How Breakdown Cascades Into Collapse

Maintaining the illusion of confidence, permanence and stability serves the interests of

those benefiting from the bubbles and those who prefer the safety of the herd, even

as the herd thunders toward the precipice.

The misconception that collapse is an all or nothing phenomenon is common:

Either the system rights itself with a bit of money-printing and rah-rah or it collapses

into post-industrial ruin and gangs are battling over the last stash of canned beans.

Neither scenario considers the fragility and resilience of the socio-economic system as a whole.

It is both far more fragile than the believers in the permanence of the waste is growth

model grasp and more resilient than the complete collapse prognosticators grasp.

The recent relatively mild logjams in global supply chains of essentials are mere glimpses of

precariously fragile delivery-supply systems. These can be understood as bottlenecks

that only insiders see, or as unstable nodes through which all the economy's connections run. Put

another way, the economy's as a network appears decentralized and robust, but this illusion

vanishes when we consider how the entire economy rests on a few unstable nodes.

One such node is the delivery of gasoline and fuels. It's such an efficient and reliable

system that 99.9% of us take it for granted: there will always be plenty of gasoline at

every station, the tanks of jet fuel will always be topped off, and so on.

The 0.1% know that this system, once disrupted, would knock over dominoes all through the economy.

Hyper-efficiency and hyper-globalization has reduced the number of producers of essentials

to the point that disruptions cannot be overcome with redundant sources. We see this everywhere in the global

economy: a handful of plants and companies (sometimes a single source of essential components)

process or manufacture essential components in much larger systems.

This is how you end up with thousands of newly manufactured vehicles parked in lots awaiting

one critical part that is in short supply.

Another key weakness is the entire system's reliance on debt, leverage and speculation.

Few seem to understand that physical production and delivery systems can grind to a halt for

financial reasons--for example, lines of credit being pulled, a counterparty to some arcane

commodity swap goes under, taking the presumably solvent corporation down with it, and so on.

The more debt that's been piled up, the greater the instability of the entire system.

Risk always appears low until the system destabilizes, and then all the hedges fail and

risk breaks out, flooding through the entire financial system.

Leverage is great fun on the way up, as it magnifies gains. Since the Federal Reserve

implicitly guarantees that "buy the dip" will generate massive gains, why not ramp up

leverage ten-fold to maximize those Fed-guaranteed gains?

Leverage is less fun on the way down. When the underlying collateral has shrunk to

20% of the leveraged bets being made, a 21% decline in the asset wipes out all the collateral

holding up the palace of leveraged debt.

The Fed can print money but it can't create collateral, nor can it make insolvent

entities solvent. All the Fed can do is increase the debt and leverage, which is not the

solution, it's the problem.

Speculation is also inherently unstable, as the euphoric herd, once startled, turns

in panic and stampeded in fear. Markets which appeared liquid--i.e., sellers could count

on someone buying as many millions of shares as they desired to sell--become illiquid, as

buyers vanish like mist in Death Valley. With buyers gone, prices plummet to levels

the herd reckoned "impossible" just days before.

The Fed's entire strategy in the 21st century has been to inflate asset bubbles that generate

the illusion of wealth--the so-called wealth effect which is presumed to inspire

voracious borrowing and spending.

Unfortunately for the Fed, most of the gains flowed to the top 0.1%, and an economy based

on a handful of billionaires buying super-yachts and spaceships is a line of dominoes awaiting

the inevitable "accident." So there are two systemic problems with relying on asset bubbles

to generate "wealth": 1) since 90% of the assets are owned by a thin slice of the populace,

bubbles increase destabilizing inequality, and 2) bubbles are intrinsically unstable. So the

U.S. economy, dependent on the Fed for the "juice" of monetary stimulus, is now dependent on

incredibly unstable bubbles in assets, debt and leverage, bubbles which have generated

extremes of wealth/income inequality that are destabilizing the social and political orders.

As the three charts below illustrate, the fragility and instability are well hidden until

it's too late: bubbles, debt, leverage, budgets and revenues can only click higher because

the system breaks down if there is any sustained decline (the rising wedge model of breakdown).

Once the subsystems fail, there's no putting the eggshell back together.

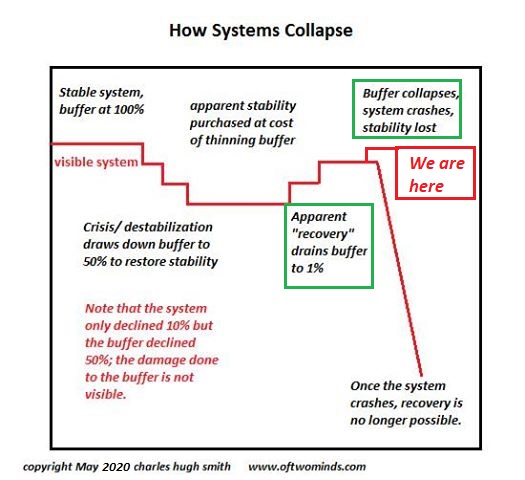

The second chart depicts how buffers thin beneath the surface, masking the systemic

fragility. The loss of redundancy, the decay of maintenance, the loss of experienced

workers--all of these are hidden from public view until the system breaks down.

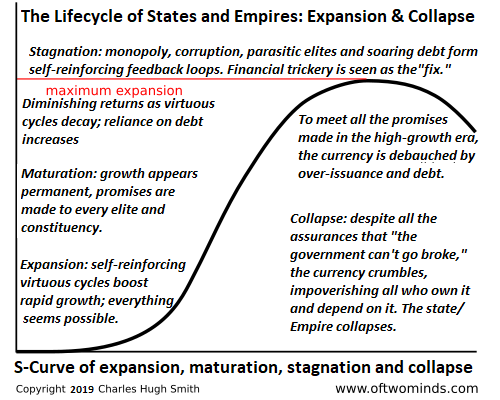

The third chart tracks the S-curve of expansion, confidence, complacency, delusion and

collapse followed by human systems, from nations to empires to corporations: as the

buffers thin and the rising wedge reaches an apex of vulnerability, the leadership evinces

a delusional confidence in the permanence and stability of increasingly fragile, unstable

systems.

Maintaining the illusion of confidence, permanence and stability serves the interests of

those benefiting from the bubbles and those who prefer the safety of the herd, even

as the herd thunders toward the precipice.

This is how breakdowns in apparently stable subsystems triggers the fall of dominoes throughout

the larger system, leading to a collapse that was widely viewed as "impossible." Such is the

power of complacency and delusion.

If you found value in this content, please join me in seeking solutions by

becoming

a $1/month patron of my work via patreon.com.

My new book is available!

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

20% and 15% discounts (Kindle $7, print $17,

audiobook now available $17.46)

Read excerpts of the book for free (PDF).

The Story Behind the Book and the Introduction.

Recent Videos/Podcasts:

AoE Salon #44: We say "Satyagraha", they say "sedition" with author Max Borders (1:03 hrs)

My COVID-19 Pandemic Posts

My recent books:

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic

($5 (Kindle), $10 (print), (

audiobook):

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake

$1.29 (Kindle), $8.95 (print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 (Kindle), $15 (print)

Read the first section for free (PDF).

Become

a $1/month patron of my work via patreon.com.

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Marsha B. ($54), for your superbly generous contribution to this site -- I am greatly honored by your support and readership. |

Thank you, Ann K. ($5/month), for your marvelously generous pledge to this site -- I am greatly honored by your steadfast support and readership. |

|

|

Thank you, Robert S. ($5/month), for your magnificently generous pledge to this site -- I am greatly honored by your steadfast support and readership. |

Thank you, Bart N. ($54), for your splendidly generous contribution to this site -- I am greatly honored by your support and readership. |