The Big-Picture Economy, Part 4: Income Disparity and Education

"More education" of the current sort is not a panacea to wealth inequality, as the widening gaps in education, employment and income are all reflections of a much larger set of forces at work. The solution is The Nearly Free University.

Rising income disparity in the U.S. troubles many of us, for a number of reasons. If more of the national income is flowing to the top 1/2 of 1% and less to those earning income from their labor, the foundations of both a vibrant economy and stable democracy are undermined.

Many observers identify education as one solution for rising income disparity, as those with higher education (college) have more skills and knowledge and tend to earn more.

There are a number of causal factors driving income/wealth disparity, including capture of the processes of governance by super-wealthy financial and corporate Elites, globalization, a "winner takes all" cultural mindset, heightened competition coupled with a surplus of labor, and financialization, to name just the top few.

Statistically, the connection between getting a college degree and higher incomes is weakening as those with college degrees are now in surplus. In effect, a 4-year college degree is becoming the entry-level minimum, replacing the high school diploma. Further up the food chain, Masters degrees are also in surplus, pushing many ambitious youth into PhD programs, in the hope that a PhD will guarantee a high-paying job.

Alas, there is a growing surplus of people with PhDs, at least in some fields. Some claim the unemployment rate for PhDs is very low, but these surveys do not measure under-employment, i.e. did the PhD take a position where a Masters Degree was all that was required? The Ph.D Bust: America's Awful Market for Young Scientists—in 7 Charts.

Granting more advanced degrees does not magically create positions for those holding freshly issued diplomas. Instead, it seems degree inflation is at work: what once required a high school diploma now requires a bachelor's degree, what once required a bachelor's degree now requires a Master's degree, and so on.

As higher education costs soar, the gap between wealthy and poor families widens. As Jerry Z. Muller observed in his recent Foreign Affairs article Capitalism and Inequality: What the Right and the Left Get Wrong:

Indeed, one of the most robust findings of contemporary social scientific inquiry is that as the gap between high-income and low-income families has increased, the educational and employment achievement gaps between the children of these families has increased even more."More education" of the current sort is not a panacea to wealth inequality, as the widening gaps in education, employment and income are all reflections of a much larger set of forces at work that includes financialization (favoring those with financial capital) and the built-in advantages of higher-income households' human and social capital.

Social scientist Edward Banfield summarized these advantages thusly: "All education favors the middle- and upper-class child, because to be middle- or upper-class is to have the qualities that makes one particularly educable."

Soaring higher education costs are further widening the achievement gap as non-wealthy students are forced to become debt-serfs to pay for college. A system that forces poor households to shoulder student loans for decades in return for marginal-return degrees is not just immoral, it is recklessly predatory. Yet this is the system higher education supports:

The "solution" for those within higher education is for the Federal government to borrow or print trillions of dollars to fund their bloated cartel in the manner to which it has become accustomed: multiple layers of highly paid management, monstrously costly edifices glorifying the institution, etc.

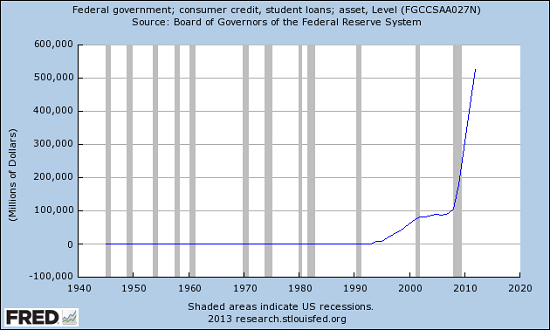

This chart shows the insane trajectory of Federal student debt:

Our Huge, Stinking Mountain of Debt: Student Loans (September 11, 2013)

If there is any operative difference between the higher education cartel and the military-industrial cartel, it is wafer-thin.

The real solution is nearly free instruction and accreditation of the individual, not the institution: a solution I flesh out in my new book The Nearly Free University and The Emerging Economy.

One of the key points of the book is that higher education must teach students how to acquire human and social capital, and the values that are essential to success in the emerging economy. The current system assumes students will acquire the necessary values by some sort of magic. This explains much of the failure of the current system to prepare students to prosper in the emerging economy.

Though it is un-PC to make this observation, it is painfully obvious that values, parenting and family have a great deal to do with wealth inequality and poverty. In a less politically charged (and centralized) environment, common sense would suggest that the values that lead to rising income/wealth should be part of what is considered essential education.

The conventional matrix of poverty--poor education, near-zero family wealth and low social status--does not impede those immigrants to America who have strong families and a specific set of cultural values centered around learning, thrift and investing the resulting savings in productive assets.

We can conclude that a nearly free system of higher education that focused on "learning how to learn" and the other values-based skills needed to build human and social capital and accredited each student directly (as opposed to accrediting institutions) would offer precisely the sort of higher education that would make opportunities to learn and thus to earn universally available.

Such a system would not necessarily close the income gap, but it would certainly close the opportunity gap.

Any system that depends on debt-serfdom for its existence deserves to expire as quickly as possible.

Peak Prosperity's Adam Taggart and I discuss these issues in this podcast:

My new book The Nearly Free University and The Emerging Economy (Kindle eBook) is available at a 20% discount ($7.95, list $9.95) this week.

The Nearly Free University and The Emerging Economy:

The Revolution in Higher Education

Reconnecting higher education, livelihoods and the economy

We must thoroughly understand the twin revolutions now fundamentally changing our world: The true cost of higher education and an economy that seems to re-shape itself minute to minute.

Things are falling apart--that is obvious. But why are they falling apart? The reasons are complex and global. Our economy and society have structural problems that cannot be solved by adding debt to debt. We are becoming poorer, not just from financial over-reach, but from fundamental forces that are not easy to identify. We will cover the five core reasons why things are falling apart:

1. Debt and financialization

1. Debt and financialization2. Crony capitalism

3. Diminishing returns

4. Centralization

5. Technological, financial and demographic changes in our economy

Complex systems weakened by diminishing returns collapse under their own weight and are replaced by systems that are simpler, faster and affordable. If we cling to the old ways, our system will disintegrate. If we want sustainable prosperity rather than collapse, we must embrace a new model that is Decentralized, Adaptive, Transparent and Accountable (DATA).

We are not powerless. Once we accept responsibility, we become powerful.

Kindle: $9.95 print: $24

| Thank you, Stephen K. ($50), for your superlatively generous contribution to this site-- I am greatly honored by your support and readership. |