What Every Student in America Needs to Know About the Federal Reserve

A guest commentary from Jeff W. clearly explains what every student in America needs to know about the Federal Reserve.

Frequent contributor Jeff W. recently penned this succinct explanation of the Federal Reserve, and he did so with such clarity that in my view this is the essential primer on the Fed that every high school and college student in America should read. If they study this short essay, they will grasp the essence of the Fed and understand why the financial Status Quo is doomed.

People are confused about the Fed, and I think it would be better if everybody had a clear understanding of what the Federal Reserve is and what it is not.First of all, the Federal government thinks of the Federal Reserve as a service bureau, whose function it is to print money that the government can spend. As long as the Federal Reserve performs that function--reliably printing, let's say, a trillion or more each year to top off the Federal budget--then Congress will be happy with the Federal Reserve (their rainmaker) and will follow its advice and try to keep it happy.

It should be emphasized here that the whole Keynesian smokescreen and sideshow has very little to do with the reality of the relationship here. The Federal Reserve's job is not just to lend Uncle Sam some money during a recession so as to provide temporary stimulus. The Fed is a milk cow for Uncle Sam. Its job is to give milk all the time.

So to summarize this first point, the Fed is a service bureau for the Federal government whose job it is to provide the government with freshly printed fiat every year. This job has very little to do with the Keynesian prescription of how to deal with a recession.

The Fed is also a service bureau to the big banks that own it. Its job is to give unfair advantage to those banks, either by granting them low-interest loans that can be rolled over into infinity, or by buying their bad debts and disposing of them properly, or by doing any number of other special favors for them that increase their profits and executive bonuses. The Fed is not independent in the sense that it is self-governing. It must provide service to the banks who own it and to the Federal government, which controls its legal environment. Big banks have owned and controlled the Fed since its inception in 1913.

Summary: The Fed is also a service bureau to the big banks. It is not as independent as it proclaims itself to be; it provides services for its owners. Its owners have a profit motive.

The Fed also has its own institutional agenda. It wants to expand and increase its own power. It wants to operate in a safe and predictable environment. It wants to eliminate threats. The Fed advances its own agenda by printing or withholding money. As time goes on, the Fed has asserted more and more control over government. The Federal government is now addicted to freshly printed debt-money. This gives the Fed enormous power over the government.

The big banks who own the Fed also dominate Congress and the Obama administration due to the massive bribes they deliver each year. Thus over time the Federal Reserve has become more and more the master: what it wants it gets, what it doesn't want doesn't happen.

Summary: The Fed is also a selfish, power-seeking institution. It is not an organization of scientists (even though it does employ a small army of Economics Ph.D.'s) whose sole concern is to manage the economy scientifically for the benefit of all.

Some people think the Fed prints money, but when you ask Ben B. about it, he says, "The Fed does not print money. We lend money." Printing money is easy to visualize and understand. Lending money is also easy to understand; it's what banks do. But what the Fed does is somewhat more difficult to understand. To put it into one phrase, "they print debt-money." They print money, but each dollar they print has the chains of debt attached to it. Each dollar they print represents a debt that somebody owes.

A Federal Reserve note is an IOU from the Fed that says "we owe you one dollar." There does exist in the world paper money that is not debt-money, but the Fed does not traffic in that. As the Fed prints more debt-money, they tighten the chains of debt enslaving the government and the people.

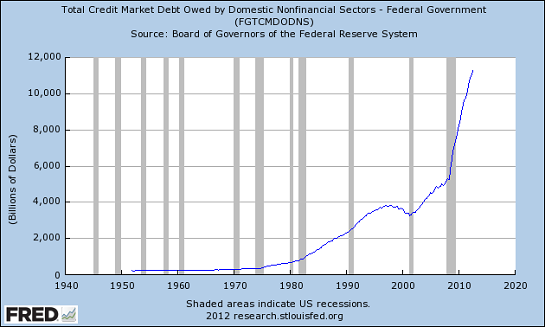

A national debt of $1 trillion is manageable. It might be paid off in a few years. But a debt of $17 trillion is permanently enslaving (unless it is defaulted upon). Ben's printing press, then, is also an enslaving press. If Americans were to try to default on $17 trillion of debt, The Powers That Be would unleash their full wrath on the American people.

Summary: Ben B. runs a printing press that is also a debt-enslaving press. We are wrong to focus just on the inflationary effects of his money printing. We should also be alarmed by the enslaving effects.

The Fed has infinite fiat, though they try to disguise that fact. It takes no more effort for them to loan a trillion dollars than a million dollars. They will never run out of zeros in their computer system. The zero keys on their keyboards will always function. No matter how much they can print, they always have available an infinitely greater amount of fiat that they can still print. Printing money requires nearly zero effort and zero cost on their part. They don't get worn out from printing money.

This whole concept of infinite fiat is hard for people to grasp; it is something outside of their experience. People's lifelong experience with money is that it is a limited resource. It is hard to conceive of a group of people who have unlimited, infinite money. Yet the Federal Reserve has just that. The Fed is not like a doctor who prescribes a short-term stimulus for a patient who is feeling run down. The Fed is not like a parent who temporarily puts training wheels on a bike until the kid learns how to ride it. These metaphors make people think that the Fed's fiat printing is temporary and limited. It is not.

Its money printing abilities are permanent and unlimited. The Fed also puts on a show about agonizing over the decision of whether to print money. That make it seem like they are agonizing over whether to pull a sum of carefully saved cash out of their vault. But when they lend to Uncle Sam, they do not pull cash out of a vault that has a finite amount of cash in it. They instead get it from a computer that has the capability of printing unlimited zeros.

Summary: The Fed has infinite fiat. It is not limited by any conceivable shortage, or because of Keynesian stimulus theory, or because the Fed has the role of a doctor, or because the Fed's role is to put training wheels on the economy from time to time, or because it is hard for it to print fiat and there are only so many hours in a day. They have infinite fiat. Their printing is limited only by how much they think they can get away with and their calculations of how they will benefit from it.

So that brings up the final question I shall deal with today. That is, “How does printing money benefit the Fed? Is it better from their point of view to print or not to print?”

The first point in response to this is that they want the government hooked on their printing. They want to be indispensable to the government. A government that balances it budget or reduces the national debt to zero (as the Jackson administration did) is the opposite of what they want.

The Fed's power over government is similar to the power a drug pusher has over a junkie. As long as the junkie is doing what the pusher wants, the supply of drugs is uninterrupted. If the junkie does not pay, the supply is cut off. If the pusher wants to jack up the price at any time, he can do so. If the junkie objects, his supply is cut off. So here we see it is in the Fed's interest usually to maintain the supply, but the supply may also be cut off from time to time in order to ratchet up its power over its victim.

The big banks always benefit from more printing. They profit from it. To the extent that they are cut off from it, they lose money. So from the standpoint of the big banks, the bias is always to print. Note that the Fed can maintain its supply to the banks while cutting off the government. The Fed's owners must always be served; the government is instead to be manipulated, enslaved and controlled under the guise of serving.

Any active defiance of the Fed is a danger signal for investors. The Fed can cut off the government at any time, thus precipitating economic chaos so as to quash rebellion. At present I do not see any serious defiance of the Fed anywhere.

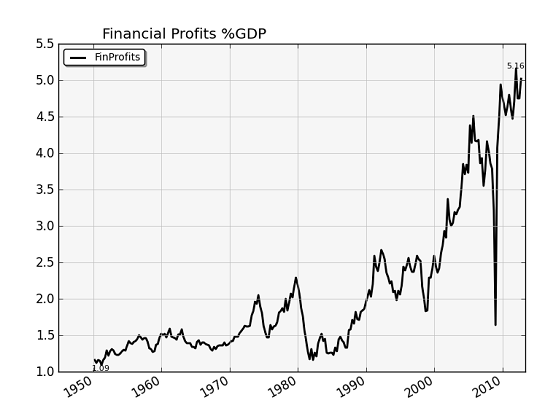

The Fed's main goal is to increase the profits of the big banks. That goal is consistent with increased profits for all firms and prosperity in general, so long as the banks and the elites grab the largest share of the profits.

But that goal is also served in the long run by boom-and-bust cycles that have a ratcheting effect of concentrating wealth in the hands of the wealthy. The clued-in super-wealthy can profit both as bulls and as bears, and can purchase prized assets cheaply at the bottom of the cycle (on easy credit from their friends at the Fed).

It is a Clausewitzian principle that individuals, organizations and nations will expand their power until some superior or equal power effectively opposes them and stops them. Because the Fed's power has no equal, we can expect the Fed's power to continue to increase indefinitely.

At some point, however, history shows that the slaves and victims of oppressors gain strength and confidence when they feel a desperate determination to live.

But that point is still far off. The numbers of the righteous are far exceeded by those who want freshly printed debt-money from Ben Bernanke. Things have not yet reached the desperate, life-threatening stage which is when most revolutions occur.

Thank you, Jeff W. for a clear, concise description of the Fed and its role in the American economy. I would add two clarifications:

1. The U.S. Treasury issues currency (paper money, i.e. Federal Reserve Notes) and sells Treasury bonds to fund Federal deficits, but it does not "print money" in the sense of adding money to the nation's money supply. It borrows money by selling newly issued U.S. Treasury bonds.

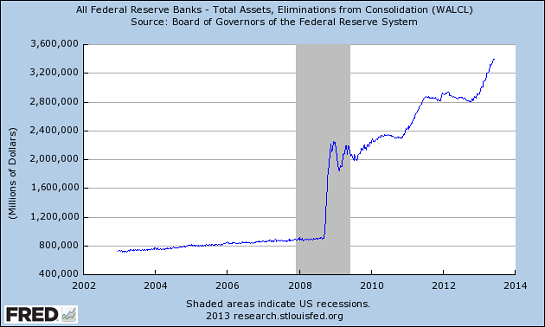

2. Technically speaking, the Fed does not give or loan the Federal government money. However, it creates money and pumps it into the economy in a number of ways, enabling large institutions such as banks and insurance companies to buy newly issued Treasury bonds. The Fed also uses its freshly created money to buy Treasury bonds directly. Lastly, the Fed can manipulate the interest rate in a variety of ways, making Treasury bonds attractive to institutional and global buyers.

So even though the Fed doesn't give or loan money directly to the government, it facilitates the sale of Treasury bonds to fund the government in a variety of ways, including direct purchase of government bonds for its own account.

These complexities act as a complexity moat that protects the Fed from inquiry and resistance, as few people understand what the Fed is or what it does.

Correspondent Doug W. recently submitted this excerpt from a letter from Thomas Jefferson to James Madison on the issue of debt as serfdom:

Writing from Paris, in his letter to James Madison dated September 6, 1789, Thomas Jefferson opened with these words:"The question Whether one generation of men has a right to bind another, seems never to have been started either on this or our side of the water. Yet it is a question of such consequences as not only to merit decision, but place also, among the fundamental principles of every government."

After elaborating on what he thought should be among "the fundamental principles of every government," Jefferson closed with this impassioned request to Madison:

"Turn this subject in your mind, my Dear Sir, and particularly as to the power of contracting debts, and develop it with that perspicuity and cogent logic which is so peculiarly yours. Your station in the councils of our country gives you an opportunity of producing it to public consideration, of forcing it into discussion. At first blush it may be rallied as a theoretical speculation; but examination will prove it to be solid and salutary. It would furnish matter for a fine preamble to our first law for appropriating the public revenue; and it will exclude, at the threshold of our new government the contagious and ruinous errors of this quarter of the globe, which have armed despots with means not sanctioned by nature for binding in chains their fellow-men."Thank you, Doug, for this reminder that the power to indebt the public is also the power to enslave them. That, fellow citizens, sums up the Federal Reserve and the Savior State it has enabled: debt is serfdom, debt is slavery.

Things are falling apart--that is obvious. But why are they falling apart? The reasons are complex and global. Our economy and society have structural problems that cannot be solved by adding debt to debt. We are becoming poorer, not just from financial over-reach, but from fundamental forces that are not easy to identify or understand. We will cover the five core reasons why things are falling apart:

1. Debt and financialization

1. Debt and financialization2. Crony capitalism and the elimination of accountability

3. Diminishing returns

4. Centralization

5. Technological, financial and demographic changes in our economy

Complex systems weakened by diminishing returns collapse under their own weight and are replaced by systems that are simpler, faster and affordable. If we cling to the old ways, our system will disintegrate. If we want sustainable prosperity rather than collapse, we must embrace a new model that is Decentralized, Adaptive, Transparent and Accountable (DATA).

We are not powerless. Not accepting responsibility and being powerless are two sides of the same coin: once we accept responsibility, we become powerful.

Kindle edition: $9.95 print edition: $24 on Amazon.com

To receive a 20% discount on the print edition: $19.20 (retail $24), follow the link, open a Createspace account and enter discount code SJRGPLAB. (This is the only way I can offer a discount.)

| Thank you, Helen S.C. ($10), for yet another splendidly generous contribution to this site -- I am greatly honored by your steadfast support and readership. | Thank you, Scott R. ($5/month), for your extremely generous subscription to this site -- I am greatly honored by your support and readership. |