A Nation of Junkies: The Empty Future of a Stimulus-Speculation Economy

Now that the US economy is totally dependent on trillions of dollars in stimulus and speculative gains reaped from the stimulus, there is no Real Economy left to pick up the pieces when the credit-stimulus-speculation bubbles all pop.

When economists speak of organic growth, they're referring to growth that arises naturally from the expansion of population, advances in productivity gained from better training and wise investments and the fruits of innovation.

Organic growth doesn't need constant stimulus, nor is it dependent on speculation. It doesn't need to be juiced by central banks and government to function. In an economy that isn't dependent on stimulus, the role of central banks is limited to being the lender of last resort in periodic financial crises, and government's role is to serve the common good by funding what fosters the common good but isn't profitable enough for private companies to pursue, for example, rural electrification and critical infrastructure.

Compare this Real Economy with the Artificial Economy we now have that is completely dependent on central bank and government stimulus and rampant speculation. If either the stimulus or speculation disappeared, the economy would collapse. Without constantly increasing monetary and fiscal stimulus, the asset bubbles inflated by stimulus would collapse.

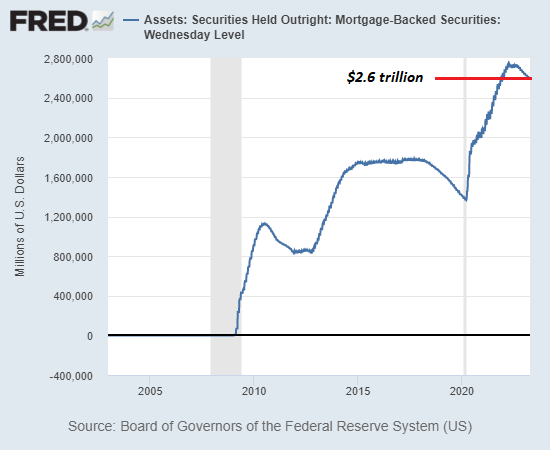

Every decision in this stimulus-speculation-dependent economy is keyed off of Federal Reserve stimulus or federal spending guarantees. Consider the decision to buy or build a residence to live in or hold as an investment. This decision is now keyed to Federal Reserve manipulation--scrape away the sugar-coating and this is what it is--of mortgage rates and the market for mortgages (mortgage backed securities) and federal government backstops and guarantees.

Glance at the first chart below of the Fed's "intervention" in the mortgage market: somehow the housing / mortgage market survived without the Fed owning any mortgage backed securities prior to 2009, but now the Fed must intervene to the tune of trillions of dollars to keep the housing / mortgage market from imploding.

All this stimulus is sold as "help" but it all ends up "helping" the wealthiest few at the expense of the bottom 90%.

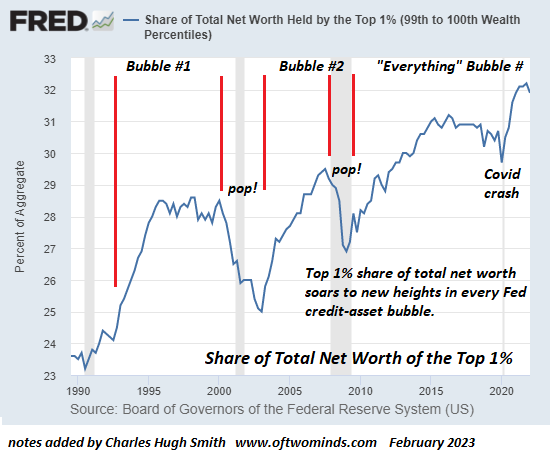

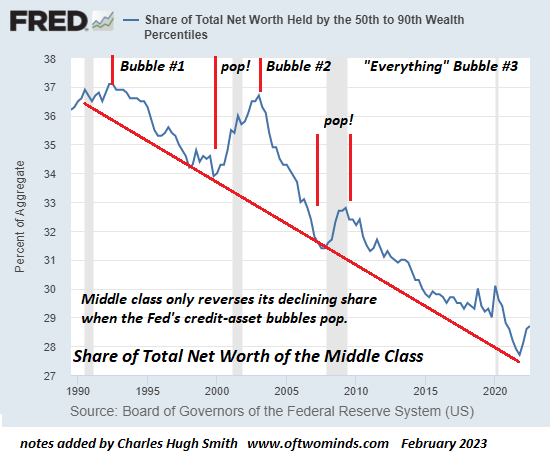

Look at the two charts below of the percentage of wealth held by the top 1% and the percentage of wealth held by the middle class, those households between 50% and 90% in terms of household income. Every new Fed / federal stimulus pushes the wealth of the 1% higher and the wealth of the middle class lower.

To those pushing the stimulus, the soaring wealth of the top 1% is "success" because that's their circle of colleagues and pals. If we're doing great, everyone must be doing great. Such is the hubris and denial olf our financial and political leadership.

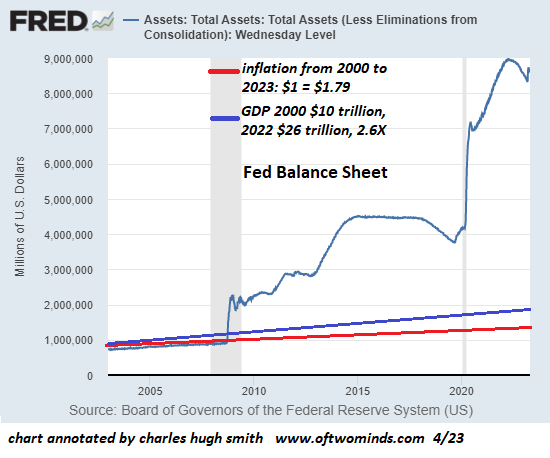

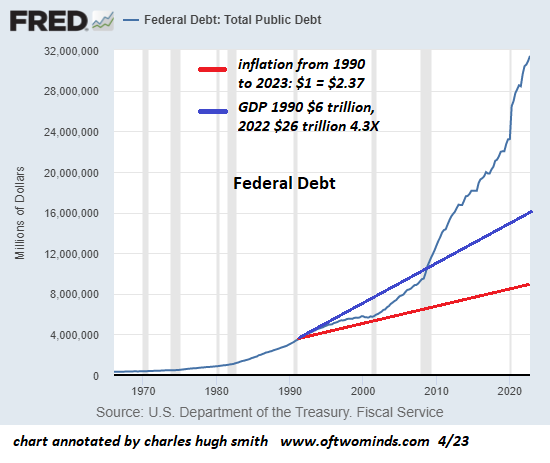

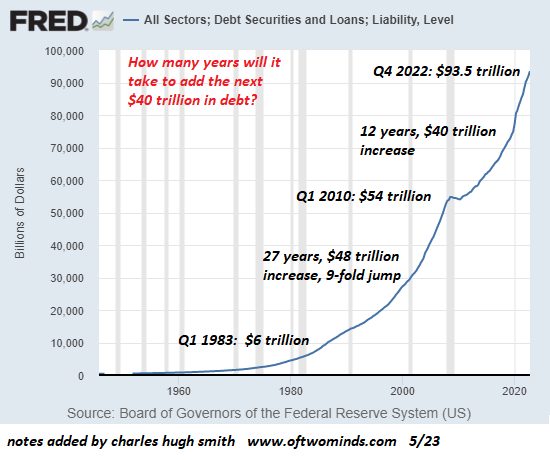

You'll notice three charts all display parabolic rises: the Fed balance sheet, federal debt and total debt.

The primary form of stimulus is credit: expand the availability of credit and (until recently) make it cheaper to borrow by manipulating interest rates lower.

All this "free money" fueled a dependency on speculation for "growth," a dependency that has hollowed out the economy.

As a direct result of all this stimulus / credit, corporations have bought tens of thousands of homes as rentals, inflating another housing bubble. Investors have snapped up tens of thousands of dwellings to cash in on the short-term rental (AirBnB etc.) boom, effectively distorting the long-term rental markets and pushing rents higher.

Debt and stimulus tracing parabolic ascents cannot end well. Eventually they collapse under their own weight.

Every junkie has an excuse. Every junkie proclaims I can stop any time. Now that the US economy is totally dependent on trillions of dollars in stimulus and speculative gains reaped from the stimulus, there is no Real Economy left to pick up the pieces when the credit-stimulus-speculation bubbles all pop.

And so we're treated to the infantile charades of the Federal Reserve and our elected officials, both bleating how wunnerful everything is while in private, with the mics safely muted, they're desperate to push the inevitable implosion off just a few more months. They have no alternative, and no way to return to an unmanipulated economy that isn't dependent on ever larger injections of stimulus and parabolic increases in debt.

The problem, friends, is the US economy has run out of veins for the coming injections of stimulus. The costs of dependency on artifices of stimulus and mood enhancement--everything's wunnerful!--are coming due, as they always do.

Unfortunately, there's no solution other than Cold Turkey, the collapse of all stimulus and all speculation.

We're about to find out just how unpleasant Cold Turkey can be, and babbling rants of denial will only make it worse.

New Podcast:

Charles Hugh Smith on Getting Ready for a Real Recession (38 min) (38 min)

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

Read the first chapter for free (PDF)

Read excerpts of all three chapters

Podcast with Richard Bonugli: Self Reliance in the 21st Century (43 min)

My recent books:

The Asian Heroine Who Seduced Me

(Novel) print $10.95,

Kindle $6.95

Read an excerpt for free (PDF)

When You Can't Go On: Burnout, Reckoning and Renewal

$18 print, $8.95 Kindle ebook;

audiobook

Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States

(Kindle $9.95, print $24, audiobook)

Read Chapter One for free (PDF).

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel)

$4.95 Kindle, $10.95 print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print)

Read the first section for free

Become

a $1/month patron of my work via patreon.com.

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, William H. ($50), for your extremely generous contribution to this site -- I am greatly honored by your steadfast support and readership. |

Thank you, Seeker ($5/month), for your wondrously generous pledge to this site -- I am greatly honored by your support and readership. |

|

Thank you, Kitty B. ($5/month), for your splendidly generous pledge to this site -- I am greatly honored by your support and readership. |

Thank you, Richard H. ($50), for your superbly generous contribution to this site -- I am greatly honored by your steadfast support and readership. |