Medicare is an example of an unsustainable system that will go away in the decade ahead.

Here are the sobering facts about the number of workers and those drawing Social Security, Medicare and Medicaid entitlements in the U.S. While the government claims to have a "trust fund" to pay for Social Security and Medicare, this is illusory propaganda. There are no funds set aside to pay these entitlements--they are "pay as you go" programs funded by current tax revenues. If the tax revenues don't cover the programs' expenses, the Treasury sells bonds, i.e. issues debt to pay the entitlements.

Kaiser Family Foundation says roughly 7 million "dual-eligibles" who receive both Medicaid and Medicare, so let's use the data point of 50 million Medicaid-only recipients.

We can assume that most people drawing Medicare benefits also draw Social Security, while the 8+ million drawing disability from Social Security are also covered by Medicaid.

However you slice it, there are roughly 60 million people drawing Social Security and Medicare/Medicaid and another 50 million Medicaid recipients for a total of 110 million people drawing significant entitlements.

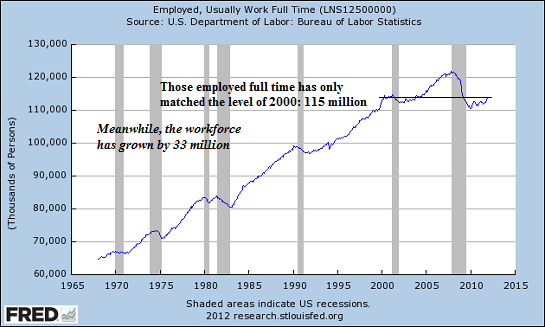

As I have noted here many times, there are only 115 million full-time jobs in the U.S.

That means the ratio of workers to recipients of significant "pay as you go" entitlements is roughly 1-to-1: 115 million full-time workers and 110 million people drawing Social Security and Medicare/Medicaid.

These programs consume the majority of the Federal budget. The Federal government spends around $3.7 trillion and collects around $2.6 trillion in taxes, so the basic deficit is $1.1 trillion. Off-balance sheet "supplemental appropriations" mean the real deficit is actually considerably higher.

Social Security costs $817 billion, Medicare and Medicaid costs total about $800 billion annually, and program outlays rise every year. The Pentagon/National Security budget is around $690 billion.

As I detailed in

The Fraud at the Heart of Social Security (January 17, 2011), the program paid out $707 billion in 2010 and collected $631 billion in taxes, a $76 billion shortfall for 2010. The current program (2012) cost is $817 billion, a leap of $100 billion in a few short years as Baby Boomers flood into the program.

100 million wage earners, or 2/3 the entire workforce, earn less than $40,000 per year.

The Medicare tax is 2.9% of wages, 1.45% each for employer and employee. If the typical worker makes $30,000 a year for 35 years, then lifetime earnings are about $1 million. If we take the $40,000/year average, then that rises to around $1.4 million in lifetime earnings. The 2.9% Medicare tax thus totals about $30,000 to $40,000 in lifetime contributions for the average worker.

The average benefits extracted from the system run from $393,000 to $525,000 (due to the benefits extended to non-working spouses, benefits for never-married people may be somewhat lower). Average annual costs per beneficiary run as high as $18,000, though expenses typically rise significantly in the last year of life.

As I have reported here earlier, a friend's father was in the hospital a few years ago for less than a week for "observation" and a non-invasive gall-stone procedure. Medicare was billed $120,000, or roughly the lifetime contributions of three workers for this modest procedure and a few days in a hospital. My Mom had an office procedure performed on one of her toes and Medicare was billed $12,000. An office procedure (not in surgery) that took a few minutes absorbed 1/3 of my entire lifetime contributions to Medicare.

What we have is a system where the full-time worker to beneficiary is already 1-to-1 and the system pays out 10 times more per person than it collects in taxes.The Medicare system would need about 10 workers for every beneficiary to be sustainable. Right now the ratio is just above 2-to-1. That simply is not sustainable.

Tweaking the payouts doesn't change the basic math: "pay as you go" entitlements are not sustainable when the number of recipients equals the number of full-time workers. Programs that pay out $400,000 per person (many of whom did not work a lifetime) and collect $40,000 per lifetime of full-time work are not sustainable.

Wishing the math were different does not make it different.

For more on this topic, please see:

"Renouncing debt would be the way forward and eventually that will happen everywhere--either the currencies will go to zero, what people call hyperinflation, or the debt will be defaulted on."

Fer crying out loud, does everyone already have their garden in?: largest discount ever from Everlasting Seeds. It's the perfect time to start your veggie/herb garden, and Everlasting Seeds is offering oftwominds.com readers 15% off all products: Buy a Vegi-Max and share with friends!

Resistance, Revolution, Liberation: A Model for Positive Change (print $25)

Resistance, Revolution, Liberation: A Model for Positive Change (print $25)

(Kindle eBook $9.95)

We are like passengers on the Titanic ten minutes after its fatal encounter with the iceberg: though our financial system seems unsinkable, its reliance on debt and financialization has already doomed it.We cannot know when the Central State and financial system will destabilize, we only know they will destabilize. We cannot know which of the State’s fast-rising debts and obligations will be renounced; we only know they will be renounced in one fashion or another.

The process of the unsustainable collapsing and a new, more sustainable model emerging is called revolution, and it combines cultural, technological, financial and political elements in a dynamic flux.History is not fixed; it is in our hands. We cannot await a remote future transition to transform our lives. Revolution begins with our internal understanding and reaches fruition in our coherently directed daily actions in the lived-in world.

| Thank you, Timothy W. ($20), for your splendidly generous contribution to this site-- I am greatly honored by your support and readership. |

Resistance, Revolution, Liberation: A Model for Positive Change (print $25)

Resistance, Revolution, Liberation: A Model for Positive Change (print $25)