The rest of us eat our losses, either all at once or in bitter bites as we trudge through the financial wasteland left after bubbles burst.

The news that the Federal Reserve Casino is giving away free gambling chips triggered a frenzied rush that trampled the bears, including poor Yogi:

There's just one catch to the giveaway: you have to be rich, and if you want more than a token free gambling chip, you need to be super-rich. Then you get a pile of free chips.

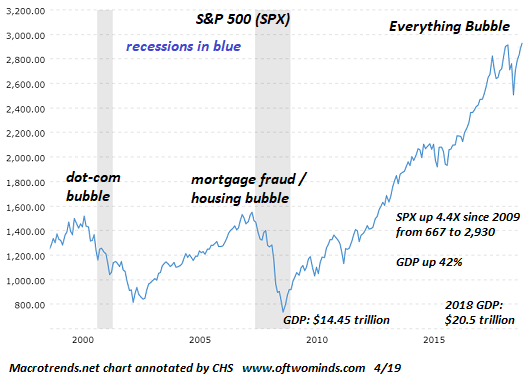

If you're not rich--none for you, debt-serf! If you're already super-rich, the Federal Reserve Casino has plenty of free gambling chips for you, which you are free to "invest" (heh) in just about any asset, since they're all going higher: gold, silver, bitcoin, stocks, bonds, bat guano, quatloos and of course shorting volatility, since volatility dies when the gambling chips are free.

If you're not rich, you're only allowed to gamble with cash you've saved from hard-earned income. And since your income has been stagnant for years or decades when adjusted for real-world inflation, that means you'll never have the leverage the super-rich have to acquire assets and watch them loft ever higher as the Federal Reserve Casino continues issuing free gambling chips to financiers, global corporations, banks and the super-wealthy.

The non-rich are allowed to borrow--but only at high rates of interest for worthless college degrees, rapidly depreciating pick-up trucks, groceries, $5 coffee beverages, etc.

When all is said and done, what's left from all this borrowing by the non-rich is the interest due the super-wealthy, who just so happen to own all the debt.

The only Federal Reserve Casino table open to the non-rich is housing, but with prices at bubble highs, it's a risky bet. Although you won't find any corporate media coverage of this, if you poke around the legal notices in newspapers (yes, the dead-tree variety), you'll find a steady trickle of mortgage foreclosures, as all the losers from the casino's housing roulette wheel are foreclosed by entities such as Deutsche Bank National Trust Company as Trustee for Morgan Stanley ABS Capital I, Inc. Trust and Deutsche Bank National Trust Company as Indenture Trustee for New Century Home Equity Loan Trust 2004-2.

Many of these defaulted mortgages date from the last housing bubble a decade ago. The lenders and mortgage-backed securities pools (legally, trusts managed by entities such as the Deutsche Bank National Trust Company) have kept these bad loans (non-performing loans, in the polite language of financial ruin) on the books, often under purposefully misleading guises to mask the enormity of the losses that are yet to be taken.

The bagholders of the defaulted mortgages are slowly liquidating the thousands of foreclosed homes under the radar now that absurd valuations are once again the norm. Since many of the foreclosed homes have not been maintained, they don't fetch much on the auction block.

The main point here is that there are losers even when the Federal Reserve is giving away free gambling chips. Since the stock market is the key signaling device that every gambler is a winner (so keep buying!), everyone reading the headlines and listening to to the daily reports of stocks rising to new highs is lulled into a very hazardous complacency: only the super-rich get bailed out when their bets go bad.

The rest of us eat our losses, either all at once or in bitter bites as we trudge through the financial wasteland left after bubbles burst.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

| |

Thank you, Brian M. ($10), for your most generous contribution to this site-- I am greatly honored by your support and readership.

| |