We interrupt the regularly scheduled Part 2 of Money from Nothing to post four charts of interest on Fed-Speak Day. Part 2 will be published tomorrow, Wednesday.

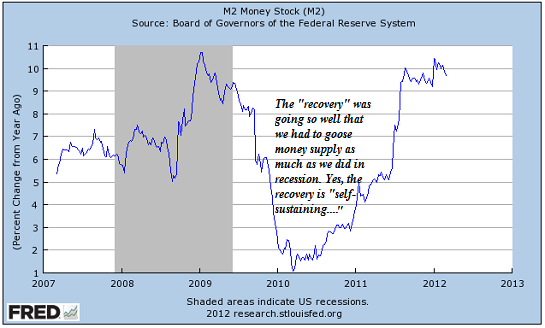

Here are four charts to ponder on Fed-Speak Day, the devotional time set aside to reassure us that all is well due to the god-like competence of the Federal Reserve. Let's start with a chart of M2 money supply, i.e. "Fed printing." Note that the "recovery" was so strong and self-sustaining in 2010 that the Fed had to goose money supply as frantically as it did in the global financial meltdown of 2008. We'd hate to see how much they'd have to print if we (gasp) ever had another recession....

Interestingly, the rapid rate of growth has rolled over. Hmm, could it have anything to do with all that "free money" sloshing into speculative bets on oil, triggering massive leaps in prices paid in the "real economy"?

Global liquidity peak spells trouble for late 2012.

Next up, excess bank reserves parked at the Fed where it earns interest. You recall the scam, right? The Fed loans money to the insolvent TBTF banks at zero interest, and they turn around and park the cash in the Fed where it earns a nice rate of interest. Nice skim if you can get it.

The core idea of Central Planning was that all this new money would flow into the real economy and spark new investment, jobs etc. Instead, 80% of that new cash sits in the Fed as dead money. Yes, 80% of the Fed's massive money expansion is in the Fed earning interest--classic dead money doing nothing but bolstering the income of the banks.

the other $400 billion was "invested" in risk assets and carry trades--the Aussie dollar, Japanese yen, high-yield bonds, the oil complex--oops, that actually had a real-world consequence: oil prices rose, and now prices are squeezing the real economy hard.

As this chart shows, when the cost of oil per unit of GDP rises, GDP tanks--what we call recession. Now that the cost of oil per GDP has spiked again, what do you think will happen to GDP? Can the Fed central-manage everything in the economy? If it's so god-like and powerful, then why is it engineering another recession?

Last up, a chart courtesy of Tony P. at Macro Story of the VIX skew and the S&P 500.

Here's Tony's explanation:

"A chart is considered good when you do not have to add any commentary to make a point. The following is one such candidate.

Below is a chart of the spread between the volatility skew and the vix compared to the SPX. For those new to skew it simply measures the distribution of option implied volatility. When speculators price in tail events they buy out of the money options which "skews" or shifts the distribution of volatility from a normal bell curve.

To oversimplify skew one could argue it is an early warning system that tail events are being priced which likely will lead to a jump in volatility as measured by the vix. On Monday the skew did something pretty interesting while the vix dropped to a near six month low. The skew jumped 11.6% to 139.25 one of the highest levels on record (142.02 the record). The level is significant but more so is the rate of change as indicated on the chart below. This spread is greater than anytime during the 2008 equity selloff."

What is abundantly clear is the Fed is not god-like and supremely competent--rather, it cluelessly triggers cascades of unintended consequences and then reacts with near-infinite incompetence to make matters worse. But hey, the market's up because nothing matters but the market. Yes, it's circular reasoning, but it's working great so far.

| Thank you, Roger H. ($50), for your massively generous contribution to this site -- I am greatly honored by your support and readership. | | Thank you, Rob M. ($400), for your beyond outrageous generous contribution to this site -- I am greatly honored by your support and readership. |