History is rather unkind to blind faith in central banks, just as the rising U.S. dollar and stagnant sales are being very unkind to corporate profits.

The quasi-religious faith that central banks can push stock markets ever higher regardless of real-world realities may well be tested in 2015-2016. The global economy spiraling into recession (a.k.a. a period of slow growth--heh) raises two questions:

1. Can the U.S. economy decouple from the global economy, i.e. keep expanding production, sales, income and payrolls while the rest of the global economy falters?

2. What happens to the U.S. stock market if/when the U.S. follows the rest of the world into recession?

In essence, the model considers four data series: real personal income, nonfarm payrolls, industrial production and real final sales (as a percentage of change). If all four are rising, the probability of recession is low.

If all four roll over and decline, the probability of recession (generally defined as a decline in gross domestic product for two consecutive quarters) approaches 100%.

This makes intuitive sense: if personal income, industrial production, real final sales and payrolls are all declining, how can GDP continue expanding?

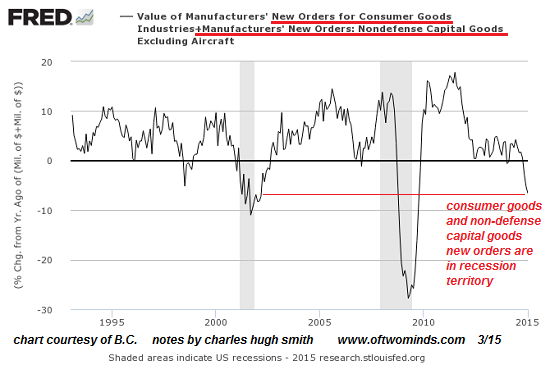

For context, let's start with a chart I published earlier this week of new manufacturing orders--which look unambiguously recessionary:

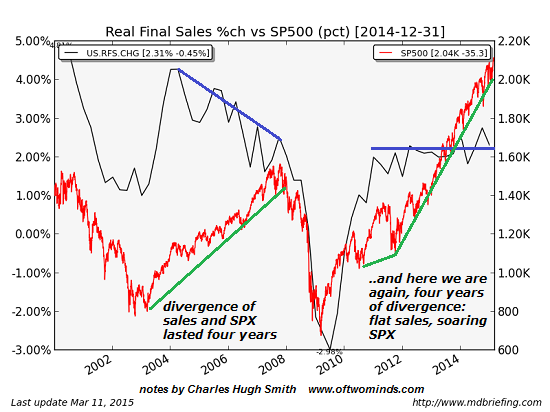

Here is a chart of real final sales (as a percentage of change) and the S&P 500 (SPX). The percentage of change of real sales declined for four years in the 2000s while the stock market soared--a remarkably long-lasting divergence.

Note that real final sales remained in positive territory (i.e. were still expanding, albeit at a pace of 1% or so) even as the U.S. economy slid into recession in early 2008.

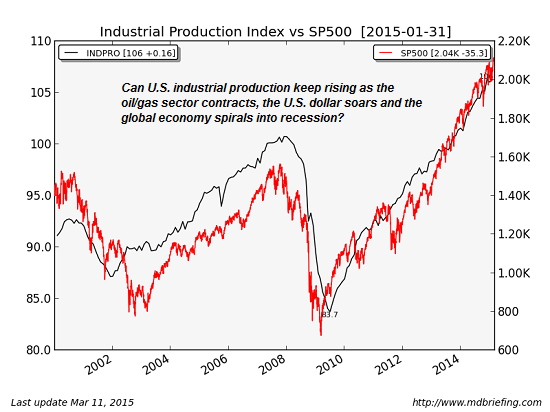

Industrial production has yet to roll over--but this may be merely a time lag in the data, as it's difficult to see how the recent drop in oil/gas employment won't eventually show up in industrial production as wells are capped and drilling rigs are idled.

Many aspects of manufacturing are dependent on either global growth or the expansion of highly risky debt--for example, subprime auto loans. What happens to auto sales when the subprime auto loan bubble bursts?

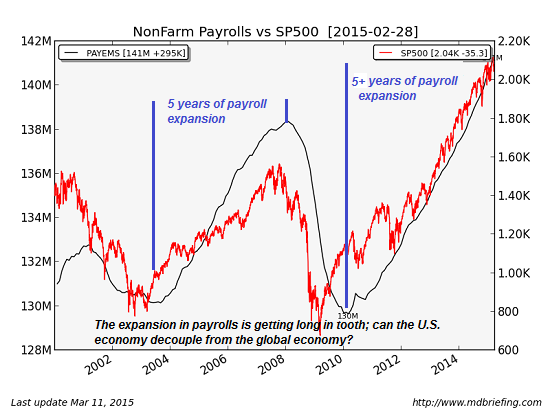

Payrolls have also been rising steadily for over five years--a period of time that exceeds the previous expansion of nonfarm employment in the 2000s. By any measure, the current period of payroll expansion is long in tooth.

Put another way--how many more millions of waiters/waitresses/bartending jobs can the U.S. economy generate? How many jobs are dependent on exports, which are being pressured by the soaring U.S. dollar? What happens to job growth as corporate profits plummet?

I didn't publish the personal income chart because this data series is highly suspect, for reasons explained by Zero Hedge in The Mystery Of America's Missing Wage Growth Has Been Solved: the wages of the lower 4/5ths of the employed are stagnant or down; only the top 20% registered any gains in real income.

There is undoubtedly a Pareto distribution in these gains, meaning 80% of the income gains enjoyed by the top 20% went to the top 20% of that 20%: in other words, most of the income gains went to the top 5% of the managerial/technocrat class--it was not evenly distributed to the entire top 20%.

What predictive value is there in income data when the vast majority of the income gains have flowed to the top 5%, a few crumbs thrown to the next 15% and the bottom 80% received no real gains in income or actually saw their income decline in real terms?

Regardless of income, history shows that stocks crater when payrolls, industrial production and real final sales all tank. The current euphoria for stocks has several components: one is soaring corporate profits, and the other is quasi-religious faith in the power of central banks to keep stocks lofting higher in a complete disconnect from fundamentals such as sales, profits, production or payrolls.

History is rather unkind to blind faith in central banks, just as the rising U.S. dollar and stagnant sales are being very unkind to corporate profits.

Get a Job, Build a Real Career and Defy a Bewildering Economy(Kindle, $9.95)(print, $20)

Are you like me? Ever since my first summer job decades ago, I've been chasing financial security. Not win-the-lottery, Bill Gates riches (although it would be nice!), but simply a feeling of financial control. I want my financial worries to if not disappear at least be manageable and comprehensible. And like most of you, the way I've moved toward my goal has always hinged not just on having a job but a career.

You don't have to be a financial blogger to know that "having a job" and "having a career" do not mean the same thing today as they did when I first started swinging a hammer for a paycheck.

Even the basic concept "getting a job" has changed so radically that jobs--getting and keeping them, and the perceived lack of them--is the number one financial topic among friends, family and for that matter, complete strangers.

So I sat down and wrote this book: Get a Job, Build a Real Career and Defy a Bewildering Economy.

It details everything I've verified about employment and the economy, and lays out an action plan to get you employed.

I am proud of this book. It is the culmination of both my practical work experiences and my financial analysis, and it is a useful, practical, and clarifying read.

Test drive the first section and see for yourself. Kindle, $9.95 print, $20

"I want to thank you for creating your book Get a Job, Build a Real Career and Defy a Bewildering Economy. It is rare to find a person with a mind like yours, who can take a holistic systems view of things without being captured by specific perspectives or agendas. Your contribution to humanity is much appreciated."

Laura Y.

Gordon Long and I discuss The New Nature of Work: Jobs, Occupations & Careers(25 minutes, YouTube)

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

| Thank you, James P. ($50), for your gloriously generous contribution to this site-- I am greatly honored by your steadfast support and readership. |

|