So ride your bubble of choice up--stocks, bonds, housing, bat guano, take your pick--but it's best to keep your thumb on the sell button.

One person's bubble is another person's "fair market value." What is clearly an outrageously overvalued asset perched at nosebleed levels of central-bank fueled speculative euphoria is to the owner an asset at "fair market value."

But beneath the euphoric confidence that valuations can only drift higher forever and ever is the latent fear that something could stick a pin in "my bubble"-- that is, whatever bubblicious asset we happen to own and treasure as a source of our financial wealth could be popped, destroying not just our financial bubble but our psychological bubble of faith in permanent manias.

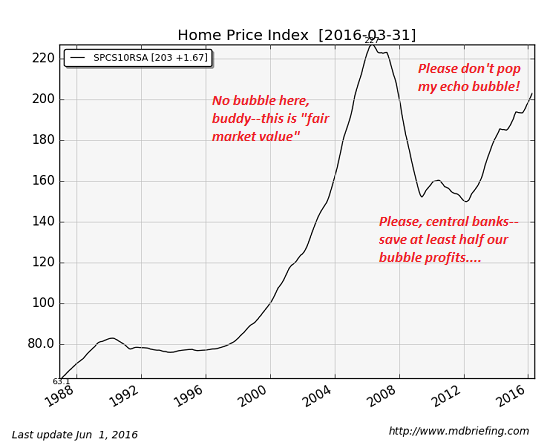

Consider housing prices, which are clearly in an echo-bubble of the Great Housing Bubble of 2000-2007. (Chart courtesy of

Market Daily Briefing.)

The psychological underpinning of all bubbles and echo bubbles is on display here. In the first bubble, those benefiting from the stupendous price increases are not just euphoric at the surge in unearned wealth--they believe the hype with all their hearts and minds that the bubble is not a bubble at all, it's all just "fair market value" at work.

In other words, the massive increase in unearned personal wealth is not just temporary good fortune--it is permanent, rational and deserved.

Alas, all bubbles, no matter how euphoric or long-lasting, eventually pop. All the certainties that seemed so obviously true and timeless to the believers melt into air, and their touching faith that the bubble valuations were permanent, rational and deserved dissipates in a wrenchingly painful reconciliation with reality.

The agonized cries of those watching their bubble-wealth vanish do not fall on deaf ears. The same central bankers that inflated the bubble with super-low interest rates suddenly see their much-loved wealth effect (i.e. the bubble-generated psychological sense of wealth that emboldens people to borrow and spend money they shouldn't borrow and spend) imploding before their eyes.

In the panicky haste of blind expediency, central bankers drop interest rates to zero and unleash unlimited liquidity to save the bubbles they inflated. Instead of flushing the system of bad debt and speculative leverage and allowing the market to reprice impaired assets, central bankers push the perverse incentives that inflated the bubble to new highs.

Should lowering interest rates to zero fail to reflate the bubble, central bankers then start buying assets hand over fist, creating trillions of dollars, yuan, yen and euros out of thin air to boost asset prices with direct and indirect purchases.

The relief of those saved from financial destruction by the heroic efforts of central bankers is palpable. Rather than retrace to pre-bubble levels, valuations are caught in mid-air and pushed higher by central bank liquidity and asset purchases.

But the naive faith of asset owners cannot be restored to its pre-bubble virginal state. The nagging realization that all bubbles are temporary and irrational, and that bubblicious wealth is unearned and undeserved, lingers in the traumatized psyches of the former true believers.

Sensing their vulnerability, every asset owner demands: don't pop my bubble!Go pop somebody else's bubble, but please please please leave mine intact.

This knowledge that all bubbles pop sooner or later generates a skittishness that finds voice in sell-offs. Once the skittish owners of a bubblicious asset sense the nail is pushing against the bubble and the inevitable popping is nigh, they sell sell sell.

No wonder the stock market has sold off hard three times in the past 18 months. Every punter who's not a sucker knows that 1) stocks are overvalued, 2) every bubble eventually pops, and 3) the survivors are those who sell at the first whiff of trouble.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Melissa A. ($50), for your magnificently generous contribution to this site-- I am greatly honored by your steadfast support and readership.

| |