Who Wins and Who Loses in a Deep Global Recession?

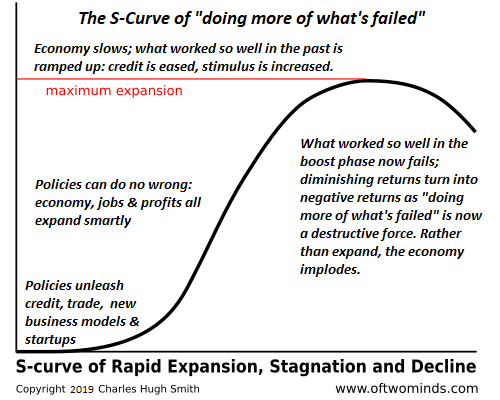

Globalization and financialization have fueled the global economy for 40 years. Now they're in the decline phase of the S-Curve.

Does anyone benefit from a deep, prolonged global recession? Perhaps not in absolute terms, but in relative terms we can say some will suffer less than others. We can also say that some will strengthen their relative positions vis a vis competitors and others will lose ground / weaken, with potentially fatal consequences if the recession leads to systemic instability, i.e. phase change or tipping point.

We tend to speak of economics in abstractions and statistics, but the consequences are social and political. Humans tend to get restive when they're hungry or their lifestyle is no longer affordable.

Small changes in complex, tightly-bound emergent systems can generate cascading consequences that bring the system down. The initial conditions of such systems may appear inconsequential when there are surpluses of food, energy, credit, jobs, etc., but they are often recognized as critically consequential once cascading failures unravel the entire system.

In other words, stability is always contingent in tightly-bound emergent systems like complex economies. Everything looks stable until it's not. This is why it's worth looking at who benefits and who loses ground in a prolonged, deep global recession of the sort the global economy is entering (I know it's taboo to say the R-Word, but avoiding words doesn't actually change systems dynamics.)

Those nations that lose ground might just stagnate, or they might be pushed off a cliff. Apparently small declines can end up unraveling the entire economy, with severe social and political consequences.

Let's start with supply and demand, as those influence price and availability via scarcity, costs and needs.

Demand comes in two basic flavors, elastic and inelastic. The demand for fresh water and food is inelastic, in that we don't have the option of foregoing either for long.

Within the broad human need for sustenance, the demand for specific types of food is elastic, meaning that price and cultural tastes influence demand. If steak becomes too expensive, consumers substitute lower-cost chicken. A food item might be abundant and low-cost but the culture is unfamiliar with it or doesn't favor it.

One way to understand these dynamics is to ask: is there a substitute for what's needed and what's desirable?

If there is a substitute, then demand tends to be elastic. If there is no substitute, then demand tends to be inelastic.

For gasoline-powered vehicles, there is no substitute for hydrocarbons, though biofuels like ethanol can be added. There is no substitute for fresh water.

Needs are inelastic, desires are elastic. We have to have food, but if we desire caviar and can afford it (and it's available), then we can consume caviar. If all we can afford are beans and rice, we consume beans and rice.

Changes in behavior influence demand. Not wasting food reduces how much food we have to buy. Carpooling reduces our consumption of gasoline, and so on. Though behavioral changes can make a substantial dent in demand, there's no way to eliminate our basic needs for water, food, shelter and energy to zero.

But behavioral changes can dramatically change price. If the cost of producing a commodity is high, faltering demand can reduce the price below production costs. The producers will then have to choose between restricting production and thus income, or go broke selling their surplus below the cost of production.

Supply responds to the incentives of price and the constraints of nature, energy and technology. In abstract economic theory, there's always a way to increase supply or substitute another product to meet demand. But the real world isn't quite so simplistic. Take grains, which are the foundation of human food because they're storable, transportable, nutritious and lend themselves to large-scale, mechanized farming and processing.

Unfortunately, only a few regions on Earth generate the vast majority of grain surpluses. The same can be said for hydrocarbons and other essentials. If any of these key sources of exportable surpluses of essentials is taken offline for any reason, the world economy will soon face scarcities for which there are no substitutes.

If we follow these realities to their logical conclusions, we end up with these conclusions:

1. A prolonged, deep global recession will reduce demand for everything, even essentials, but especially for desirables. Behavioral changes will substantially reduce demand for energy as people reduce inessential consumption (tourism, etc.). If consumers can no longer afford beef, demand for certain grains will fall accordingly, as cattle are generally fed grain.

2. The cost of production will become the critical determinant of consequences. If consumers can no longer afford to consume as much energy as they once did, price will drop regardless of production costs. Producers will experience substantial declines in their income as a result. Those with high production costs may go broke once price drops below their costs, and those with enormous domestic spending will experience social and political turmoil as their free-spending governments are forced to retrench.

3. Nations that can reliably produce exportable surpluses of essentials at low cost will take market share from those with high production costs. Their income may drop but not by as much as high-cost producers.

4. Costs are constrained by initial conditions and specific constraints imposed by nature, infrastructure, and political and social conditions. Weather and fresh water availability are constraints. Some high-cost labor can be offshored to cheaper labor markets, but not all high-cost labor can be exported. Industries that require constant capital investment to maintain production (an initial condition of that industry) will start breaking down once investment is reduced in a recession.

5. Those nations that can provide most or all of their essentials domestically will weather a prolonged recession far better than those dependent on global surpluses for essentials. Once people are hungry, the clock of Revolution starts approaching midnight.

6. Those nations that are heavily dependent on the manufacture of desirables will face significant declines in demand. Disposable incomes (what's left after paying essentials and debt) are already being crushed by inflation. Add in declines in jobs and reduced overtime / bonuses and the result is the potential erasure of most household disposable income.

7. Time is the enemy of the vulnerable and the friend of the self-reliant. This dynamic is scale invariant, meaning that it applies to individuals and households (something I discuss in my book Self-Reliance in the 21st Century) but also to enterprises and nations. As incomes decline, the self-reliant have a much easier time adapting to constraints. Those who depend on the continuity of import-dependent, high-cost, high-consumption economies as surpluses and incomes dry up will edge closer and closer to the cliff of systemic unraveling.

8. Social and political cohesion will become determinants of stability and instability. Fragile socio-political regimes based solely on rising prosperity and generous state welfare will face existential instability as these decay and unravel. States that manage to keep their populations supplied with essentials will maintain stability, those who let inequality distribute essentials will stumble into the abyss of instability.

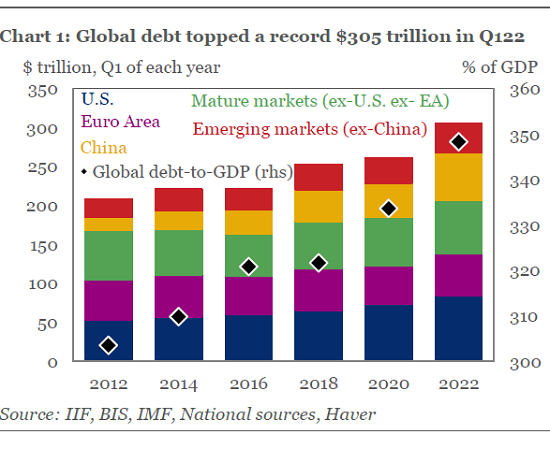

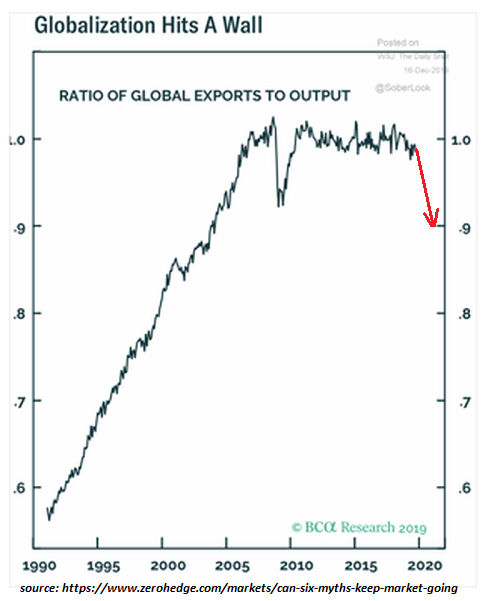

Globalization and financialization have fueled the global economy for 40 years. Now they're in the decline phase of the S-Curve. The status quo response to this decay / decline is to do more of what's failed until it fails spectacularly.

The reason why we keep doing more of what's failed is there are no substitutes for globalization and financialization. The 40+ years of soaring prosperity are ending and a new era is being in which globalization and financialization can no longer fuel growth. Instead, they only accelerate instability and decay.

Funny things happen when complex, tightly-bound systems unravel. Profits get clawed back. Lifestyles that were taken as birthrights are on permanent back-order. Gambling no longer yields reliable gains. The recent past in no longer a reliable guide to the present or the future. Economic theories fail, as scarcities aren't alleviated by substitutions and new sources being brought on line. Technologies held up as global solutions cannot be scaled. Emergent systems start displaying characteristics that are not just the sum of their parts. Predictability and stability are lost. The impossible suddenly becomes not just possible but inevitable.

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

My new book is now available at a 10% discount ($8.95 ebook, $18 print):

Self-Reliance in the 21st Century.

Read the first chapter for free (PDF)

Read excerpts of all three chapters

Podcast with Richard Bonugli: Self Reliance in the 21st Century (43 min)

My recent books:

The Asian Heroine Who Seduced Me

(Novel) print $10.95,

Kindle $6.95

Read an excerpt for free (PDF)

When You Can't Go On: Burnout, Reckoning and Renewal

$18 print, $8.95 Kindle ebook;

audiobook

Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States

(Kindle $9.95, print $24, audiobook)

Read Chapter One for free (PDF).

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet

(Kindle $8.95, print $20,

audiobook $17.46)

Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $5, print $10, audiobook)

Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel)

$4.95 Kindle, $10.95 print);

read the first chapters

for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print)

Read the first section for free

Become

a $1/month patron of my work via patreon.com.

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, newbs3247 ($50), for your splendidly generous Substack subscription to this site -- I am greatly honored by your support and readership. |

Thank you, starucca ($5/month), for your superbly generous Substack subscription to this site -- I am greatly honored by your support and readership. |

|

Thank you, bpodkulski ($5/month), for your superbly generous Substack subscription to this site -- I am greatly honored by your support and readership. |

Thank you, mcbride ($50), for your outstandingly generous Substack subscription to this site -- I am greatly honored by your support and readership. |