If you make it so burdensome to operate a legit business, then you're basically giving people without big lines of credit and capital few choices but to work in the cash-only underground economy.

It won't be much of a surprise to those living outside the Washington D.C. beltway and the Unicorn Herd of start-ups selling for millions of dollars that the underground cash-only economy is one of the few bright spots in the U.S. economy. Correspondent B.U. recently submitted this report from rural America in response to my entry

What Happens to our Economy as Millions of People Lose the Habits of Hard Work?, which mentioned those in the cash-only sector as not showing up in official employment statistics:

It is very common for folks where I live to get some form of subsidy be it SSI or WIC or whatever. Then they maintain their lifestyle by:

-- Selling items for cash on Craigslist:

This is mostly sub $1500 cars, Building materials or scrap metal.

I know quite a few folks that are doing very well in this line of business.

--Selling at various ‘trades-days’:

A friend mine clears ~$100K just trading in gold, firearms and ammunition.

Others I know trade cattle and livestock.

Another friend repairs cars at his home. He has weeks of backlog and turns away work all the time.

The key to all of this is that these folks have no official business. They trade only in cash. They do not make deposits in the bank except for the government checks.

The point is that for these folks, unplugging was a pay raise just in the tax exposure. When they get sick, they claim indigent and get whatever they need.

The spread between the burden of regulation and taxes is getting so onerous that folks are just falling into the very solution you describe.

I believe your focus is more professional in nature in terms of folks being a hired gun (i.e. free-lancer/contract employee). But what I see are the non-professionals as the ones who are really moving to fill the void of value that is growing as deflation/inflation oscillate.

Thank you, B.U., for the straight-up report from the real world. Despite the fact I pay all my taxes (and am royally reamed as a result), I sympathize with those making tax-free incomes in the cash-only economy.

Back when I had multiple employees in the 1980s, I was basically working to pay workers compensation insurance (40% to 80% of the hourly wage for construction workers), liability coverage, unemployment insurance, disability insurance, FICA (employers' share of Social Security), excise tax, income tax, rent on the office that we were required by law to maintain, healthcare insurance for all the employees, filling out HUD/FHA forms required when building homes with FHA loans, and so on. Then there's the cost of accounting and tax returns (complicated when you're operating a business), and a long list of other expenses I've forgotten.

My partner and I had a stock response when any employee griped about all the money we must be making: we'd take out our keys to the office and offer it to them, and say "payday's on Friday. It's all yours." I'd have been relieved if any had been dumb enough to accept the offer. No one ever did.

It's no wonder that legit small business and self-employment is often a struggle for financial survival. I've covered the travails of one serial entrepreneur in launching a new business in today's America: the costs were so heavy that he gave up. It was impossible to actually make a living once you met all the absurd regulations, codes and requirements.

The people enforcing the regulations ("just doing my job") are paid by taxpayers; their job is safe, their paycheck and benefits guaranteed.

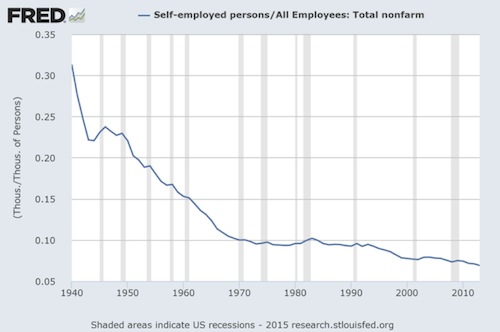

This chart shows the tax-paying self-employed as a percentage of those with jobs (all nonfarm employees). According to the FRED data base, there are 142 million employed and 9.4 million self-employed. (The incorporated self-employed, typically physicians, attorneys, engineers, architects etc. who are employees of their own corporations, total about 5 million.)

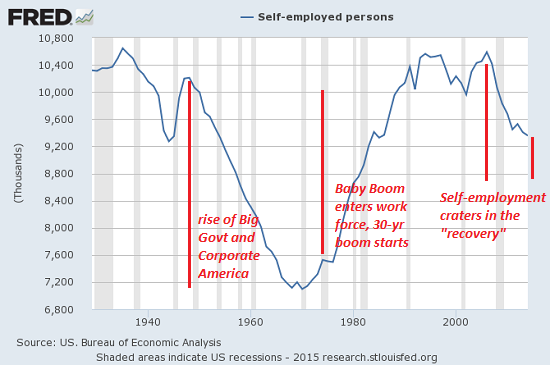

This chart depicts self-employment from 1929 to 2015. Self-employment is cratering in the "recovery" of high taxes, senseless regulations and burdensome report-filing (big fines if you don't comply), tax preparation, business licence fees, fishing-expedition lawsuits, etc.

I have no problem with paying all my taxes for a couple of reasons. One relates to "Render therefore unto Caesar the things which are Caesar's." That's my view, but I don't hold anyone else to it. That's up to them to deal with.

Having experienced COINTELPRO in the early 1970s, I know what's it like to be an enemy of the State. Violating tax codes makes you a very easy target for the state. If you want to draw a target on your back, be my guest. I'm going to pass.

(The FBI thug who "was just doing his job" snarled at me, "This isn't the Sunshine Biscuit Company, this is the FBI!" Hopefully their witty-threat training has improved.)

Anyone who can't find a state/Corporate America job or says Take This Job And Shove It has my sympathy. I've been down to my last $100, and it's a lonesome, troublesome feeling. If you make it so burdensome to operate a legit business, then you're basically giving people without big lines of credit or plenty of capital and regulatory expertise few choices but to work in the cash-only underground economy.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

Thank you, Ryan R. ($5/month), for your stupendously generous subscription to this site -- I am greatly honored by your steadfast support and readership.

| |

Thank you,Terry M. ($5/month), for your marvelously generous subscription to this site -- I am greatly honored by your support and readership.

|