The Center Cannot Hold: Kleptocracy Delegitimizes the Status Quo

The center cannot hold because it has failed the nation by defending the Status Quo kleptocracy.

Let's start with William Butler Yeats' (1865-1939) poem, The Second Coming:

Turning and turning in the widening gyre

The falcon cannot hear the falconer;

Things fall apart; the centre cannot hold;

Mere anarchy is loosed upon the world,

The blood-dimmed tide is loosed, and everywhere

The ceremony of innocence is drowned;

The best lack all conviction, while the worst

Are full of passionate intensity.

Though the poem was penned in 1919, it speaks presciently to our era. If we take "the center" to be the political machinery at the gravitational center of the Status Quo, Yeats is suggesting the center cannot hold as things such as the economy and living standards fall apart.

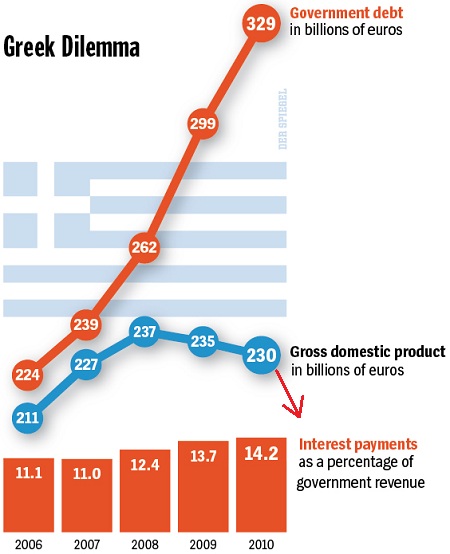

As a case study, let's look at Greece, a nation that is the leading-edge of Status Quo delegitimization and destabilization. As I noted last week, ( In a Dysfunctional Status Quo, Reform Triggers Collapse), corruption isn't a feature of the Greek Status Quo: it is the Status Quo. Any reformation that eliminated corruption would dismantle the Status Quo and bring down the Elites who have been looting the nation at will.

Corruption Continues Virtually Unchecked in Greece:

How can someone who has declared an annual income of €25,000 ($32,400) transfer €52 million abroad? What kind of supplementary income must an individual have who, according to his tax returns, earned €5,588 in 2010, yet still managed to move €19.8 million abroad? And how can it be that a Greek citizen sequesters €9.7 million abroad although he supposedly earned exactly zero euros?The "Lagarde List" contains the names of 54,000 Greek citizens who have transferred major assets out of the country. The Greek Establishment is (naturally) doing nothing to investigate these 54,000 people, because the 54,000 are the Greek establishment.

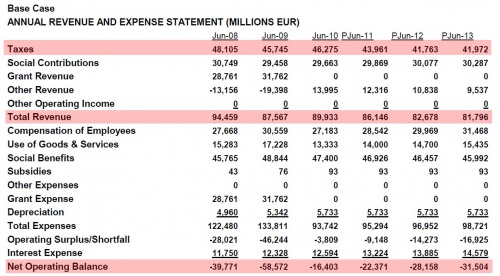

I have long held that Greece Is a Kleptocracy (June 28, 2011). This chart is the acme of unsustainability.

By all accounts, these tax revenue figures are wildly optimistic, and so the actual current deficit is much higher.

To cut to the last act: the Status Quo of Greece is expending the last dregs of its legitimacy and cash defending its kleptocratic Elites from their fellow citizens and from the nation's creditors. As noted above, it is impossible to "reform" a Status Quo whose foundation is corruption, just as it is impossible to wean an economy based on debt and leverage for its "growth" of excessive debt and leverage: financialization isn't a feature of the economy, it is the economy.

The entire eurozone is a kleptocracy as well: 500 Million Debt-Serfs: The European Union Is a Neo-Feudal Kleptocracy (July 22, 2011).

Here are the key dynamics of delegitimization:

1. The consequences of austerity. The kleptocratic "fix" is to divert more of the debtor nations' national incomes to debt service. In other words, money that once went to labor (wages) and social services now goes to debt repayments and interest.

What are the consequences of this massive diversion of income? The economy shrinks. Less income means less spending, which means negative growth.

The Eurozone's "solution" of debt-on-debt depends on debtor economies "growing their way out of debt." If labor's share of the national income is falling, and both private and government spending and income are falling, precisely where is the "growth" supposed to come from? As private income falls, tax revenues fall, causing the government to raise taxes and junk fees. This further reduces private income, and so on in a self-reinforcing feedback loop of contraction.

Austerity sets up a positive feedback loop of less income and less spending. The people in these debtor economies can look around and see the consequences: everyone has less money, and less confidence that the "austerity fix" will do anything but put debt-junkies into fatal withdrawal.

Once an economy becomes dependent on debt that rises faster than the resulting "growth," then that economy is set on an unwavering path to implosion. (The Cycle of Dependency and the Atrophy of Self-Reliance).

When Belief in the System Fades (March 12, 2008), institutions lose their legitimacy(The Three Ds: Delegitimization, Definancialization, Deglobalization July 1, 2011) and people naturally save more as insurance against an uncertain future. Fewer people are willing to risk their capital in new ventures, and as the economy loses vitality then these trends reinforce each other.

2. This loss of faith and confidence triggers hoarding and capital flight. As Ludwig von Mises noted long ago, the only way to organically "grow" an economy is for capital to accumulate faster than the population, that is, capital increases on a per capita basis. Capital means savings/cash, not debt, that is invested in productive assets and enterprises.

So what happens when you skim more of a nation's income to service debt? There is less capital accumulated, and thus less capital available for investment.

What happens when people lose faith in the financial institutions and their coercive "fixes"? They move their capital to less-risky, more productive climes. In other words, capital flight is another positive feedback: as people move their capital out of the country, then there is less available per capita for productive investment. Toss in a kleptocratic government which increases taxes while misallocating precious capital on crony Capitalism and corruption, and you get a death-spiral of capital flight and risk avoidance.

The irony of a loss of faith is people instinctively place their capital in non-productive savings: in gold, Swiss lock boxes, and so on. This instinct removes capital from the pool of investments in productive assets.

As the Status Quo fails to protect the national interests and the citizenry from the neofeudal kleptocracy, faith in the political center fades. The centerist parties cannot "reform" corruption because they are the embodiment of corruption. In desperation, people move from the center to the extreme left or right, seeking a party that is willing to overthrow the corrupt, failed kleptocracy.

This is of course the pathway to dictatorship and fascism: Love or nothing: The real Greek parallel with Weimar.

These were the men who tried and failed to use a mixture of austerity, tough policing and what we might now call "technocratic" rule to save German democracy. They failed.Horrified inertia is now seeping from the world of the semi-outlawed young activists into the lives of ordinary people.My Greek sources report that the abandonment of the failed political center is well under way as austerity is tightened while kleptocrats maintain their grip on the machinery of governance.

On the streets of Athens there is already the answer. You can feel what it is like when the political system - and even the rule of law - becomes paralysed and atrophies.

The "hopeless inertia" begins to grip even the middle classes, as the evidence of organised racist violence encroaches into their lives.

The solution has long been obvious: Greece, Please Do The Right Thing: Default Now (June 1, 2011).

The same holds true for every nation ruled by kleptocratic Elites that has attempted to "grow our way out of debt" by piling debt on debt. Doesn't that include Spain, Italy, China, the U.S. and a host of other nations?

For more on this topic:

The First Dominoes: Greece, Reality, and Cascading Default (February 13, 2012)

Do We Really Know Greece's Default Will Be Orderly? (February 17, 2012)

Greek Theater Double-Feature: A Farce and a Tragicomedy (June 19, 2012)

| Thank you, Bill B. ($5), for your most-generous contribution to this site--I am greatly honored by your ongoing support and readership. |