The Next Global Meltdown Is Baked In: Connecting the Dots Between Oil, Debt, Interest Rates and Risk

The bottom line is the Fed can only keep the machine duct-taped together by suppressing the market's pricing of risk.

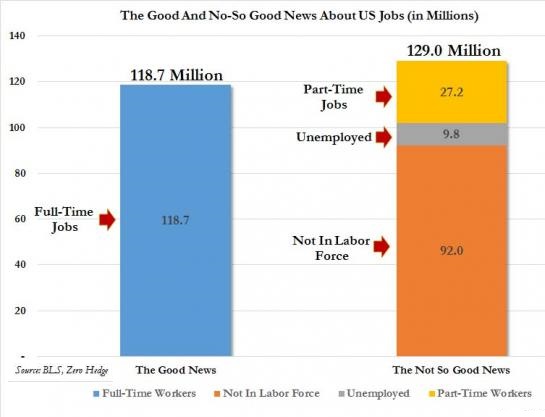

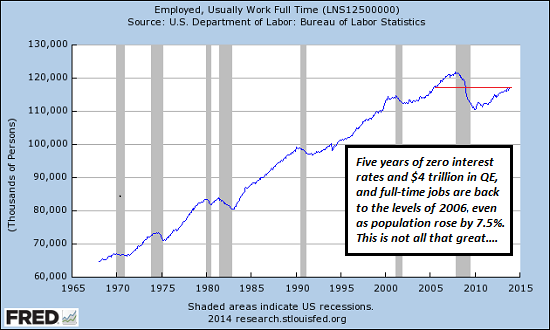

One of the Grand Narratives of our era is the substitution of debt for income: as earned income and disposable income have stagnated for 40 years, the gap between the rising cost of living and stagnant household income has been filled by borrowed money.

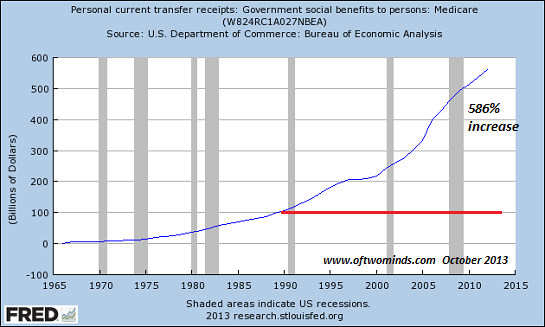

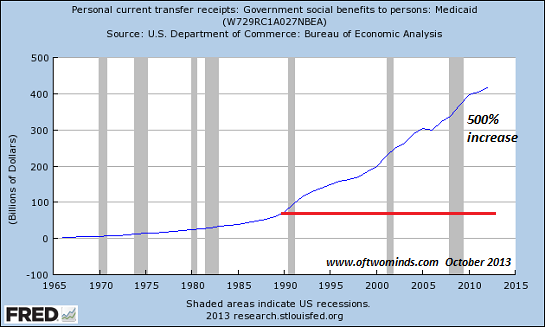

Money has been borrowed to replace income everywhere: consumers have borrowed money to buy things they otherwise couldn't afford, students have borrowed over $1 trillion to attend college, governments have borrowed money to fund wars and social spending, corporations have borrowed money to buy back their own shares, pushing stock prices higher.

There's one little problem with debt: interest must be paid on debt. Let's focus for a second on the difference between cash income and borrowing money. Cash doesn't cost money to maintain; debt does. In a functioning economy (as opposed to the dysfunctional mess we have now), cash would earn income from interest paid by borrowers.

If cash income is saved, the cash can buy stuff without debt or interest payments. That is a powerful advantage over debt.

How powerful is the advantage of cash over debt? It's literally life-changing. Take a look at your credit card statements, which now include an estimate of interest you will pay and how long it will take to pay off the balance at a given monthly payment.

Those making minimal payments will end up paying 100% or more of the balance due in interest.

The phenomenally high accrued costs of interest is true of mortgages, student loans, auto loans, corporate debt and government debt: eventually, current spending is crimped as more and more net income is devoted to paying interest.

There are two words for what happens when real income declines and interest payments rise: impoverishment and insolvency. This dynamic is scale-invariant, meaning it works the same for individuals, households, enterprises and governments.

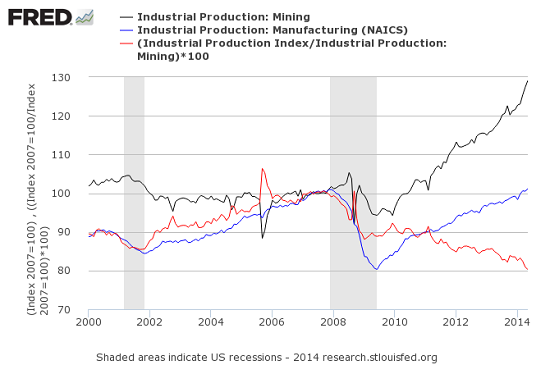

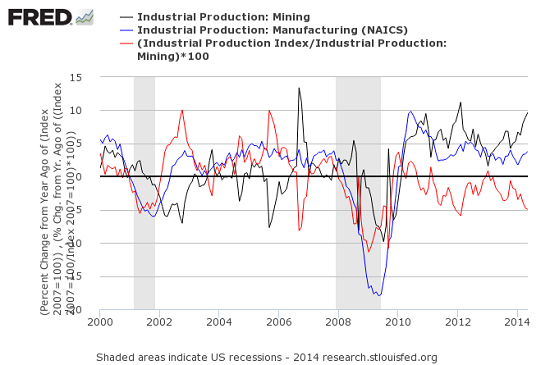

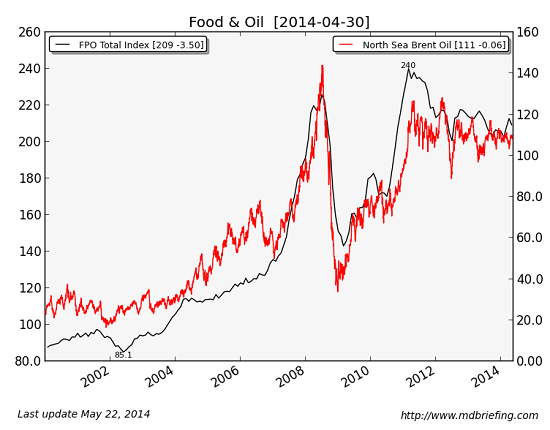

Let's connect the rising cost of oil to debt. As we all know, oil matters because it's the foundation of our economy, and the cost of oil is built into virtually every sector in some way. For example, look at how the the cost of food rises and declines in lockstep with the cost of oil:

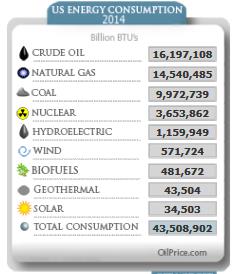

Despite the substitution of cheaper natural gas for oil, we use a lot of oil.

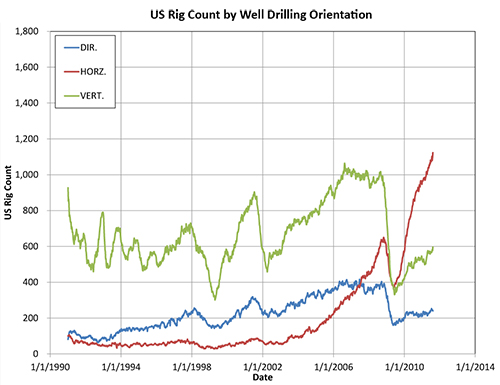

While the recent increase of 3+ million barrels a day in domestic production is welcome on many fronts (more jobs, more money kept at home, reduced dependence on foreign suppliers, etc.), the U.S. still needs to import crude oil.

U.S. Imports by Country of Origin (U.S. Energy Information Administration)

The rising cost of oil acts as an economy-wide tax. Everything that uses oil in its production or transport rises in price without offering consumers any more value than it did at much lower prices.

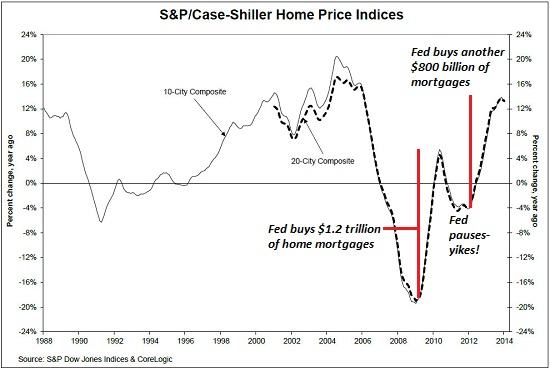

Look at the impact on food prices as oil rose from $20/barrel in 2002 to $140/barrel in 2008. While government statisticians adjust the consumer price index (CPI) based on hedonics (as the quality of things goes up, the price is adjusted accordingly) and substitution (people buy chicken instead of steak, etc.), the reality is, as one heckler put it, "We don't eat iPads:" that is, all the stuff that is hedonically adjusted (tech goodies, etc.) is non-essential.

The Status Quo has compensated for the relentless rise in the systemic oil "tax" by making debt cheaper to service. The Federal Reserve's zero-interest rate policy (ZIRP) has two purposes:

1. Channel immense sums of free money to the too big to fail banks by relieving them of the onerous requirement of paying interest on deposits while giving them unlimited access to nearly-free money they can lend out at huge spreads. (This is crony-capitalism writ large. The winners were picked by the Fed and the rest of us are the losers. Yea for the godlike Fed, our modern-day Mammon.)

2. To keep consumption alive as income declined and the oil tax eroded household disposable income, the Fed made borrowing cheaper.

Unfortunately for the godlike deities residing in the Fed, zero-interest rates trigger malinvestments, which are inherently risky. When unqualified borrowers borrow a ton of money--for example, a student with no assets or income, or a poor credit risk household assumes an FHA mortgage, or a corporation sells junk-rated bonds-- the risk of default is intrinsically higher than debt taken on by qualified borrowers.

This poses a systemic problem for the Fed: The Fed needs to enable more borrowing by the uncreditworthy to keep consumption growing and bank profits flowing, yet the inevitable result of such credit expansion is a massive expansion of systemic risk.

The more debt that is taken on by marginal borrowers--where marginal is defined as unable to weather any shock or decline to their financial position or income--the more risk piles up in the system.

The analogy is a forest where the deadwood is never allowed to burn: The Yellowstone Analogy and The Crisis of Neoliberal Capitalism (May 18, 2009). The net result of rising systemic risk is a massive conflagration that burns off off the accumulated risk and bad debt.

Such a fire sweeping through the mountains of risky debt piled up in the American financial system would bring down the entire Status Quo. So what's a godlike Federal Reserve to do when it can no longer lower interest rates?

Answer: it suppresses visible risk by manipulating the stock market to reflect complacency.

"Old" VIX Plunges To Record Low (Zero Hedge)

Does a record low measure of risk reflect the systemic risk of default and a decline in consumption, or is it merely a reflection of the herd's boundless faith in the godlike powers of the Fed to suppress risk even as Fed policies pile risk ever higher?

The bottom line is the Fed can only keep the machine duct-taped together by suppressing the market's pricing of risk. Suppressing the market's ability to price risk is throwing common-sense fiscal caution to the winds; when risk arises from its drugged slumber despite the Fed's best efforts to eliminate it, we will all reap what the Fed has sown.

Get a Job, Build a Real Career and Defy a Bewildering Economy(Kindle, $9.95)(print, $20)

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible.

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible.And like most of you, the way I've moved toward my goal has always hinged not just on having a job but a career.

You don't have to be a financial blogger to know that "having a job" and "having a career" do not mean the same thing today as they did when I first started swinging a hammer for a paycheck.

Even the basic concept "getting a job" has changed so radically that jobs--getting and keeping them, and the perceived lack of them--is the number one financial topic among friends, family and for that matter, complete strangers.

So I sat down and wrote this book: Get a Job, Build a Real Career and Defy a Bewildering Economy.

It details everything I've verified about employment and the economy, and lays out an action plan to get you employed.

I am proud of this book. It is the culmination of both my practical work experiences and my financial analysis, and it is a useful, practical, and clarifying read.

Test drive the first section and see for yourself. Kindle, $9.95 print, $20

"I want to thank you for creating your book Get a Job, Build a Real Career and Defy a Bewildering Economy. It is rare to find a person with a mind like yours, who can take a holistic systems view of things without being captured by specific perspectives or agendas. Your contribution to humanity is much appreciated."

Laura Y.

Gordon Long and I discuss The New Nature of Work: Jobs, Occupations & Careers (25 minutes, YouTube)

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

| Thank you, Charlie W. ($300), for your beyond outrageously generous contribution to this site -- I am greatly honored by your steadfast support and readership. | Thank you, Daniel E. ($3.59), for yet another generous contribution to this site -- I am greatly honored by your steadfast support and readership. |