support the idea the market can't decline very much.

Let's stand in the shoes of the hedge manager for a moment. Let's say you sense GOOG is weakening--say it's dropped below the key technical level of the 20-day moving average. Why would you hold your long shares if you detected a downtrend in the making? You'd sell (distribute) your long shares, and hold your short shares or puts until the dust settles.

Guess what: every other manager with a long position is thinking the same way. So as everyone dumps their long shares, the selling accelerates the price decline. At some point--again, perhaps the 50-day or 200-day moving average, some managers will "cover their shorts" by buying shares of GOOG.

This does provide a temporary "floor" under a stock's decline--but what happens when the shorts have all covered and the price is still dropping? There is no longer any shorts to provide a bid/buying. As this chart (the stock is CFC) shows, once key technical levels which trigger short covering are violated, then the stock continues dropping.

You may recall reading contributor Harun I.'s comments on the Pareto Principle in Hedge Funds and The Pareto Principle (February 19, 2007). The principle is often called the 80/20 rule, and it has an adjunct: the 64/4 rule.

Hmm, isn't it interesting that short positions are about 4% of the market. The principle suggests that small number of shares can have an effect far larger than their percentage would suggest, causing major shifts in 64% of all shares. Proponents of the "short covering will support the market" idea are convinced the 4% covering will support the 64% of stocks declining; they may be right for awhile, but when the 4% have covered, the effect might be to remove the last leg of support from a market which then goes into a free-fall.

Why is short interest rising? There may be two reasons. One is the growth of hedge funds, which hedge long positions by going short. (Many mutual funds are restricted from having large short positions.) The other might be that those who tend to go short--i.e. professional managers and traders--are making sure they will profit should a sharp downtrend occur.

To summarize: take all assurances that "record shorts will support the market" with a hefty grain of salt/skepticism. Hedge funds may unwind both long and short positions in a hurry, further draining the pool of shorts which need to be covered.

Tuesday, June 26, 2007

The 9 Biggest Mistakes Investors Make

A certain investment service has been buying full-page ads in major U.S. newspapers touting their free report, The 8 Biggest Mistakes Investors Make. Ha, I sneer at their mere 8, and handily trump them by offering The 9 Biggest Mistakes Investors Make.

1. Investors purchase stocks, bonds or real estate in the months of January, February, March, April, May or June.

2. Investors purchase stocks, bonds or real estate in the months of July, August, September, October, November, or (horrors) December.

3. Investors base their decisions on investment newsletters hyped in full-page ads or on the "financial" TV channels rather than on their own analysis.

4. Investors rely on "hot tips" from blogs and websites rather than sweat through their own analysis. (Yes, blogs like this one)

5. Investors confuse goateed raving lunatics providing free entertainment in the form of "investment advice" on TV with trustworthy expertise.

6. Investors buy Kraft Foods (ticker KFT) because they like Cheez-Whiz, e.g. "buy what they know."

7. Investors obsess over high-falutin' math (standard deviations, etc.) and obtuse technical signals (The Titanic Signal, etc.) while ignoring the most basic formula of investing: Hope + Greed + Ignorance + Fear = Losses.

8. Investors focus on the "buy" button but forget to hit the "sell" button until it's too late.

9. Investors actually give credence to investment banks and buy-side analysts' recommendations--for instance, the recommendation yesterday to "buy General Motors."

Now this must be right, because it comes from Goldman Sachs, right? Goldman Sachs analyst Robert Barry upgraded General Motors (GM) to buy from neutral in what he described as a "tactical trading call." He also raised his price target on the shares to $42 from $29.

"GM's stock price "implies little to no downside and potentially large upside from the real possibility concessions end up even larger than what is priced in," he said in a note to clients."

Count me skeptical, but even though this analyst from the fine firm which provided us our current Treasury Secretary says there is "little to no downside" in GM, let's look at a simple chart:

Please go to www.oftwominds.com/blog.html for chart.

"Little to no downside"? I guess a drop from $37 to $20 doesn't count? A target of $42, when $37 has been ironclad resistance since early 2005? What alternative Universe does this analyst think GM inhabits?

Never mind that a purely technical view suggests this stock is a beautiful short (i.e. primed to drop significantly)--take a gander at the MACD divergence, if you will--what about the fundamentals of the company's business?

Is the consumer in fine fettle and raring to take on even more auto loan debt? Does GM have a profitable small-car line as gasoline retrenches at $3/gallon on its way to $4/gallon? Do they manufacture a hybrid lines of vehicles to compete with Toyota and Honda? Is there any published analysis which proves modest "concessions" from the UAW will transform an essentially bankrupt corporation (its pension and retiree healthcare liabilities far exceed its assets) into a viable firm?

Allow me to sumamrize: there is absolutely no technical reason to believe GM is heading to $42, and much evidence it's heading to $20, if not $ .20. There is absolutely no evidence that GM is not a technically bankrupt company heading for formal bankrupty in the next recession (scheduled to begin in October 2007).

Yet here we have "reputable analysts" from "reputable firms" (gag!) telling suckers, I mean "retail investors," to gamble their hard-earned money on a high-risk bet. Why? Probably so Goldman Sachs and its big clients can distribute/dump/unload their doomed shares of GM onto poor suckers naive enough to believe their "recommendation" isn't purely self-serving. Is there no shame? None whatsoever. Caveat emptor, Baby. Let the buyer beware.

NOTE: At the time of posting this entry, I did not have any position in GM. However, I did profitably buy puts on the stock the last time it hit $36. That is disclosure, not advice.

EXTRA SPECIAL BONUS NOTE: "The Titanic Signal" is a fabrication/satire. It is my invention. Oh, and by the way, it's flashing a huge gleaming red "sell".

Monday, June 25, 2007

Profiting from the Housing Bubble Popping

Is there some way to profit from the deflating housing bubble? Perhaps.

Let's get one thing straight: the following is not investment advice. It is merely a series of "if-then" statements with which you may or may not agree.

IF you believe that the real estate industry is losing steam/trending downward/dropping in value, THEN note that the Ultra-Short Real Estate ETF (exchange-traded fund) rises 2% for every 1% drop in the ETF's constituent stocks--hence the descriptor "ultra-short." ETFs trade like stocks. Here is a chart of the fund, which only started this year; note that it rises in value as the ETF drops in value.

Please go to www.oftwominds.com/blog.html to view the charts.

IF you believe that Fannie Mae, the quasi-government mortgage outfit, holds a lot more risky mortgages and debt than Wall Street reckons, THEN note the negative indicators on this chart which support the notion that this stock is about to drop through its 20-day moving average support:

IF you believe that the entire banking/lending sector holds a lot more at-risk debt than Wall Street reckons, THEN note the negative indicators on this chart; this ETF has dropped below the critical 200-day moving average support:

IF you believe that lenders such as Countrywide Finance Corp. hold substantially more at-risk (subprime, ALT-A, ARM) mortgages than Wall Street reckons, THEN note the negative indicators on this chart; this stock has dropped below the critical 200-day moving average support:

IF you believe that a stock/ETF will drop in price, and you want to gain from that drop, THEN you either sell the stock/ETF short or purchase put options on that stock/ETF.

IF you aren't familiar with these terms, THEN please do some Web searches to find out more. TO REPEAT (sorry for shouting): none of the above, or anything on this site, is investment advice. It is a series of if-then statements with which you are free to disagree, ponder, ignore, explore, etc.

NOTE: at the time of this posting, I have no position in any of the securities mentioned above.

Saturday, June 23, 2007

On-The-Ground Reporting in China

Longtime correspondent Martin recently recommended an article on China The Empire of Lies by French free-lance journalist Guy Sorman.

What separates Sorman's report from the typical China story is his on-the-ground journalism with people and places rarely visited by Western media types. In case you didn't know, the Chinese government employs a vast army of people to manage/spin news, not just for its own citizens ("The Great Firewall of China" to censor the Web) but for the outside world as well. It takes some real digging to get past the bogus government statistics, cover-ups and lies. Sorman does a fine job, one which can't be denied or dismissed by cheerleaders.

Here's a taste of his reporting:

It had taken me several months and many intermediaries before I could finally meet with this self-effacing, frail 75-year-old, branded an enemy of China by the Party—a label it gives to anyone with the temerity to oppose the regime.

Here is his report on the central government's response to AIDS:

The government’s initial reaction was to deny any problem, isolate AIDS-affected areas, and let the sick die (a pattern that initially repeated itself when SARS broke out in the country).

Police barred entry to the contaminated villages, and new maps of Henan appeared without the villages, as if they had vanished into thin air. But after the international press became aware of the growing crisis, the Party banned the blood trade (though it enforced the prohibition fitfully) and in 2000 at last officially acknowledged the existence of AIDS on Chinese soil.

Despite all its pious declarations in the subsequent years, though, the government continues more to obfuscate than to help. When Bill Clinton visited Henan in 2005 to distribute AIDS medicine provided by his foundation, for example, the Party prevented him from visiting the worst-off villages. Instead, in the Henan capital city of Zengzhou, he posed with several Party-selected AIDS orphans as the cameras clicked away. It was an elaborate public-relations charade: “China, with the West’s help, was tackling AIDS!” The world saw a smiling Clinton, but not the real tragedy of Henan.

To extend our theme of Context with a Capital C, let's consider how little understanding of Chinese culture goes into the standard U.S. financial analysis. To take but one example, financial analyst John Mauldin is recommending a book by PIMCO (bond fund) manager Paul McCulley and veteran reporter Jonathon Fuerbringer, Your Financial Edge. From Mr. Mauldin's review, the book seems to have much good analysis of big issues; but the authors' lack of understanding of Chinese culture is striking. Here is a quote:

"Ultimately, though, China will switch from a mass production economy to a mass production and mass consumption economy and have the courage and ability to free its exchange rate and shift away from its mercantilist model."

I wonder if either of the writers actually knows any mainland Chinese people. Why do I wonder? Because every one of our many Chinese friends has paid off their house mortgage within a few years of its purchase. This is true regardless of which city they came from in China (central, coast, Nanjing, etc.) and regardless of their salaries: those with substantial incomes bought more expensive houses, and those with more modest salaries bought less expensive houses.

How many non-Chinese Americans do you know who pay off their mortgage in 5 years? Again, these are not big-bucks doctors and lawyers or people who inherited wealth or trust funds; these are average folks with median incomes. Do you know how they achieved this monumental goal? Scrimp and save. Minimum consumption. No frills lifestyle. And once the mortgage is paid off, do they then begin spending lavishly? No, they buy another property or add on to their house--paid in cash.

If you examine the lifestyles of everyone beyond the few million Shanghai-Beijing-yuppies, you will find a nation, and more importantly, a culture, of prodigious savers. If you know anything about Chinese culture or if you know even a few dozen mainland Chinese people well, you know China will not transition to a culture of consumption in this generation. A very good anthropological case could be made that China will never leap from a culture of savers and investors to one of borrowing and consumption. Not in five years, 20 years or even 100 years. Economies may change quickly, but cultures do not.

Yes, Proctor and Gamble is selling Crest toothpaste to residents of small villages in western China. Chinese people will buy TVs, meat, seafood, and a variety of other consumer goods. But to claim that China's culture and economy will seamlessly transform from a mercantilist export-driven model to a consumerist clone of the U.S.--based on what evidence? A few million free-spending yuppies out of a nation of 1.2 billion? If you think that's a sound footing for an analysis of an enormous nation, then do you base your prognostications for the U.S. on the top-income residents of Manhattan?

If so, your analysis will be fatally flawed. Yet financial writers continue to accept the most breathless extrapolations for Chinese consumption based on the spending of an equivalent handful of rich, top-of-the-heap free-spenders who can be seen in hotel bars and fancy restaurants in Shanghai and Beijing--the kind financial journalists apparently base their "research" on.

If you haven't read my own attempt at providing a broad context for China's economy, here it is: China: An Interim Report.

Friday, June 22, 2007

Little Miss Sunshine and American Optimism

Is the incredibly wicked satire of last year's independent film hit Little Miss Sunshine accessible to non-Americans? I wonder.

Do other cultures breed a hyper-competitive drive for "number one" rankings in everything from piloting USAF jets to talent contests to wealth and recognition on the motivational circuit to academic studies of Proust? Do other cultures quickly label everyone who competes but doesn't win "a loser"? Do other cultures heap such lopsided praise on "winners" and offer so little to the "rest of us" that suicide (at least in this film) seems like a better alternative than slipping in the rankings? I honestly don't know, but I suspect not.

In the event other cultures may be mystified by the dark humor and rapier-like parody in this film, I offer up the following as context for understanding this justifiably popular movie.

I am not immune to competitive juices, so I say this not as a smarmy putdown of competition but to draw the distinction between the honor implicit in competing and the pathological emphasis now placed on "winning" "the top spot" in American society. I played on basketball teams for five years in junior and high school and a year of football in 10th grade (hard-working talentless benchwarmer, but hey, I had fun being part of the teams), and I was a contractor/carpenter in the deep recession of the early 80s.

You want a "Darwinian fight to the death?" That was the "interest rate is 16%, nobody's building anything" reality then. And if you want a competition where winning is literally one shot in a million--try writing. 30 million blogs (or is it 300 million?), 5,000 novels published each year, 100,000 books in print, blah blah blah. The point is: has our society veered into a pathology of winning, in which parents are punching Little League coaches and screaming at little kids for not scoring more than their opponents?

This film says yes, definitely, categorically, yes.

Critics generally describe this as a comedy about a dysfunctional family. It isn't that at all; it's a biting critique of a dysfunctional society.

The family is actually the only source of support and solace available to the beleagered individuals depicted in the film as they each strive--and painfully fail to reach--the pinnacle of the American Dream: success through hard work and meritocracy.

The banality of this goal is ruthlessly satirized as the movie progresses. Every conceivable form of American Success with a Capital S is savagely revealed as distorting and empty.

The wholesome Dad swears under his breath as his dream of a motivational-speaker-writer empire crumbles before him; his family is disgusted by his hollow cheerleader motivational patter--the soundtrack, if you will, of the American Dream.

The acerbic grandfather shoots heroin to control his various aches and pains, and rudely defines success as having sex with as many women as possible (hey, it worked for JFK, Bill Clinton and innumerable "sports heroes")--a crass, unwholesome portrayal of the "real American Dream"-- or at least the male one.

The harried, chain-smoking mother is frayed by the insuperable demands of holding the family together while she puts fast-food on the table and rescues her mentally unstable brother.

Her brother, an openly gay aspiring academic superstar, is suicidal because another academic has replaced him as the number one Proust scholar--and snagged his gay lover to boot.

The son, who has taken a vow of silence to express his open hatred of his family, single-mindedly works out in order to achieve his goal of being accepted to the Air Force Academy and becoming a pilot. His dreams are dashed by a weakness beyond his control, and he is inconsolable.

The slightly chubby daughter pursues her dream of winning a sickeningly saccharine talent contest in California, "Little Miss Sunshine." Despite its wholesome veneer, the entire contest is deeply subversive of childhood, a bizarre distortion in which girls are made up to look like small adult women and perform "Miss America" type song-and-dance routines.

The daughter's painfully bawdy routine--a searing exaggeration of the contest's subtext of pushing adulthood onto little girls--draws predictable howls of outrage from the contest authorities, and rallies the family to her side.

When Granddad unexpectedly passes away, the American bureaucracy takes a mirthful beating as the family is forced to sneak the body out of the hospital and load it in their decrepit VW van.

Though other bits of American life get similarly skewered, the key satire is of The American Dream: wealth and recognition achieved via hard work and "pursuing your dreams." As the wheels fall off the U.S. and global economies, I have to wonder how Americans will adapt to the narrowing of opportunities and the ever-tightening strictures of debt and job losses.

I wonder if they will begin to understand the myths they bought into and clung to so tenaciously as their plight deepened, ("the Ownership Society funded by leveraged debt", for instance) and realise that if they bothered to vote (recall that U.S. voter turnout is a miserable 40% compared to 80% in France and other well-established democracies), they might regain the political power which they have so passively ceded in their individual obsession with competitive triumph and public recognition.

Thursday, June 21, 2007

Sword of Doom

Normally you could safely assume an entry entitled "Sword of Doom" refers to some financial meltdown, but today we refer to a classic samurai film.

This week's theme of context requires at least one cultural entry, for there are few more dangerous minefields than context-free cultural misunderstandings. "Why can't they be more like us?" A universal plea, to be sure.

Since movies can offer an uncannily accurate window into a culture, let's consider a 1966 Japanese classic of the samurai genre, The Sword of Doom.

As those of you familiar with the genre might expect, Sword of Doom depicts tremendous violence. Most of the swordplay is highly stylized, but if seeing 20+ swordsmen cut down is not your cup of tea, you might decide to pass on the film. In a way, that would be a shame, for this film speaks not just to Japanese culture and history, but to universal themes of evil and revenge.

The movie stars the incomparable Tatsuya Nakadai as a heartless--some might even say sociopathic-- samurai who has mastered a non-standard, unorthodox style of kendo or fencing. Perhaps it is his unorthodox style, or his ruthlessness, or both, but he has been kicked out of his kendo school. This establishes him as a ronin, or masterless samurai--in our nomenclature, a lone wolf.

The movie is set in a time of social dissolution and turmoil, the early 1860s, when the feudal order which had held sway over Japan for over 200 years was breaking apart. The Meiji Restoration of 1868 restored social order by dissolving the Shogunate in favor of the Imperial household. (In practical terms, a ruling-class oligarchy was established.)

Thus later in the film, Nakadai's mistress bemoans his lack of standing, commenting that in earlier time, he would have had his own kendo school and they could have lived comfortably. Instead, Nakadai is forced to hire himself out as a political assassin for a pittance; he consoles himself by drinking prodigious quantities of sake (rice wine).

Early on, Nakadai dispatches an unarmed elderly man and shortly thereafter, an opponent in what was supposed to be a non-lethal match. (In exchange for her favors, he'd secretly agreed with his opponent's wife to throw the match. Alas, the cuckolded husband tried to dispatch him, forcing Nakadai to kill him.)

These unsavory scenes establish Nakadai as ruthless, amoral and maddeningly difficult to kill. Nonetheless, the outlines of his own unorthodox code of conduct are visible. The elderly man had been praying to be released from this life; overhearing the gent's plea to Buddha, Nakadai took it upon himself to grant the man's stated wish via his sword.

And Nakadai held to his bargain with the other samurai's wife, allowing the match to be a draw, until his opponent tried to kill him with an illegal move. But there is a karmic consequence of these needless killings, and a subplot of revenge is set in motion, building our anticipation of a classic showdown in the final reel.

But our expectations are foiled. I won't give away the ending, except to say it is not the one-on-one "good guy versus bad guy" showdown we are led to expect, but a harrowing melee in a burning Japanese house in which Nakadai takes on the entire clan who'd engaged him as a sword-for-hire.

Online sources say this "unsatisfying" ending results from the film originally being planned as the first of a trilogy. I respectfully submit that the filmaker designed this movie to stand on its own, and deliberately chose a very 1960s "anti-expectation" ending.

This final climatic sword battle--truly one of the great action sequences of world film, in my humble view--is unleashed by a betrayal (the clan tries to kill Nakadai) and a ghostly visit by Nakadai's victims, who haunt him to the edge of madness. One online reviewer scoffed at this haunting (shall we also then dismiss Shakespeare's Hamlet?), but ghosts (obake, spirits, etc.), animism and various superstitions are key elements of Japanese culture. That Nakadai's descent into madness begins with a haunting is essentially Japanese.

Those of you who are Japanese or who have lived in Japan for years may disagree, but I see this film as a critique of the Japanese reverence for mastery--an unplanned, subconscious critique or a conscious one, I can't say. Acting legend Toshiro Mifune plays the master of another kendo school, and in a meeting with Nakadai he proclaims that "The sword is the soul. Study the soul to know the sword. Evil mind, evil sword."

For his part, the Nakadai character exclaims, "I trust only my sword in this world. When I fight, I have no family." That is, he has no loyalty to anyone but himself and his mastery of the sword. Mifune's comment--the sword is the soul--embodies the ideal of mastery; in Japan, masters of craft are revered as Living Masters.

Mifune is proclaiming a moral truism: if the heart is evil, so too will be the mastery. But Nakadai's character also expresses an ideal of mastery--that of one unbound from loyalty and obligation to anyone or anything but the mastery itself.

Perhaps the theme many Japanese viewers would identify is this: mastery without loyalty and duty is inherently unstable and ultimately dangerous.

In American Westerns, such as the 1960s Clint Eastwood films A Fistful of Dollars and For a Few Dollars More (which were based on Kurosawa's samurai classics, Yojimbo and Sanjuro), the anti-hero is a higher-order hero, wreaking a justice which the orthodox lawman could not pursue. In this 1966 Japanese anti-hero classic, the Nakadai character is not a source of justice or righteous vengence, but a "loose cannon" who is dangerous to all around him, an uncontrollable force so evil that his own father wants him killed.

Can we view this film in a cultural vacuum, knowing nothing of Japan's history and culture? Of course we can; but without such context, key themes of the movie may well be indiscernible, just as much of Japan will remain hidden to the casual visitor.

Wednesday, June 20, 2007

How the Housing Bubble/Credit Bubble Will Pop

When 2008 rolls around and the U.S. economy is sinking with frightening momentum into a bottomless quagmire, you'll be glad you read this entry. Why? Because you anticipated every step of the implosion and warned your friends who were still floating complacently down that river in Egypt (de-nial).

In keeping with our theme of context, let's begin by noting that the proper context for the housing bubble is the all-encompassing global credit bubble which has inflated every asset class. With this fundamental firmly in mind, let's follow Deep Throat's advice from the classic film All the President's Men and "Follow the money."

Let's first dispense with "the real estate market". Yes, supply and demand and housing starts and zillow.com and neighborhood sales and all the other market stuff play a part in the coming implosion, but all that noise is more a sideshow than the Main Event. Why? Follow the money. The main event is the credit market, because if you can't borrow money, or can only borrow it at a premium and under tight conditions, then how many houses are for sale in your neighborhood or the median price paid, etc. shrink to near-meaningless. Real estate sales and valuations depend solely on credit. Everything else is secondary.

Next, let's dispense with the notion that the implosion of housing-based lending can be "quarantined" and won't affect the economy. The reason is that mortgage-backed securities, and the CDOs and other derivatives which have been piled in untold trillions onto them, are one leg of an increasingly wobbly three-leg stool. The second leg is so-called "junk bonds" and other commercial paper (which has ballooned to astounding levels--see chart), and the third is government bonds in all their flavors. Once the MBS leg snaps, the entire debt stool collapses.

Please visit www.oftwominds.com/blog.html to view charts.

Third, let's note the critical role real estate ownership, sales and high valuations play in funding local and state governments. Government at all levels is about 25% of the U.S. economy, though in many locales it's more like a third. As mortgage rates rise and credit tightens, real estate sales fall, cutting transfer taxes; as prices fall, homeowners demand lower assessment values, further reducing tax revenues.

And as frequent contributor Harun I. noted in submitting this link, local governments desperate for property tax payments are rushing the foreclosure process, dumping the foreclosed (and often trashed) home back on the lenders or builder, who then has to pay the taxes themselves before they can even auction the property off to a new buyer: Hundreds delinquent on taxes:

"In the Village I No. 2 district, between 5 and 6 percent of homes are delinquent while about 14 percent are late in Fairview Village. In Patterson, the delinquent taxes make up 16.43 percent of what residents in the subdivisions owe.

A year ago, Britton said, only about 2 percent of the taxes in the Modesto subdivisions were late.

Britton said the city sent out letters this month encouraging homeowners to catch up on the taxes. If the residents fail to do so, the city will begin negotiating with lenders. Often, Britton said, lenders will pay the delinquent taxes rather than allow a tax lien to be placed on a property. Those liens must be paid before lenders can receive money from buyers.

Britton cautioned that the collections cost will increase in each step of the foreclosure costs. Those charges will be passed on to the delinquent taxpayers."

Let's say you're a lender or builder on the edge of bankruptcy. (Yes, there are many more than you might imagine.Please see Aaron Krowne's Mortgage Lender Implode-O-Meter site for more.) You suddenly get hundreds of overdue property tax bills to pay, in cash, before you can even put the distressed houses on the auction block. Might these hundreds/thousands of property tax bills be the straw that breaks the lender's back? Believe me, the bills in California are humongous; multiply $10,000+ a year by thousands of foreclosed McMansions and you come up with some serious money due the local governments.

And who, pray tell, will pay the tax lien when the lender (owner of last resort) goes belly-up? Sure, the bankruptcy court will pay the liens, but only if there's enough money left to do so. But what if the lender is well and truly stripped of cash/assets? Then what? The local government eats the taxes due--unless they try to collect in escrow when a new owner buys the property. This may work if you're talking about a $500,000 property with a $10,000 tax bill, but what happens if the process drags out, and the tax bill grows ever larger? The net proceeds from the eventual sale (assuming a buyer can be found) might well be most or all of the proceeds, leaving the holder of the mortgages with a mere fraction of the principle and none of the interest.

But isn't the value of all those trillions in mortgage-backed securities based solely on the income streams generated by mortgages? What's their value if those streams dry up? That's right, the value of those MBS and all the derivatives downstream drops--a lot. And when that happens, a credit contraction or crisis occurs.

For an excellent description of exactly how this can unfold, I reprint (with permission) a commentary by Karl Denninger, proprietor of the insightful Market Ticker and several other sites.

"I think people have been trying like hell to keep the credit market bombs quiet, and they succeeded - until this evening, when it came out that Merrill seized $400m worth of Bear's Hedgie bonds.

NOW the fun starts because that little bitty amount of money (in the grand scheme of the indices) is NOT enough to blow them up. So what ELSE is going on that we don't know about? And who's in trouble on the CMBX (Commercial R/E bonds) side?

Once cannibalism gets started it is very, very easy for it to get out of control in the credit markets. Nervousness begets nervousness. You saw how fast New Century blew up - one day they were working it out, two days later - BOOM - shortly followed by a bunch of other BOOMs, including LEND and others. The carnage picked up speed FAST.

Here's a scenario for how it can happen - Fund #1 blows up (as it appears Bear's Hedgie just did.) The AAA bonds were sold off over the last couple of weeks to try to prevent that, which is not really all that big of a deal - they're very high credit quality and didn't hit the spreads all that much, although the "AA" components DID get hit. Nonetheless, price paid was reasonable, so all is more-or-less ok - so far.

Ok, now the TRASH gets sold. But the trash isn't worth much - if anything. This forces Moody's to re-evaluate some of these issues, perhaps up and down the line. NOW you got trouble, because Moody's, while they're beholden to the issuers (after all that's who pays 'em!) can't be seen as complicit in an outright FRAUD! So now they're forced to take a look at CURRENT conditions and say "hmmm... that bond looks like crap!"

Suddenly, you get a cascade of downgrades that sweep through. Some nail low-level investment grade bonds and push them under investment grade. That makes them unable to be owned in certain types of funds, such as some pension trusts, forcing a sale - at very unfavorable terms. THAT creates even more losses.

The equity tranches, which are the worst of the junk, become completely illiquid - basically, they're worth nothing at all in the market; you may as well hold them and PRAY that there is something left when the dust settles. Repeat until you can knife it and it comes out clean - lots and lots of people become very quickly DONE.

The effective coupon shoots up on these because in order to get people to buy you must give them a hell of a discount. That is, RISK COMES BACK except now that "enhancement" to the coupon comes out of the seller's hide! That's a REAL capital loss and its not a small amount of money either.

We're in for Round #2 of this game and this one looks worse than February - FAR WORSE - as its NOT just in residential R/E loans this time. Something is going on in the commercial R/E sector as well, but I can't get a handle on what it is.

If it starts to spread through the credit markets as derivitives contracts start to reprice risk, well, then things get very, very ugly indeed - especially for those guys who WROTE swaps (insuring against the failures!)"

To summarize: Say I'm a pension fund manager seeking higher yield (alpha) so I buy $100 million tranch of a mortgage-backed security, which a rating agency has, in its infinite wisdom, rated AA. My fund isn't allowed to buy less than AA, so everyone's happy.

Until the underlying mortgages slip into default. Oops, the income stream is drying up. Now what? Well, there's no market for this security-- no "mark to market"--so I can hide my little mistake in the portfolio, keeping the $100 million value on it (and not coincidentally, my job).

But alas, all good things come to an end, and when the rating on the MBS is dropped to BB, I have to sell it--or try to sell it. A frenzied calculation is made. Hmm, it seems the open-market value of this risky security is $5 million, tops. Not only do I lose my job, but the pensioners depending on the fund growing and producing income are in for a shock. The fund just plummeted in value and can no longer meet its pension obligations. Sorry, folks; I was just seeking alpha.

Let's check the quarantine. Foreclosed homeowners: financially destroyed. Bankrupt lenders and all their employees: ditto. Local government: facing sharply reduced tax income. Since 80% of local government costs are for employees, then the only choice is lay-offs. Pension funds: income and value drop, causing pensioners to accept cuts or current employees to pony up much higher contributions--or both. Credit markets: in full panic, new loans and mortgages made only to the very lowest-risk, premium customers--in other words, a big chunk of potential home buyers can't borrow money at any price.

And let's not forget how precariously perched the U.S. household is on the threshold of insolvency: (see chart at www.oftwominds.com/blog.html )

I'd say the quarantine was a failure, as the disease seems to be spreading like wildfire.

There's one last critical context: the Treasury.

As I have endlessly explained, the Treasury's job is not to keep mortgage rates low; that's up to the bond market. The Treasury's job is to sell government debt via bonds--at whatever the market demands. As I have said many times, there is no Plan B. If no buyers take the bonds off the Treasury's hands at 5%, then they raise the yield until buyers appear.

So everyone who is absolutely sure interest rates will drop as the economy plummets is off the mark. Rates might drop, if there's a panic "flight to quality" to Treasuries. But if there is no longer hundreds of billions in easy money sloshing around the world--i.e., the credit contraction is global, and there is no reason to think it won't be--maybe there won't be enough cash laying around to fund our government's enormous appetite for deficits/more debt.

That thought is completely alien to a market which assumes the world will forever be awash in cash seeking a return. But when the credit markets turn, and fear replaces panic, then cash dries up--not just cash for mortgages, but even for Treasuries. Since there is no Plan B to fund the government debt, rates will rise, regardless of the impact on the U.S. housing market. The U.S. housing market is a sideshow; the main event is the global credit market.

If you'd like more context on real estate bubbles, knowledgeable reader John Brennan recommended this insightful academic paper from 2002 Bubbles in Real Estate Markets by Richard Herring and Susan Wachter (Wharton School).

Tuesday, June 19, 2007

What Makes a Bubble?

Here is an excellent description of the present:

"Shares rose faster than at any time during the century. House prices were also climbing sharply, producing a boom in the construction of suburban mansions. The Republic lost some of its Calvinist austerity as its people became a nation of consumers, mixing their love of display with an avidly speculative pursuit of wealth."

The present it describes is Holland in 1635, at the height of the Tulip Mania. With some very minor editing, this is a quote from Devil Take the Hindmost: A History of Financial Speculation by Edward Chancellor, an excellent book recently recommended here by reader/analyst U. Doran.

The key context for manias, bubbles, crashes and financial panics is of course the human mind. To quote again from this book:

"Speculators were, in Vega's words, "full of instability, insanity, pride and foolishness. They will sell without knowing the motive; they will buy without reason." Vega's speculators exhibit many of the features associated with the full range of manic-depressive behavior. A manic-depressive experiences violent and uncontrollable mood swings. As his expectations grow increasingly unrealistic, the manic becomes careless and this precipitates his downfall. Unable to see the broader picture, he becomes fixated on insignificant details."

That's a very good description of the psychology of greed and fear--emotions shared by all humans. But what other characteristics of previous bubbles might provide context for our own stock and asset bubbles? Here are three which seem under-reported:

An expansion of easy credit allows companies to borrow off their assets, and then spend the borrowed money buying their own stock, thereby boosting their assets as share prices rise, enabling the company to borrow even more for future buy-backs.

The use of margin debt (buying an asset with only a percentage of cash, the balance being borrowed from the broker). In the tulip mania, 20% cash was all that was required to buy a tulip future (the bulb itself was still in the ground) worth ten times the annual average salary (200-400 florins). In the 1929 mania, margin requirement was 10%. Today, it is 50%.

The purchase of derivatives and credit swaps without having to deliver the underlying good or shares. As fantastic sums were borrowed and traded for rights to various bulbs, the derivatives/futures outstripped the actual supply of highly valued bulbs; when it came time to actually deliver the goods--by this time, the bulb had a mountain of trades piled on it--there weren't enough bulbs to go around. All the trades and swaps made on non-existent bulbs blew up, and after months of lawsuits, "a government commission declared that tulip contracts could be annulled on payment of 3.5% of the agreed price."

Speaking of insignificant details: Does anyone remember the book-to-bill ratio? During the 1990s tech boom, the semiconductor industry's book-to-bill (orders/shipments) ratio could trigger massive movements in the NASDAQ each month; the report was awaited with breathless anticipation. Now it's merely an artifact of that bubble.

Our current insignificant details include phony, manipulated measures of inflation and GDP growth. The initial number is inevitably wide of reality, more a wild guess than truth, yet the invaribaly inflated number moves the market ever higher, even as later downward revisions are utterly ignored.

Let's hear a cheer for stock buy-backs! The South Seas bubble of 1720 was based on a variation of the current private-equity/stock buy-back bubble. In our present bubble, it works like this: you borrow $1 billion based on company assets--the value of its outstanding shares--and then you buy $1 billion of shares back and retire them, effectively reducing the float (supply) of stock. This reduced supply means any demand moves the price of the shares up, boosting the value of the company, which can then support another $1 billion loan. Rinse and repeat.

Do you see the circularity of this "Bull market"? Rising prices feed more borrowing which raises values even higher which enables more borrowing which... hmm, is this "value investing"? It's more like crass manipulation by insiders--all perfectly legal and even hyped as a "good thing for current stockholders."

As for mountains of derivatives and credit swaps built on tulips which can't be delivered--how about all those CDOs and other mortgage-backed securities? All those instruments are based on the delivery of income and/or principle from tranches of pooled mortgages. If the homeowners stop paying the mortgages, then there's nothing to deliver, and the house of trading cards falls. The same also holds true if the homes are foreclosed and sold "as is" for a mere slice of the mortgage; the promised principle comes up short, and all the promises made to holders of CDOs melt like an icecube dropped in the Sahara.

In other words, the "value promised"--the interest and principle--become undeliverable. This triggers demands for payment on holders of upstream contracts (CDOs, credit swaps, you name it) who can't deliver, either. As the bottom layer defaults--the homeowners--so too does the next layer, and the next layer and so on to the very pinnacle of the derivative mountain.

This is how you get a crash. All the same machinations were in play in 1635 and 1720. Global trade was extraordinarily vigorous and profitable then, too. "Prosperity" was just as limitless as it is now. But the endgame wasn't decades more of wealth-creating machinations; it was financial ruin for everyone who played until the end.

Monday, June 18, 2007

This Week's Theme: Context

A Semi-Long View

Allow me to summarize the economic Optimists and Pessimists core positions:

Optimists: Today's prosperity is based on China and India's emergence as global industrial and trading powers. It will endure for decades, driving global prosperity to new heights.

Pessimists: Today's prosperity is based on unprecedented growth of money supply, speculative lending and synchronous speculative manias in housing, durable goods and stocks. It is about to pop, which is the inevitable endgame for all speculative bubbles.

Which is right? Or are both right? This week's theme is Context, for establishing the appropriate context goes a long way toward resolving apparent contradictions. In this sense, problem-solving (and forecasting) boils down to assembling a context which accounts for the known facts and the influences of history, culture and events. One philosophic word for this is "totalization" (from Critique de la Raison Dialectique).

By way of an example: consider welfare. Those ideologically against welfare focus on those gaming the system (the scofflaws and cheats), and other deficiencies such as dependency being passed down to the next generation. Those ideologically predisposed to support welfare focus on those impoverished children and mothers whose lives have been improved by welfare, and those who successfully transition from dependency to the workforce.

But the larger context of welfare must include its size in the overall Federal Budget (modest) and various technocratic methods/policies to minimize cheating and encourage job skills and entry-level employment of people who were previously "hard-core unemployed." Belief systems may drive politics but they don't provide context or understanding.

To establish some basic context for any economic forecast, I've drawn a graphic depiction of some major forces which have influenced the global economy over the past 40 years.

Please visit www.oftwominds.com/blog.html to view the chart.

Note that the lines are not scaled, but they do roughly track trends and key inflection points.

What seems rather obvious:

Sustainable global growth a.k.a. "The Great Bull Market" occured in an environment of dropping interest rates and inflation, relative peace, moderating budget deficits and perhaps most importantly declining oil costs.

Interest rates and inflation are rising, budget deficits are climbing even in "prosperity," the price of oil has skyrocketed, as has that of gold, and bubbles have formed in the Shanghai Composite stock market and global housing markets. We are currently waging two expensive wars, in Iraq and the GWOT (global war on terrorism).

What did not exist during either the period of stagflation or the Great Bull Market is the Yen Carry Trade, a pervasive expansion of global liquidity on a massive scale.

The rise of China began in 1978, a 30-year expansion roughly analogous to the 30 years in Japan's history from 1950 to 1980. Japan's Bubble Economy burst in 1990, followed by 15 years of malaise known as "the Lost Decade." Now that the Shanghai stock market has risen to Nikkei-and Nasdaq-like bubble heights, the possibility that its eventual bursting could presage a relative decline in China's fortunes should be considered.

The vulnerabilities posed by rising interest rates, inflation and debt, inflated asset bubbles and rising energy costs bear some similarities to the conditions prior to the Great Bear Market/stagflation of 1967-82.

Is this an exhaustive "totalization"? Of course not. But as a broad-brush sketch, it does serve a purpose, I think, to set the current "prosperity" in a large context.

Saturday, June 16, 2007

Corrections and Additions

Knowledgeable reader Fabius Maximus was kind enough to point out an important distinction between oil shale and oil sands, two hydrocarbon sources which I had incorrectly lumped together:

"Kerogen -- aka "oil shale" -- is not in commercial production, except in a few pilot plants build with government money.

I suspect you are thinking of bitumen -- aka oil sands -- mined in Canada.

Oil shale is not commercially feasible to mine at today's oil prices with current technology. The same is true about switchgrass. Neither is even close to commercial production, despite claims of promoters.

For that matter, it's not clear that Canada has the necessary natural gas and water to mine and refine enough bitumen to produce 5 million barrels/day of synfuel -- the commonly quoted production goal for the year 2020."

Thank you, F.M., for taking the time to elucidate a key point in a key topic (synfuel substitutes for oil). If you'd like to read more by Fabius Maximus, you can find a number of archived articles at Defense and the National Interest, a very rich source of information on Defense issues, the war in Iraq, the GWOT and much more.

Frequent contributor Harun I. added this comment about hedging--an investment strategy I will be addressing as part of my own education on this subject:

"The futures markets reason for existing is to transfer risk. When commodity prices rise, ceteris paribus, we see those prices increases as end users. And it means we can purchase less of the things we need in effect, changing our standard of living. Prices can rise due to monetary related issues or supply/demand issues which can be complex. But for end users it is simple: they purchase less or substitute.

If you listen to the podcast of the interview of Steve Jobs and Bill Gates, these guys frequently use the phrase "took the bet". This is what business is about. Trading is a business and therefore we take bets.

I bet that if fat cattle futures go from 70 to 114, rib eye steaks are going to cost more at the checkout counter. Why not buy futures to lock in the price at 70? Currently we hear and see mortgage lenders advertising how rates are at 40 year lows. We all know they won't stay this low but how many people are taking action to lock in these rates by shorting bond futures/options? The inevitable rate rise will change the purchasing plans of many, but if doesn't have to be this way.

Major corporations, banks, farmers etc..., do this (put on hedges) everyday to protect profits. If we can convince people to turn off the TV, sit down in their comfy chair, open a book that will educate them on the business of commodities and how it can help protect their profits (earnings/purchasing power) while sipping on a glass of fine wine then, IMHO, our work is done."

Thank you, Harun, for providing us with additional information on hedging. As a mere pawn in the game of life, I am interested in hedging my "bets"--not just the bets I consciously place in the stock market, but in the involuntary "bets" we all make by being citizens of this country and participants in the global economy: bets in the value of the dollar, bets on interest rates, bets on commodity prices, bets that real estate won't plummet, and much more.

Friday, June 15, 2007

Gratitude

If you haven't felt a jolt of gratitude in your life recently, allow me to spark one: be glad you're not in a hospital. I helped another friend pick up our elderly (78 years old) neighbor from a major city hospital after a weeklong stay to treat pneumonia. The release process took about an hour and a half; my friend joked that getting out of jail had to be easier.

Being in a hospital is no fun. Is that the result of incourteous staff? No--the staff was uniformly professional and courteous. The un-fun part starts with why you're there in the first place, of course; you feel lousy, and are in pain, and probably very weak.

But the experience of being there is not fun, either. Here you are, feeling and looking your worst, lying in a bed facing an open door to a hallway filled with the chatter and clatter of innumerable staff going about their day and night duties, and complete strangers who are free to poke their head in and ogle you at your worst. Across the hall is an open door and another ill person; not exactly a cheery view. There is a window in your ward, but you're not close to it; there is no view of Nature or the outside world to relieve the tedium of being ill in a closed, always busy impersonal world of other ill people and those who care for them.

The food is microwaved. You're diabetic, and not hungry, and the protein drink you're given has too much sugar in it. Oops. The doctor says no, the dietician says yes. Take it away. They're confused, and so are you.

Every patient has rights; they're posted in a long list on practically every door: to be treated as an individual, blah blah blah. But the right you care about is the one the other patients in your room seem to treasure, which is to play their TV all day and night, even when you hear them snoring. Your request to have the sound turned down--gosh, the other patient might be hard of hearing. Her visitors come in, turn up a baseball game and sit down to watch it for three hours. When they leave, they leave the volume up. It's their right.

Other visitors crowd in--younger, even more disrespectful--and one pulls the curtain aside to take your TV remote--yuor TV is off--"since you're not using it." After a protest, your remote is grudgingly returned to you. Are all our rights equal? No, for respect and courtesy are not rights.

Consideration, it seems, isn't a right, either. Neither is your desire to sleep a right. We can give you earplugs, Honey. They have their rights, and they insist on them, even when they trample yours. Welcome to America, Baby. I got my rights, and they always trump yours.

So we're ready to take the patient home. There are dozens of staffers around, but nobody to get a wheelchair. That's another department, of course. A half-hour later, after three polite requests, the wheels start turning. This is Hospital Time, a version of Hurry Up and Wait. It's interesting, observing the great variety of the staff--every ethnicity and religion is represented, some more than others. But after a while you start wondering why there are hundreds of people at work here but nobody to get a wheelchair.

Minute 40 rolls around and the wheelchair and staffer appears. Great. Now we go down to pay the $200 co-pay--that's important. Another long wait ensues while they find her personal effects--her wallet--and carefully count out the cash inside to confirm (sign here) that nobody ripped her off during her stay. Make the payment, and we're off to the Discharge pharmacy.

Ah, they were wondering whose prescription this is; there's no patient name or number on it. They will call her doctor. My, what interesting floor tiles; they seem to hold up to wear and tear pretty darn well. Oops, her doctor's not available, we'll find another. Thank you. Some time later it's all confirmed and the medications are handed over. The staffer with the wheelchair has to call her department; this Discharge is lengthier than expected, it seems.

Ah, fresh air! Sunshine! After a mere hour and a half, you've forgotten what they feel like. Imagine what it's like after a week in a stuffy room, listening to an idiotic sports channel all day and and the constant noise of a 24/7 staff all night. It's hard being a patient; it must also be very hard being a staffer. I would rather dig ditches all day or carry lumber all day than work in the hospital environment, and I am grateful someone is willing to do so.

Home sweet home. The healthy have no idea. Be grateful you're not in a hospital as a patient.

Thursday, June 14, 2007

Recklessness, Security and Fantasy

New Readers Journal: British medical care, living in unusual times, dying for chastity, the futures market and buying gold.

The media and our government leaders (elected and appointed) are constantly reassuring us that our nation, lifestyle and economy are safe and secure. Nothing truly threatens Pax Americana and our global hegemony except the GWOT (global war on terror) which is going well because there have been no follow-up attacks on American soil after 9/11.

Our politicos are slightly annoyed by China's huge trade surpluses, but nobody else cares--the shelves are full, housing has bottomed, the stock market is hitting new highs and the indefatigible U.S. consumer has money to spend: retail sales rose yet again, "beating analysts' expectations."

I think you either know, or sense, that we are not secure at all, which is why you're reading this site and others like it. Our leadership has recklessly led us to a precipice which they obscure with distortions, cheerleading and/or outright lies.

Is this a rant? Is it a rant if everything is factual?

It is fact that oil shale and switchgrass are incapable of replacing our 21 million-barrels-a-day petroleum consumption. Yet how often have you read this simple fact? Buried in the fine print, so to speak, you might read that oil shale produces 2 million barrels a day, and that much of it has been contracted to China and the nation where it is processed, Canada; but unless you already know the U.S. uses 21 MBD, then it might seem like a lot.

But the simple fact is we as a nation will be fortunate to get 1 million barrels a day from these "bigger than Saudi Arabia" oil reserves. In the big picture, 1 MBD isn't enough to make a difference. Yet you will never read a media story or hear a government official place the oil shale fields in a realistic context.

Why? Because it might suggest the reality, that we are extremely dependent on a handful of quasi-allies or unstable regimes for our daily "fix" of 25% of the globe's petroleum consumption. Even worse, the super-giant fields in Mexico and the Mideast which we have been depending on are already declining in daily production; in other words, they've peaked and will only produce less every year from now on. (The links documenting this can be found in the 2007 Archives.)

Is this mere oversight? Of course not, any more than the headlines blaring that housing prices are still rising is an oversight. Does the story contain an explanation of how a few mansions selling for millions can skew the median price upwards, even as 90% of the houses sold have declined in price? No, it doesn't.

The truth is a gigantically profitable debt/lending machine has been recklessly unleashed to chew up anyone foolish enough to believe the endless hype about "the ownership society" and "housing never goes down." Should there be any regulation whatsoever on lending standards? How about on "saving" the lenders who foolishly handed billions to unqualified borrowers? No?