Not only are there not that many slots in the upper middle class, the number of open slots is considerably lower.

If America is the Land of Opportunity, why are so many parents worried that their princeling/princess might not get into the "right" pre-school, i.e. the first rung on the ladder to the Ivy League-issued "ticket to the upper middle class"? The obsessive focus on getting your kids into the "right" pre-school, kindergarten and prep school to grease the path to the Ivy League suggests there aren't as many slots open as we're led to believe.

Let's set aside the endless debate over what qualifies a household to be "middle class." Most people define themselves as middle class, with little regard for their income. Let's cut to the chase and ask: how many young people aspire to joining this ill-defined middle class? Does this mean a rising standard of living and security? Not any more.

If you want those things, you must aspire to join the upper middle class.

So the more fruitful question is: what qualifies as upper-middle class?Here's a handy line in the sand: Stanford University covers the tuition for all incoming undergraduates whose household income is less than $125,000.

According to the U.S. Census Bureau data (here displayed on Wikipedia), $125,000 is right about the 85% line--only the top 15% households make $125,000 and up annually:Household income in the United States.

For context, median household income in the U.S. is around $52,000 annually.

A few years ago, I calculated What Does It Take To Be Middle Class? (December 5, 2013) and came up with an absolute minimum of $111,000 for two self-employed wage earners, as this includes the cost of healthcare insurance and the employer's share of Social Security and Medicare taxes. This was bare-bones.

Since employees of the government or Corporate America receive healthcare and retirement benefits (matching contributions to employee 401K plans, etc.), these can be subtracted from the $111,000. But this didn't allow for vacations or any of the finer things in life, so if we are talking about a truly comfortable household income, around $105,000 for state/corporate employed people sounds right and $125,000 for self-employed people is more or less the minimum required.

(Obviously, money goes further in the Midwest and not very far on the Left and Right coasts.)

Stanford's cutoff of $125,000 isn't as outlandish as it might seem at first glance.See where your household income fits in the spectrum with this online tool: What Is Your U.S. Income Percentile Ranking? (This confirms that an income of $125,000 puts the household in the top 15%.)

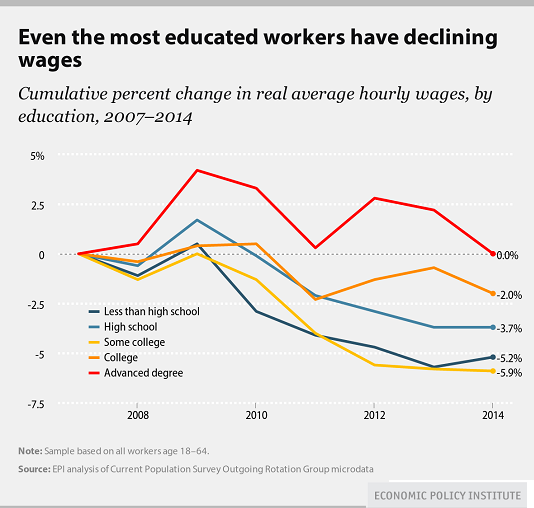

Meanwhile, wages for every category of worker, from the highly educated to the high school graduate, have been declining:

How many slots are there in this upper middle class? A household income of $190,000 is in the top 5% nationally. According to the Social Security Administration data for 2013 (the latest data available), Wage Statistics for 2013, individuals who earn $125,000 or more are in the top 5% of all earners. Two such workers would earn $250,00 together. The 2.8 million households with incomes of $250,000 or more are in the top 2.5%. If we define the top few percent as upper middle class, then who qualifies as wealthy? Only the top 1%?

I think it is reasonable to define the 10% of households earning between $125,000 (top 15%) and $190,000 (top 5%) as upper middle class. This is around 12 million households, out of a total of 121 million households.

Most of those jobs are already held by people with years of experience and abundant social and human capital. Yes, there are plenty of wastrels living off trust funds and free-riders doing as little as possible in their guaranteed government jobs, but by and large the people earning these incomes are working hard and will do whatever it takes to maintain their current incomes for the sake of their kids and their own security.

This explains the frantic drive to be one of the 2,100 students accepted by Stanford out of 42,000 applicants. These low admission numbers reflect the admission realities in the upper crust of Ivy league universities, both public and private.

The assumption is the few open slots in the upper middle class (or dare we hope, the 1%) will disproportionately go to those who have the credentials that signal they have the social breeding and brains to fit the corporate culture and they're willing to work hard and make their bosses lots of money.

Meanwhile, the top 5% of households in San Francisco earn a whopping $423,000 annually. (brookings.edu)

4,575 writers (out of 92,000 nationally) are in top 1% households. Where do I sign up? Another 10,134 writers in "other industries" (out of 465,000 people claiming this employment category) are also in top 1% households. 15,000 retail clerks also live in top 1% households.

Perhaps the trick is not to make a lot of money writing or selling accessories, but to marry a top-level attorney, doctor, business owner, dot-com millionaire, lobbyist or trust funder?

(You can look up what qualifies as a 1% household income in this link, which has a chart of all 50 states and Washington D.C.)

Not only are there not that many slots in the upper middle class, the number of open slots is considerably lower. No wonder so many parents are desperate for an insider's pathway for their offspring.

Get a Job, Build a Real Career and Defy a Bewildering Economy(Kindle, $9.95)(print, $20)

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible. And like most of you, the way I've moved toward my goal has always hinged not just on having a job but a career.

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible. And like most of you, the way I've moved toward my goal has always hinged not just on having a job but a career.

You don't have to be a financial blogger to know that "having a job" and "having a career" do not mean the same thing today as they did when I first started swinging a hammer for a paycheck.

Even the basic concept "getting a job" has changed so radically that jobs--getting and keeping them, and the perceived lack of them--is the number one financial topic among friends, family and for that matter, complete strangers.

So I sat down and wrote this book: Get a Job, Build a Real Career and Defy a Bewildering Economy.

It details everything I've verified about employment and the economy, and lays out an action plan to get you employed.

I am proud of this book. It is the culmination of both my practical work experiences and my financial analysis, and it is a useful, practical, and clarifying read.

Test drive the first section and see for yourself. Kindle, $9.95 print, $20

"I want to thank you for creating your book Get a Job, Build a Real Career and Defy a Bewildering Economy. It is rare to find a person with a mind like yours, who can take a holistic systems view of things without being captured by specific perspectives or agendas. Your contribution to humanity is much appreciated."

Laura Y.

Gordon Long and I discuss The New Nature of Work: Jobs, Occupations & Careers(25 minutes, YouTube)

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

| Thank you, Elston Exhaust ($100), for your outrageously contribution to this site-- I am greatly honored by your steadfast support and readership. |

|

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible. And like most of you, the way I've moved toward my goal has always hinged not just on having a job but a career.

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible. And like most of you, the way I've moved toward my goal has always hinged not just on having a job but a career.