The No-Win Bubble "Wealth Effect": Either Way We Lose

Spoiler alert: this ends badly.

I have endeavored to explain how our economy has changed dramatically over the past 50 years beneath the surface. Nothing that's going to happen in the future will make sense unless we understand this, so refill your beverage of choice and let's go through what changed.

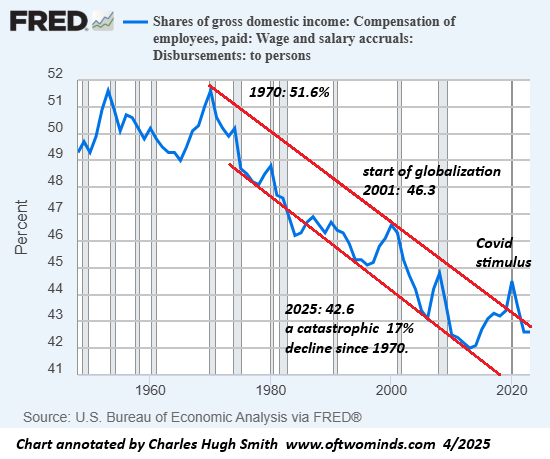

Wages gained ground 1945 - 1975, and lost ground 1975 - 2025. In the "glorious 30" (Trente Glorieuses) years of sustained global growth 1945 - 1975, wages' share of the economy remained around 50% of the nation's income. As the economy expanded, wages increased in step with the economy.

Since the mid-1970s, that trend has reversed. Wages have lost ground for the past 50 years. As the economy expanded, wages' share declined, meaning the economy's gains flowed to capital rather than wages. (Chart #1 below)

This wealth transfer was non-trivial: $150 trillion was siphoned from wages to owners of capital.

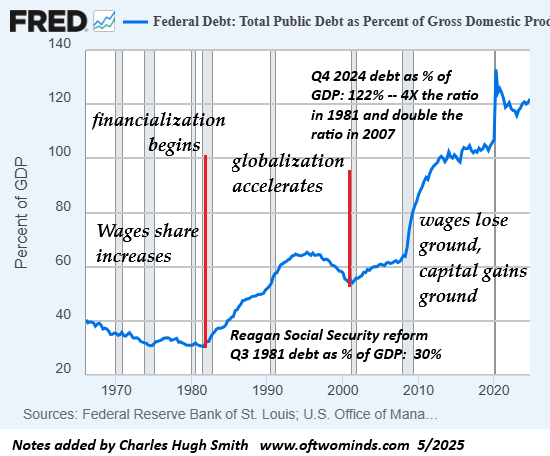

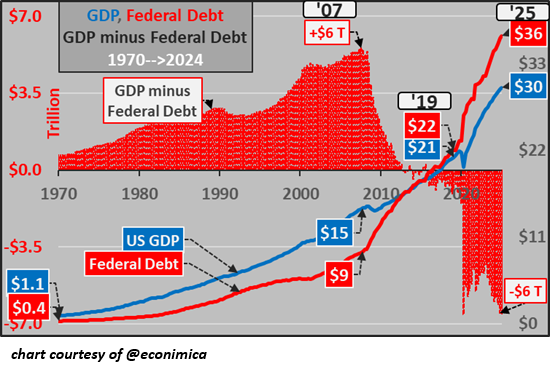

As the chart below shows, Federal debt as a percentage of GDP declined in the the decades of organic growth, meaning the economy expanded from increases in productivity, efficiencies and resource extraction, as opposed to the synthetic growth of using debt / financialization to boost consumption.

Financialization took off in the 1980s as unlimited credit for financiers enabled a synthetic boom of corporate takeovers and mergers. Financialization expanded into every nook and cranny of the economy in the 1990s and 2000s, so that assets such as the family home became commoditized assets that could be sold as securities to global capital.

As the Federal-debt-GDP charts illustrates, Federal debt rose faster than GDP as financialization hollowed out the US economy. The acceleration of globalization from 2001 advanced this hollowing out.

The destabilizing nature of financialization manifested in 2008 as the Global Financial Crisis, when heavily financialized subprime mortgage securities catalyzed a global meltdown.

the 2008-09 crisis and response was a critical juncture in American history , as the organic economy became subservient to the synthetic economy of debt, bubbles and "the wealth effect," the toxic harvest of hyper-financialization and hyper-globalization.

Federal debt, which has risen from 40% of GDP in the early 1980s to 60% in 2007, exploded higher to 120% as the synthetic "growth" of using debt to inflate asset bubbles that generated "the wealth effect" became the engine of consumption.

As a result of policy decisions made in 2008-2010, our economy became dependent not on wages but on "the wealth effect" for consumption: as asset valuations bubble higher, the owners of the assets feel wealthier, and are incentivized to borrow and spend more of their phantom wealth.

The top 10% of US households now account for 49.7% of all US consumer spending:

The U.S. Economy Depends More Than Ever on Rich People:

The highest-earning 10% of Americans have increased their spending far beyond inflation. Everyone else hasn't. (WSJ.com)

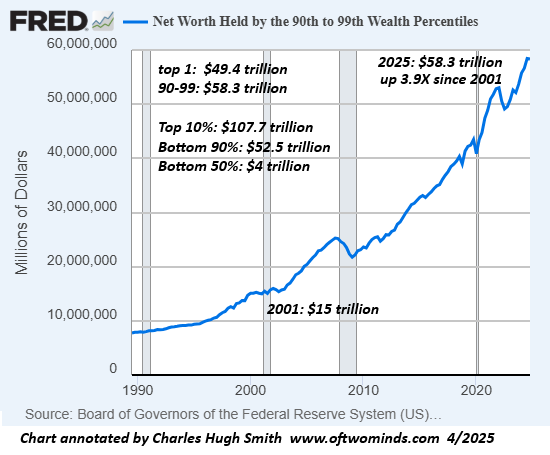

The problem is that unlike wages, which are broadly distributed, asset ownership is concentrated in the top 10% of households, so "the wealth effect" dramatically boosted wealth and income inequality. So all the synthetic "growth" since 2009 has flowed to the top tier of households as wages' share of the nation's income continued losing ground.

This sets up a can't win scenario: if the Everything Bubble that drives "the wealth effect" continues inflating, wealth inequality will crack our society wide open. If the bubble pops, consumption implodes, jobs will be lost and the Great Recession that was pushed forward in 2009 will kick in with a vengeance.

Beneath the superficial surface of rising GDP, the policies of inflating debt-bubbles to drive "the wealth effect" have hollowed out not just the economy but society. Courtesy of @econimica (X/Twitter), these charts show the pernicious consequences of relying on debt for consumption and channeling gains to the owners of assets.

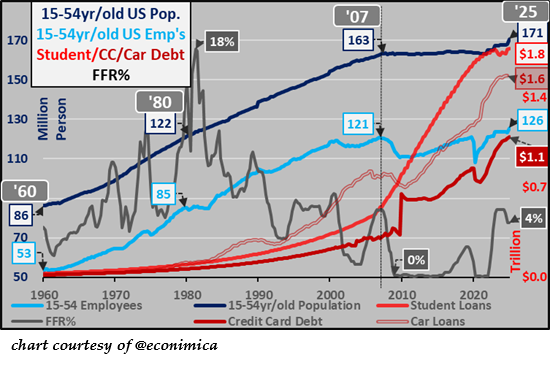

The net effect was to load younger generations with debt while funneling the majority of Federal spending to the older generations who also happen to own most of the assets. Since younger workers couldn't buy assets when they were cheap, few have gained from "the wealth effect."

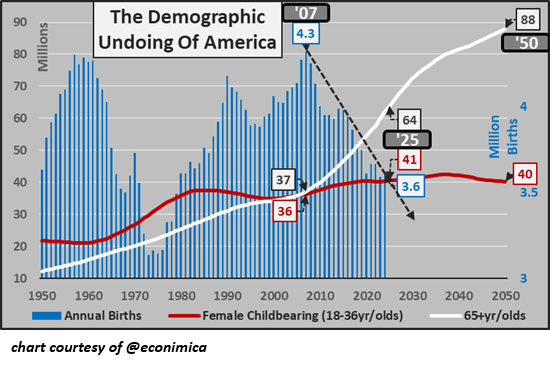

By effectively impoverishing the nation's younger generations, we've chosen a demographic doom-loop as marriage and birth rates have collapsed from 2007. Guess what happens when you make starting a family and buying a house unaffordable to younger generations? They no longer start families and have children.

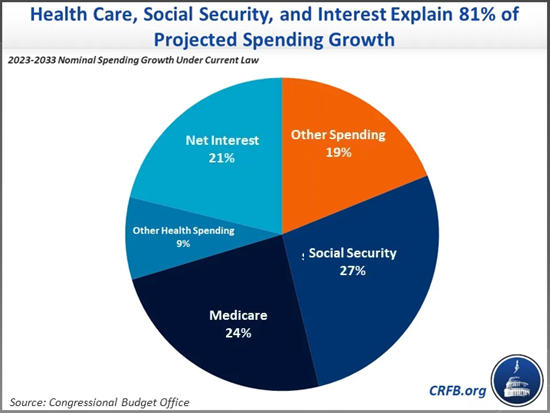

As the Boomer generation retires, the legacy of retirement programs designed in the 1930s (Social Security) and the 1960s (Medicare) is fiscal bankruptcy as these programs are driving the expansion of federal spending and borrowing.

It's called a Doom Loop, with no exit, for all speculative asst bubbles pop. Once "the wealth effect" reverses, assets get sold off to raise cash and since only the wealthy can afford to buy them, there's no buyers left, so valuations crash.

It didn't have to be this way, but our leadership chose poorly, and the consequences will fall on us.

Let's go through the charts supporting this grim reality.

Wages share of the national income has declined for 50 years.

As a percentage of GDP, Federal debt has tripled from 40% of GDP to 120% of GDP as synthetic "growth" replaced organic growth:

Thanks to the policy decision to reply on "the wealth effect" for consumption, wealth inequality has soared: the net worth of the top 10% (34 million Americans) is 2X the net worth of the bottom 90% (306 million Americans) and 27X the net worth of the bottom 50%--170 million Americans.

Most of the future expansion of Federal spending and debt is in programs for the older generations and rising interest payments on the expanding debt to pay for these programs.

Here are Econimica's explanatory comments on his three charts reprinted below:

"Federal Reserve policies have far-reaching consequences, well beyond interest rates and economics / finance. Given the Fed is a non-democratically elected entity making policy that is ultimately deciding the winners and losers or our modern-day society...perhaps it's time for a rethink of the power that has been handed to them?

Consider since 2007 (when ZIRP & QE were implemented):

---US births (blue columns) have declined by -0.7 million/yr (-16%...or 12 million fewer births than Census projected since '07 w/ the delta only continuing to grow)

---US female childbearing population (red line) +4.2 million (+11%)

---US 65+yr/old pop (white line) increased +27 million (+72%)

Think of who the economic / financial policies implemented since '07 favor (elderly/institutions holding the bulk of assets) and who they punish (young adults w/ little to no assets to shield them). Young adults have made the logical choice to have fewer or avoid children altogether. Unless something dramatic changes, suggest births/families will continue moving significantly lower and the future of the US working class is likewise deteriorating.

2007 was also the interest rate driven explosion in student loan debt and consumer debt (vehicles, credit cards, etc.) to allow a flat consumer population to continue consuming more."

Note how debt serviced by younger generations exploded higher from 2008 while the population and workforce made only marginal gains.

GDP minus federal debt was positive until 2008-09, and has since crashed into deeply negative territory. It's called eating our seed corn, spending money borrowed from future productivity and generations to fund unsustainable consumption today. Spoiler alert: this ends badly.

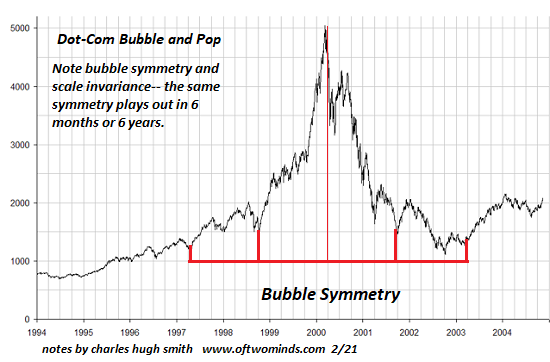

Regardless of assurances that this bubble will never pop, all bubbles pop, and they do so with remarkable symmetry, returning to their starting point.

Either way, we lose: if the Federal Reserve manages to keep the Everything Bubble inflated, we decimate the nation's younger generations, fatally destabilizing our society. If the bubble finally pops, all the phantom wealth that's been propping up consumption goes to Money Heaven, gone for good.

We will collectively bear the burdens of catastrophically short-sighted / self-serving policies of 2009-2025 for decades to come. Beneath the easily gamed statistical veneer, our economy and society have been hollowed out to the benefit of the few at the expense of the many.

These are real-world problems, not monetary problems. Unfortunately, playing around with "money" doesn't make all this go away: stablecoins, Universal Basic Income (UBI) and Modern Monetary Theory (MMT) are all disconnected from the real world: what ultimately matters is resources extracted, productivity and efficiency, and how the gains and losses of these real world factors are distributed.

"Money" in all its manifestations is simply the unit/medium used to instantiate the distribution.

Check out my new book Ultra-Processed Life and my new fiction/novels page.

Become

a $3/month patron of my work via patreon.com.

Subscribe to my Substack for free

My recent books:

Disclosure: As an Amazon Associate I earn from qualifying purchases originated via links to Amazon products on this site.

Ultra-Processed Life print $16, (Kindle $7.95, Hardcover $20 (129 pages, 2025) Read the Introduction and first chapter for free (PDF)

The Mythology of Progress, Anti-Progress and a Mythology for the 21st Century print $16, (Kindle $6.95, Hardcover $24 (215 pages, 2024) Read the Introduction and first chapter for free (PDF)

Self-Reliance in the 21st Century print $15, (Kindle $6.95, audiobook $13.08 (96 pages, 2022) Read the first chapter for free (PDF)

When You Can't Go On: Burnout, Reckoning and Renewal $15 print, $6.95 Kindle ebook; audiobook Read the first section for free (PDF)

Global Crisis, National Renewal: A (Revolutionary) Grand Strategy for the United States (Kindle $6.95, print $16, audiobook) Read Chapter One for free (PDF).

A Hacker's Teleology: Sharing the Wealth of Our Shrinking Planet (Kindle $6.95, print $15, audiobook $17.46) Read the first section for free (PDF).

Will You Be Richer or Poorer?: Profit, Power, and AI in a Traumatized World

(Kindle $3.95, print $12, audiobook) Read the first section for free (PDF).

The Adventures of the Consulting Philosopher: The Disappearance of Drake (Novel) $3.95 Kindle, $12 print); read the first chapters for free (PDF)

Money and Work Unchained $6.95 Kindle, $15 print) Read the first section for free

Become a $3/month patron of my work via patreon.com.

Subscribe to my Substack for free

NOTE: Contributions/subscriptions are acknowledged in the order received. Your name and email remain confidential and will not be given to any other individual, company or agency.

|

Thank you, Ken E. ($70), for your exceedingly generous subscription to this site -- I am greatly honored by your support and readership. |

Thank you, Mr Smith ($7/month), for your marvelously generous subscription to this site -- I am greatly honored by your support and readership. |

|

|

Thank you, Jonas T. ($7/month), for your superbly generous subscription to this site -- I am greatly honored by your support and readership. |

Thank you, J.D. ($70), for your splendidly generous subscription to this site -- I am greatly honored by your support and readership. |