Believing official reassurances based on Fantasyland projections of ever-rising payroll taxes and employment does not magically make the Social Security system viable.

Questioning the financial viability of the Social Security system is often taken as an attack on the program itself. Nothing could be further from reality. Anyone who truly wants Social Security to continue as is should take an active interest in structural trends rather than focusing all their energy on attacking those who question the official reassurances that the

the system is sound until 2033.

The two primary trends are obvious:

1. A structural decline in full-time employment

2. A historically unprecedented increase in Social Security benefits paid

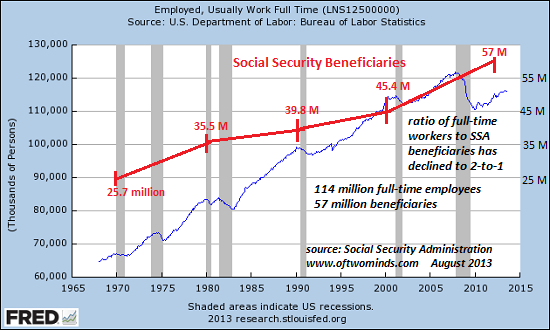

Notice that the ratio of full-time workers to SSA beneficiaries was comfortably higher than 2-to-1 for decades. Simply put, the number of full-time workers rose at roughly the same rate as the number of people drawing SSA benefits.

The full-time worker/beneficiary ratio was 2.56 in 1970 and 2.49 in 2000--basically the same ratio held for 30 years as full-time employment expanded along with the number of SSA beneficiaries.

But the trendlines are separating as the number of people drawing SSA benefits is soaring while the number of full-time jobs is stagnating. The increase in beneficiaries fro 1970 to 1980 was a steep 9.8 million, but full-time jobs increased by about 16 million despite the stagflationary economy.

The increases in beneficiaries in the next two decades was modest: 4.3 million more between 1980 and 1990, and 5.6 million more between 1990 and 2000. Meanwhile, the economy added roughly 30 million full-time jobs over those two decades.

The increase in beneficiaries between 2000 and 2010 was almost 10 million, while the number of full-time jobs in 2010 actually declined from 2000.

The ratio of full-time workers to SSA beneficiaries is now 2-to-1 and will fall below 2-to-1 as the number of beneficiaries rises.

The recession of 2008-9 revealed a deeply structural decline in full-time employment. Why focus on full-time employment? Only full-time workers pay enough payroll taxes to fund the system. Around 38 million workers make less than $10,000 a year, which means the SSA contributions they and their employers pay is on the order of $1,000 or so a year.

Workers paying in $1,000 or so a year (adjusted for inflation) will receive far more than their contributions in benefits, and so the system depends on higher-income workers.

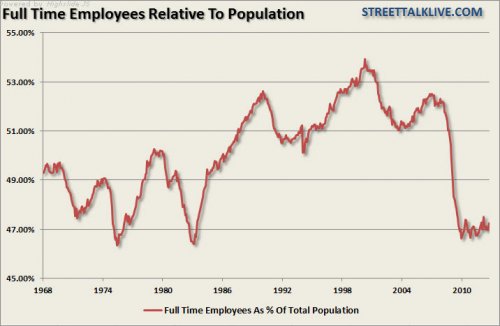

The problem is full-time work is in structural decline for a number of reasons that aren't going away: globalization, robotics, advances in software, fast-rising cost of employee healthcare benefits and so on. We can clearly see this structural decline in these charts:

Here is full-time employees as a percentage of the population, courtesy of

Lance Roberts:

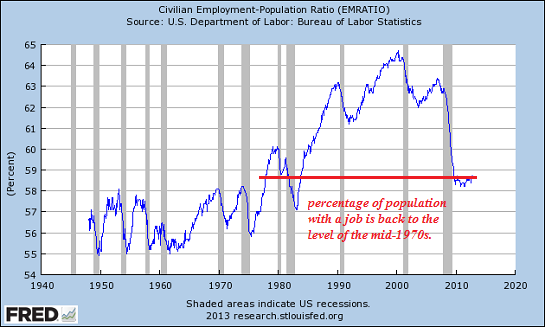

The same trend in a chart of civilian employment, which includes part-time jobs:

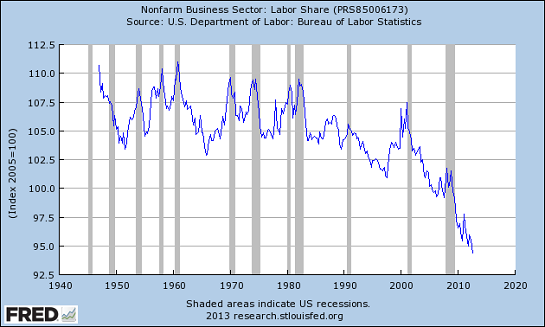

Labor's share of the economy is in near-freefall:

Notice the trajectory of Social Security benefits: to the moon, while full-time employment has stagnated.

The Social Security system ran a $55 billion deficit in 2012, meaning that payroll tax receipts did not cover benefits paid. (Recall that SSA is "pay as you go," meaning that current taxpayers fund the benefits paid to current beneficiaries.)

The fiction of the Trust Fund enables some intergovernmental sleight-of-hand, as the Treasury borrows money on the global bond market and pays the SSA interest on the fictional Trust Fund, but the bottom line is that the SSA deficit is funded by the Treasury borrowing money by selling Treasury bonds.

If the global economy slides into recession in the years ahead, as seems increasingly likely, full-time employment in the U.S. could slip to 100 million while the number of beneficiaries continues to soar by 10+ million a decade. All the official projections assume steady, strong increases in payroll taxes and full-time employment; the system's deficits will explode higher if full-time employment sags while the number of beneficiaries increases from 57 million to 70 million and then on to 80 and 90 million.

Anyone who cares about the viability of Social Security had better wake up to the widening divergence of full-time employment and SSA beneficiaries.

Believing official reassurances based on Fantasyland projections of ever-rising payroll taxes and employment does not magically make the system viable.

Things are falling apart--that is obvious. But why are they falling apart? The reasons are complex and global. Our economy and society have structural problems that cannot be solved by adding debt to debt. We are becoming poorer, not just from financial over-reach, but from fundamental forces that are not easy to identify or understand. We will cover the five core reasons why things are falling apart:

1. Debt and financialization

1. Debt and financialization

2. Crony capitalism and the elimination of accountability

3. Diminishing returns

4. Centralization

5. Technological, financial and demographic changes in our economy

Complex systems weakened by diminishing returns collapse under their own weight and are replaced by systems that are simpler, faster and affordable. If we cling to the old ways, our system will disintegrate. If we want sustainable prosperity rather than collapse, we must embrace a new model that is Decentralized, Adaptive, Transparent and Accountable (DATA).

We are not powerless. Not accepting responsibility and being powerless are two sides of the same coin: once we accept responsibility, we become powerful.

Kindle edition: $9.95 print edition: $24 on Amazon.com

To receive a 20% discount on the print edition: $19.20 (retail $24), follow the link, open a Createspace account and enter discount code SJRGPLAB. (This is the only way I can offer a discount.)

| Thank you, Stephen L. ($25), for yet another supremely generous contribution to this site-- I am greatly honored by your steadfast support and readership. | |

1. Debt and financialization

1. Debt and financialization