The key to understanding the current Depression is the devolution of credit. As that devolved, it has toppled asset valuations, spending, tax revenues and jobs.

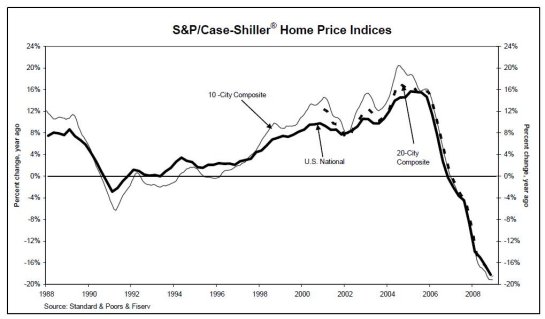

To understand the devolution of the global economy (macro) and our own communities (micro), we need to look up the chain of fallen dominoes to the first one: credit.The debauchery of credit reached its perfection in the housing bubble. Credit, leverage and speculative fraud came to dominate the global economy: the global housing boom depended entirely on abundant credit at low interest rates, leveraged, securitized debt instruments (mortgage backed securities, CDOs, credit default swaps, etc.) and speculative fraud: housing-backed investment securities fraudulently rated and sold as "low-risk," property appraisals fraudulently jacked higher than market, mortgage applications backed with fraudulently stated income, and high-risk "toxic" exotic mortgages fraudulently presented and sold as "low-risk because the property value is rising."

As stated here many times: household income for all but the top 10% "high-caste" technocracy has been stagnant since the mid-1970s. Consumer spending, which made up 70% of the U.S. economy and a significant share of the global GDP, was totally dependent on the housing bubble in three ways:

1. Direct equity extraction via re-financing and HELOCs (home equity lines of credit)

2. The "wealth effect": for the 69% of households who owned a home, their home equity was their chief asset and the vast bulk of their wealth. As that rose, it fed the "animal spirits" so beloved by economists: as people feel wealthier, they spend more freely.

3. The housing bubble created vast new wealth for the middle class and the Elite alike due to the huge transactional churn of tens of millions of houses built and sold, then sold again and again, tens of millions of mortgages originated and then refinanced, tens of millions of new insurance policies written for ever larger amounts, tens of millions of new furniture sales, etc.

As for the Elite (the Plutocracy), the transactional churn was in immensely profitable derivatives and mortgage-backed securities, and a stock market rising on this bubbly "prosperity." The top hedge fund managers averaged $600 million a year in compesnation each while investment banks distributed tens of billions a year in bonuses.

Now the credit bubble has burst and credit is devolving everywhere. The stock market is encountering a spot of bother this morning as it's been discovered (gasp) that consumers are actually saving rather than spending every dollar (and then some) of their income. The signs of credit devolution are everywhere:

Credit card and HELOC limits are being dropped

Credit card issuance has plummeted

Credit card delinquency has risen to 10%

The market for mortgage-backed securities (MBS) has imploded to near-zero

The qualification standards for mortgages have risen

The devolution of global credit and the return of risk aversion means that the transactional churn which created so much of the wealth of the bubble has collapsed.

Even more devastating, the bubble-era asset valuations have also devolved, destroying most of the bubble's illusory rise in home equity. This means the homeowner has no collateral on which to base future borrowing/debt; thus no matter how cheap and abundant credit might be, there is no foundation for additional credit.

The "wealth effect" has devolved as well; people now feel (rightly) much poorer, and their response is to start saving after a decade of euphoric credit0based spending.

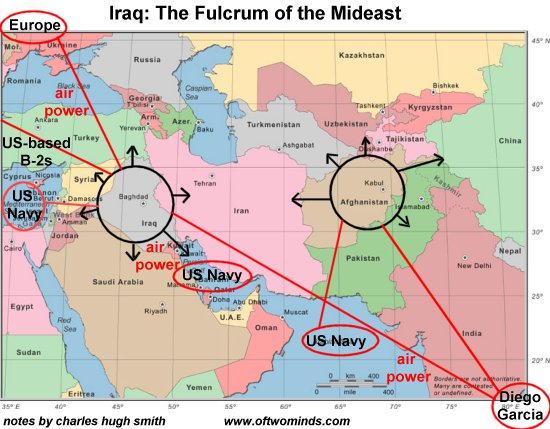

The government also debauched credit on a vast scale. The quasi-governmental (and now fully Federally backed) mortgage mills, Freddie Mac and Fannie Mae. churned out over $5 trillion in suspect mortgages. The Treasury borrowed additional trillions, largely from China, Japan and the Gulf oil exporters, to fund the expansion of empire (Good Cop, Bad Cop: Obama, Bush and Iraq June 24, 2009) and the distribution of "free money" to vast entitlement programs like Medicare which enriched a vast network of profitably parasitic enterprises.

Now the U.S. is borrowing $2 trillion a year just to maintain the status quo.The notion that every government on the planet can borrow vast sums each and every year, running stupendous deficits to prop up the status quo, and do so indefinitely, will soon be revealed as impossible. Credit cannot rise exponentially while assets, incomes and profits devolve.

At some point the demand for credit (deficit spending) will outstrip the supply of surplus capital and global interest rates will skyrocket. At that point the global game of "quantititive easing" and propping up the status quo with borrowed money will quickly devolve, as will the illusion that any government can repeal the business cycle and inflate additional asset bubbles at will to prop up consumer spending and tax revenues.

As income, profits and assets all devolve together, tax revenues devolve, too. Local and state governments have grown accustomed to ever higher employee counts, ever higher wages and ever richer benefits. The collapse of tax revenues is now causing state and local spending to contract and the services they provided to devolve.

So the devolution of credit led to the devolution of asset valuations/collateral, income, profits and thus tax revenues. All those dominoes are now toppling the one with the greatest impact on households: jobs.

Back in January I posted an analysis of the U.S. job market ( Endgame 3: The End of (Paying) Work; January 21, 2009) which concluded job losses will rise far beyond the current 6.7 million to 21 or even 30 million. Since this is the most critical devolution in process, I am reposting the key analysis.

Many commentators refer back to the Great Depression as a historical guide or template to our present situation. But our current predicaments are far deeper, as commentators such as James Howard Kunstler have shown. (The Long Emergency: Surviving the End of Oil, Climate Change, and Other Converging Catastrophes of the Twenty-First Century ) To mention a few of Kunstler's observations:

) To mention a few of Kunstler's observations:

In 1929, the U.S. was the equivalent of Saudi Arabia today: the world's largest oil producer. Now we have to import fossil fuels on a gigantic scale. In 1929, the U.S. had a fully functioning rail system for passenger transportation. This has shrunk to a shadow of its former capacity. As extreme as debt loads were in 1929, our current level of indebtedness (as measured by GDP) is far higher for all sectors: government, business and households. In 1929, millions of jobless citizens could return to the family farm or a family home in the countryside or small town. Now that the U.S. is heavily urbanized, this "Plan B" is no longer available for most unemployed. In 1929, the U.S. was a major manufacturing/exporting power which actually ran trade surpluses for much of the previous 50 years. In 1929, the government sector extracted a much smaller percentage of national income than it does today.Hidden beneath these visible material, financial and demographic changes is a deeper one: the end of (paying) work.

The drivers behind this long-term decline in paying work cannot be reversed:

1. The U.S. is a high-cost economy with high structural overhead costs which cannot be reduced by any mechanism short of bankruptcy/insolvency or political revolution.

These costs include:

A. High taxes on business and households

B. Absurdly high "healthcare" (a.k.a. "sick-care") costs which are inexorably climbing at twice the rate of growth of the underlying economy

C. High real estate valuations based on cheap, "no-risk" money which have raised the costs of commercial rents and housing to levels which are far beyond historical correlations of real estate to income

D. The growth of government and its employees who have won pension benefits and wages which are roughly twice the cost of average private-sector wages and pension benefits.

2. The Internet and digital information technology are creatively destroying entire industries and entire job classifications which will not be coming back. Examples include the music and publishing industries and administrative overhead jobs such as file clerks and customer service representatives.

Even the IT sector itself (information technology) is vulnerable to the automation of software and coding. In industries such as tax preparation, 90% of their high-priced labor can be replaced by $30 software.

The consequences of the Internet's ubiquity are far-reaching. Not only can vast swaths of digital work be automated, much of the remainder can be performed overseas at lower labor rates than in the U.S. (Recall that up to half of a U.S. employee's compensation costs are healthcare and other overhead costs, so a wage-to-wage comparison will be misleading.)

As the Internet enables telecommuting and home-based digital work then the need for millions of square feet of office space falls, further pressuring the demand for high-cost commercial real estate.

Internet-enabled retail trade (Amazon.com, eBay.com, Zappos, etc.) is decimating high-rent brick-and-mortar retail outlets; as these close their doors then the demand for retail space falls precipitously, pressuring rents downward.

Just as craigslist has essentially wiped out print classified ads and Internet ticket sales have driven most travel agencies out of business, many other fields and industries will be reduced or eliminated by the efficiencies made possible by the Internet. Even fields like education may find the need for costly physical space may diminish as high-cost education migrates online.

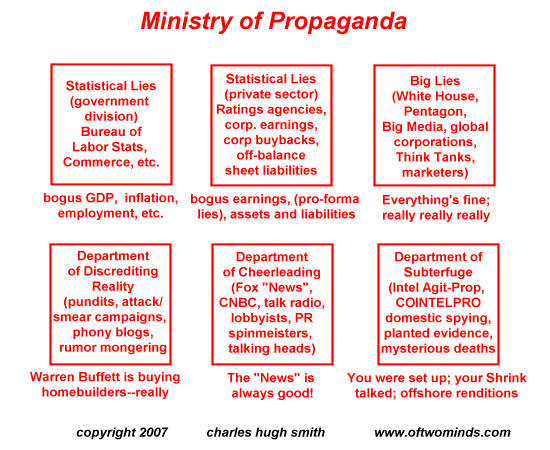

Political control depends in large part on a quasi-monopolistic mass media amenable to the political goals of the State and Plutocracy. To the degree that the Web undermines that mass media's monopoly on "news" then it also undermines the political control of the State and its Plutocratic overlords.

The Internet/Web is thus the acme of creative destruction, for it is undermining all monopolies except that of capital and petroleum.

3. Globalization and a semi-open U.S. economy force global corporations and small businesses alike to make efficient cost-benefit analyses of where to deploy capital and shift production. Economies of scale, flexible production and lower tax/labor costs spell the difference between profitability and insolvency.

Hopelessly expensive industries like healthcare which have been protected to date will find global competition for scarce healthcare and pharmaceutical dollars rising.

4. As cheap, abundant energy disappears, the cost of materials, transport and production rise,leaving less for labor. As cheap, abundant energy disappears, tourism and the "leisure industry" is priced beyond the reach of consumers facing declining real wealth and income, slashing service jobs in leisure/tourism.

5. The debt-based consumer economy was not a permanent new level of consumption but a one-time anomaly based on an imprudently engineered reduction in the cost and availability of credit combined with a (false) perception of near-zero risk. The entire FIRE economy (finance, real estate and insurance) will be permanently reduced by digital automation and the shrinking of these sectors as the global debt and real estate bubbles burst.

If history is any guide, then interest rates will rise for a generation, effectively depressing real estate and other debt-dependent assets for a generation.

Though the Federal government is furiously borrowing and printing money, the ability to do so at no cost to the dollar (in terms of depreciating purchasing power) and at low interest rates is ending. Since Federal borrowing of trillions of dollars has effectively backstopped the U.S. GDP, the end of the government's "borrow and spend trillions" campaign will remove that backstop and cause spending and employment to further shrink.

Even worse, the rise in interest rates will divert billions from programs to servicing the Federal debt, further reducing government expenditures on goods and services. Since so much of the debt is held by non-U.S. entities, a significant share of this interest paid will end up overseas. This feedback loop will further reduce Federal spending and employment.

If reckless Federal borrowing and money-creation ends up destroying the purchasing power of the U.S. dollar, then that will add yet another feedback loop as consumers pay more for imported oil and other goods and have less to spend domestically, further suppressing employment.

As collateral (bubble-era real estate valuations) and credit fall, so will consumer debt and the spending it enabled.

6. The demographics of a large cohort (the global Baby Boom) entering retirement coupled with longer lives and costlier "healthcare" options guarantee all government entitlement programs will face insolvency and collapse or greatly reduced benefits within a decade.

One of the consequences of this will be the reduction of currently "healthy" healthcare employment; another will be the diversion of vast sums of income away from consumption and into retirement savings.

7. ESSA (eliminate, simplify, standardize and automate) has barely touched much of the U.S. economy. Union rules, old habits and lush revenues have protected millions of processes, procedures and jobs from the scrutiny of plummeting revenues and taxes. As credit dries up and collateral falls in value, spending falls which reduces employment and taxes, which further erodes jobs in a self-reinforcing feedback loop of ever lower spending and ever falling employment.

For instance, buying a car or property no longer requires the expertise implied by a 6% transaction fee. In effect, the research and transaction could be done digitally.

8. Mechanization and automation form a "scalability trap;" once production can be scaled up then the necessity for human labor permanently declines. If I understand the concept correctly, it refers to the inevitability of new scalable technologies replacing human labor.

In 2008, various analysts estimated the U.S. economy would shed about 2 millions jobs in 2009. Given that as of December 2008 there were over 137 million jobs, that doesn't sound all that horrific. Here are the employment statistics by category from the Bureau of Labor Statistics:

Nonfarm employment.......| 137,331

Goods-producing (1)........| 21,351

Construction ......... 7,141

Manufacturing ....... 13,423

Service-providing (1)......| 115,980

Retail trade (2)....... 15,259

Professional and

business services ..... 17,849

Education and health

services .......... 18,975

Leisure and

hospitality ....... 13,627

Government .......... 22,504

With job losses already exceeding 6.7 million as I write this in June, 2009, it seems the analysts were incredibly optimistic. (That is of course their job.)

Setting aside the absurdly low estimate of 2 million jobs lost, let's look at each category and make a rough back-of-the-envelope estimate for how much paying work each category might support in, say, 18 to 24 months.

Construction. While bridges being repaired will certainly support heavy-construction employment, the far larger categories of residential building and remodeling and commercial construction (office towers, malls, warehouses, etc.) are completely overbuilt for years to come. So let's guesstimate that there will be 50% less demand for construction and a job loss of 3.5 million in this category.

Manufacturing. Unfortunately, a tremendous amount of manufacturing is dependent on construction (glass, appliances, steel, etc.) and transportation (rubber, steel, components, semiconductors, etc.) both of which are in freefalls. Exports are falling as fast as imports. Let's be charitable and only carve off 3.5 million jobs here, leaving 10 million intact.

Retail. Does anyone doubt that fully 1/3 of all retail outlets are now surplus?

We're talking about fulltime positions here; so cutting hours from everyone on the floor may actually save jobs (i.e. hours cut will not show up in the above statistics) but the equivalent fulltime positions (that is, 40 hours of paid work a week) may well have vanished.

Let's guesstimate that 5 million retail positions will no longer be supported by sales/profits.

Professional and Business Services. Legal and accounting services will suffer as businesses fold. Businesses will decide they need fewer contract workers, fewer consultants, fewer financial services and fewer software upgrades. Let's guesstimate that 2.5 million jobs will eventually be lost in this category.

Education and Health Services. These have been the growth industries, along with financial services, during the bogus "prosperity" of the past eight years. Once millions of jobs are shed, then millions of dollars of health insurance are no longer paid by employers, which means healthcare providers will get squeezed along with every other category.

Here is California, college enrollments are being capped as deficits soar; the inevitable next step is to leave jobs unfilled as people retire--one way or another, a reduction in total education employment. Let's guesstimate 1 million of these jobs get cut--perhaps not by layoffs but by retiring workers not being replaced.

Leisure and hospitality. The sad fact is nobody needs to take a cruise or a vacation; both are the acme of discretionary expenditures. I would be shocked if the U.S. economy didn't shed 3.5 million jobs in this category.

Government. Local government (cities, counties, states and agencies) has added 12% more employees in the past eight years of bogus debt-based "prosperity," and the freefall in tax revenues means those 12% of "new" government jobs will vanish--and that's the best-case scenario. Let's guess that a total of 2.5 million jobs will disappear as tax revenues plummet and then keep plummeting.

The total: 21.5 million jobs--10 times the 2008 MSM-approved estimate of 2 million jobs lost. Very few have the stomach to consider the reality that perhaps 20+ million jobs are no longer supportable by private industry revenues and profits and the tax revenues which depend on those profits and jobs. 21.5 million jobs lost works out to about 15.6% unemployment--a full 10% lower than the 25% unemployment rate reached in the Great Depression.

In other words, 21 million jobs lost is actually an optimistic guesstimate compared to what could transpire in the years ahead--a gradual evaporation of 30-35 million jobs. If Federal fiscal stimulus funds a couple million jobs--more likely retaining jobs in heavy construction and manufacturing that would otherwise be lost rather than adding jobs--then the total job loss might not be as severe until the "extra" Federal spending ends.

Just off the top of my head, here are industries which are sure to be hard-hit: media, advertising, cruise ships (many if not most will be mothballed), professional sports (how many people will be able to afford $45 tickets for lousy seats plus $10 for parking and $25 for a few beers and hotdogs?), spas, auto detailing, non-profits, pricey venues like museums which depend on wealthy donors (far fewer of those suddenly)--the list is long indeed.

Even worse, the deeper issue--the End of Work in a resource-profligate and consumer-based economy--isn't even being addressed yet.

Knowledgeable reader Matt S. who first recommended the seminal demographic study The Fourth Turning recently recommended The End of Work

recently recommended The End of Work by Jeremy Rifkin.

by Jeremy Rifkin.

Rifkin's primary point is that the "full employment" of the bubble eras (dot-com asset bubble followed by credit-housing bubble) was a temporary aberration from the underlying trend caused solely by unsustainable credit-based (borrow and spend) consumerism. The longterm trend is this: productivity is raised by the replacement of human labor (jobs) with automation/machines/software.

As productivity rises, the number of jobs decreases.

This reality has long been visible in manufacturing. The reality of competitive global forces lead to factories of robots assembling robot-assembled components with a few hundred humans to maintain the machines. There are already auto factories like this in Japan. The entire world's auto industry will continue shedding workers even if the number of units produced increases.

Rifkin points to the U.S. steel industry as another example. Since 1981, the industry has boosted production by about a third while reducing the number of jobs from 384,000 to 74,000.

Many observers believe the answer is to pay all of us $25/hour for service work so we can all afford the high-priced services provided by each other. In other words, I prepare you a $5 coffee (plus $2 tax) and then spend my earnings on a haircut, downloading a song off iTunes, going to a club and buying a high-priced drink, playing golf, etc. etc.

While this is certainly appealing--a high-wage service economy which is entirely self-supporting-- the nations which most resemble this model (Japan, France, Germany and Scandinavia) all depend on exports and a trade surplus, and all live with structurally high unemployment.

In other words, their prosperity is still based on the old-fashioned model: make and sell more than than you buy/consume from others.

The only nation which has run massive structural trade deficits during "prosperity" is the U.S., and now the painful reality is revealed: that deficit-borrow-spend model has essentially bankrupted the nation.

Here is how the U.S. has gotten away with it: we have arbitraged our currency, in essence creating a "surplus" of chimerical value via the U.S. dollar.

One way to think about this is: we have traded dollars for goods valued at X (in other currencies, in gold, whatever metric you want) and paid for them with currency worth X-$700 billion: the dollar. This is how we have been able to sustain trade deficits which have broken every other profligate nation's economy throughout recorded history.

Since the rest of the world depends entirely on the export/trade surplus model, they really have no choice: either accept the dollar arbitrage (in effect ceding $700 billion in excess value every year to the dollar) or face the end of the export/surplus model.

Since nobody's come up with a sustainable alternative to the export/surplus model, then the entire world accepted the dollar arbitrage: sell to the American consumer, pocket a surplus to support one's economy, and accept the dollar arbitrage.

The U.S. has "exported" two things in exchange for trillions of dollars of oil and other real goods: inflation via a depreciation of its own currency, and "financial instruments" based on the dollar arbitrage. It continues to be a wonderful scam: we print/create with fractional lending as much paper money as we want (X), and everyone continues to accept it as an IOU worth X when in fact it is worth X-Y (with Y being the U.S. trade deficit).

Can this model of global prosperity continue essentially forever? It's hard to see how, but to date it has proven extremely durable because nobody has a Plan B. So it might last for years to come--as long as the dollar arbitrage doesn't become too onerous. At what point does it become too burdensome? Nobody knows.

The Dollar Crisis: Causes, Consequences, Cures argues that this currency arbitrage/structural deficit is indeed unsustainable.

argues that this currency arbitrage/structural deficit is indeed unsustainable.

When the scam breaks down, then the export/surplus model will break down, and global unemployment will skyrocket. There is a lot being written now about the "race to the bottom" in currencies, in which every nation/trading bloc is trying to devalue their currency faster than their rivals in order to support their exports. What makes this so laughable is the one currency which is rising is--drum roll, please--the U.S. dollar. Why?

Because every other nation/trading bloc is still pursuing the export/surplus model: sell more than you buy. That requires they not only accept the dollar arbitrage, they must actively support it. Many observers are astounded by the dollar's strength: this profligate nation's currency should be plummeting like a stone, yet instead it rises!

Once you understand the global dollar arbitrage--we buy your goods to support your export/surplus model, and you accept a dollar intrinsically worth less than the the goods sold, and everyone walks away happy--then this seeming impossibility makes sense.

Were the dollar to fall, as many expect, from 80 on the DXY (dollar index) to say 45, then the global export/surplus model of everyone selling their surplus production to the U.S. will no longer work. Since there is no Plan B, then it's in everyone's interest to keep the game going. It's a lot less painful to accept a "hidden" loss via dollar arbitrage than it is to face structural unemployment and civil unrest if the export model breaks down.

We also read how China is going to transition to a domestic economy, but a study of history finds virtually no examples of such a model. Wealth and thus prosperity has always been created by trade, and it precisely the point at which China turned away from global trade in the 16th century that its long decline began.

Rifkin is an optimist, as he sees the possibility of a new model in which "paying work" is replaced by "work" in a high-tech hydrogen-based economy.

While we work toward that goal--or the alternative vision I suggest in Survival+--then we better be ready to fund food stamps and unemployment benefits for 25-30 million people without paying jobs, and find something productive for them to do--for idle hands eventually find employment with the Devil.

Our previous lists of hot reading and viewing can be found at Books and Films.

Of Two Minds is now available via Kindle: Of Two Minds blog-Kindle

Of Two Minds reader forum (hosted offsite, reader moderated)

Thank you, Anthony S. ($20), for your ongoing encouragement and many generous contributions to this site. I am greatly honored by your support and readership.