The grim reality is that real inflation is 7+% per year.

What would happen if the real rate of inflation was revealed? The entire status quo would immediately implode. Consider the immediate consequences to Social Security, interest rates and the cost of refinancing government debt.

Unbiased private-sector efforts to calculate the real rate of inflation have yielded a rate of around 7% to 13% per year, depending on the locale--many multiples of the official rate of around 1% per year.

So what happens if the status quo accepted the reality of 7+% inflation? Here are a few of the consequences:

1. Social Security beneficiaries would demand annual increases of 7+% instead of zero or near-zero annual increases. The Social Security system, which is already distributing more benefit payments that it is receiving in payroll tax revenues, would immediately go deep in the red.

(Please don't claim the SSA Trust Fund will be solvent for decades. I've dismissed the fraud of the illusory Trust Fund many times. The reality is the federal government has to borrow every dollar of deficit spending by Social Security by selling more Treasury bonds, just as it borrows every other dollar of deficit spending.)

The Social Security system would be revealed as unsustainable if real inflation (7+% annually) were made public.

2. Global investors might start demanding yields on Treasury bonds that are above the real rate of inflation. If inflation is running at 7%, then bond buyers would need to earn 8% per year just to earn a real return of 1%.

Central states are only able to sustain their enormous deficit spending because interest rates and bond yields are near-zero or even below zero. If the federal government suddenly had to pay 8% to roll over maturing government bonds, the cost of servicing the existing debt--never mind the cost of borrowing an additional $400 billion or more every year--would skyrocket, squeezing out all other government spending and triggering massive deficits just to pay the ballooning interest on existing debt.

Bond yields of 8+% would collapse the status quo of massive government deficit spending.

3. Private-sector interest rates would also rise, crushing private borrowing.How many autos, trucks and homes would sell if buyers had to pay 8% interest on new loans? A lot less than are being sold at 1% interest auto loans or 3.5% mortgages.

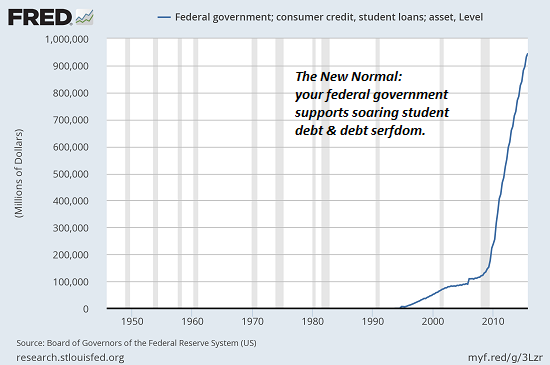

4. Any serious decline in private and state borrowing would implode the entire system. Recall that a very modest drop in new borrowing very nearly collapsed the global financial system in 2008-09, as the whole system depends on a permanently monstrous expansion of new borrowing to fund consumption, student loans, taxes, etc.

How many billions of dollars will be siphoned off the debt-serfs, oops, I mean students, should student loans be issued at interest rates north of 8%? (Some private student loans are already in the range of 8%; where will those go if inflation is recognized as running at 7% per year?)

The grim reality is that real inflation is 7+% per year, and this reality must be hidden behind bogus official calculations of inflation as this reality would collapse the entire status quo. Super-wealthy elites earning 10+% yields on stock, bond and real estate portfolios aren't particularly impacted by 7% inflation; their real wealth continues to expand nicely.

Who's being destroyed by 7+% real inflation? Everyone whose income has stagnated and everyone who depends on wages rather than assets to get by--in other words, the bottom 95%.

My new book is #7 on Kindle short reads -> politics and social science: Why Our Status Quo Failed and Is Beyond Reform ($3.95 Kindle ebook, $8.95 print edition)For more, please visit the book's website.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Maurice M. ($10), for your most generous contribution to this site-- I am greatly honored by your support and readership.

| |