Market cheerleaders see a rally coming; Mr. VIX is issuing a sell signal. Looks like the next few days will be a grudge match between Santa and Mr. VIX.

Everybody wants a Santa rally in stocks: Wall Street, the financial media cheerleaders, mutual fund managers, politicos, pump-and-dumpers, retail investors, gamblers, grifters and even Mrs. Santa all want a year-end stock market rally.

Santa's willing, but he's going to have to get past Mr. VIX.

The VIX volatility index is a remarkably accurate indicator of market highs and lows. You can see how well extremes in the VIX line up with highs and lows in the S&P 500 in the charts below.

I've marked the "Highs/Sells" in red lines and the "Lows/Buys" in black lines.

As you can see, Mr. VIX isn't signaling a big fat buy here--he's signaling a big fat sell. The general idea with Mr. VIX is that when investors are panicky and bearish, then they buy hedges against further declines, and this spikes the VIX up. If the VIX breaches the upper Bollinger Band, that aligns rather closely with the stock market lows.

If complacency is high and few investors feel much need to hedge against declines, then the VIX drops to the lower Bollinger Band. That generally aligns with market tops.

The VIX just plummeted below 25. The last time it fell below 25, the market reversed and sold off hard. Bulls expecting Santa to deliver a rally come heck or high water have to explain why the VIX is no longer relevant, and what looks like a strong VIX sell signal is actually a monster-buy signal.

Note the giant wedge pattern that suggests a major move in whichever direction price breaks decisively out of the wedge. Also note the support/resistance around the round number 1,200. Interestingly, the lower line of the wedge (the lower trend line) aligns rather closely with the 1,200 area of support/resistance.

To ignore the VIX sell signal, Bulls have to make the case that the global economy is so rock-solid that continued complacency and a reduction in volatility are to be expected.

Uh, right. Is the global economy rock-solid? (If you don't think the U.S. markets are correlated to global issues, just look at copper and the S&P 500. Copper leads, and the U.S. market follows. Ditto with the euro.) Is a sudden decline in volatility really reflecting global realities, or is it merely wishful thinking?

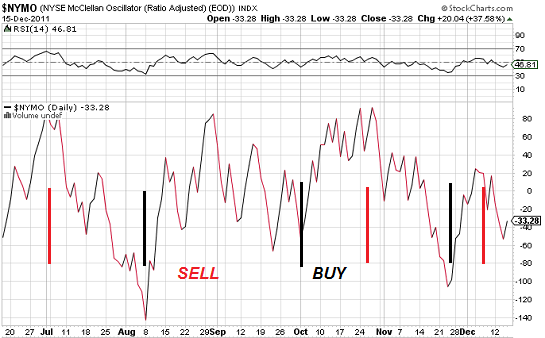

I've also tossed in a chart of the McClellan Oscillator, another tool for identifying buys (lows) and sells (highs) in the stock market. When this indicator plunges to its lows, that typically aligns with stock market lows/buys, and when it reaches peaks, those typically align with market tops/sells.

There are no perfect indicators, but there is a visible correlation between market tops and bottoms and Mr. VIX and the McClellan Oscillator. The problem for Santa is the McClellan Oscillator isn't exactly offering up a screaming buy signal, either.

Maybe Santa delivers a one-two punch to Mr. VIX and serves up a piping hot year-end rally as volatility falls off a cliff. Hey, anything's possible, especially if the referee is on the take.

If you're giving "store-bought" gifts this year:

And your gift-giving philosophy favors 1) everyday utility 2) durability/high quality 3) cost between $5 and $23, and 4) made in U.S.A. then this is the list for you: Favorite Practical Kitchen Tools (All Under $23, many under $10, most made in U.S.A.)

If you're giving "store-bought" gifts this year:

And your gift-giving philosophy favors 1) everyday utility 2) durability/high quality 3) cost between $5 and $23, and 4) made in U.S.A. then this is the list for you: Favorite Practical Kitchen Tools (All Under $23, many under $10, most made in U.S.A.)

| Thank you, Roger M. ($50), for your wondrously generous contribution to this site -- I am greatly honored by your support and readership. | | Thank you, Pierre D. ($50), for your marvelously generous contribution to this site -- I am greatly honored by your support and readership. |