Even if the Fed hadn't institutionalized perverse incentives to borrow and speculate in asset bubbles, the economy would still be generating far fewer winners than losers.

If we scrape away the shuck and jive (a difficult task when the majority of what the media presents is shuck and jive) the whole economy boils down to who reaps the gains and who eats the losses. While conventional economics focuses on how much the pie is expanding (GDP is higher, yea!), the real action is in how the pie is sliced up and distributed.

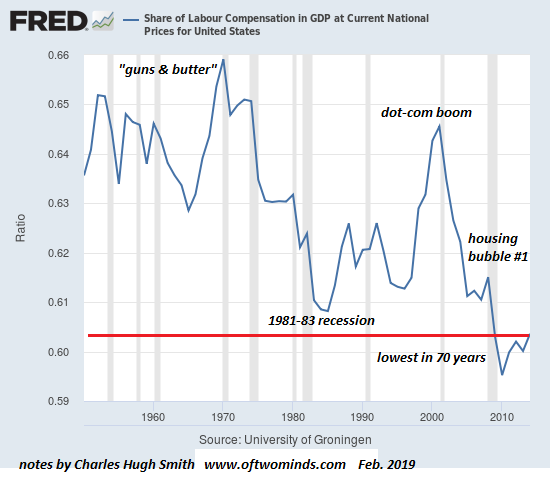

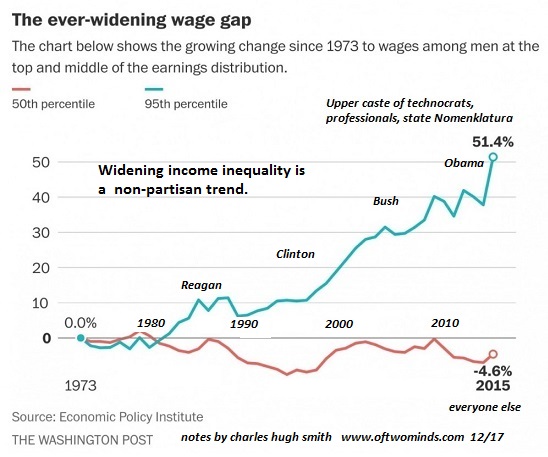

Since the end of the dot-com boom (see chart below), which actually increased labor's share of the gains, the gains have all flowed to those holding assets that have bubbled higher while the losses have been distributed to 95% of those selling their labor for wages, and to everyone exposed to high inflation in big-ticket expenses such as healthcare insurance, rent and college tuition.

The central bank shenanigans that exacerbated this remarkably unequal distribution were sold as promoting "the wealth effect": as assets bubbled higher, the lucky recipients of this unearned wealth would feel richer and would then start borrowing and spending freely, propping up a sickly economy which was no longer expanding organically.

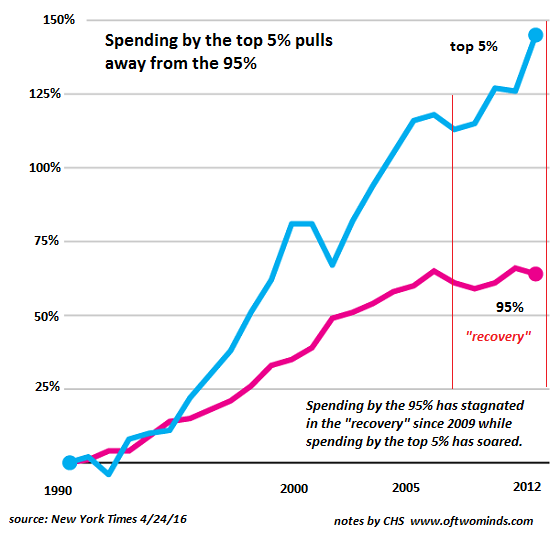

But since only the top 5% of households own enough assets to matter, this amounted to a stealth "trickle down" policy in which the top slice of asset owners would be so enriched they would spend more, and this spending would trickle down to the bottom 95%.

As this chart shows, the spending of the top 5% has far outpaced the spending of the bottom 95%, but as the chart of labor's share of the economy reveals, very little has trickled down.

Not much trickled down. The Mercedes salesperson got a commission and the bistros and bars are crowded with free-spending top-5ers and wannabes living on debt, but this trickle hasn't been enough to push wages higher.

Meanwhile the neofeudal structure of the American economy-- an economy dominated by state-cartels that enforce monopolistic rentier skims on vast swaths of the economy (healthcare, higher education, national defense, etc.)-- guarantees prices rise while wages stagnate. Many of us have addressed the reality that official inflation (Consumer price Index) doesn't accurately reflect real-world price increases, especially in big-ticket expenses such as healthcare, higher education, housing/rent, vehicles, services, etc.

Also missing in the statistics is the enormous difference between those protected from real-world price increases via government employment or subsidies, and those fully exposed to the unrelenting leaps in costs the unprotected.

By reducing interest on safe assets such as savings to near-zero, the Fed has pushed everyone into risk assets. This has pushed prices higher as bubbles inflate, but it's exposed much of the nation's capital to catastrophic declines as the artificial asset bubbles pop.

Even if the Fed hadn't institutionalized perverse incentives to borrow and speculate in asset bubbles, the economy would still be generating far fewer winners than losers. As I've described in my books (

Get a Job and Build a Real Career,

Money and Work Unchained and

Pathfinding our Destiny), many of the skills and credentials that once had scarcity value no longer have any scarcity value, and so the value of those skills and credentials in the marketplace has declined accordingly.

When only 20% of the working populace had a college diploma, that diploma had some scarcity value. Now that roughly half the working populace has a college diploma or some college, the scarcity value of college diplomas has fallen to near-zero except in specific fields--fields which are quickly inundated with a flood of new graduates once the word gets out, reducing the value of that diploma to background noise.

As a result of these factors--the neofeudal economy and an over-abundance of normal capital and labor--only the top 5% of wage-earners have enjoyed real increases in earned income.

There are no easy answers to these structural realities. It's difficult to wean an economy that's dependent on assets bubbles off of asset bubbles, and it's difficult to reverse demographic and technological changes.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

Thank you, Edward ($6.13/month), for your monumentally generous pledge to this site -- I am greatly honored by your steadfast support and readership.

| |

Thank you, Patrick J. ($5/month), for your magnificently generous pledge to this site -- I am greatly honored by your steadfast support and readership.

|