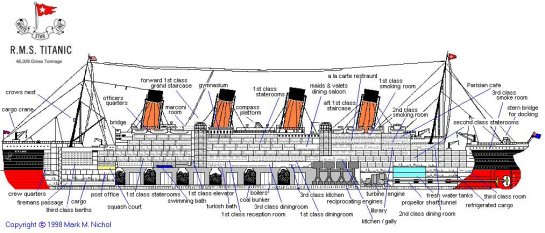

The Titanic's Great Pumps Finally Fail On April 14, 1912, the liner Titanic, considered unsinkable due to its watertight compartments and other features, struck a glancing blow against a massive iceberg on that moonless, weirdly calm night. In the early hours of April 15, the great ship broke in half and sank, ending the lives of the majority of its passengers and crew. The usual analogy drawn between the Titanic and our financial meltdown stems from the initial complacency of the passengers after the collision.Some passengers went on deck to play with the ice scraped off the berg, while most returned to the festivities still working their magic as midnight approached. The class structure of Edwardian Britain soon came into play, however; as the situation grew visibly threatening, the First Class passengers were herded into the few lifeboats while the steerage/Third Class passengers--many of them immigrants--were mostly kept below decks, sealing their doom. But there are even more compelling analogies than initial complacency turning to panic. Consider this diagram of the great ship: The large black rectangles on the lower deck represent the coal bunkers; they were located adjacent to the boilers which powered the engines. Though the ship only scraped against the iceberg, as Titanic explorer Robert Ballard explains, that was enough to pop rivets and open hull plates: Considerable hullabaloo attended the attempt in the summer of 1996 to raise a piece of the hull from the debris field, but far more interesting was the ultrasound investigation of the area of the bow damaged by the iceberg. These images revealed six small tears or openings affecting the first six compartments. Just as we had surmised in 1986, the great gash was a myth and the actual openings into the ship seem to have been the result of rivets popping and hull plates separating. This provides us a very powerful analogy to the fatal damage inflicted on our financial system by an apparently "glancing blow" with risky subprime mortgages and high-flying derivatives. Just as the Titanic was mortally wounded not by great tears in its hull but by the buckling of steel hull plates, so the U.S. (and thus global) financial system is sinking from similarly "glancing" blows. The actual damage could have been contained--do you sense another analogy about to surface?-- had the fifth watertight bulwark--shall we call it "the bulwark against systemic failure"?-- extended a few decks higher. But inexplicably, this watertight barrier did not extend as high as the other watertight bulkheads. Thus even though the water gushing through a fat three foot gash in the forward engine room was held back by the ship's great pumps, as the bow sank lower then water seeped over the fifth watertight bulkhead and gushed into the boiler room. And so against all "rational odds," the ship's apparently minor structural design flaw led to its inevitable loss as the mighty pumps lost their battle against the rising water. To all the "experts," the risk of collision with an iceberg were considered low, while the risk of catastrophic damage were considered essentially zero. Hmm, does that remind you of our financial system circa April 2008, just as the great U.S. economy's hull was buckling? As the water rose higher, the forward boilers driving the ship's massive engines were extinguished, causing the pumps to falter, and thus a positive feedback loop was created: the higher the water rose, the more boilers were extinguished and the less power was available to the pumps. Now we have the Great Pumps of the Stimulus, which in a close analogy are pumping hundreds of billions of dollars into the sinking U.S. economy. But just as the engines of the Titanic lost power as the water extinguished the boilers supplying steam to the engines, so the stimulus is only keeping the rising water temporarily at bay-- it is not actually saving the "engines" of the economy from sputtering. And what are those engines? 1. Debt, which must increase to fuel spending, income and thus taxes 2. Rising assets, which provide the basis for ever-more borrowing 3. Government borrowing, which enables governemnt spending to keep rising without regard to actual tax revenues or the health of those being taxed 4. Rising employment as vast borrowing and spending creates new jobs The ice-cold water is splashing into each of these engines. As assets fall then there is simply no foundation to support more borrowing. As debt is paid down rather than expanded, then spending falls. As spending falls, so do revenues, profits and employment, all of which crimp tax revenues. The last engine is government borrowing. To those still standing ont he sloping deck, this seems like the engine which can never be extinguished. Through thick and thin the Federal government and the state and local governments (via muni bonds) have been able to borrow and spend stupendous sums seemingly at will. But the world is finally running out of steam and the will and ability to buy trillions of dollars of additional U.S. governmental debt is declining. The demise of this last great engine will surprise as many as the sinking of the Titanic did, but it is as inevitable as the sinking of the great ship. The pumps can only hold the water back for a while, and the Stimulus's magic will expire sometime next year. As the government scrambles to find buyers for another $1 trillion in new U.S. bonds (and another trillion or two in new corporate debt, new mortgages, new consumer debt, new muni debt, etc.) then interest rates will rise and the great engine of ever-greater debt will hiss and sigh as the water rises and then go silent and cold. Thank you to everyone who emailed me in the past two weeks. I will try to respond to everyone over the next week. Your patience and understanding are greatly appreciated. If you'd like to watch me blink a lot and try desperately not to make a fool of myself answering very tough questions, you might enjoy: Dangerous Minds w/ Richard Metzger Episode 1 Part 1 (interviewing Charles Hugh Smith) Dangerous Minds w/ Richard Metzger Episode 1 Part 2 Dangerous Minds w/ Richard Metzger Episode 1 Part 3 Dangerous Minds w/ Richard Metzger Episode 1 Part 4 Thank you, Richard, for giving me a rare opportunity to pontificate on Marx. Thank you, Derek S. ($40), for your handsomely generous contribution to this site. I am greatly honored by your support and readership.

April 15, 2009

In honor of the sinking of the great ship Titanic on April 15, 1912, we extend the analogy of its sinking to our current financial situation.

The glancing blow that ruptured the Titanic's hull over a distance of roughly 250 feet (out of a full length of 882 feet) and admitted water into six of her compartments sealed her fate.

Wednesday, April 15, 2009

Terms of Service

All content on this blog is provided by Trewe LLC for informational purposes only. The owner of this blog makes no representations as to the accuracy or completeness of any information on this site or found by following any link on this site. The owner will not be liable for any errors or omissions in this information nor for the availability of this information. The owner will not be liable for any losses, injuries, or damages from the display or use of this information. These terms and conditions of use are subject to change at anytime and without notice.

Our Privacy Policy:

Correspondents' email is strictly confidential. This site does not collect digital data from visitors or distribute cookies. Advertisements served by a third-party advertising network (Investing Channel) may use cookies or collect information from visitors for the purpose of Interest-Based Advertising; if you wish to opt out of Interest-Based Advertising, please go to Opt out of interest-based advertising (The Network Advertising Initiative). If you have other privacy concerns relating to advertisements, please contact advertisers directly. Websites and blog links on the site's blog roll are posted at my discretion.

PRIVACY NOTICE FOR EEA INDIVIDUALS

This section covers disclosures on the General Data Protection Regulation (GDPR) for users residing within EEA only. GDPR replaces the existing Directive 95/46/ec, and aims at harmonizing data protection laws in the EU that are fit for purpose in the digital age. The primary objective of the GDPR is to give citizens back control of their personal data. Please follow the link below to access InvestingChannel’s General Data Protection Notice. https://stg.media.investingchannel.com/gdpr-notice/

Notice of Compliance with

The California Consumer Protection Act

This site does not collect digital data from visitors or distribute cookies.

Advertisements served by a third-party advertising network

(Investing Channel) may use cookies or collect information from visitors for the

purpose of Interest-Based Advertising. If you do not want any personal information

that may be collected by third-party advertising to be sold, please

follow the instructions on this page:

Limit the Use of My Sensitive Personal Information.

Regarding Cookies:

This site does not collect digital data from visitors or distribute cookies. Advertisements served by third-party advertising networks such as Investing Channel may use cookies or collect information from visitors for the purpose of Interest-Based Advertising; if you wish to opt out of Interest-Based Advertising, please go to Opt out of interest-based advertising (The Network Advertising Initiative) If you have other privacy concerns relating to advertisements, please contact advertisers directly.

Our Commission Policy:

As an Amazon Associate I earn from qualifying purchases. I also earn a commission on purchases of precious metals via BullionVault. I receive no fees or compensation for any other non-advertising links or content posted on my site.