Another Reason for Stocks to Tank in 2012: Jobs

Though nobody seems to notice, stock prices are correlated to employment, which is trending down.

The Federal Reserve would have you believe that Monday morning ramp-and-camp and rumor-mill rallies in the last five minutes of trading are signs of a healthy Bull market. Or you can consider the reality of these charts. Not unsurprisingly, employment is correlated to the stock market. If lots of people have stable fulltime work, then they're earning enough money to generate a surplus that flows into the market via IRA and 401K retirement plans and other accounts.

Conversely, if few people have stable fulltime work, then few households can generate a surplus to put in the market. Instead, households short of cash will be removing money from their stock accounts.

Courtesy of longtime correspondent B.C., here is a chart of total employment per capita (in blue) and the stock market (in red), represented by the broad-based S&P 500 adjusted for inflation with the official metric of inflation, the CPI (consumer price index).

There is a wealth of information here not just about the stock market but also about employment, demographics and history. The great postwar Bull Market topped out in 1967 and coasted for a few years before falling in a 14-year Bear Market fueled by rising oil input costs and stagflation.

We can see how employment per capita declined during this period of stagflationary recession, that is, rising inflation coupled with a recessionary decline in employment.

Around 1982, the final deep recession of this period ended and a new era of financialization and globalization generated a 25-year long expansion of the GDP and employment. This rise in employment created a vast pool of surplus which created buying pressure in the stock market. Basic supply and demand--a relatively limited amount of stocks and a rising demand for them--led to higher stock prices.

Once employment topped out and began falling, so did stock prices in real terms, i.e. adjusted for the rise in consumer prices (CPI).

If we select employment per capita in the critical 35-44 years of age demographic, we find a very similar pattern.

Market pundits would have you believe that corporate profits are the driver of stock prices. They're wrong. Ultimately, it is demand for stocks that drive prices. If demand falters for whatever reason (for example, loss of faith in a rigged market), then stocks will decline in price as organic selling pressure (people liquidating positions and accounts for whatever reason, such as paying their mortgage and buying food now that the household is surviving on one shaky income) is a constant that only rises as the economy sheds stable fulltime employment.

The Federal Reserve has backstopped the stock market by destroying every other source of yield via zero-interest rates (ZIRP), effectively pushing anyone seeking a yield into long-term Treasury bonds or "risk-on" assets such as stocks and junk-rated corporate bonds.

But Fed manipulation cannot overcome the much larger forces of demographics and employment for long. Despite all the brave talk of the manipulators on the Board of the Federal Reserve, they've run out of manipulative tricks. With interest rates already near zero, their most basic toolbox is empty. Now they're reduced to bleating about all the phantom tools in their possession and playing around with long-term bond yields and mortgage rates-- interventions that cannot possibly create jobs or organic (i.e. real, unmanipulated) demand for stocks and housing.

Here is the reality of employment in the U.S.--it's down.

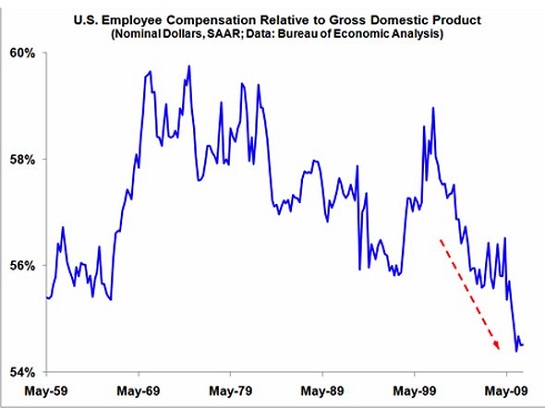

And here is the reality of employment compensation in the U.S.--it's falling off a cliff. This is unsurprising if we examine the employment statistics below the gamed "headline number" of unemployment. Roughly 18 million of the 140 million jobs are part-time, and another 17 million are self-employed people who are counted as "employed" even if they earned next to nothing. Millions more of these jobs are temporary, i.e. contract or free-lance, without benefits or stability. Many "permanent" jobs have have their hours of paid work slashed.

So there are far fewer jobs per capita, and the total compensation earned by the workforce is tanking. History is clear: the stock market rises when employment generates surpluses that create demand for stocks. When employment and compensation decline, buying pressure turns into selling pressure, and stocks tank.

At some point the Fed's Monday morning ramp-and-camps and the frenzied, psychotic rallies based on threadbare rumors in the last few minutes of trading will fail to overcome the organic selling--selling which ironically is rising as people lose faith in a market that is so transparently rigged.

Oh, and about those corporate profits: they've been based on two things that are ending: a declining U.S. dollar that magically inflates overseas earnings and a global economy based on unsustainable debt bubbles in Europe, the U.S. and China. As those bubbles pop, so too will corporate profits.

Price always boils down to supply and demand, and people whose compensation is dropping have neither the interest nor the means to buy stocks. Rather, those with any assets in the market are selling, cashing out to park the money in a less manipulated asset class or simply using the money to replace their lost income and borrowing power.

If your gift-giving philosophy favors 1) everyday utility 2) durability/high quality and 3) cost between $5 and $23, then this is the list for you: Favorite Practical Kitchen Tools (All Under $23, many under $10, most made in U.S.A.)

If this recession strikes you as different from previous downturns, you might be interested in my new book An Unconventional Guide to Investing in Troubled Times(print edition) or Kindle ebook format. You can read the ebook on any computer, smart phone, iPad, etc. Click here for links to Kindle apps and Chapter One. The solution in one word: Localism.

My Big Island Girl(song) Thrill the players to bits by buying the tune from CD Baby or amazon.com (99-cent MP3 download)

Readers forum: DailyJava.net.

Order Survival+: Structuring Prosperity for Yourself and the Nation (free bits) (Kindle) orSurvival+ The Primer (Kindle) or Weblogs & New Media: Marketing in Crisis (free bits)(Kindle) or from your local bookseller.

Of Two Minds Kindle edition: Of Two Minds blog-Kindle

| Thank you, Kevin K. ($5/mo), for your splendidly generous subscription to this site-- I am greatly honored by your support and readership. |